| __timestamp | Ingersoll Rand Inc. | Saia, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 37563000 |

| Thursday, January 1, 2015 | 427000000 | 26832000 |

| Friday, January 1, 2016 | 414339000 | 39625000 |

| Sunday, January 1, 2017 | 446600000 | 37162000 |

| Monday, January 1, 2018 | 434600000 | 38425000 |

| Tuesday, January 1, 2019 | 436400000 | 43073000 |

| Wednesday, January 1, 2020 | 894800000 | 49761000 |

| Friday, January 1, 2021 | 1028000000 | 61345000 |

| Saturday, January 1, 2022 | 1095800000 | 56601000 |

| Sunday, January 1, 2023 | 1272700000 | 67984000 |

| Monday, January 1, 2024 | 0 |

Unleashing the power of data

In the competitive landscape of industrial and transportation sectors, understanding SG&A (Selling, General, and Administrative) efficiency is crucial. Ingersoll Rand Inc. and Saia, Inc. offer a fascinating comparison over the past decade. From 2014 to 2023, Ingersoll Rand's SG&A expenses surged by approximately 167%, reflecting strategic investments and expansion efforts. In contrast, Saia, Inc. maintained a more modest increase of around 81%, showcasing a disciplined approach to cost management.

Ingersoll Rand's expenses peaked in 2023, reaching nearly three times their 2014 levels, indicating aggressive growth strategies. Meanwhile, Saia's expenses grew steadily, with a notable 83% increase from 2014 to 2023. This divergence highlights differing corporate strategies: Ingersoll Rand's focus on scaling operations versus Saia's emphasis on operational efficiency. As these companies navigate future challenges, their SG&A strategies will be pivotal in shaping their competitive edge.

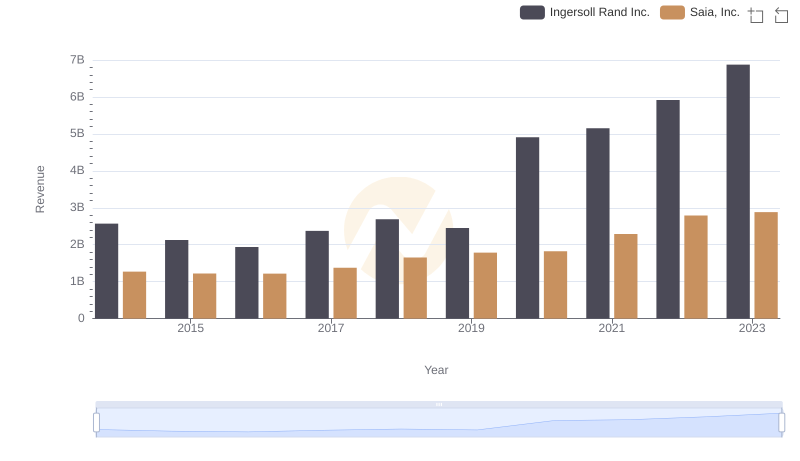

Ingersoll Rand Inc. and Saia, Inc.: A Comprehensive Revenue Analysis

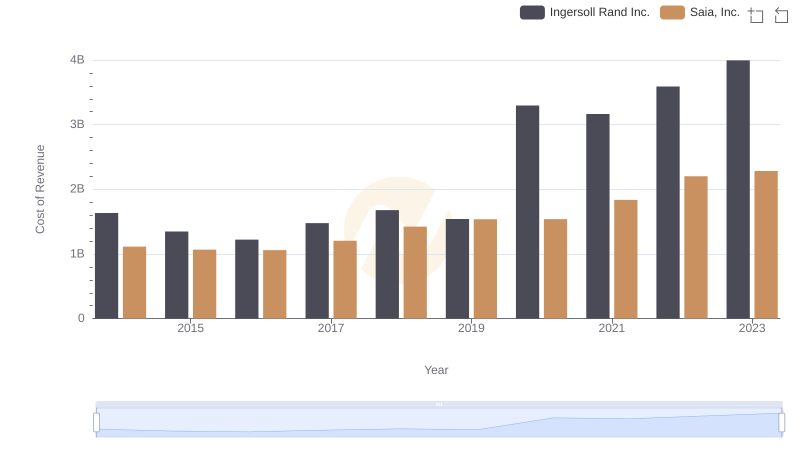

Cost of Revenue: Key Insights for Ingersoll Rand Inc. and Saia, Inc.

