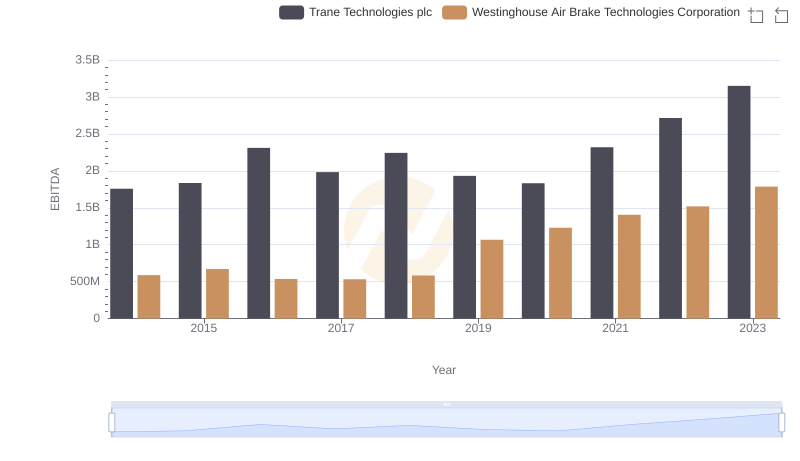

| __timestamp | Trane Technologies plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2503900000 | 324539000 |

| Thursday, January 1, 2015 | 2541100000 | 319173000 |

| Friday, January 1, 2016 | 2606500000 | 327505000 |

| Sunday, January 1, 2017 | 2720700000 | 482852000 |

| Monday, January 1, 2018 | 2903200000 | 573644000 |

| Tuesday, January 1, 2019 | 3129800000 | 936600000 |

| Wednesday, January 1, 2020 | 2270600000 | 877100000 |

| Friday, January 1, 2021 | 2446300000 | 1005000000 |

| Saturday, January 1, 2022 | 2545900000 | 1020000000 |

| Sunday, January 1, 2023 | 2963200000 | 1139000000 |

| Monday, January 1, 2024 | 3580400000 | 1248000000 |

Igniting the spark of knowledge

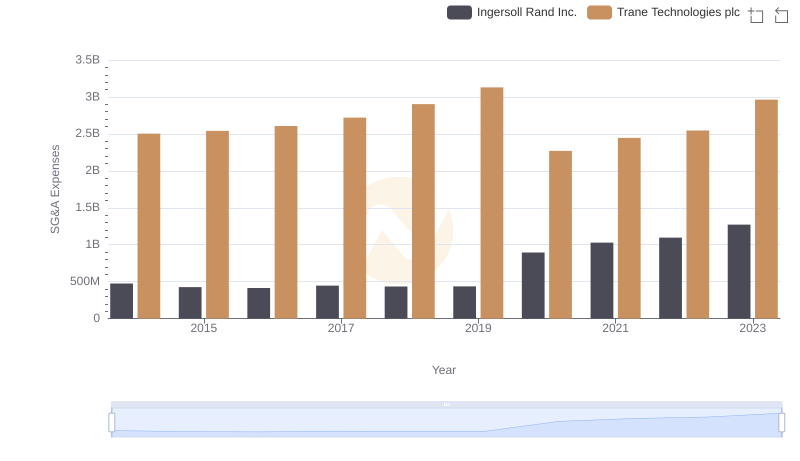

In the world of industrial innovation, Trane Technologies plc and Westinghouse Air Brake Technologies Corporation have carved distinct paths. Over the past decade, from 2014 to 2023, their spending on Selling, General, and Administrative (SG&A) expenses reveals intriguing trends. Trane Technologies consistently allocated a significant portion of its budget to SG&A, peaking in 2019 with a 25% increase from 2014. Meanwhile, Westinghouse Air Brake Technologies saw a remarkable 250% rise in SG&A expenses over the same period, reflecting strategic investments in growth and innovation.

Trane Technologies' SG&A expenses fluctuated, with a notable dip in 2020, likely due to global economic challenges. In contrast, Westinghouse's steady increase underscores its commitment to expanding its market presence. These patterns highlight the companies' differing strategies in navigating the competitive industrial landscape.

