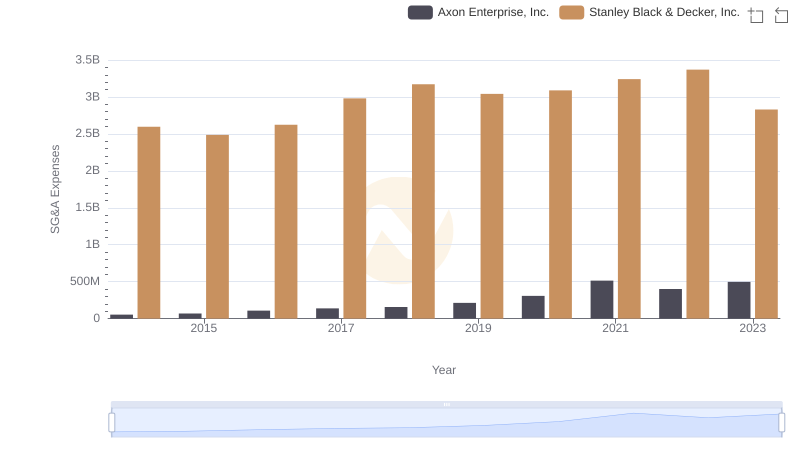

| __timestamp | Axon Enterprise, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 4102700000 |

| Thursday, January 1, 2015 | 128647000 | 4072000000 |

| Friday, January 1, 2016 | 170536000 | 4267200000 |

| Sunday, January 1, 2017 | 207088000 | 4778000000 |

| Monday, January 1, 2018 | 258583000 | 4901900000 |

| Tuesday, January 1, 2019 | 307286000 | 4805500000 |

| Wednesday, January 1, 2020 | 416331000 | 4967900000 |

| Friday, January 1, 2021 | 540910000 | 5194200000 |

| Saturday, January 1, 2022 | 728638000 | 4284100000 |

| Sunday, January 1, 2023 | 955382000 | 4098000000 |

| Monday, January 1, 2024 | 4514400000 |

Unleashing the power of data

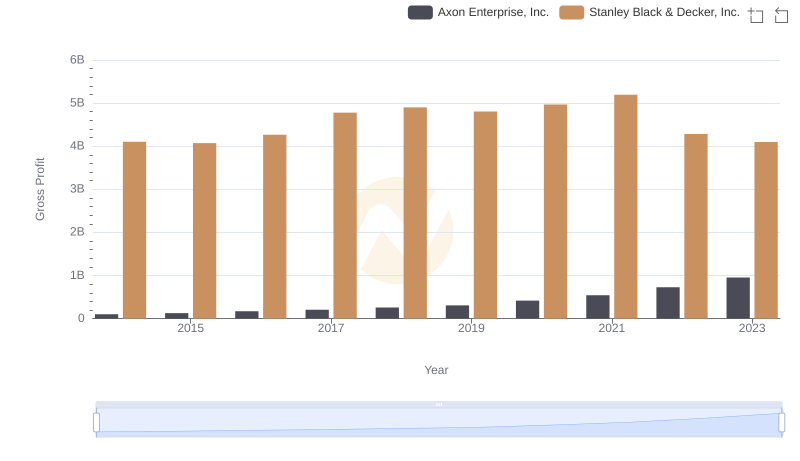

In the ever-evolving landscape of corporate profitability, the battle between Axon Enterprise, Inc. and Stanley Black & Decker, Inc. offers a fascinating glimpse into the dynamics of gross profit generation. Over the past decade, Stanley Black & Decker has consistently outperformed Axon, boasting gross profits that are approximately 10 times higher. However, Axon has shown remarkable growth, with its gross profit increasing by nearly 840% from 2014 to 2023. This surge is a testament to Axon's strategic innovations and market expansion. Meanwhile, Stanley Black & Decker, despite a slight dip in recent years, remains a powerhouse with a stable gross profit margin. As we look to the future, the question remains: will Axon's rapid growth continue to close the gap, or will Stanley Black & Decker maintain its lead?

