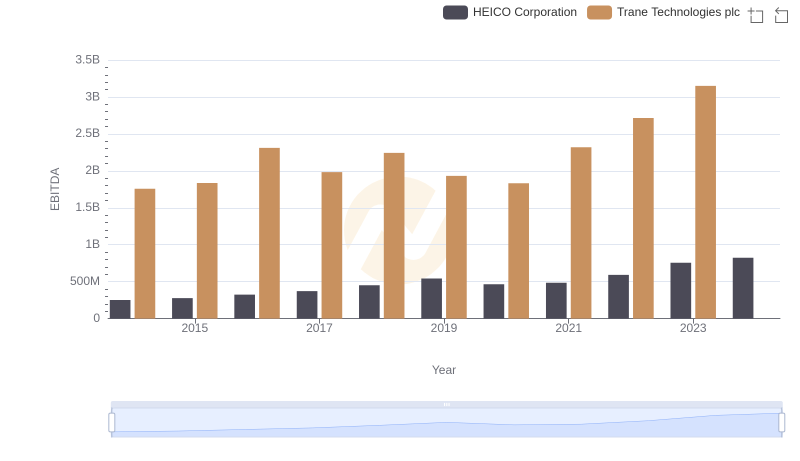

| __timestamp | Trane Technologies plc | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1757000000 | 588370000 |

| Thursday, January 1, 2015 | 1835000000 | 672301000 |

| Friday, January 1, 2016 | 2311000000 | 535893000 |

| Sunday, January 1, 2017 | 1982500000 | 532795000 |

| Monday, January 1, 2018 | 2242400000 | 584199000 |

| Tuesday, January 1, 2019 | 1931200000 | 1067300000 |

| Wednesday, January 1, 2020 | 1831900000 | 1229400000 |

| Friday, January 1, 2021 | 2319200000 | 1405000000 |

| Saturday, January 1, 2022 | 2715500000 | 1519000000 |

| Sunday, January 1, 2023 | 3149900000 | 1787000000 |

| Monday, January 1, 2024 | 3859600000 | 1609000000 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial technology, Trane Technologies plc and Westinghouse Air Brake Technologies Corporation have emerged as formidable players. Over the past decade, from 2014 to 2023, Trane Technologies has consistently outperformed its counterpart in terms of EBITDA, showcasing a robust growth trajectory. Starting at approximately $1.76 billion in 2014, Trane Technologies' EBITDA surged by nearly 79% to reach $3.15 billion in 2023. In contrast, Westinghouse Air Brake Technologies, while demonstrating steady growth, increased its EBITDA from around $588 million to $1.79 billion, marking a 204% rise. This analysis highlights Trane Technologies' dominance in the sector, yet also underscores the impressive growth rate of Westinghouse Air Brake Technologies. As the industrial sector continues to innovate, these companies remain pivotal in shaping the future of technology and infrastructure.

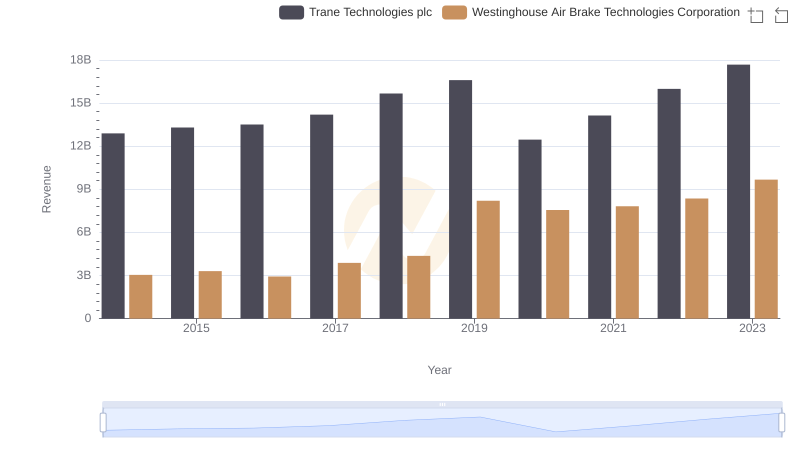

Trane Technologies plc vs Westinghouse Air Brake Technologies Corporation: Examining Key Revenue Metrics

