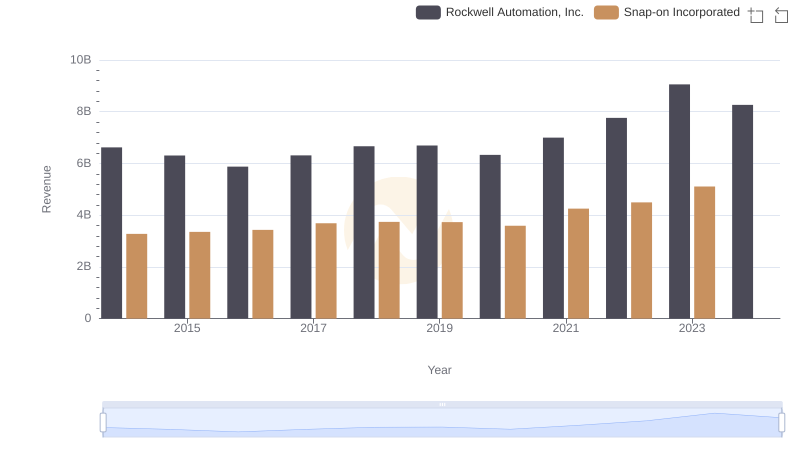

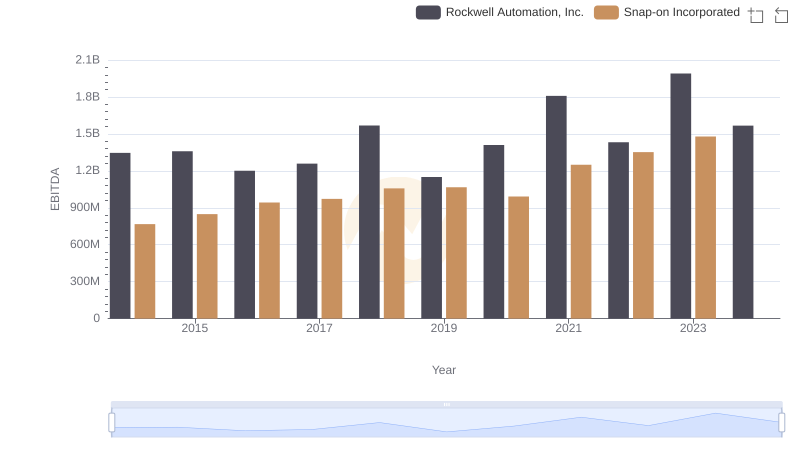

| __timestamp | Rockwell Automation, Inc. | Snap-on Incorporated |

|---|---|---|

| Wednesday, January 1, 2014 | 2753900000 | 1584300000 |

| Thursday, January 1, 2015 | 2703100000 | 1648300000 |

| Friday, January 1, 2016 | 2475500000 | 1709600000 |

| Sunday, January 1, 2017 | 2624200000 | 1824900000 |

| Monday, January 1, 2018 | 2872200000 | 1870000000 |

| Tuesday, January 1, 2019 | 2900100000 | 1844000000 |

| Wednesday, January 1, 2020 | 2595200000 | 1748500000 |

| Friday, January 1, 2021 | 2897700000 | 2110800000 |

| Saturday, January 1, 2022 | 3102000000 | 2181100000 |

| Sunday, January 1, 2023 | 3717000000 | 2619800000 |

| Monday, January 1, 2024 | 3193400000 | 2377900000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial automation and tools, Rockwell Automation and Snap-on Incorporated have been key players. Over the past decade, Rockwell Automation has consistently outperformed Snap-on in terms of gross profit. From 2014 to 2023, Rockwell Automation's gross profit grew by approximately 16%, peaking in 2023 with a remarkable 3.7 billion dollars. In contrast, Snap-on's gross profit increased by about 65% during the same period, reaching its highest in 2023 at 2.6 billion dollars. Despite Snap-on's impressive growth rate, Rockwell Automation maintained a higher gross profit each year. The data for 2024 is incomplete, but the trend suggests Rockwell Automation's dominance in gross profit generation is likely to continue. This analysis highlights the importance of strategic growth and market positioning in the industrial sector.

Rockwell Automation, Inc. or Snap-on Incorporated: Who Leads in Yearly Revenue?

