| __timestamp | AECOM | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 80908000 | 476000000 |

| Thursday, January 1, 2015 | 113975000 | 427000000 |

| Friday, January 1, 2016 | 115088000 | 414339000 |

| Sunday, January 1, 2017 | 133309000 | 446600000 |

| Monday, January 1, 2018 | 135787000 | 434600000 |

| Tuesday, January 1, 2019 | 148123000 | 436400000 |

| Wednesday, January 1, 2020 | 188535000 | 894800000 |

| Friday, January 1, 2021 | 155072000 | 1028000000 |

| Saturday, January 1, 2022 | 147309000 | 1095800000 |

| Sunday, January 1, 2023 | 153575000 | 1272700000 |

| Monday, January 1, 2024 | 160105000 | 0 |

Unlocking the unknown

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for maintaining profitability. AECOM and Ingersoll Rand Inc., two industry giants, have shown contrasting approaches over the past decade. From 2014 to 2023, AECOM's SG&A expenses have grown by approximately 98%, starting from 8% of their 2014 expenses. In contrast, Ingersoll Rand Inc. has seen a staggering 167% increase, with expenses peaking in 2023. Notably, 2020 marked a significant surge for both companies, with Ingersoll Rand Inc. experiencing a dramatic rise of over 100% compared to the previous year. While AECOM's expenses have remained relatively stable post-2020, Ingersoll Rand Inc. continues to grapple with higher costs. This analysis highlights the importance of strategic cost management in sustaining long-term growth and profitability.

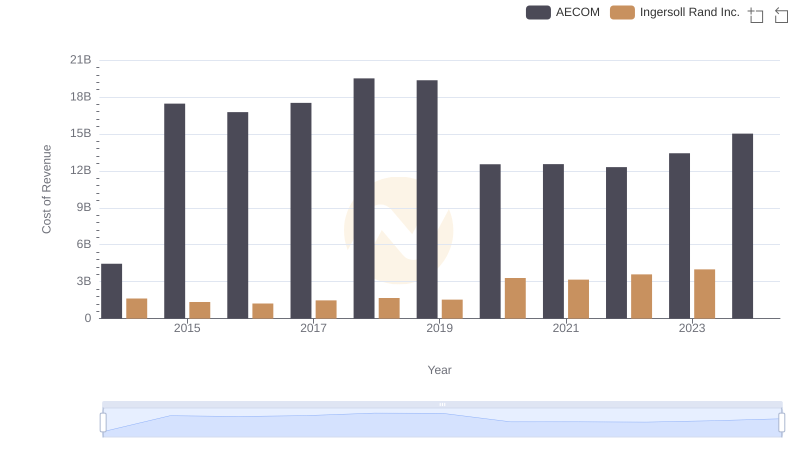

Ingersoll Rand Inc. vs AECOM: Examining Key Revenue Metrics

Cost Insights: Breaking Down Ingersoll Rand Inc. and AECOM's Expenses

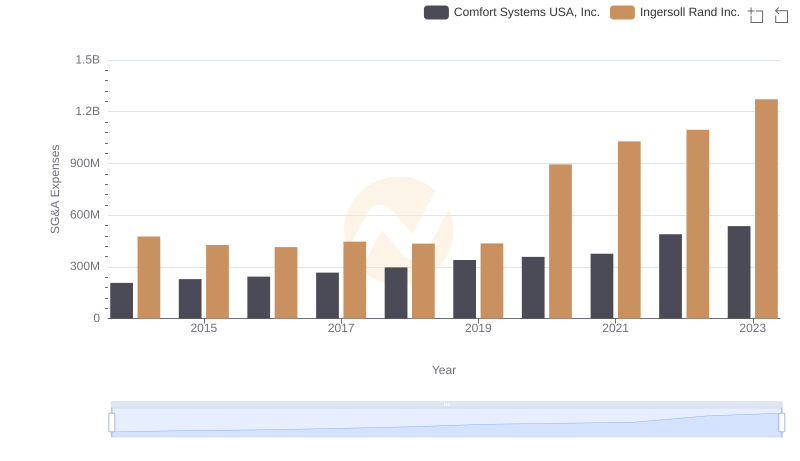

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Comfort Systems USA, Inc.

