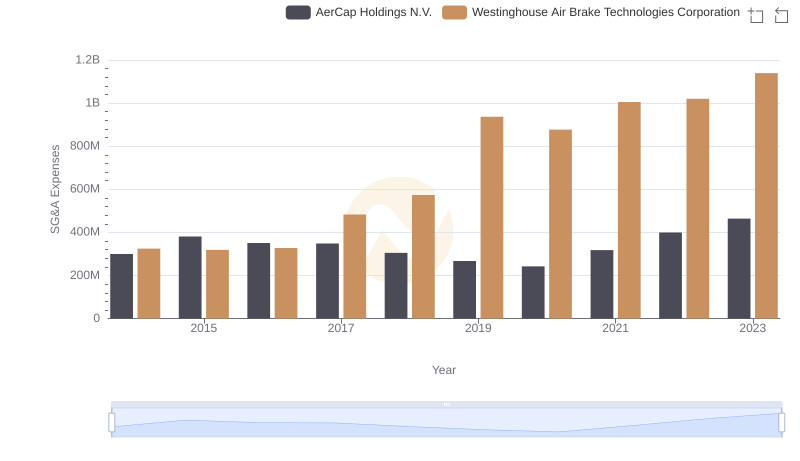

| __timestamp | AerCap Holdings N.V. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1282919000 | 913534000 |

| Thursday, January 1, 2015 | 1822255000 | 1026153000 |

| Friday, January 1, 2016 | 1686404000 | 901541000 |

| Sunday, January 1, 2017 | 1660054000 | 1040597000 |

| Monday, January 1, 2018 | 1500345000 | 1211731000 |

| Tuesday, January 1, 2019 | 1678249000 | 2077600000 |

| Wednesday, January 1, 2020 | 1276496000 | 1898700000 |

| Friday, January 1, 2021 | 1301517000 | 2135000000 |

| Saturday, January 1, 2022 | 2109708000 | 2292000000 |

| Sunday, January 1, 2023 | 4337648000 | 2944000000 |

| Monday, January 1, 2024 | 3366000000 |

In pursuit of knowledge

In the competitive landscape of the transportation and leasing industries, Westinghouse Air Brake Technologies Corporation and AerCap Holdings N.V. have showcased intriguing gross profit trajectories over the past decade. From 2014 to 2023, AerCap Holdings N.V. experienced a remarkable surge, with its gross profit peaking at a staggering 4.34 billion in 2023, marking a 238% increase from its 2014 figures. Meanwhile, Westinghouse Air Brake Technologies Corporation demonstrated steady growth, achieving a 222% rise in gross profit, culminating in 2.94 billion in 2023.

These trends highlight the dynamic nature of these industries and the strategic maneuvers of these corporations.

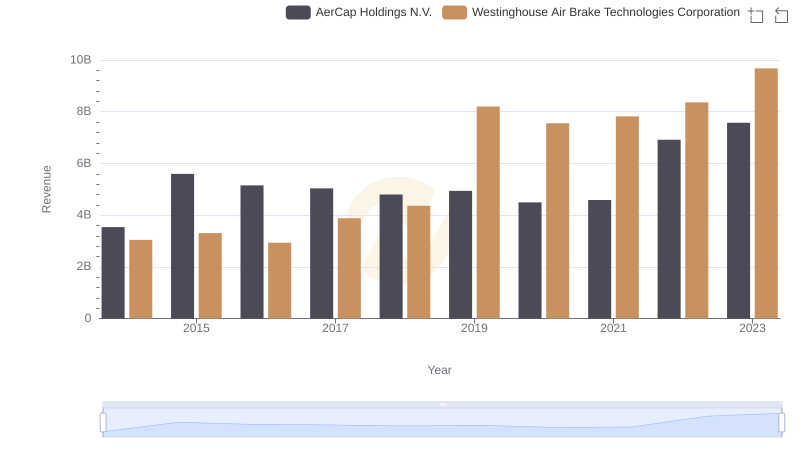

Breaking Down Revenue Trends: Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.

