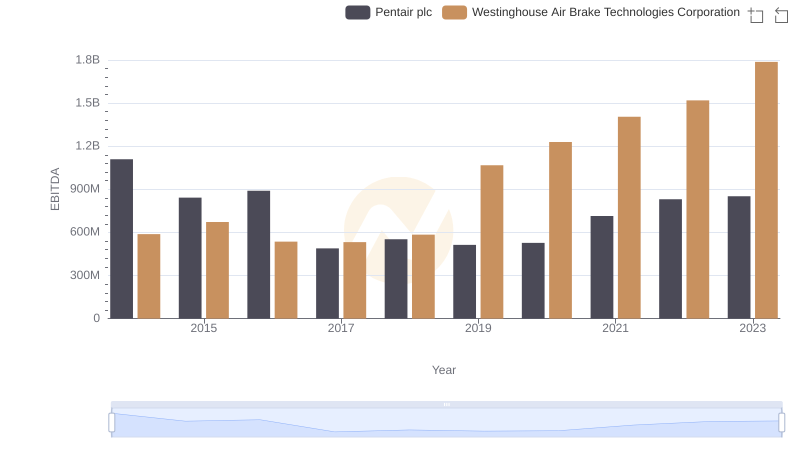

| __timestamp | Westinghouse Air Brake Technologies Corporation | ZTO Express (Cayman) Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 588370000 | 876815000 |

| Thursday, January 1, 2015 | 672301000 | 1687285000 |

| Friday, January 1, 2016 | 535893000 | 3093956000 |

| Sunday, January 1, 2017 | 532795000 | 4308801000 |

| Monday, January 1, 2018 | 584199000 | 5185941000 |

| Tuesday, January 1, 2019 | 1067300000 | 6727397000 |

| Wednesday, January 1, 2020 | 1229400000 | 5197064000 |

| Friday, January 1, 2021 | 1405000000 | 5866901000 |

| Saturday, January 1, 2022 | 1519000000 | 11147519000 |

| Sunday, January 1, 2023 | 1787000000 | 13853443000 |

| Monday, January 1, 2024 | 1609000000 |

Unleashing the power of data

In the ever-evolving landscape of global logistics and transportation, Westinghouse Air Brake Technologies Corporation (WAB) and ZTO Express (Cayman) Inc. have emerged as formidable players. Over the past decade, these companies have demonstrated remarkable growth in their EBITDA, a key indicator of financial health and operational efficiency.

From 2014 to 2023, ZTO Express has consistently outperformed WAB, with its EBITDA growing by an impressive 1,480%, reaching a peak of approximately $13.85 billion in 2023. In contrast, WAB's EBITDA has increased by 204% over the same period, culminating in a 2023 figure of around $1.79 billion. This stark contrast highlights ZTO's aggressive expansion and market penetration strategies, particularly in the burgeoning Asian markets.

As the global economy continues to recover and adapt, these two companies offer a fascinating study in strategic growth and resilience.

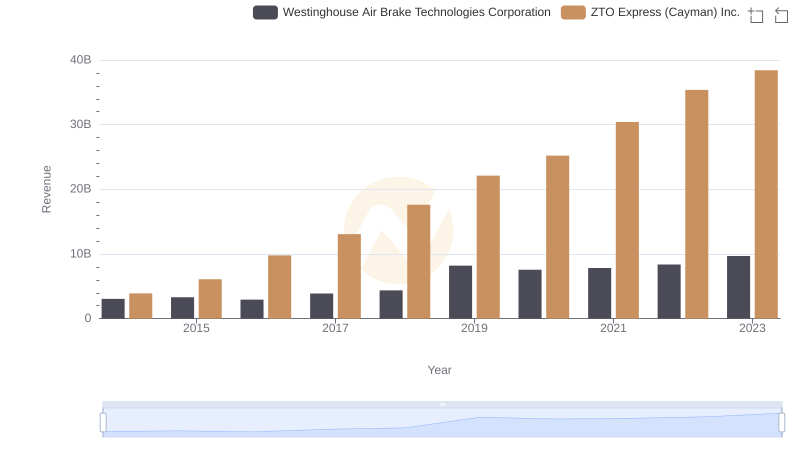

Who Generates More Revenue? Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.