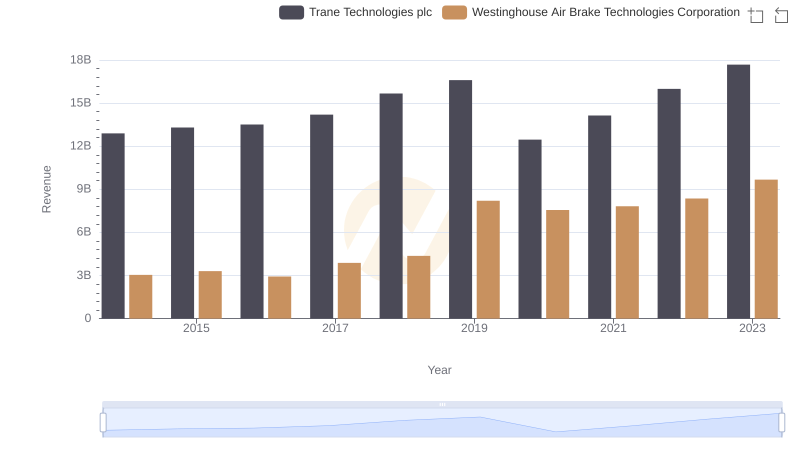

Trane Technologies plc vs Westinghouse Air Brake Technologies Corporation: Examining Key Revenue Metrics

Cost of Revenue Comparison: Trane Technologies plc vs Westinghouse Air Brake Technologies Corporation

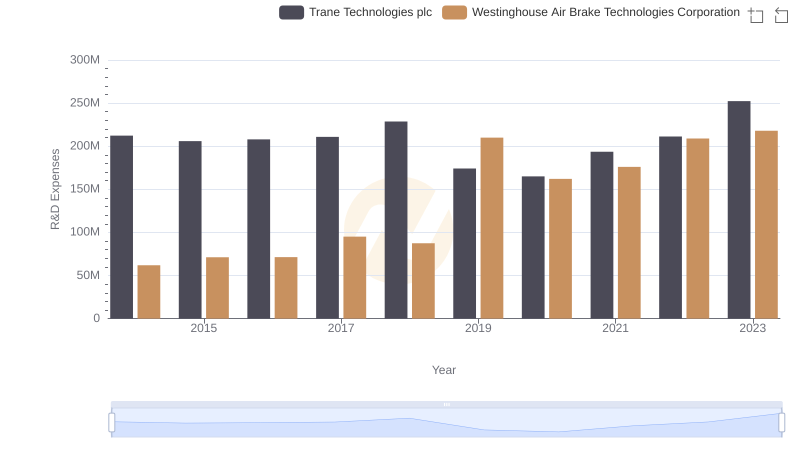

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Westinghouse Air Brake Technologies Corporation

Comparing SG&A Expenses: Trane Technologies plc vs Ingersoll Rand Inc. Trends and Insights

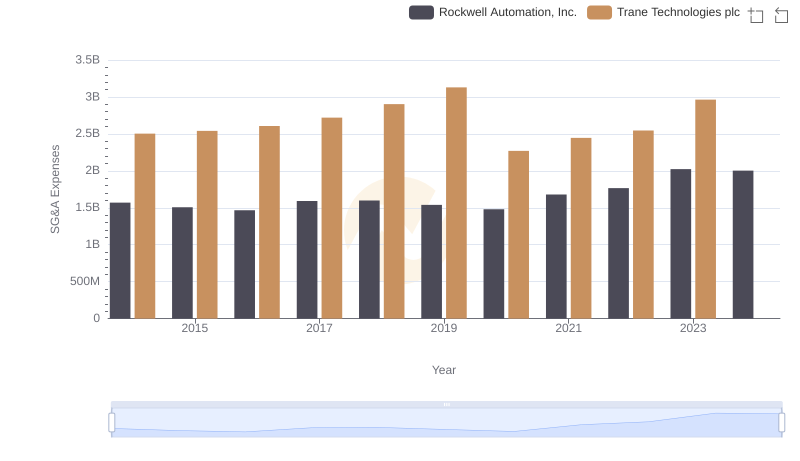

SG&A Efficiency Analysis: Comparing Trane Technologies plc and Rockwell Automation, Inc.

