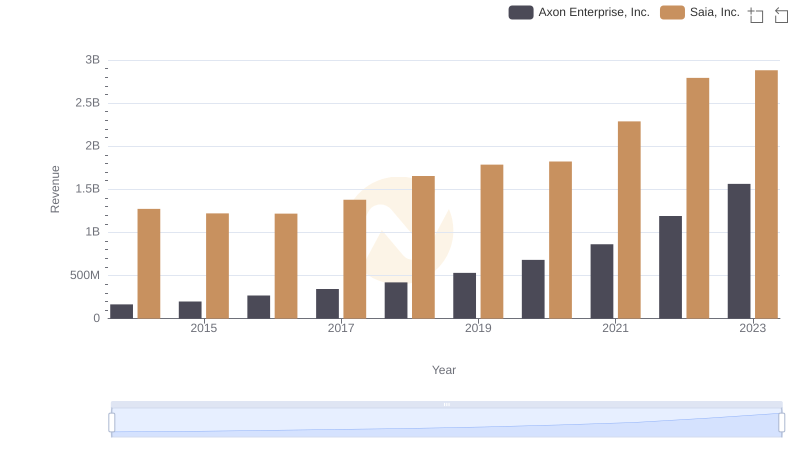

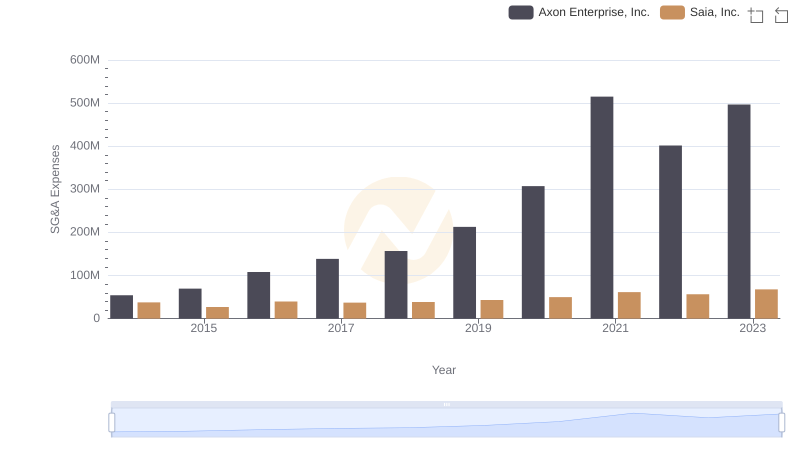

| __timestamp | Axon Enterprise, Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 101548000 | 159268000 |

| Thursday, January 1, 2015 | 128647000 | 154120000 |

| Friday, January 1, 2016 | 170536000 | 159502000 |

| Sunday, January 1, 2017 | 207088000 | 175046000 |

| Monday, January 1, 2018 | 258583000 | 230070000 |

| Tuesday, January 1, 2019 | 307286000 | 249653000 |

| Wednesday, January 1, 2020 | 416331000 | 283848000 |

| Friday, January 1, 2021 | 540910000 | 451687000 |

| Saturday, January 1, 2022 | 728638000 | 590963000 |

| Sunday, January 1, 2023 | 955382000 | 598932000 |

Unleashing insights

In the ever-evolving landscape of American business, Axon Enterprise, Inc. and Saia, Inc. have emerged as intriguing case studies in growth and resilience. Over the past decade, Axon has seen its gross profit skyrocket by over 840%, starting from a modest $101 million in 2014 to an impressive $955 million in 2023. This remarkable growth underscores Axon's strategic prowess in the tech-driven public safety sector.

Meanwhile, Saia, Inc., a key player in the transportation industry, has also demonstrated robust growth, with its gross profit increasing by nearly 280% from $159 million in 2014 to $599 million in 2023. This steady rise highlights Saia's ability to navigate the challenges of logistics and supply chain management.

Both companies exemplify the dynamic nature of their respective industries, offering valuable insights into strategic growth and market adaptation.

Axon Enterprise, Inc. or Saia, Inc.: Who Leads in Yearly Revenue?

