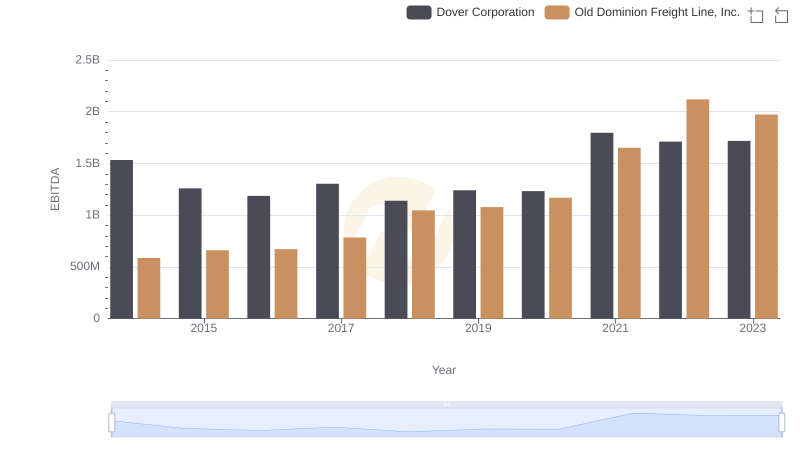

| __timestamp | Dover Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1758765000 | 144817000 |