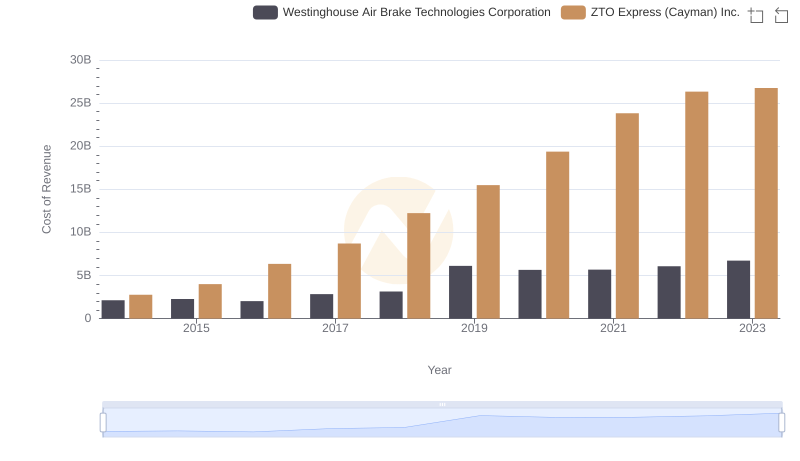

Cost of Revenue Trends: Westinghouse Air Brake Technologies Corporation vs ZTO Express (Cayman) Inc.

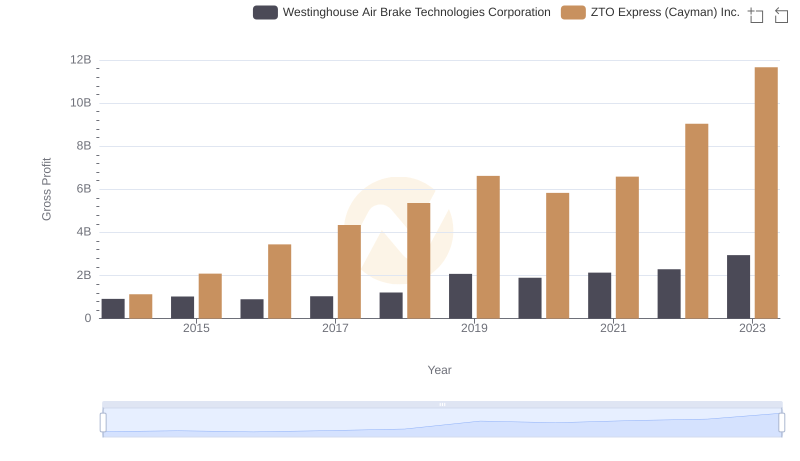

Westinghouse Air Brake Technologies Corporation and ZTO Express (Cayman) Inc.: A Detailed Gross Profit Analysis

EBITDA Metrics Evaluated: Westinghouse Air Brake Technologies Corporation vs Pentair plc