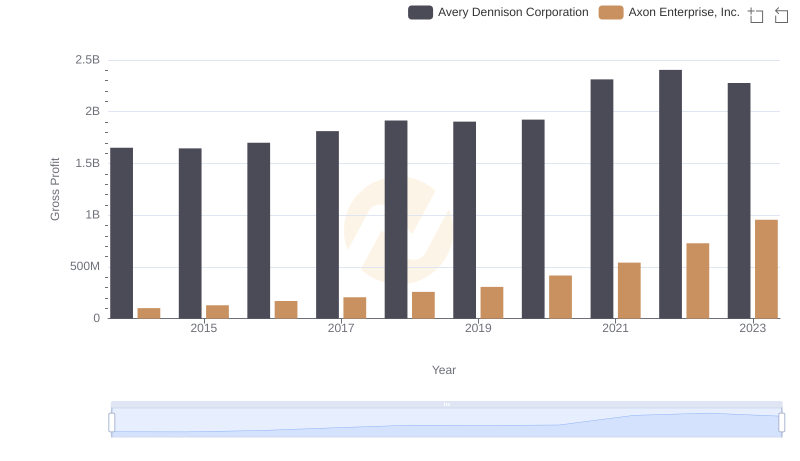

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Avery Dennison Corporation

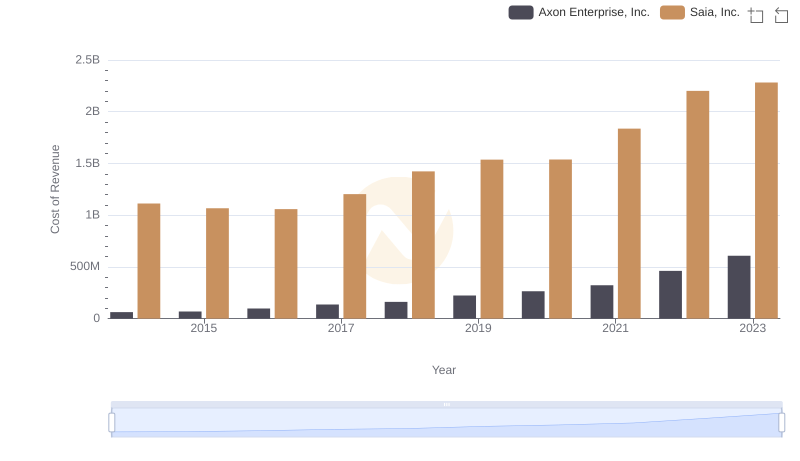

Cost of Revenue Trends: Axon Enterprise, Inc. vs Saia, Inc.

