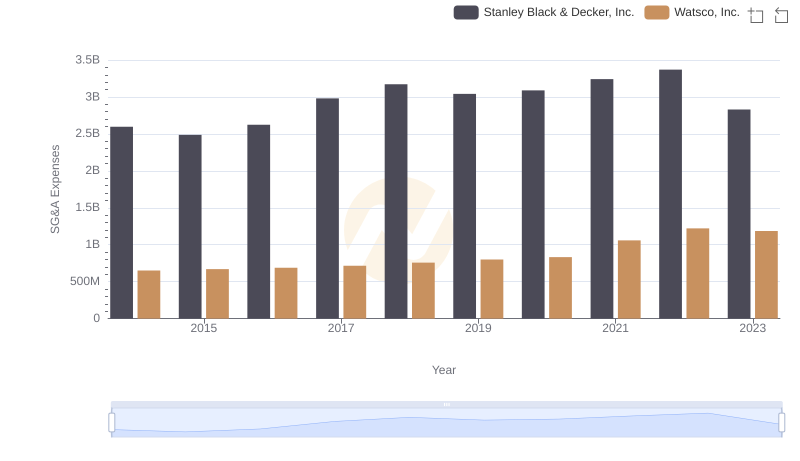

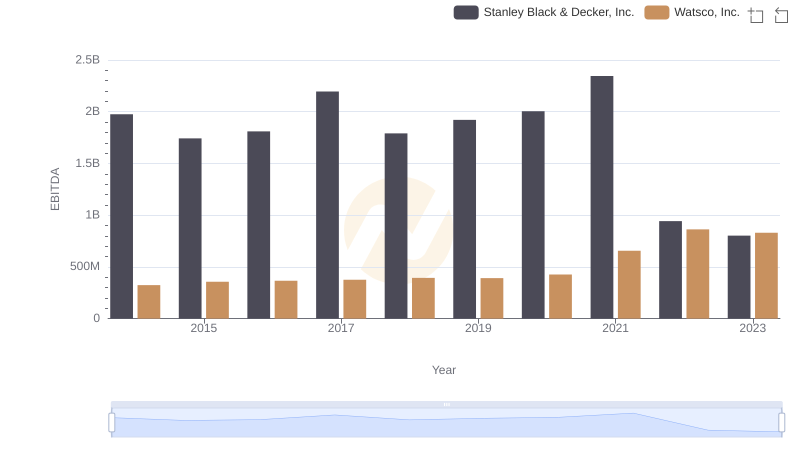

| __timestamp | Stanley Black & Decker, Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 2595900000 | 650655000 |

| Thursday, January 1, 2015 | 2486400000 | 670609000 |

| Friday, January 1, 2016 | 2623900000 | 688952000 |

| Sunday, January 1, 2017 | 2980100000 | 715671000 |

| Monday, January 1, 2018 | 3171700000 | 757452000 |

| Tuesday, January 1, 2019 | 3041000000 | 800328000 |

| Wednesday, January 1, 2020 | 3089600000 | 833051000 |

| Friday, January 1, 2021 | 3240400000 | 1058316000 |

| Saturday, January 1, 2022 | 3370000000 | 1221382000 |

| Sunday, January 1, 2023 | 2829300000 | 1185626000 |

| Monday, January 1, 2024 | 3310500000 | 1262938000 |

Unlocking the unknown

In the ever-evolving landscape of corporate finance, effective cost management is crucial for sustaining growth and profitability. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: Watsco, Inc. and Stanley Black & Decker, Inc., from 2014 to 2023.

Over the past decade, Stanley Black & Decker, Inc. has seen its SG&A expenses fluctuate, peaking in 2022 with a 35% increase from 2014, before a notable 16% drop in 2023. Meanwhile, Watsco, Inc. demonstrated a steady upward trend, with expenses nearly doubling by 2022, reflecting strategic investments in growth.

These trends highlight the contrasting strategies of these companies. While Stanley Black & Decker, Inc. appears to be optimizing costs post-2022, Watsco, Inc. continues to expand its operational footprint, underscoring the diverse approaches to cost management in today's competitive market.

