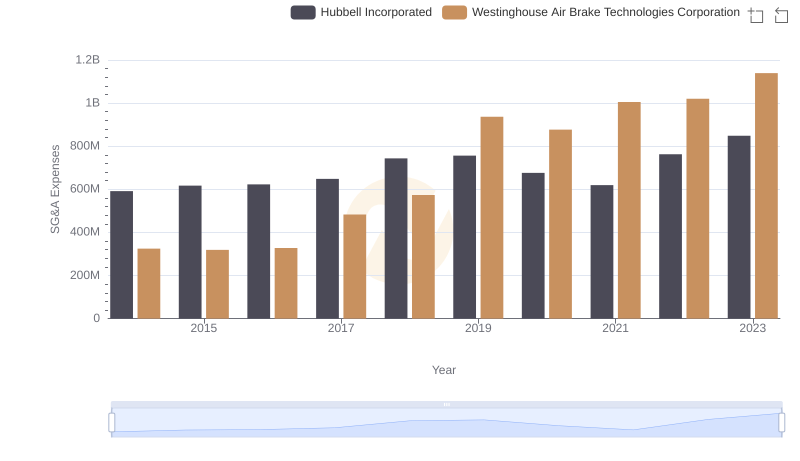

| __timestamp | AerCap Holdings N.V. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 324539000 |

| Thursday, January 1, 2015 | 381308000 | 319173000 |

| Friday, January 1, 2016 | 351012000 | 327505000 |

| Sunday, January 1, 2017 | 348291000 | 482852000 |

| Monday, January 1, 2018 | 305226000 | 573644000 |

| Tuesday, January 1, 2019 | 267458000 | 936600000 |

| Wednesday, January 1, 2020 | 242161000 | 877100000 |

| Friday, January 1, 2021 | 317888000 | 1005000000 |

| Saturday, January 1, 2022 | 399530000 | 1020000000 |

| Sunday, January 1, 2023 | 464128000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Unleashing the power of data

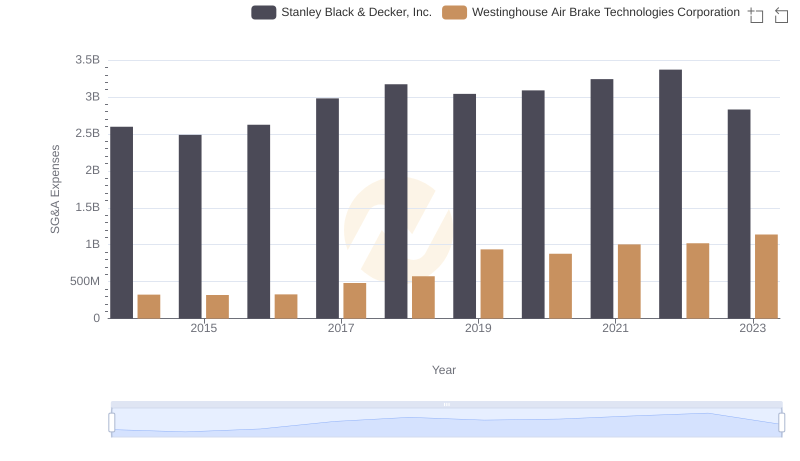

In the ever-evolving landscape of the transportation industry, understanding the financial dynamics of key players is crucial. Westinghouse Air Brake Technologies Corporation and AerCap Holdings N.V. have been at the forefront, showcasing intriguing trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Westinghouse consistently outpaced AerCap in SG&A expenses, with a notable 60% higher average. This trend highlights Westinghouse's aggressive investment in administrative and sales functions, peaking in 2023 with expenses reaching over 1.1 billion. Meanwhile, AerCap's expenses grew steadily, culminating in a 55% increase from 2014 to 2023, reflecting strategic expansions.

These insights offer a window into the strategic priorities of these industry leaders, emphasizing the importance of SG&A management in maintaining competitive advantage.

