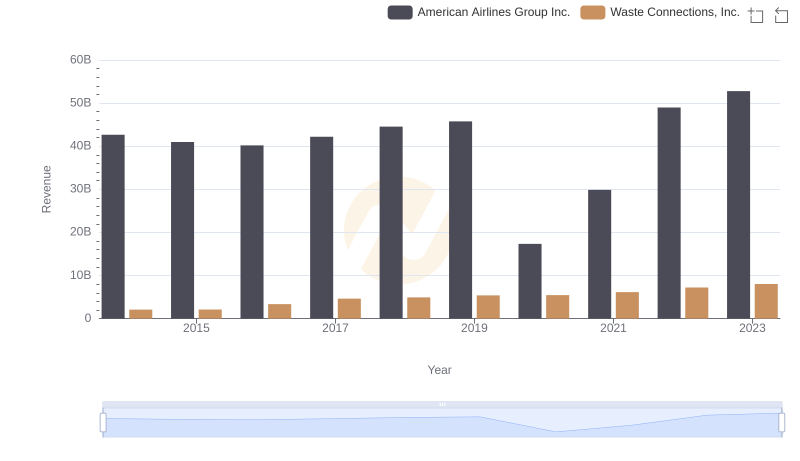

| __timestamp | American Airlines Group Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1544000000 | 229474000 |

| Thursday, January 1, 2015 | 1394000000 | 237484000 |

| Friday, January 1, 2016 | 1323000000 | 474263000 |

| Sunday, January 1, 2017 | 1477000000 | 509638000 |

| Monday, January 1, 2018 | 1520000000 | 524388000 |

| Tuesday, January 1, 2019 | 1602000000 | 546278000 |

| Wednesday, January 1, 2020 | 513000000 | 537632000 |

| Friday, January 1, 2021 | 1098000000 | 612337000 |

| Saturday, January 1, 2022 | 1815000000 | 696467000 |

| Sunday, January 1, 2023 | 1799000000 | 799119000 |

| Monday, January 1, 2024 | 883445000 |

Infusing magic into the data realm

In the dynamic world of corporate finance, understanding Selling, General, and Administrative (SG&A) expenses is crucial for evaluating a company's operational efficiency. This analysis juxtaposes Waste Connections, Inc., a leader in waste management, with American Airlines Group Inc., a titan in the aviation industry, over a decade from 2014 to 2023.

American Airlines experienced a significant fluctuation in SG&A expenses, peaking in 2022 with a 29% increase from 2016. In contrast, Waste Connections demonstrated a steady rise, with a 248% increase over the same period, reflecting consistent growth and operational scaling.

The stark contrast in SG&A trends highlights the differing challenges and efficiencies in the waste management and aviation sectors. While American Airlines faced volatility, Waste Connections showcased resilience and strategic cost management. This comparison offers valuable insights into how industry-specific factors influence financial strategies and operational efficiencies.

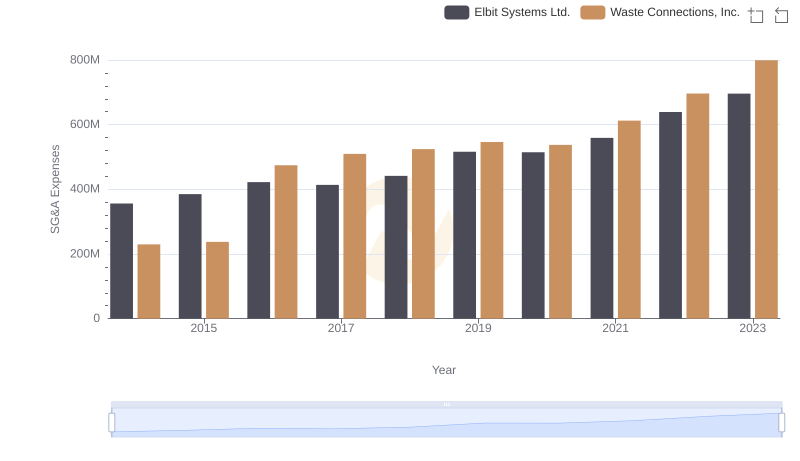

Waste Connections, Inc. and Elbit Systems Ltd.: SG&A Spending Patterns Compared

Revenue Insights: Waste Connections, Inc. and American Airlines Group Inc. Performance Compared

