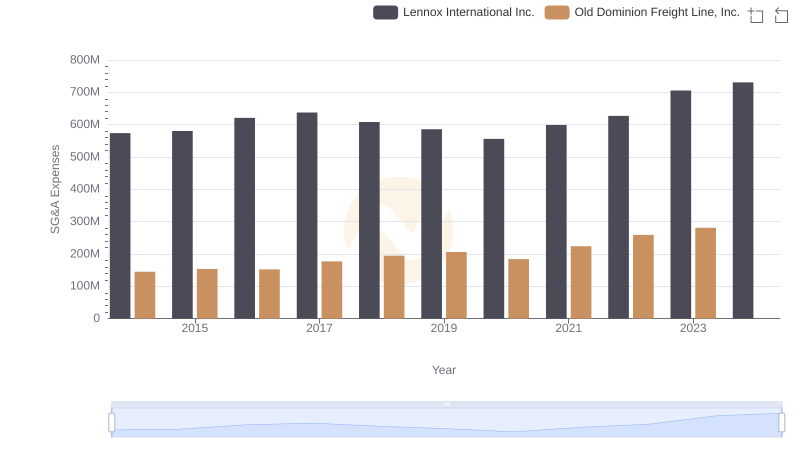

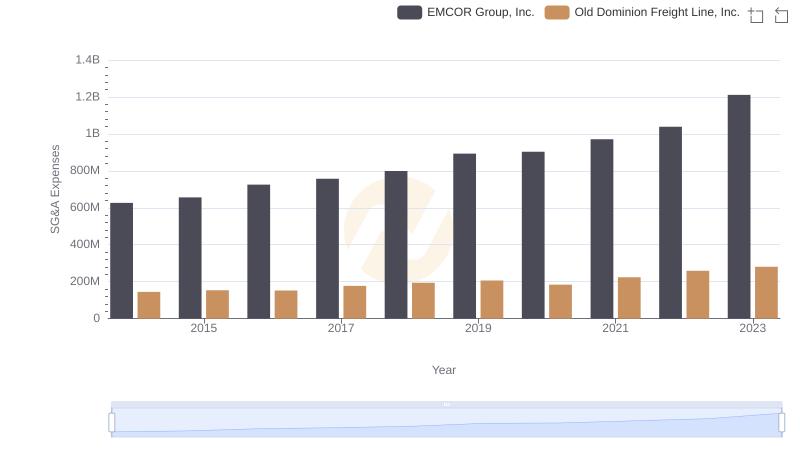

| __timestamp | Hubbell Incorporated | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 591600000 | 144817000 |

| Thursday, January 1, 2015 | 617200000 | 153589000 |

| Friday, January 1, 2016 | 622900000 | 152391000 |

| Sunday, January 1, 2017 | 648200000 | 177205000 |

| Monday, January 1, 2018 | 743500000 | 194368000 |

| Tuesday, January 1, 2019 | 756100000 | 206125000 |

| Wednesday, January 1, 2020 | 676300000 | 184185000 |

| Friday, January 1, 2021 | 619200000 | 223757000 |

| Saturday, January 1, 2022 | 762500000 | 258883000 |

| Sunday, January 1, 2023 | 848600000 | 281053000 |

| Monday, January 1, 2024 | 812500000 |

Unveiling the hidden dimensions of data

In the competitive landscape of corporate America, the efficiency of Selling, General, and Administrative (SG&A) expenses is a critical metric for evaluating a company's operational prowess. Over the past decade, Old Dominion Freight Line, Inc. and Hubbell Incorporated have showcased contrasting trajectories in their SG&A expenditures.

From 2014 to 2023, Hubbell Incorporated's SG&A expenses have surged by approximately 43%, reflecting a strategic expansion and investment in administrative capabilities. In contrast, Old Dominion Freight Line, Inc. has seen an impressive 94% increase, indicating a robust growth strategy and operational scaling.

While Hubbell's steady rise in SG&A expenses suggests a focus on maintaining operational stability, Old Dominion's sharper increase points to aggressive growth and market penetration strategies. This divergence highlights the varied approaches companies take in managing their operational costs to drive business success.