Cost of Revenue Comparison: Trane Technologies plc vs Westinghouse Air Brake Technologies Corporation

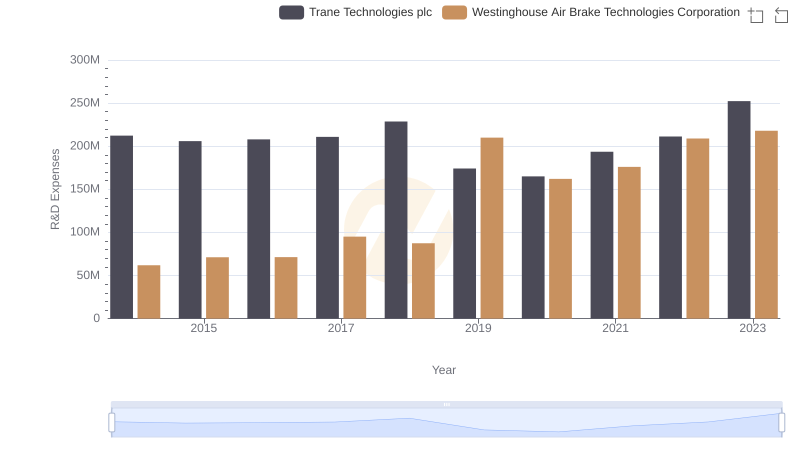

Who Prioritizes Innovation? R&D Spending Compared for Trane Technologies plc and Westinghouse Air Brake Technologies Corporation

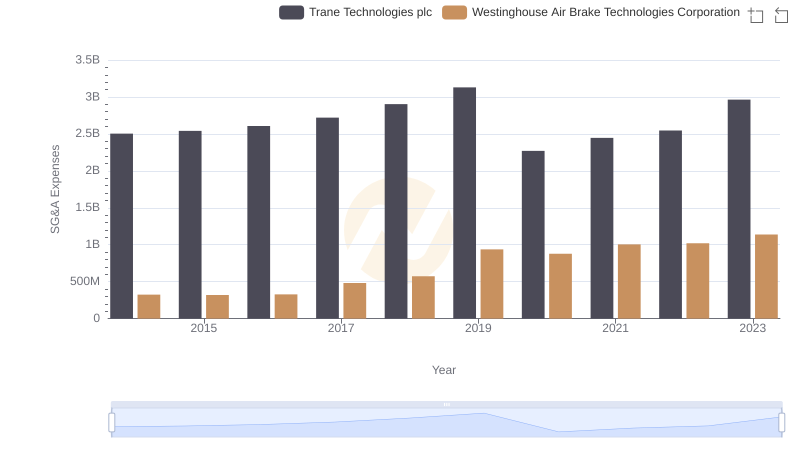

Trane Technologies plc and Westinghouse Air Brake Technologies Corporation: SG&A Spending Patterns Compared

A Professional Review of EBITDA: Trane Technologies plc Compared to HEICO Corporation

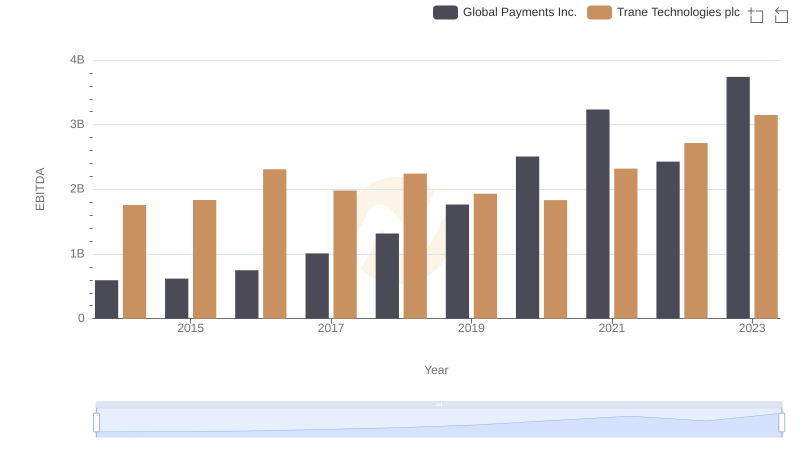

Comparative EBITDA Analysis: Trane Technologies plc vs Global Payments Inc.

