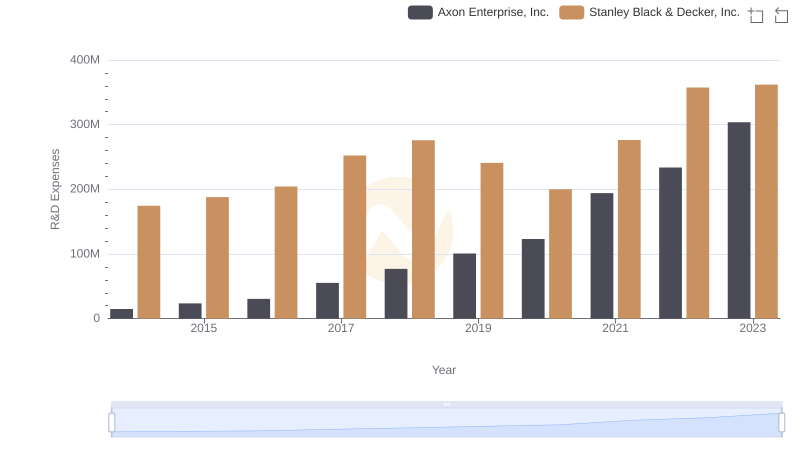

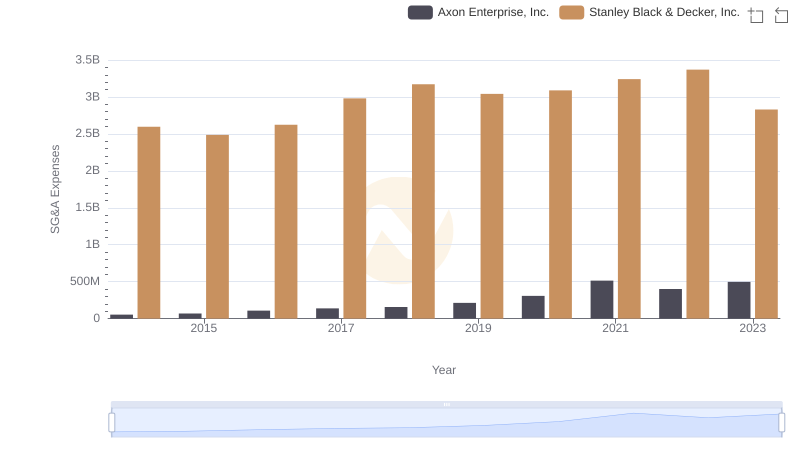

| __timestamp | Axon Enterprise, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 14885000 | 174600000 |

| Thursday, January 1, 2015 | 23614000 | 188000000 |

| Friday, January 1, 2016 | 30609000 | 204400000 |

| Sunday, January 1, 2017 | 55373000 | 252300000 |

| Monday, January 1, 2018 | 76856000 | 275800000 |

| Tuesday, January 1, 2019 | 100721000 | 240800000 |

| Wednesday, January 1, 2020 | 123195000 | 200000000 |

| Friday, January 1, 2021 | 194026000 | 276300000 |

| Saturday, January 1, 2022 | 233810000 | 357400000 |

| Sunday, January 1, 2023 | 303719000 | 362000000 |

| Monday, January 1, 2024 | 0 |

Cracking the code

In the ever-evolving landscape of technology and manufacturing, research and development (R&D) expenses are a critical indicator of a company's commitment to innovation. Over the past decade, Axon Enterprise, Inc. and Stanley Black & Decker, Inc. have demonstrated contrasting approaches to R&D investments.

From 2014 to 2023, Axon Enterprise, Inc. has seen a staggering increase in R&D spending, growing by over 1,900%. This reflects the company's aggressive push towards technological advancements, particularly in public safety solutions.

In contrast, Stanley Black & Decker, Inc. has maintained a consistent R&D investment, with a 107% increase over the same period. This steady growth underscores their focus on enhancing product quality and innovation in the tools and storage sector.

Both companies exemplify different strategies in leveraging R&D to drive future growth and maintain competitive edges in their respective industries.