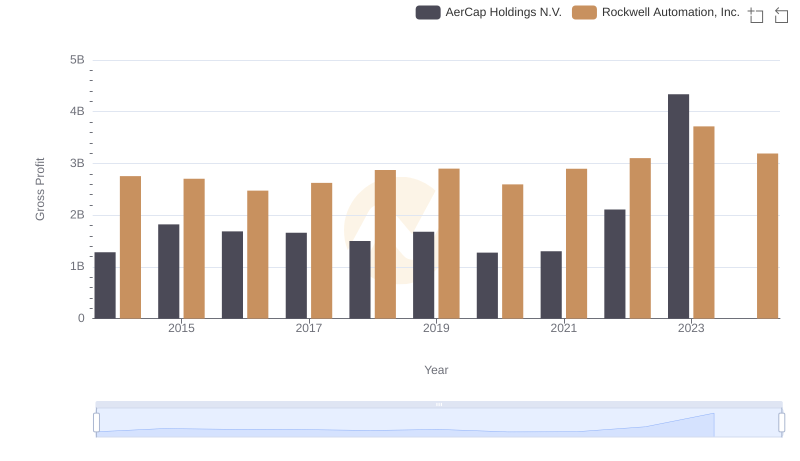

Gross Profit Comparison: Rockwell Automation, Inc. and AerCap Holdings N.V. Trends

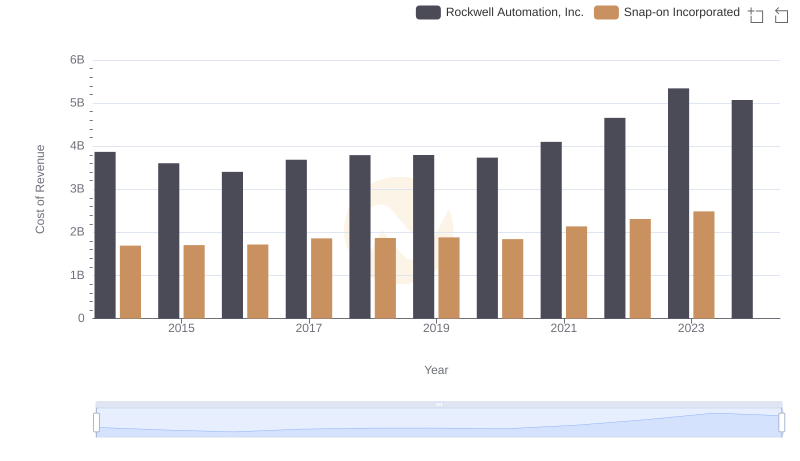

Cost Insights: Breaking Down Rockwell Automation, Inc. and Snap-on Incorporated's Expenses

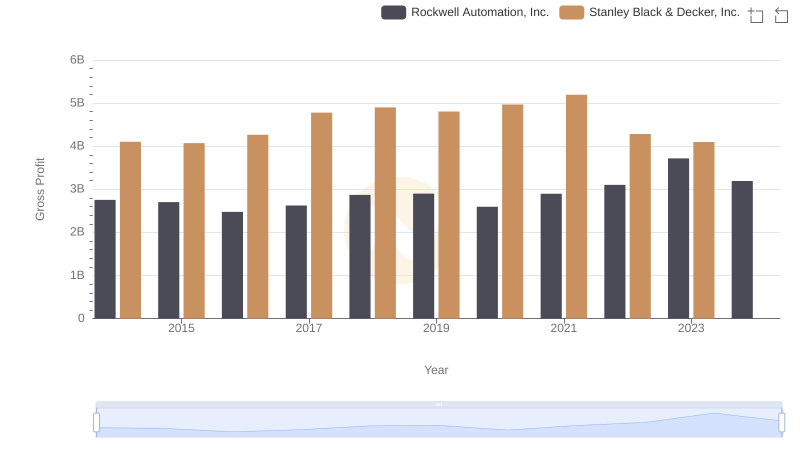

Who Generates Higher Gross Profit? Rockwell Automation, Inc. or Stanley Black & Decker, Inc.

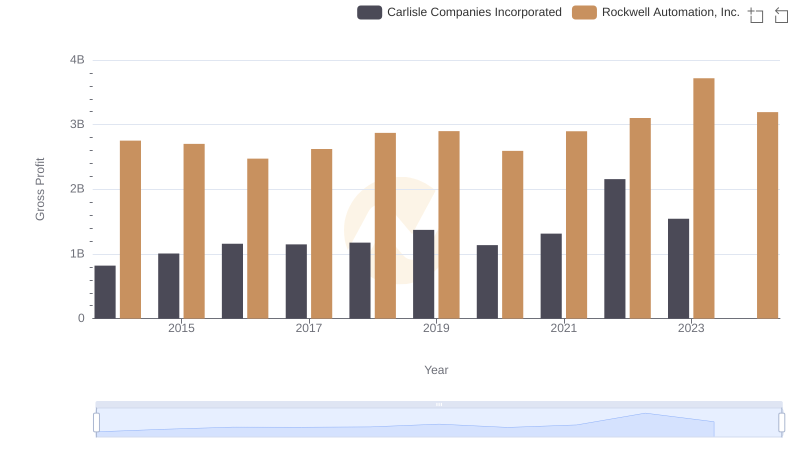

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and Carlisle Companies Incorporated