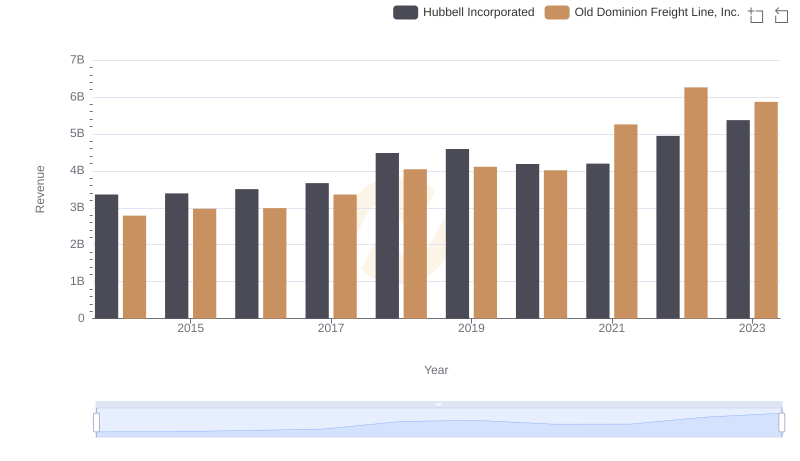

Old Dominion Freight Line, Inc. or Hubbell Incorporated: Who Leads in Yearly Revenue?

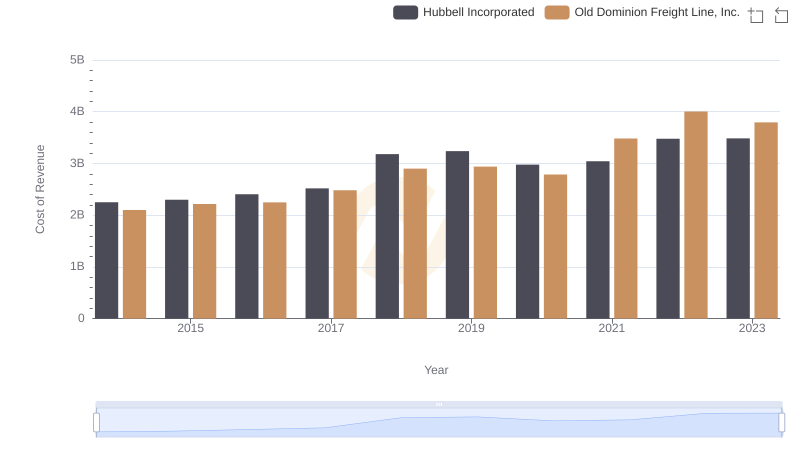

Cost of Revenue: Key Insights for Old Dominion Freight Line, Inc. and Hubbell Incorporated

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Lennox International Inc.

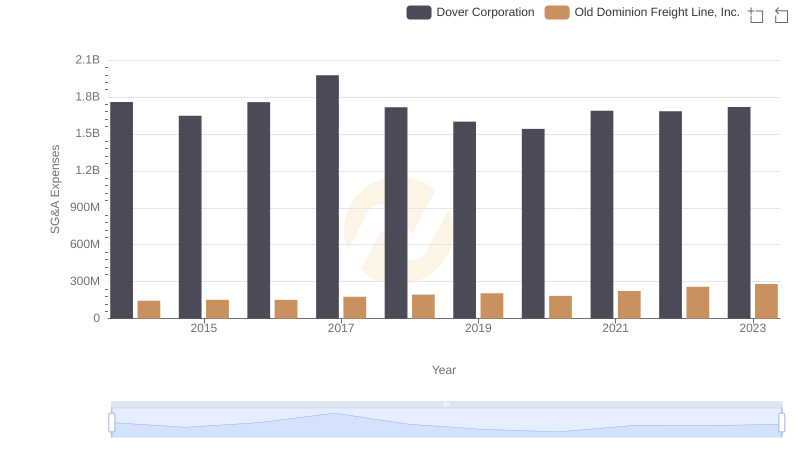

Old Dominion Freight Line, Inc. vs Dover Corporation: SG&A Expense Trends

Old Dominion Freight Line, Inc. vs EMCOR Group, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Watsco, Inc.

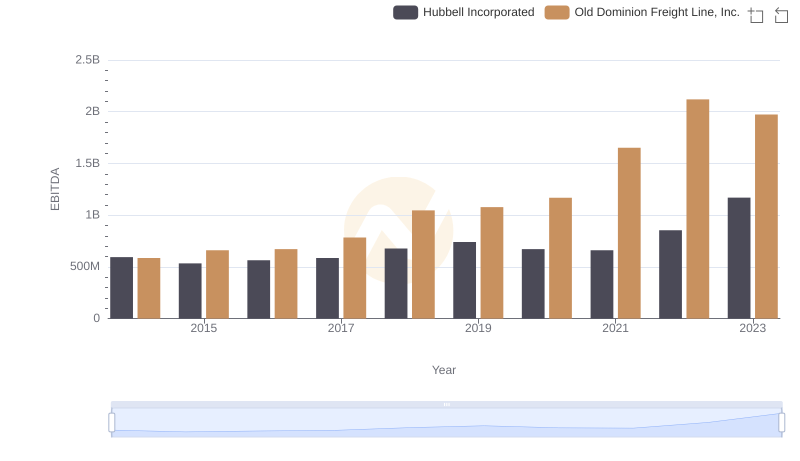

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Hubbell Incorporated