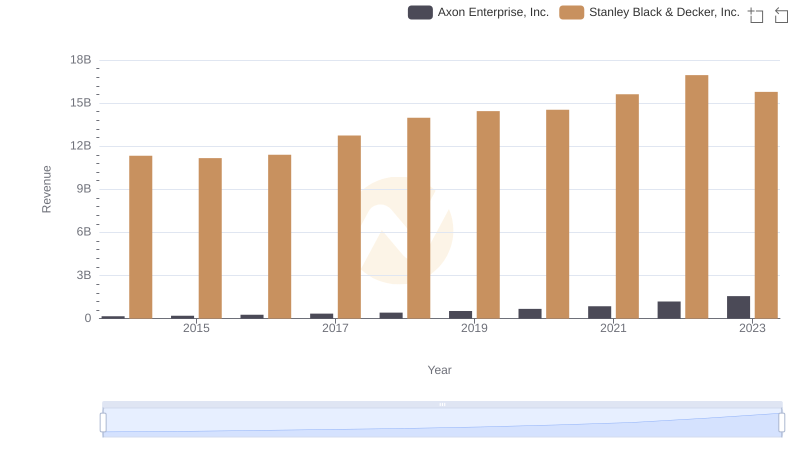

Revenue Showdown: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

Cost of Revenue Trends: Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.

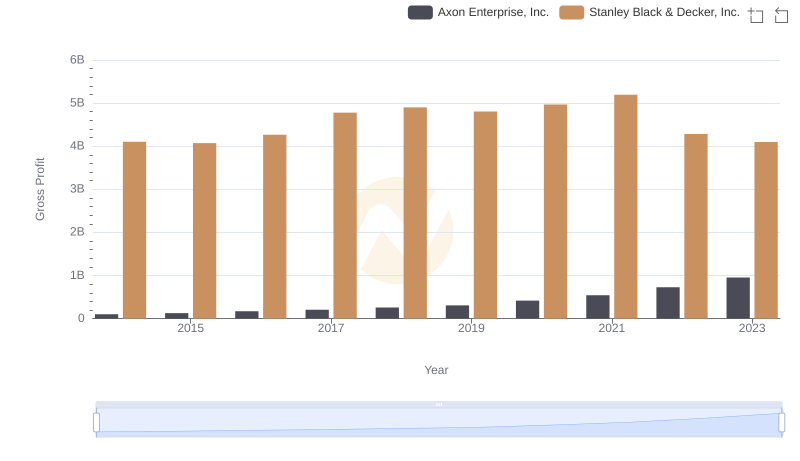

Axon Enterprise, Inc. and Stanley Black & Decker, Inc.: A Detailed Gross Profit Analysis

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

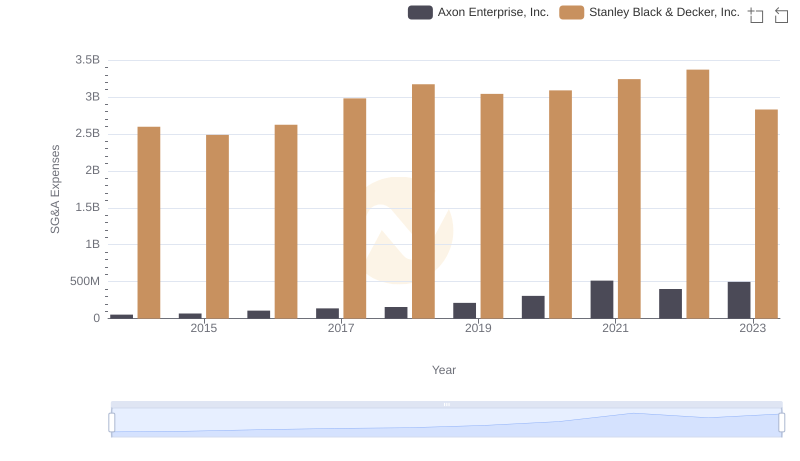

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and Stanley Black & Decker, Inc.

Cost Insights: Breaking Down Axon Enterprise, Inc. and Stanley Black & Decker, Inc.'s Expenses

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Stanley Black & Decker, Inc.