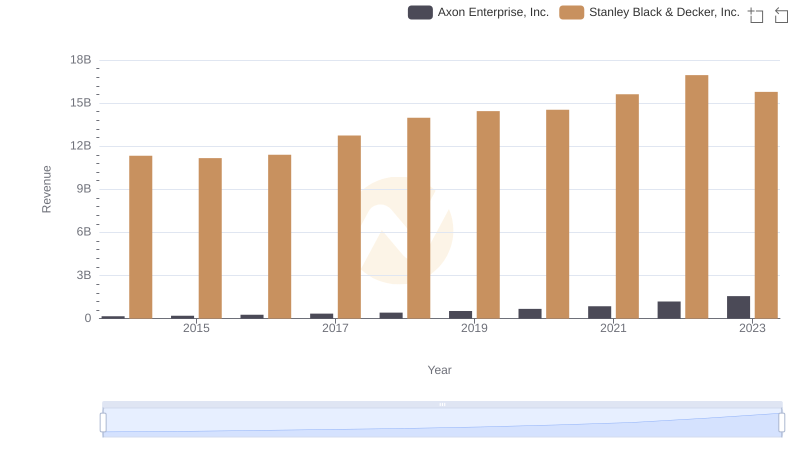

Revenue Showdown: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

Cost of Revenue Trends: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

Axon Enterprise, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

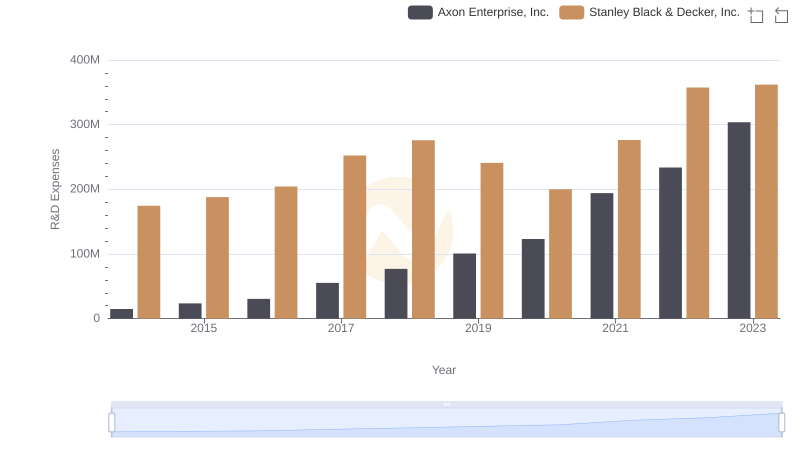

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

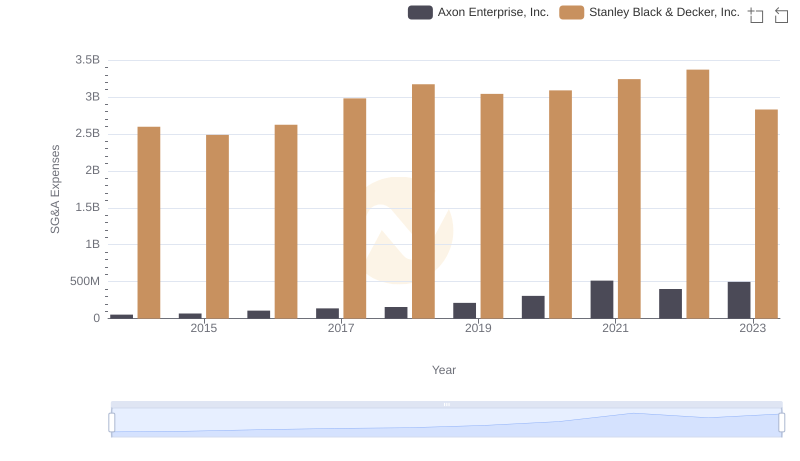

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

Cost Insights: Breaking Down Axon Enterprise, Inc. and Stanley Black & Decker, Inc.'s Expenses

