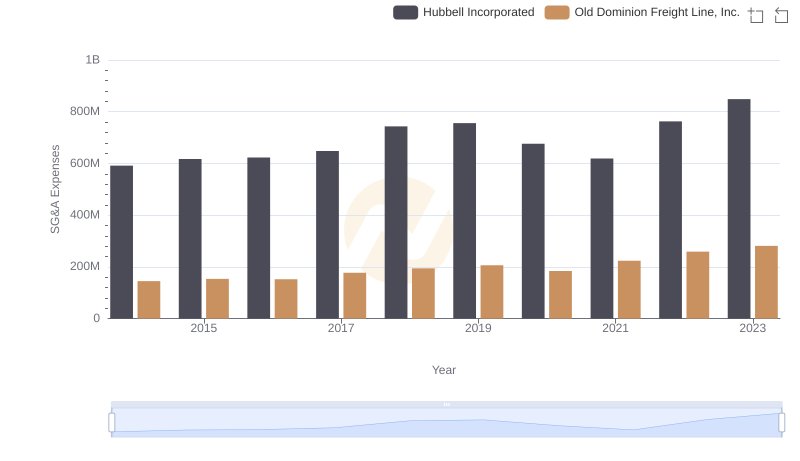

| __timestamp | EMCOR Group, Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 626478000 | 144817000 |

| Thursday, January 1, 2015 | 656573000 | 153589000 |

| Friday, January 1, 2016 | 725538000 | 152391000 |

| Sunday, January 1, 2017 | 757062000 | 177205000 |

| Monday, January 1, 2018 | 799157000 | 194368000 |

| Tuesday, January 1, 2019 | 893453000 | 206125000 |

| Wednesday, January 1, 2020 | 903584000 | 184185000 |

| Friday, January 1, 2021 | 970937000 | 223757000 |

| Saturday, January 1, 2022 | 1038717000 | 258883000 |

| Sunday, January 1, 2023 | 1211233000 | 281053000 |

Unlocking the unknown

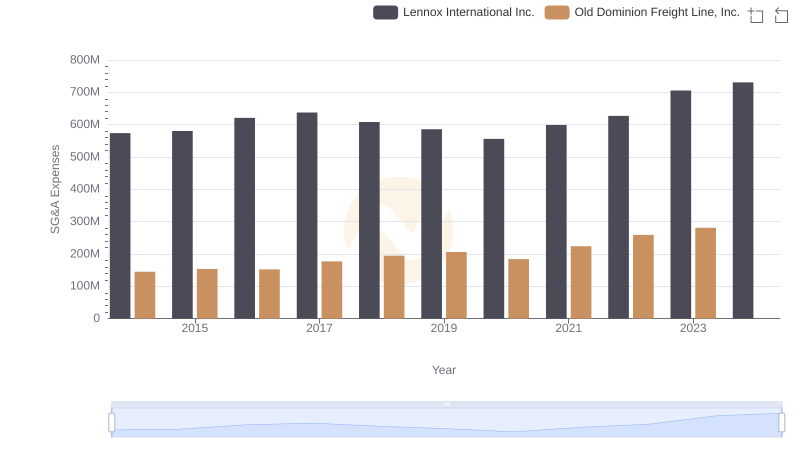

In the world of logistics and construction, Old Dominion Freight Line, Inc. and EMCOR Group, Inc. have carved out significant niches. Over the past decade, from 2014 to 2023, these industry leaders have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses.

EMCOR Group, Inc. has seen a steady increase in SG&A expenses, growing by approximately 93% over the period. This reflects their expansive growth strategy and increased operational scale. In contrast, Old Dominion Freight Line, Inc. has experienced a more moderate rise of about 94%, indicating a focus on efficiency and cost management.

These trends highlight the differing strategic priorities of the two companies. While EMCOR's rising expenses suggest aggressive expansion, Old Dominion's controlled growth points to a focus on maintaining profitability. Investors and industry analysts should consider these dynamics when evaluating future prospects.

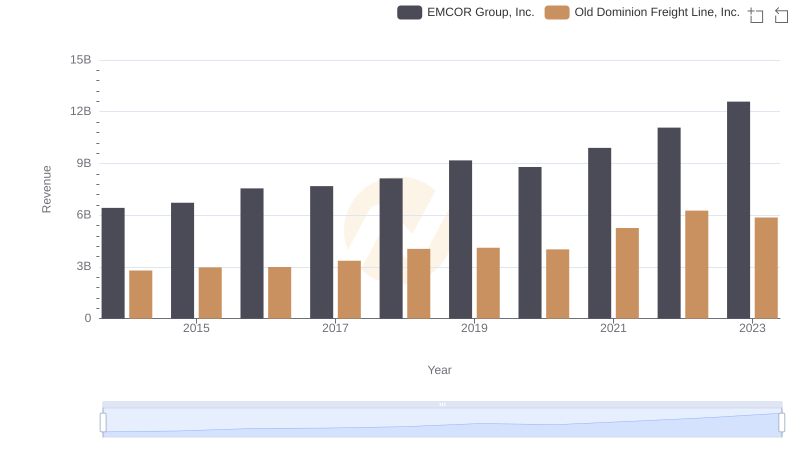

Who Generates More Revenue? Old Dominion Freight Line, Inc. or EMCOR Group, Inc.