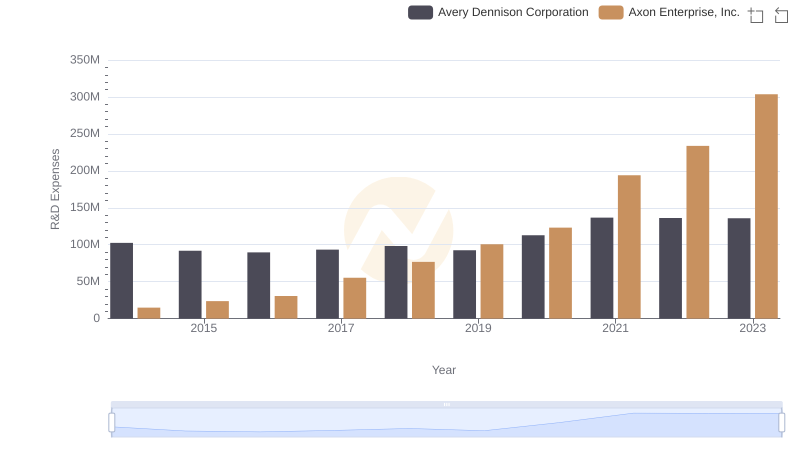

Who Prioritizes Innovation? R&D Spending Compared for Axon Enterprise, Inc. and Avery Dennison Corporation

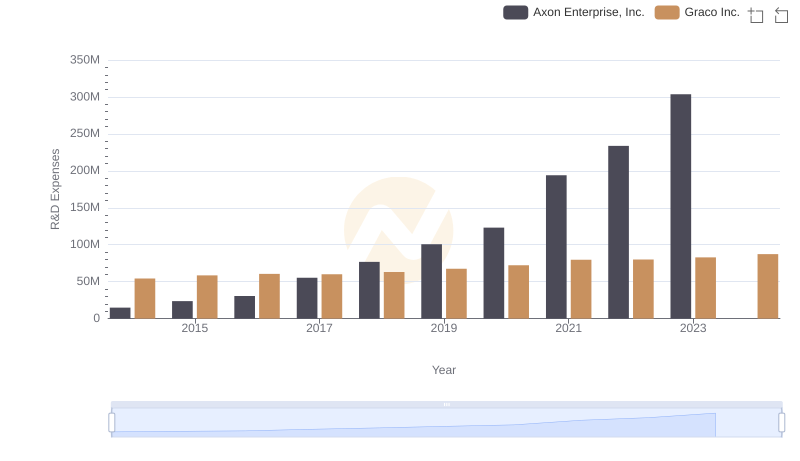

Analyzing R&D Budgets: Axon Enterprise, Inc. vs Graco Inc.

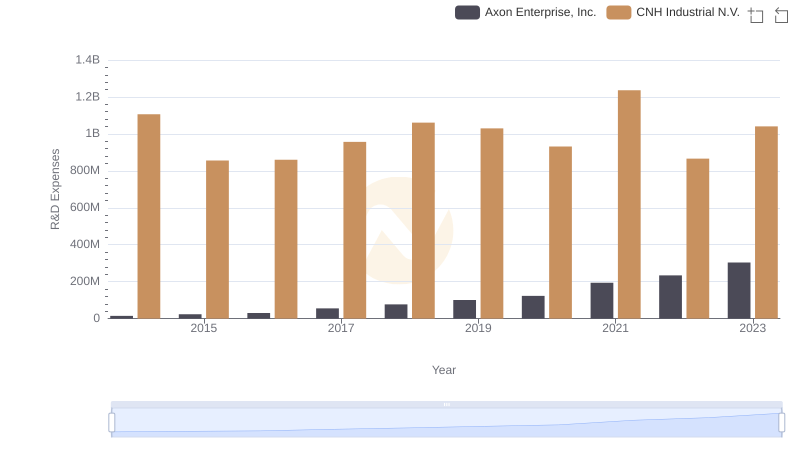

Axon Enterprise, Inc. or CNH Industrial N.V.: Who Invests More in Innovation?

Axon Enterprise, Inc. vs Stanley Black & Decker, Inc.: SG&A Expense Trends