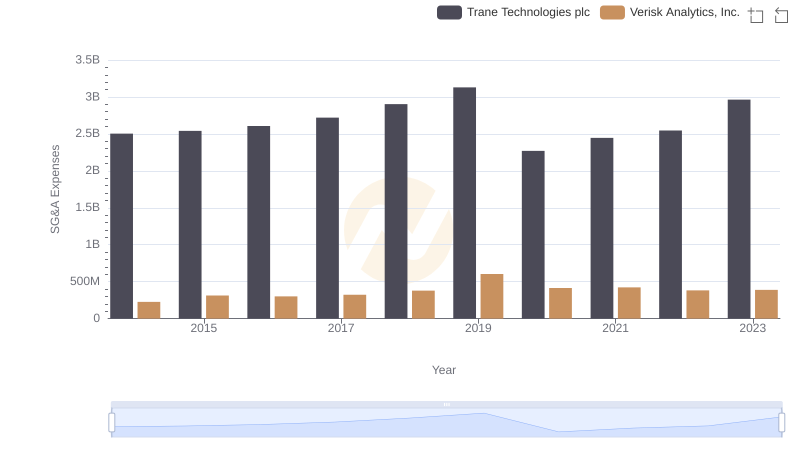

Cost Management Insights: SG&A Expenses for Trane Technologies plc and Verisk Analytics, Inc.

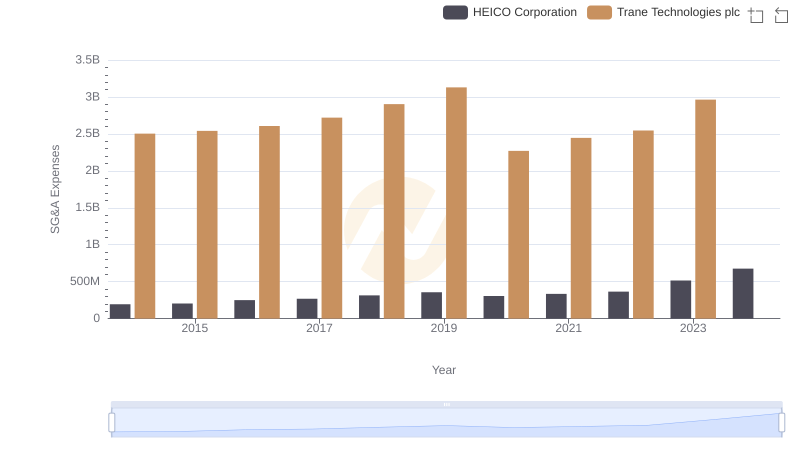

Trane Technologies plc or HEICO Corporation: Who Manages SG&A Costs Better?

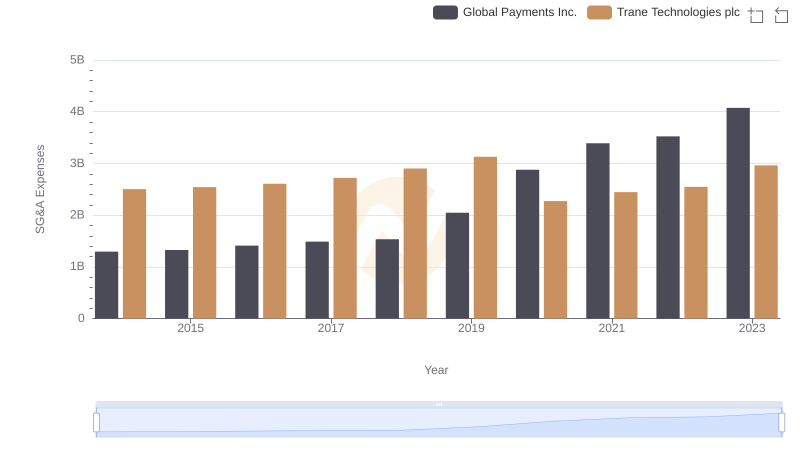

Breaking Down SG&A Expenses: Trane Technologies plc vs Global Payments Inc.

EBITDA Analysis: Evaluating Trane Technologies plc Against Westinghouse Air Brake Technologies Corporation

Trane Technologies plc and Xylem Inc.: SG&A Spending Patterns Compared