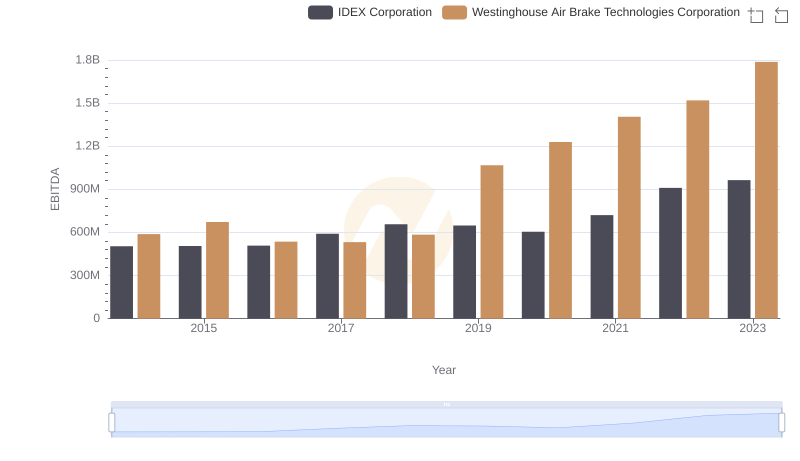

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to IDEX Corporation

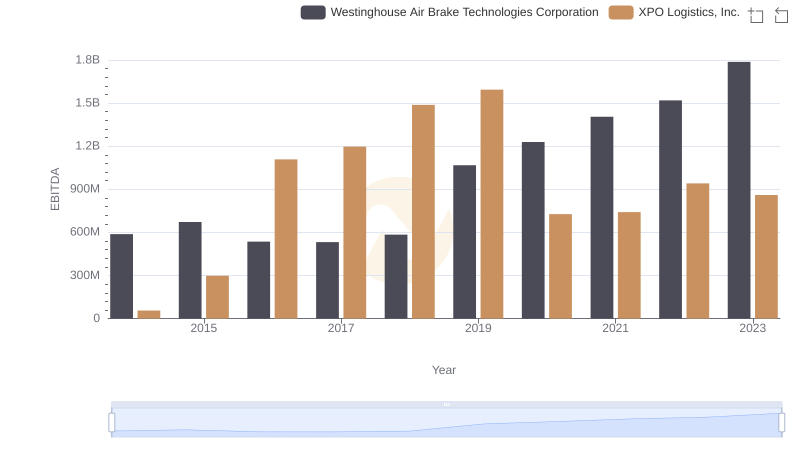

Professional EBITDA Benchmarking: Westinghouse Air Brake Technologies Corporation vs XPO Logistics, Inc.

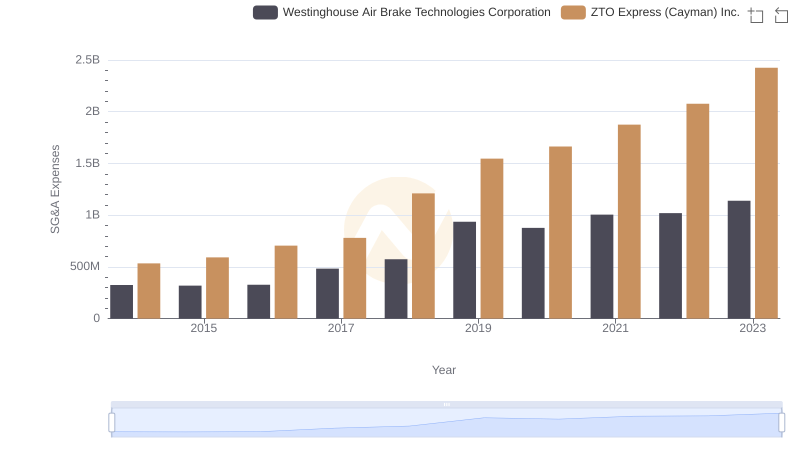

Westinghouse Air Brake Technologies Corporation or ZTO Express (Cayman) Inc.: Who Manages SG&A Costs Better?

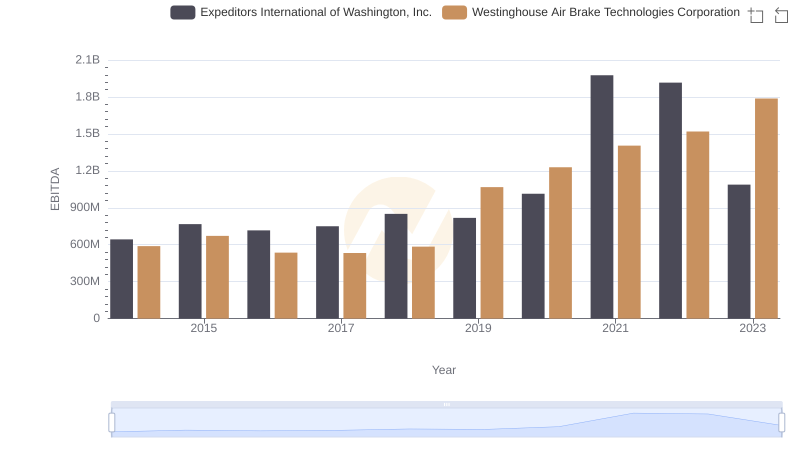

A Professional Review of EBITDA: Westinghouse Air Brake Technologies Corporation Compared to Expeditors International of Washington, Inc.

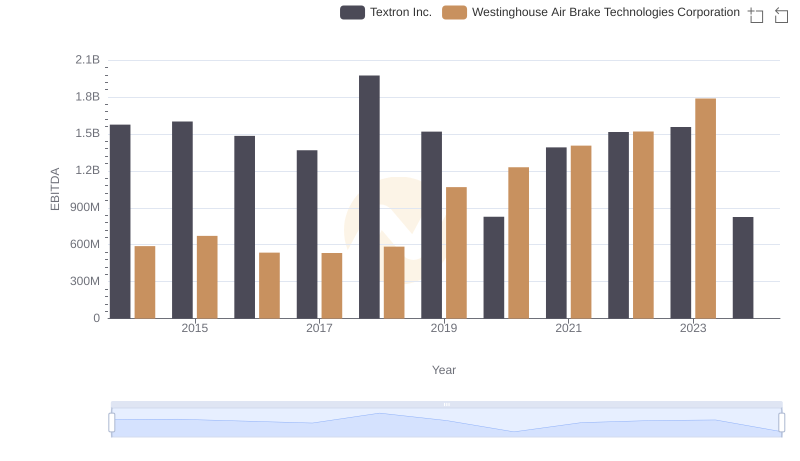

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Textron Inc.