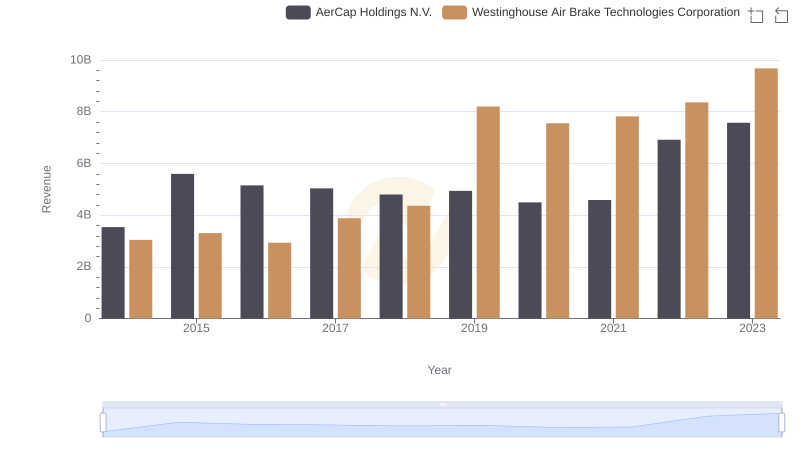

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.

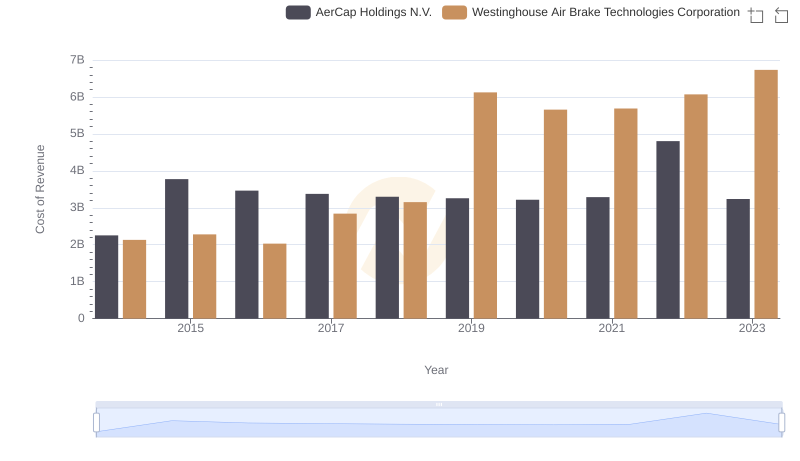

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and AerCap Holdings N.V.

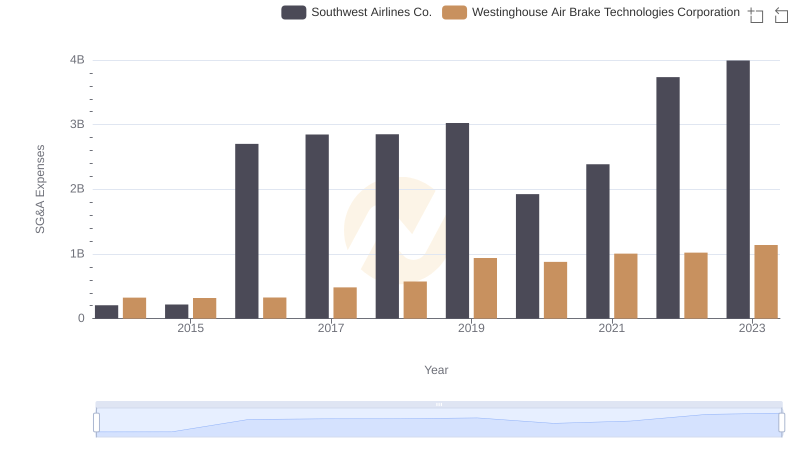

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and Southwest Airlines Co.

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Hubbell Incorporated

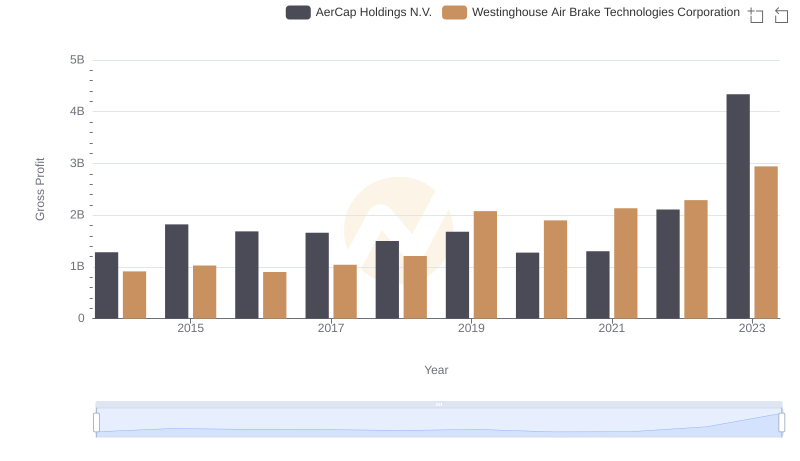

Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.: A Gross Profit Performance Breakdown