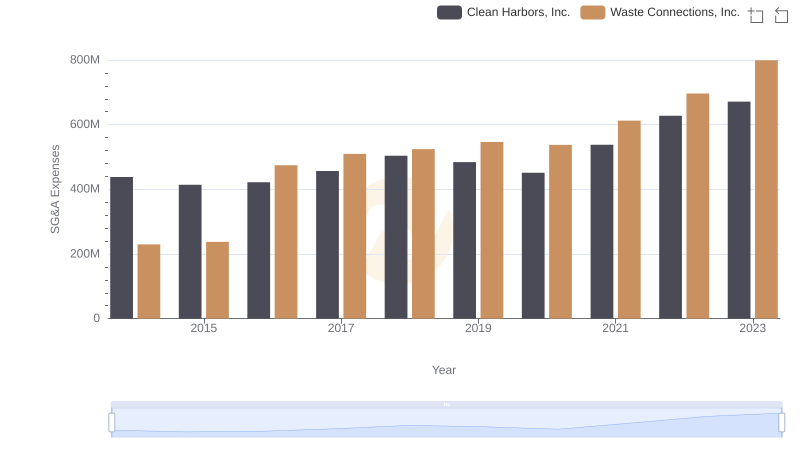

Selling, General, and Administrative Costs: Waste Connections, Inc. vs Clean Harbors, Inc.

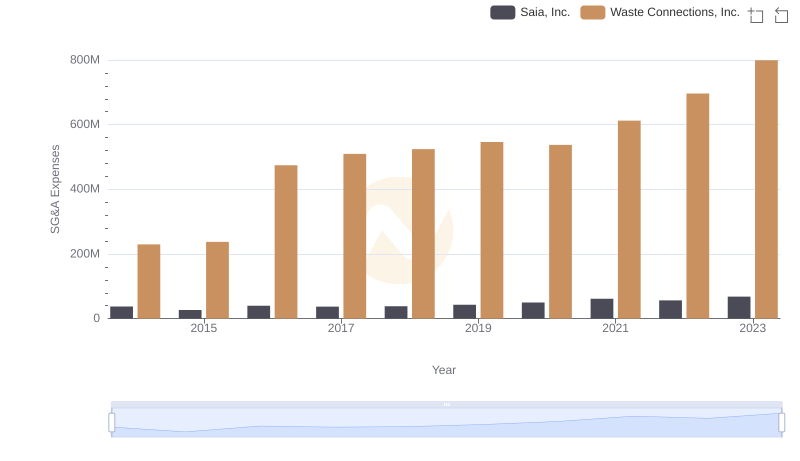

SG&A Efficiency Analysis: Comparing Waste Connections, Inc. and Saia, Inc.