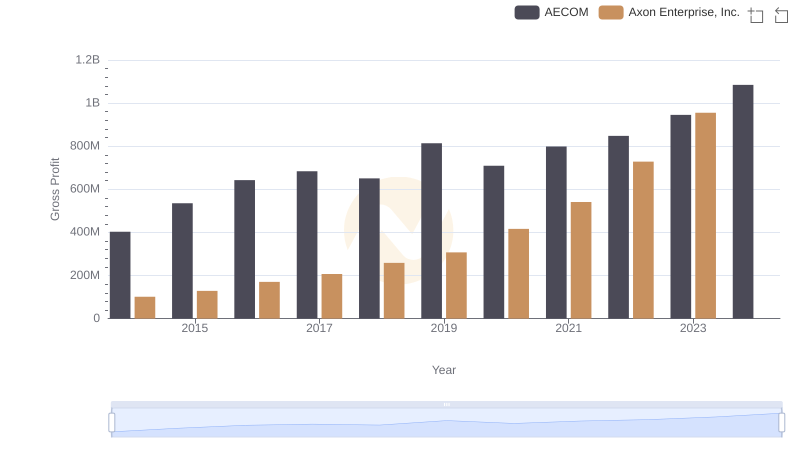

Gross Profit Comparison: Axon Enterprise, Inc. and AECOM Trends

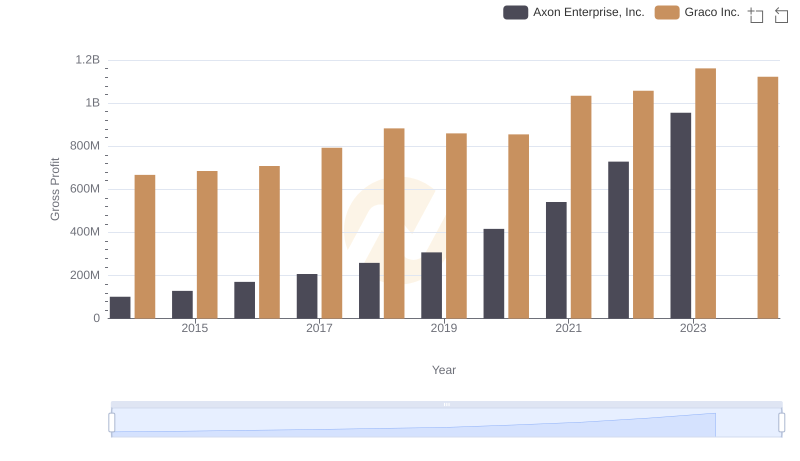

Axon Enterprise, Inc. vs Graco Inc.: A Gross Profit Performance Breakdown

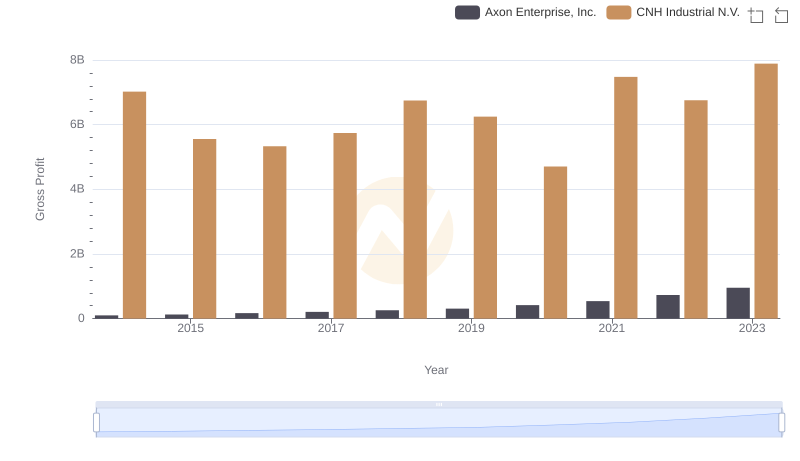

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or CNH Industrial N.V.

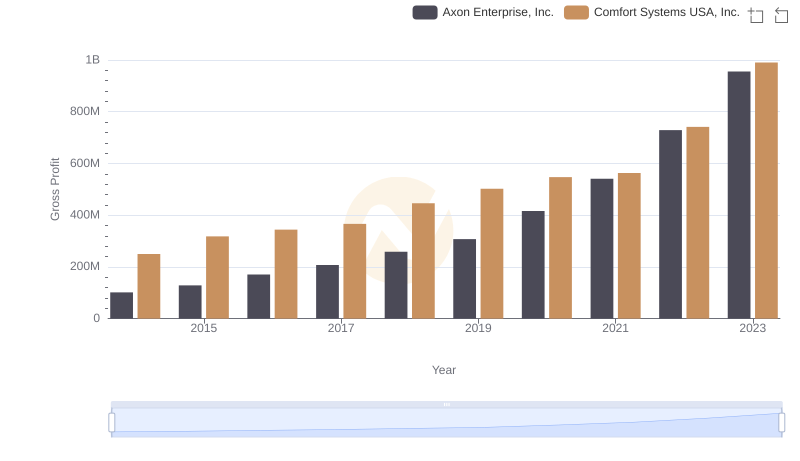

Gross Profit Comparison: Axon Enterprise, Inc. and Comfort Systems USA, Inc. Trends

Who Generates Higher Gross Profit? Axon Enterprise, Inc. or Stanley Black & Decker, Inc.