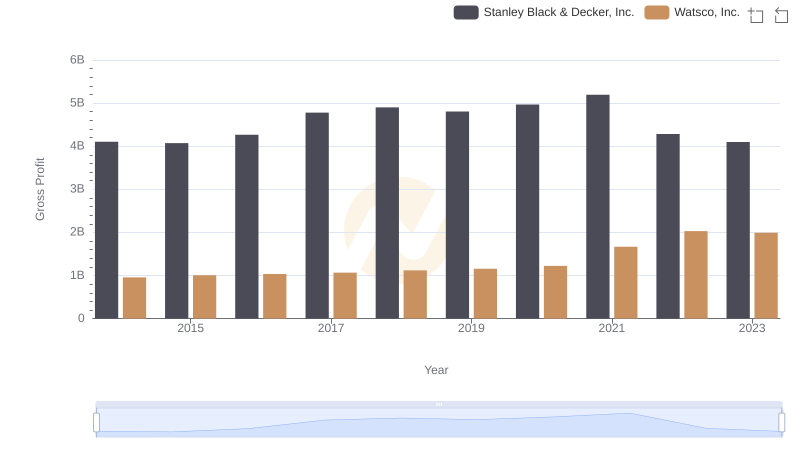

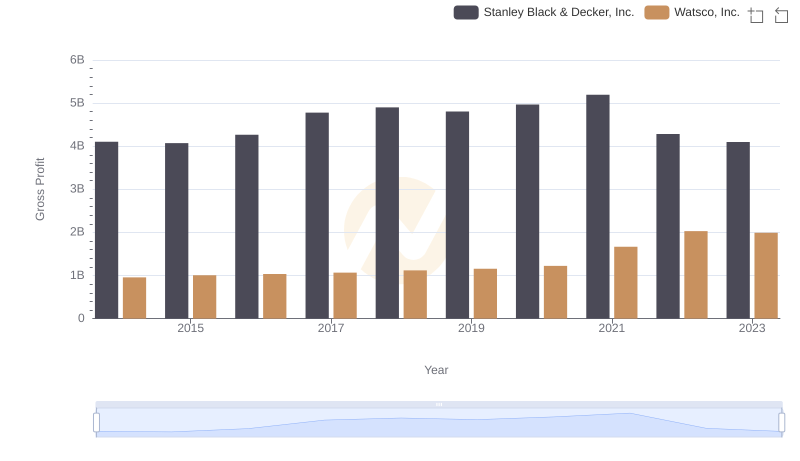

Key Insights on Gross Profit: Watsco, Inc. vs Stanley Black & Decker, Inc.

Breaking Down SG&A Expenses: Watsco, Inc. vs Stanley Black & Decker, Inc.

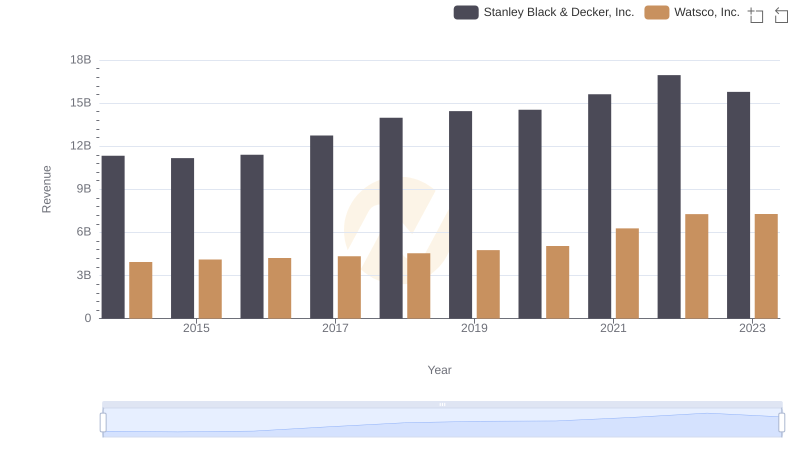

Who Generates More Revenue? Watsco, Inc. or Stanley Black & Decker, Inc.

Gross Profit Trends Compared: Watsco, Inc. vs Stanley Black & Decker, Inc.

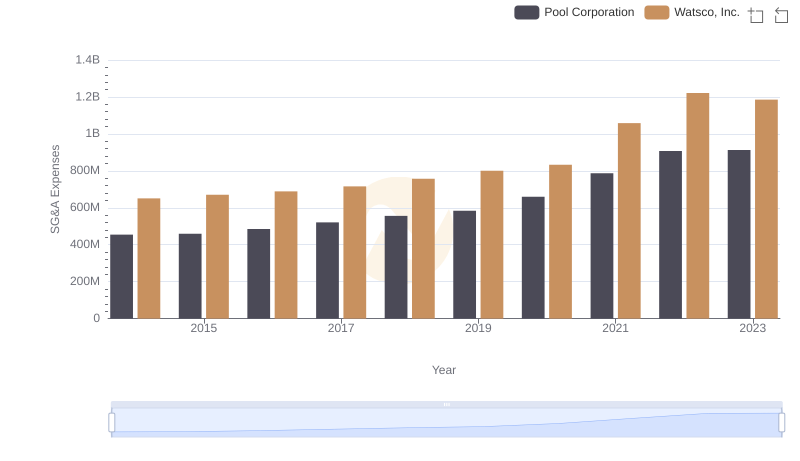

Breaking Down SG&A Expenses: Watsco, Inc. vs Pool Corporation

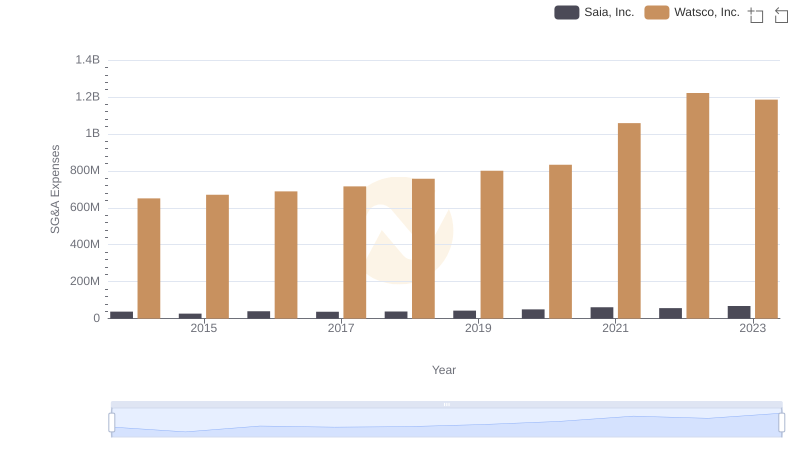

Breaking Down SG&A Expenses: Watsco, Inc. vs Saia, Inc.

Comparative EBITDA Analysis: Watsco, Inc. vs Stanley Black & Decker, Inc.