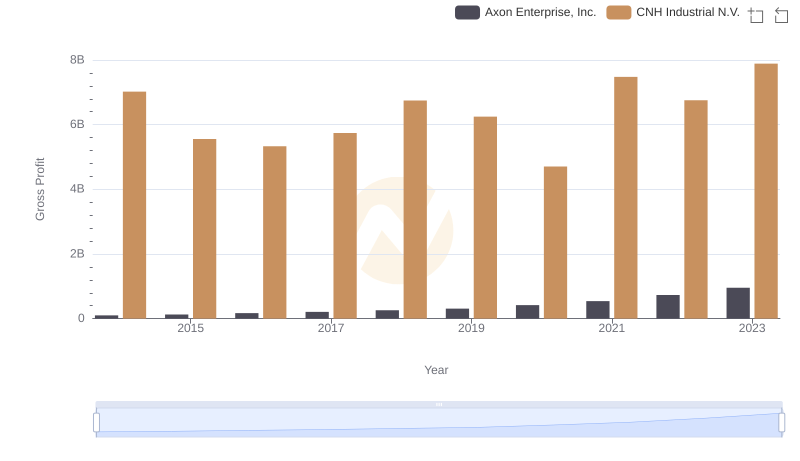

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or CNH Industrial N.V.

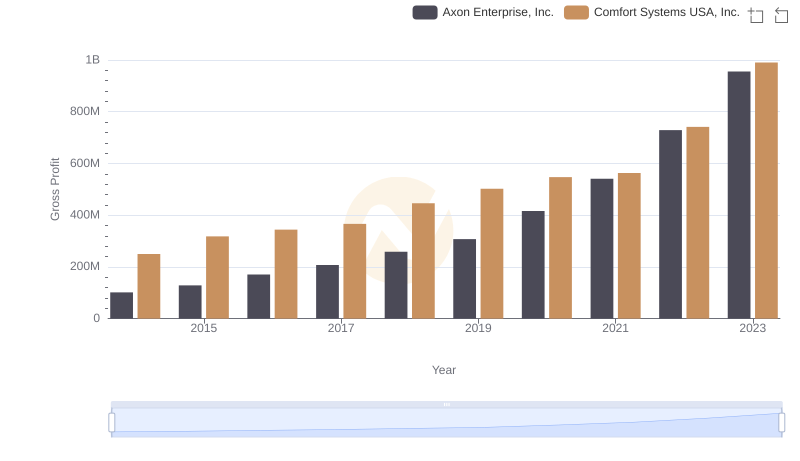

Gross Profit Comparison: Axon Enterprise, Inc. and Comfort Systems USA, Inc. Trends

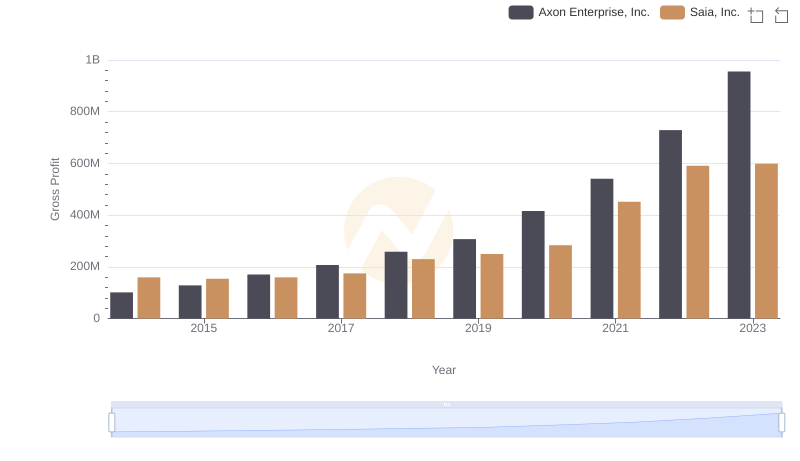

Gross Profit Comparison: Axon Enterprise, Inc. and Saia, Inc. Trends

Research and Development Expenses Breakdown: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.: SG&A Expense Trends