| Thursday, January 1, 2015 | 1647382000 | 153589000 |

| Friday, January 1, 2016 | 1757523000 | 152391000 |

| Sunday, January 1, 2017 | 1975932000 | 177205000 |

| Monday, January 1, 2018 | 1716444000 | 194368000 |

| Tuesday, January 1, 2019 | 1599098000 | 206125000 |

| Wednesday, January 1, 2020 | 1541032000 | 184185000 |

| Friday, January 1, 2021 | 1688278000 | 223757000 |

| Saturday, January 1, 2022 | 1684226000 | 258883000 |

| Sunday, January 1, 2023 | 1718290000 | 281053000 |

| Monday, January 1, 2024 | 1752266000 |

Unveiling the hidden dimensions of data

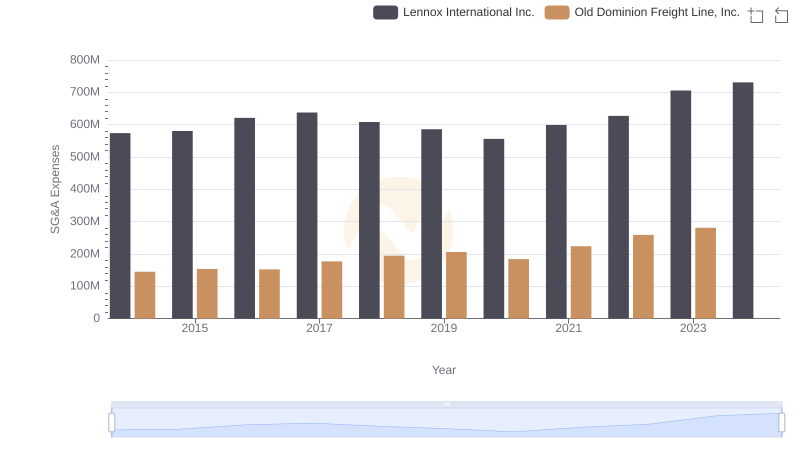

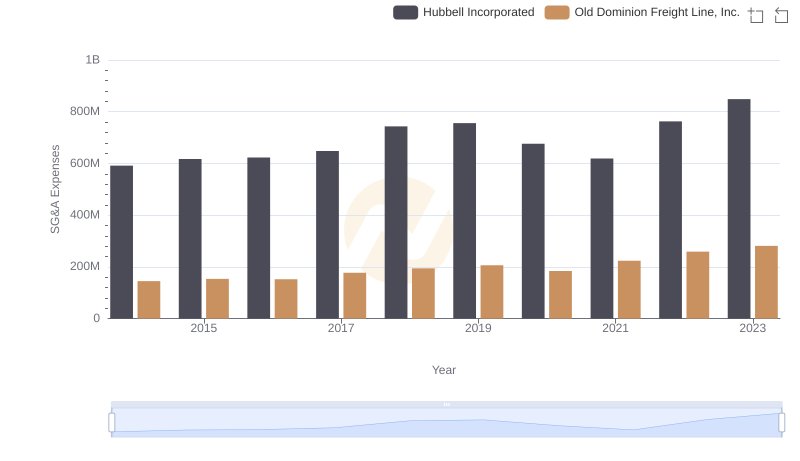

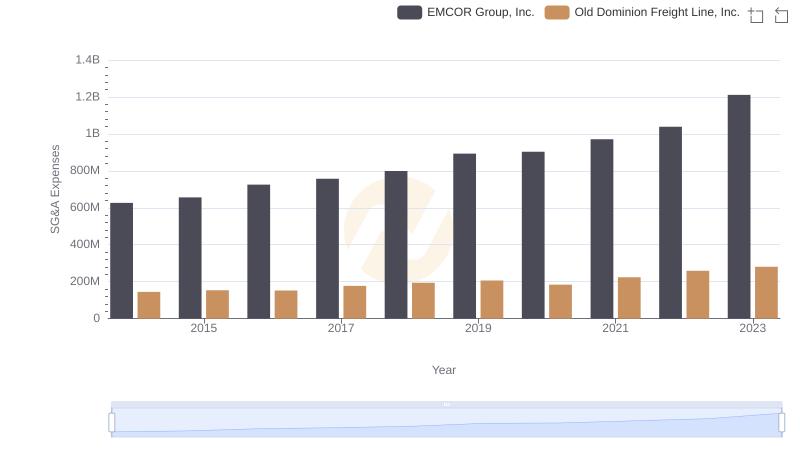

In the world of logistics and manufacturing, understanding cost structures is crucial. Over the past decade, Old Dominion Freight Line, Inc. and Dover Corporation have showcased contrasting trends in their Selling, General, and Administrative (SG&A) expenses.

From 2014 to 2023, Old Dominion Freight Line, Inc. has seen a remarkable 94% increase in SG&A expenses, reflecting its aggressive expansion and operational scaling. In contrast, Dover Corporation's SG&A expenses have remained relatively stable, with a slight decline of about 2% over the same period. This stability suggests a focus on efficiency and cost management.

These trends highlight the strategic differences between the two companies. While Old Dominion is investing heavily in growth, Dover is optimizing its existing operations. Investors and industry analysts should consider these dynamics when evaluating the future prospects of these industry leaders.

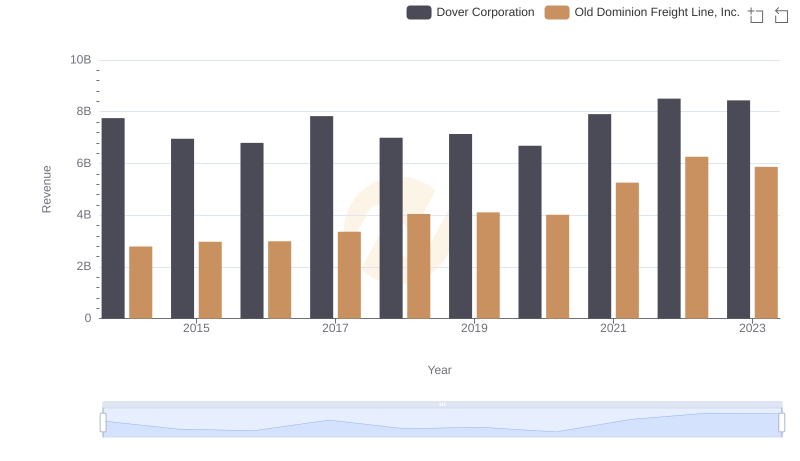

Old Dominion Freight Line, Inc. vs Dover Corporation: Examining Key Revenue Metrics

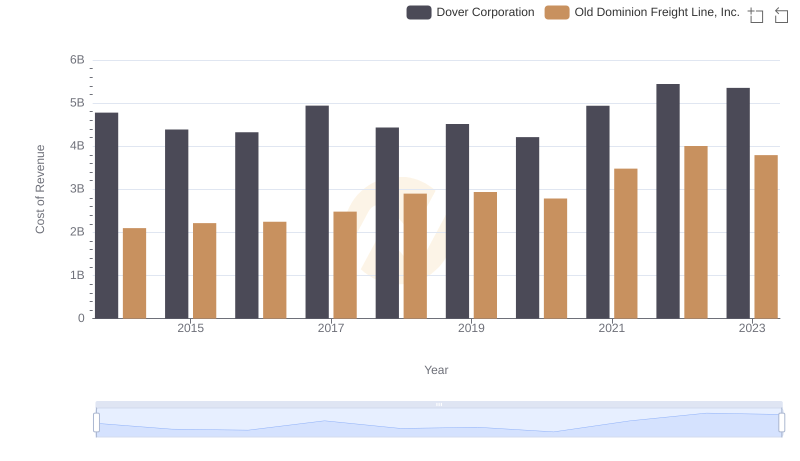

Cost of Revenue Comparison: Old Dominion Freight Line, Inc. vs Dover Corporation

Breaking Down SG&A Expenses: Old Dominion Freight Line, Inc. vs Lennox International Inc.

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Hubbell Incorporated

Old Dominion Freight Line, Inc. vs EMCOR Group, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Watsco, Inc.

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Dover Corporation