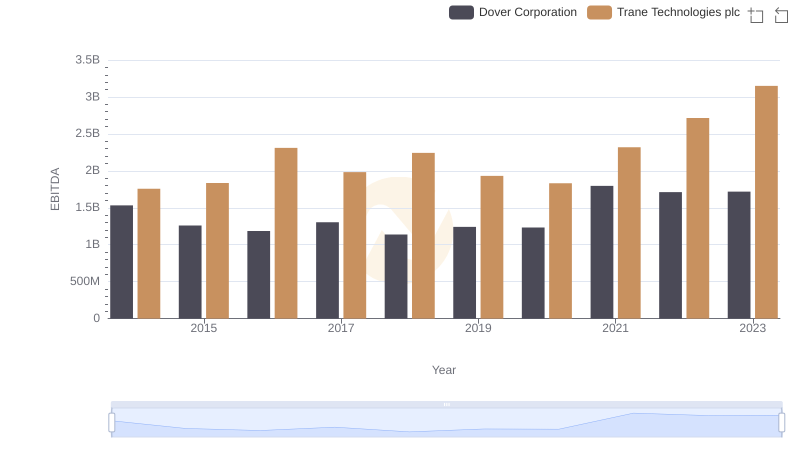

A Side-by-Side Analysis of EBITDA: Trane Technologies plc and Dover Corporation

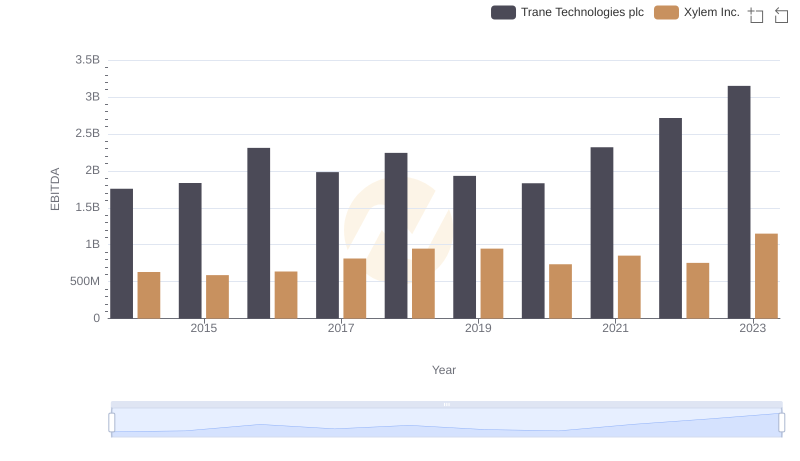

A Professional Review of EBITDA: Trane Technologies plc Compared to Xylem Inc.

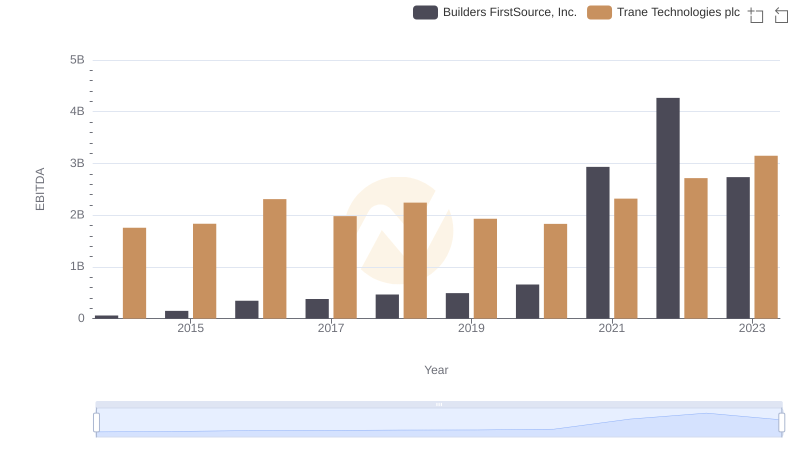

EBITDA Metrics Evaluated: Trane Technologies plc vs Builders FirstSource, Inc.