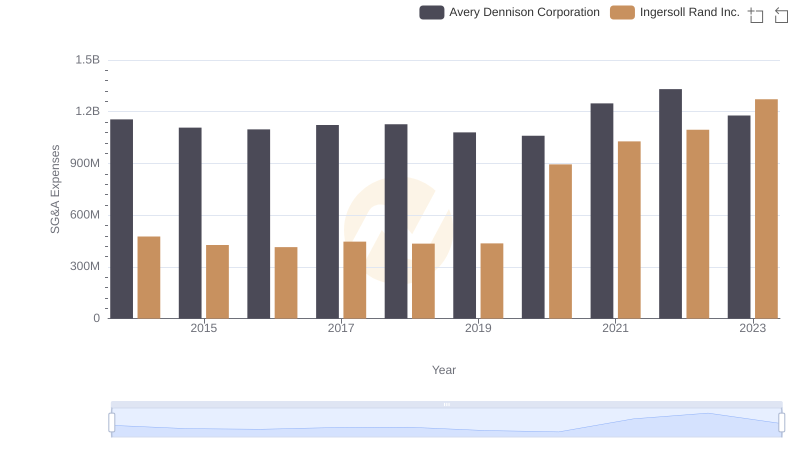

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Avery Dennison Corporation

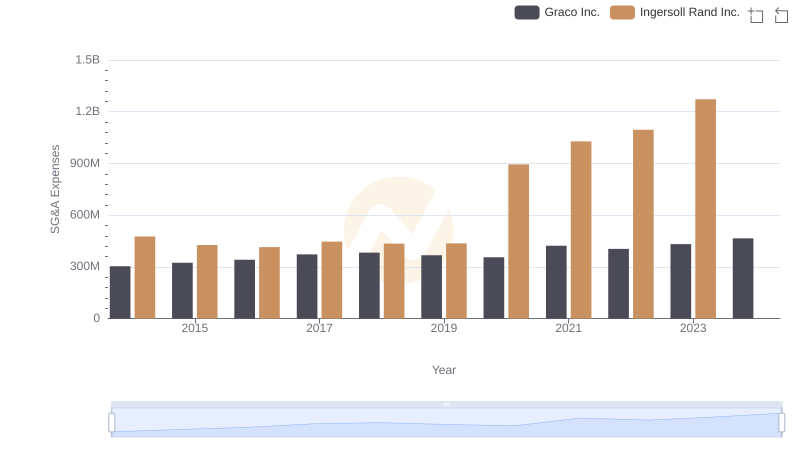

Ingersoll Rand Inc. vs Graco Inc.: SG&A Expense Trends

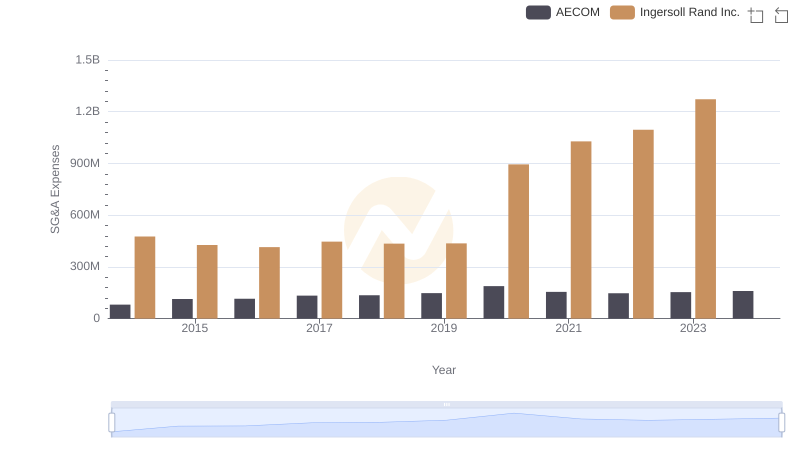

Ingersoll Rand Inc. or AECOM: Who Manages SG&A Costs Better?