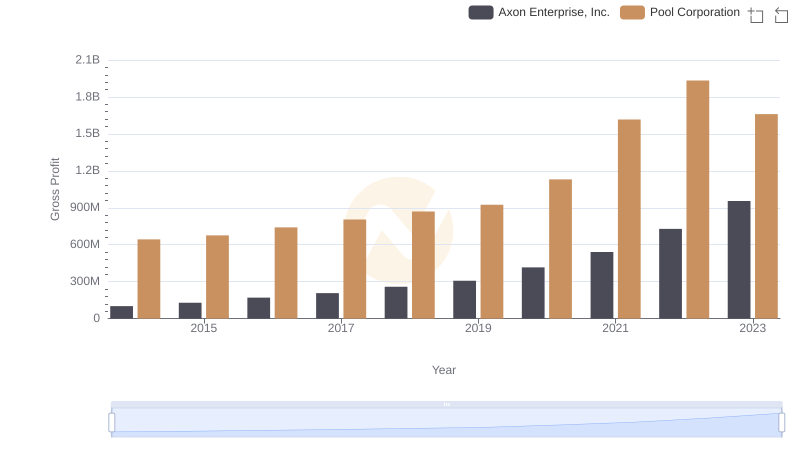

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Pool Corporation

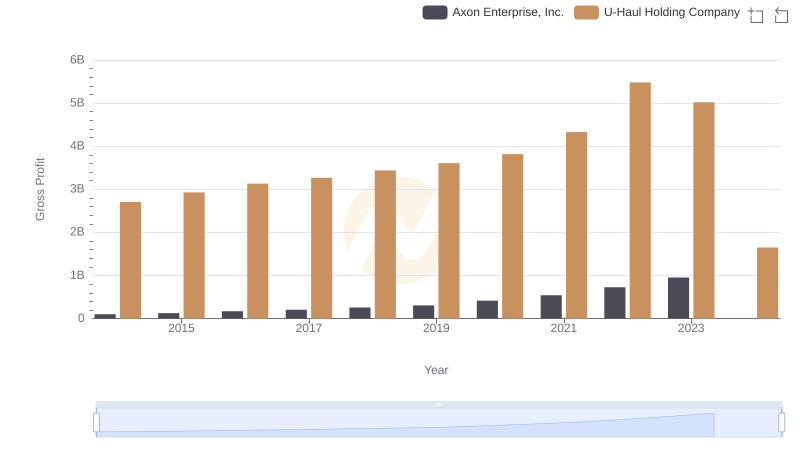

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and U-Haul Holding Company

Axon Enterprise, Inc. and Saia, Inc.: SG&A Spending Patterns Compared

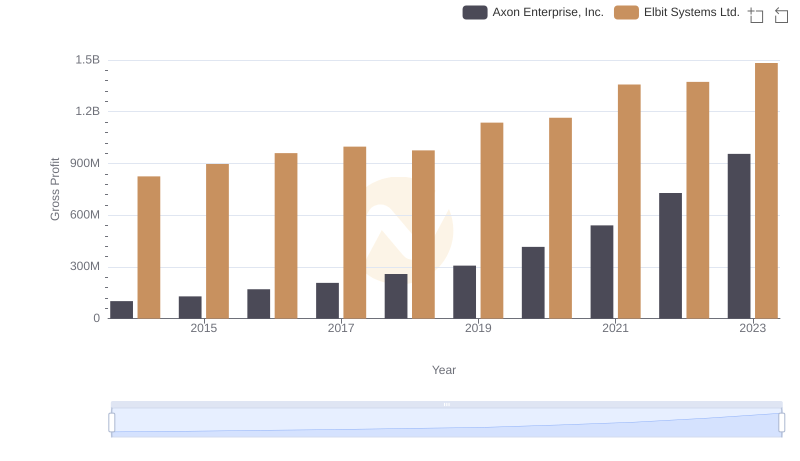

Gross Profit Analysis: Comparing Axon Enterprise, Inc. and Elbit Systems Ltd.