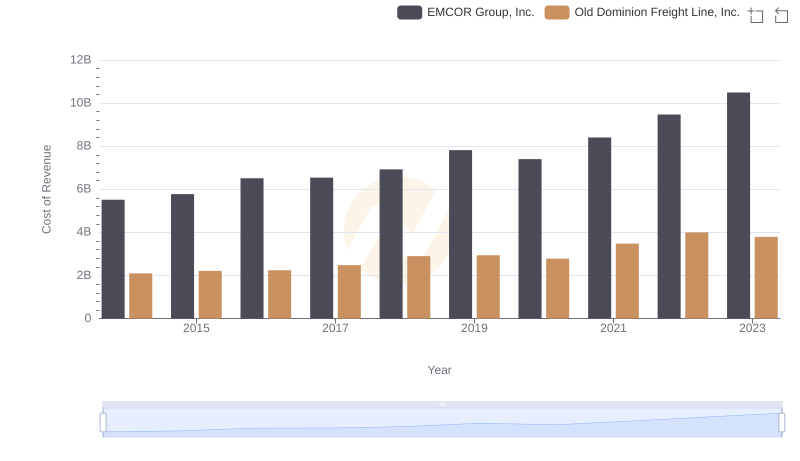

Cost of Revenue Comparison: Old Dominion Freight Line, Inc. vs EMCOR Group, Inc.

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Lennox International Inc.

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Hubbell Incorporated

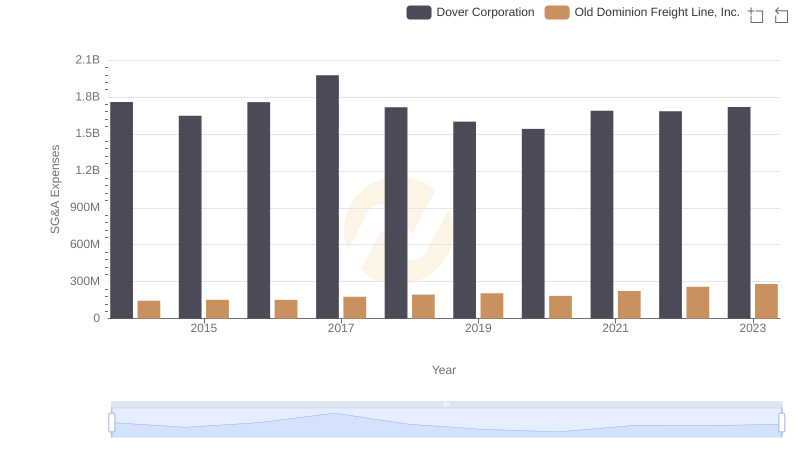

Old Dominion Freight Line, Inc. vs Dover Corporation: SG&A Expense Trends

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Watsco, Inc.

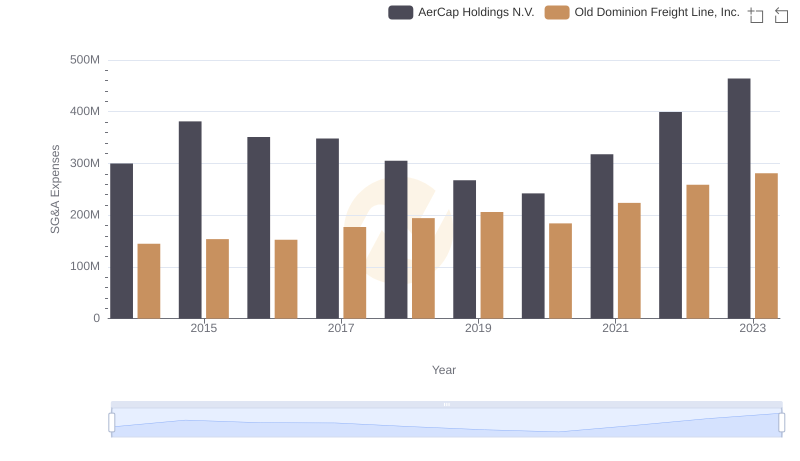

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs AerCap Holdings N.V. Trends and Insights