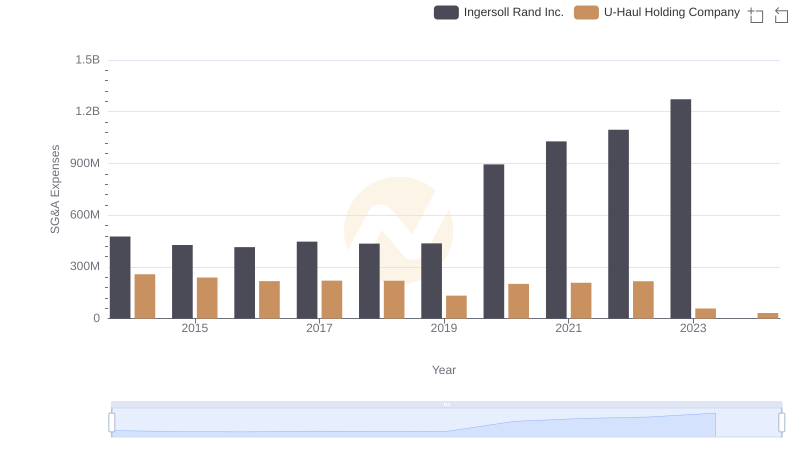

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and U-Haul Holding Company

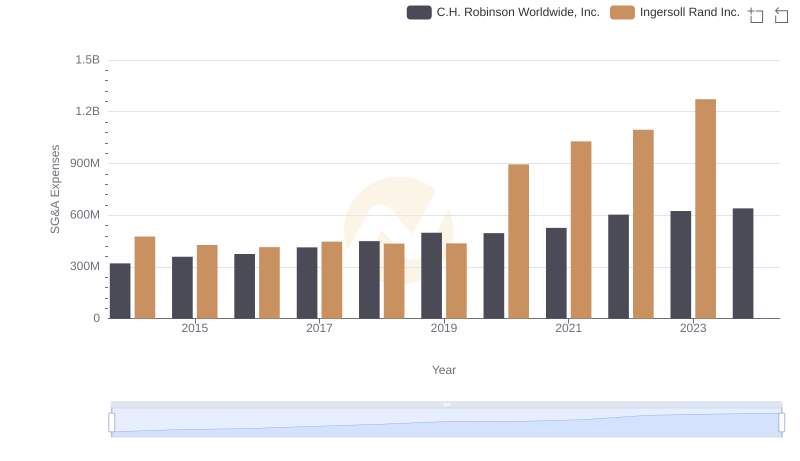

Breaking Down SG&A Expenses: Ingersoll Rand Inc. vs C.H. Robinson Worldwide, Inc.

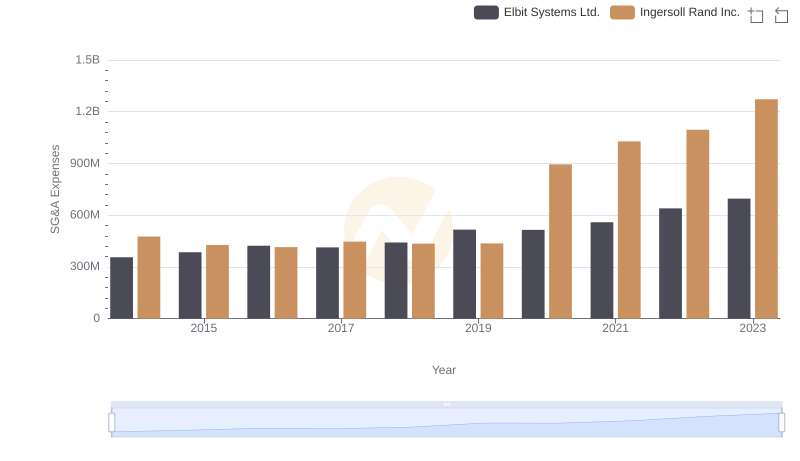

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and Elbit Systems Ltd.