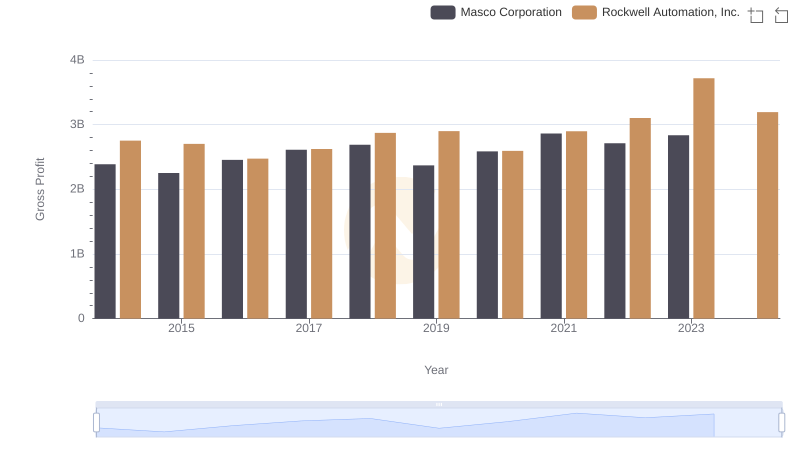

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Masco Corporation

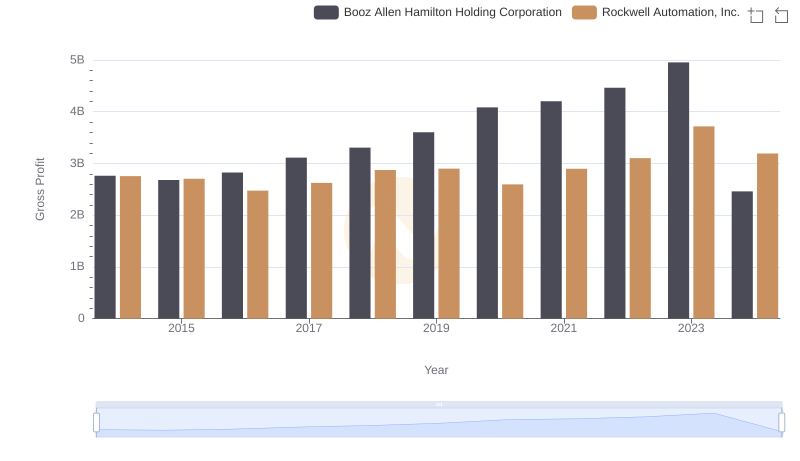

Gross Profit Trends Compared: Rockwell Automation, Inc. vs Booz Allen Hamilton Holding Corporation

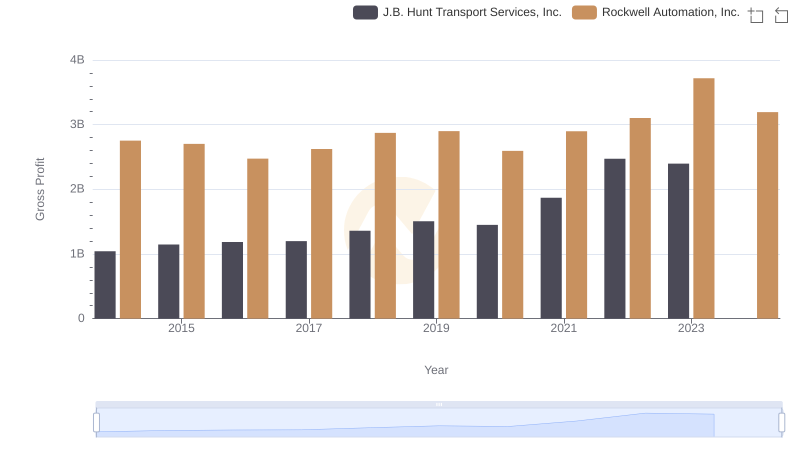

Key Insights on Gross Profit: Rockwell Automation, Inc. vs J.B. Hunt Transport Services, Inc.

EBITDA Metrics Evaluated: Rockwell Automation, Inc. vs Snap-on Incorporated