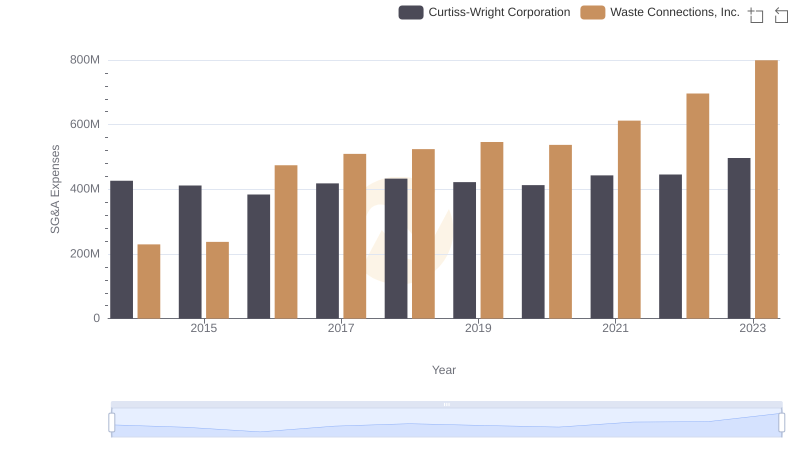

Waste Connections, Inc. vs Curtiss-Wright Corporation: SG&A Expense Trends

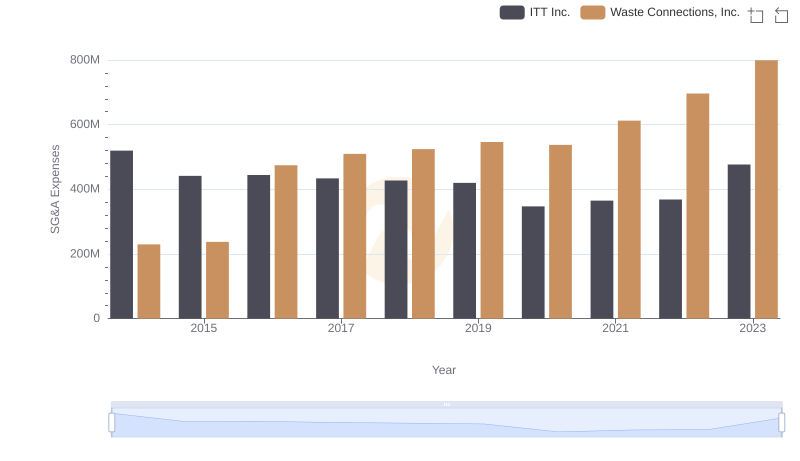

Cost Management Insights: SG&A Expenses for Waste Connections, Inc. and ITT Inc.

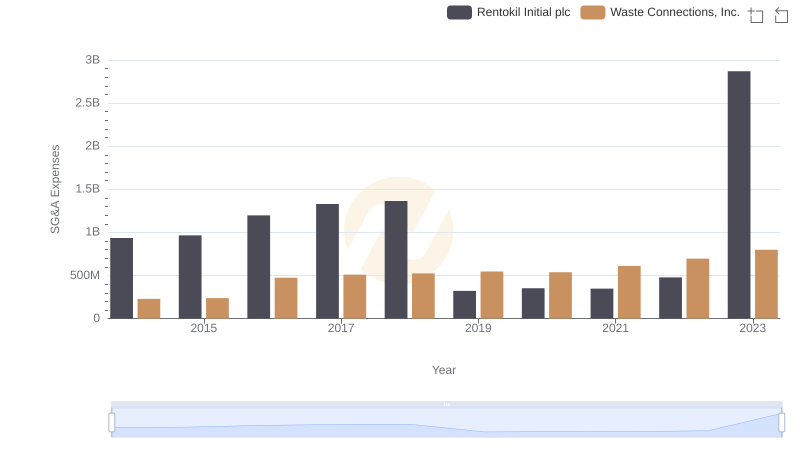

Comparing SG&A Expenses: Waste Connections, Inc. vs Rentokil Initial plc Trends and Insights

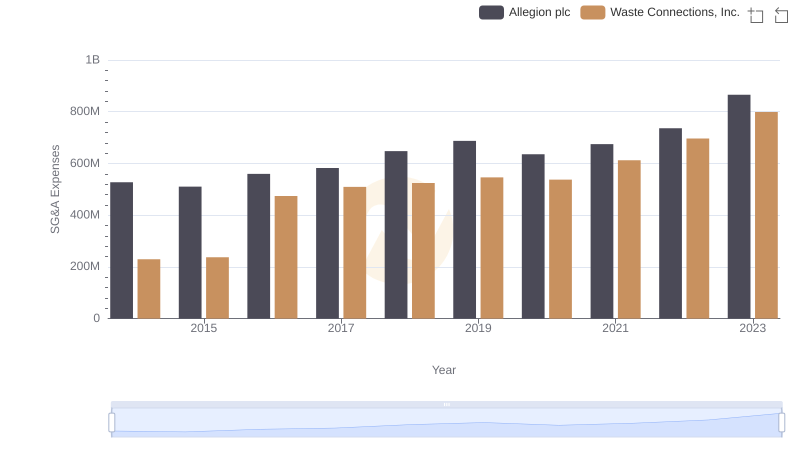

Waste Connections, Inc. or Allegion plc: Who Manages SG&A Costs Better?