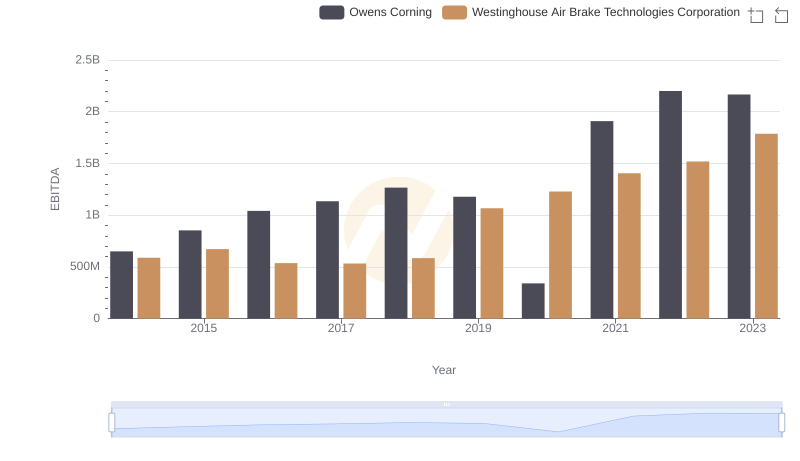

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Owens Corning

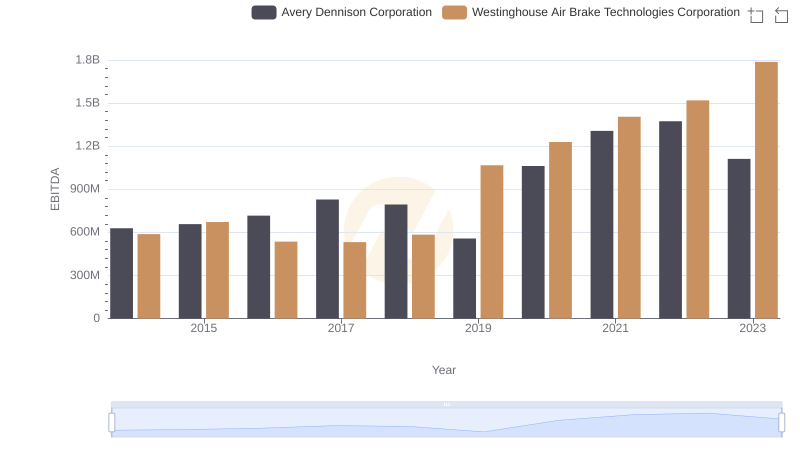

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs Avery Dennison Corporation

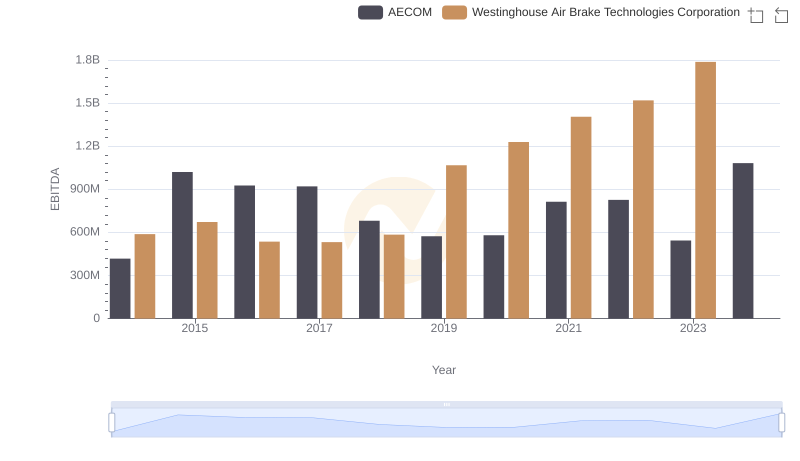

EBITDA Performance Review: Westinghouse Air Brake Technologies Corporation vs AECOM