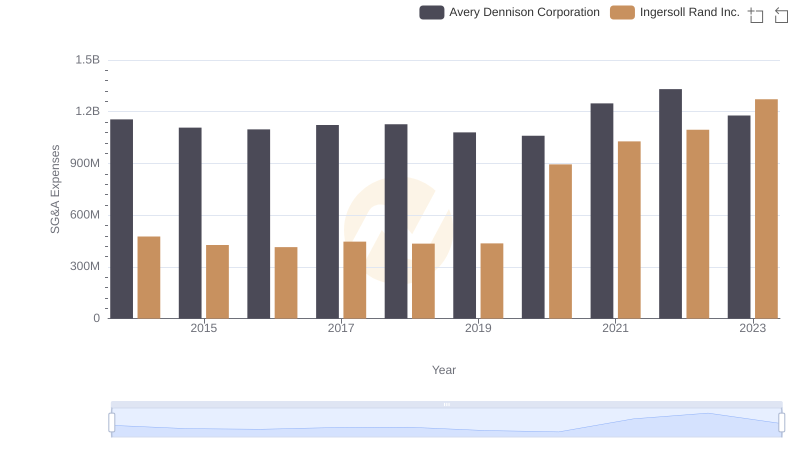

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Avery Dennison Corporation

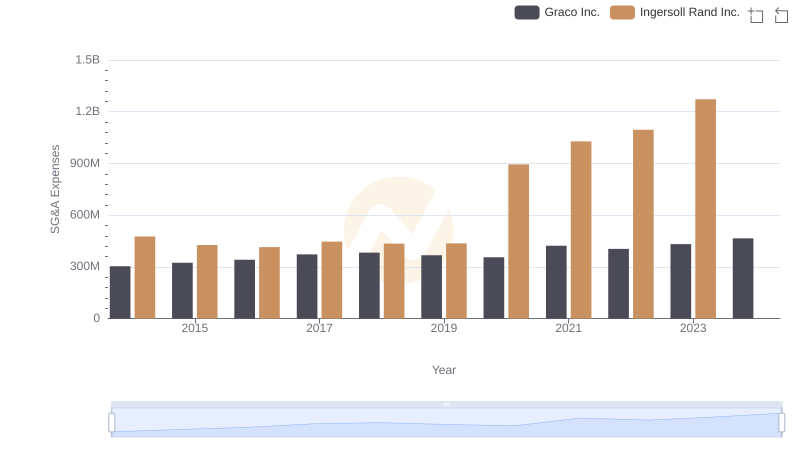

Ingersoll Rand Inc. vs Graco Inc.: SG&A Expense Trends

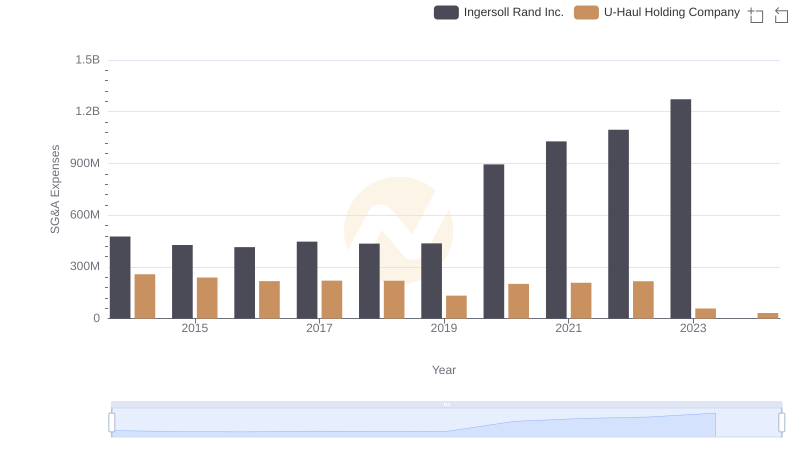

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and U-Haul Holding Company

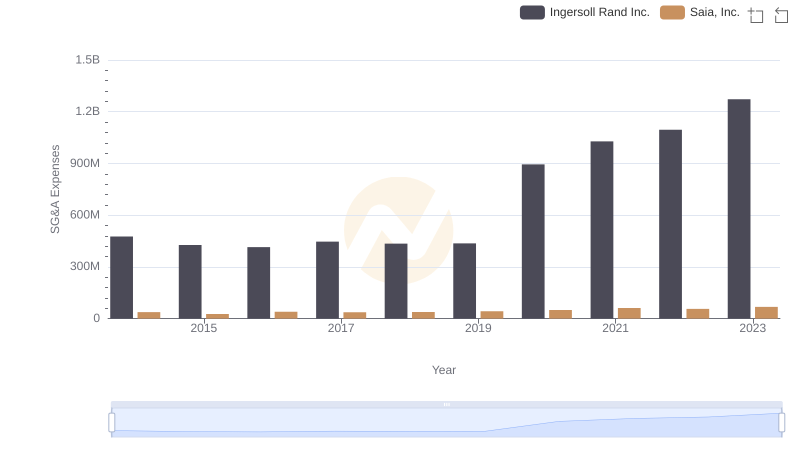

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and Saia, Inc.

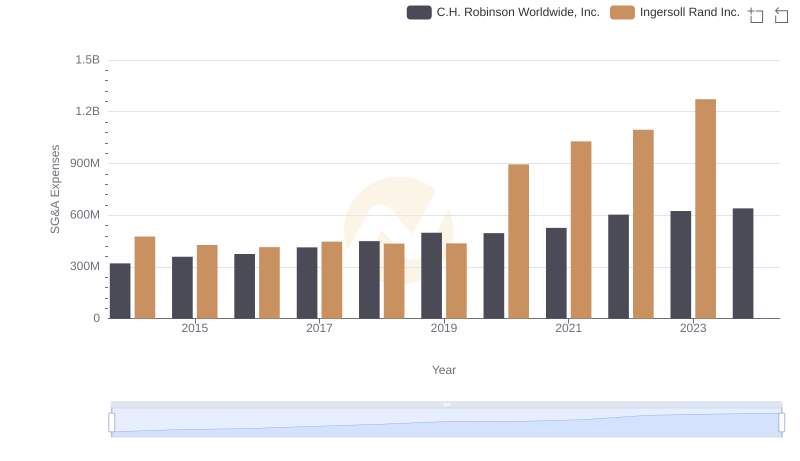

Breaking Down SG&A Expenses: Ingersoll Rand Inc. vs C.H. Robinson Worldwide, Inc.