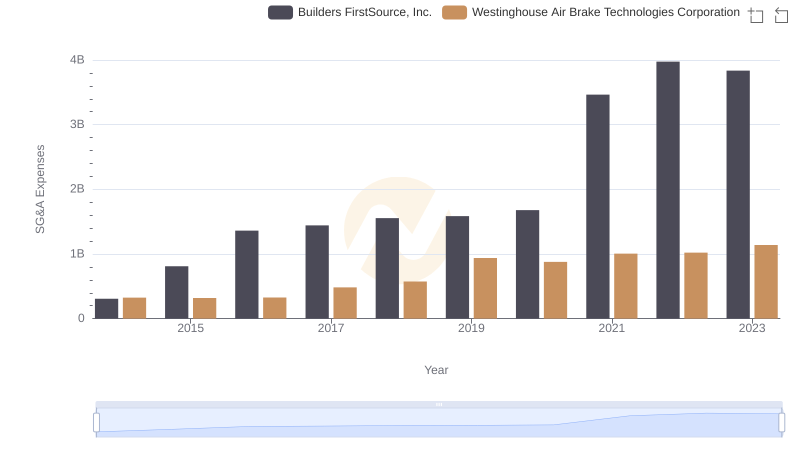

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Builders FirstSource, Inc.

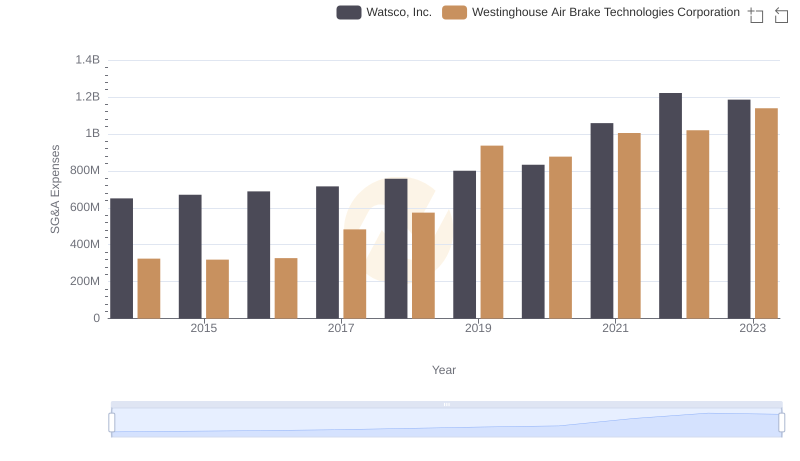

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Watsco, Inc.

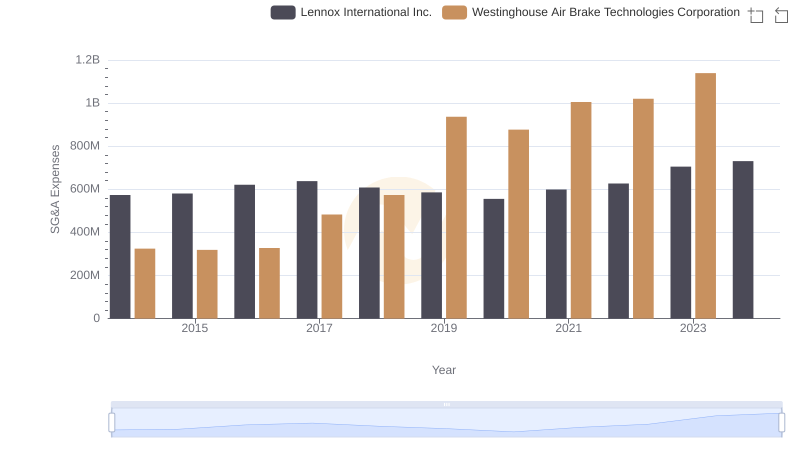

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Lennox International Inc.

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.