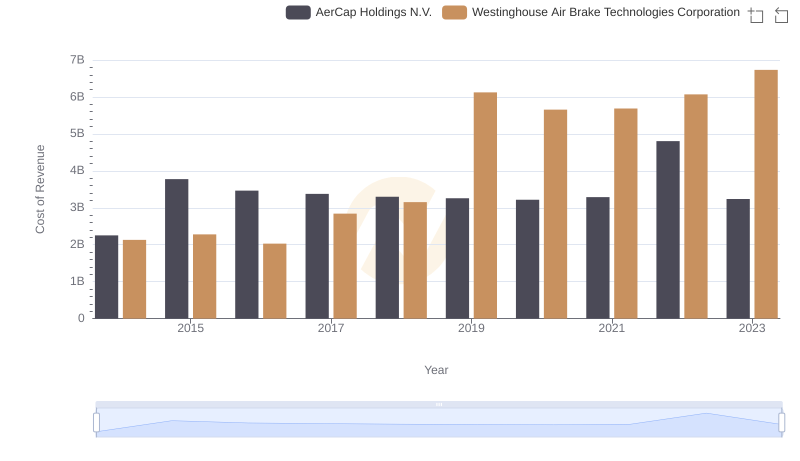

Analyzing Cost of Revenue: Westinghouse Air Brake Technologies Corporation and AerCap Holdings N.V.

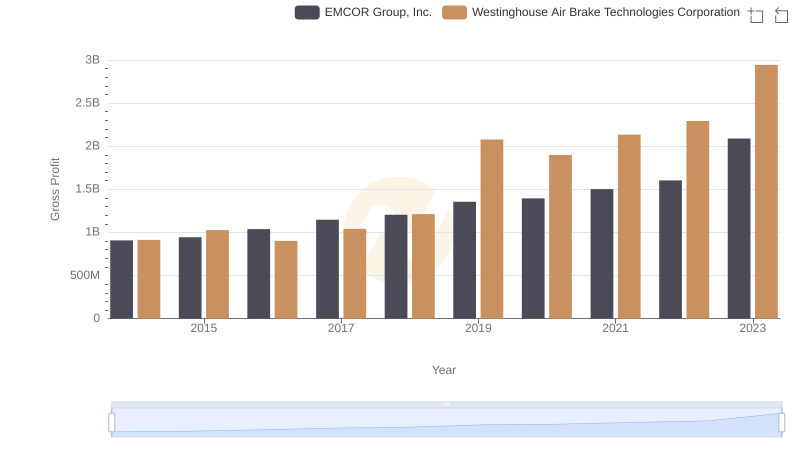

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or EMCOR Group, Inc.

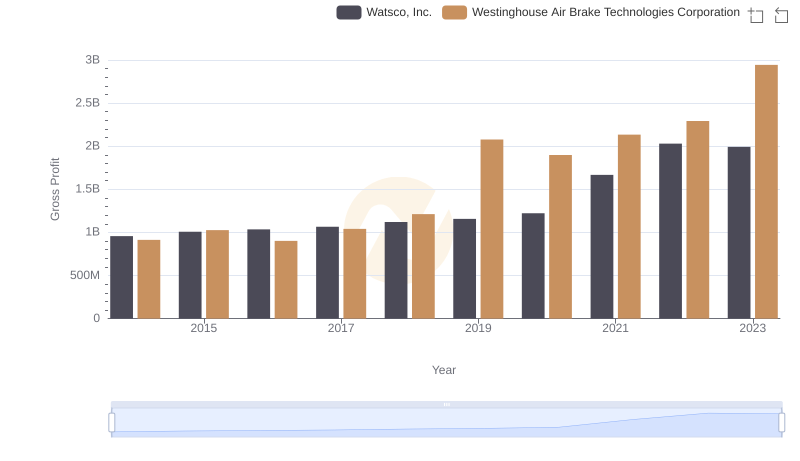

Gross Profit Trends Compared: Westinghouse Air Brake Technologies Corporation vs Watsco, Inc.

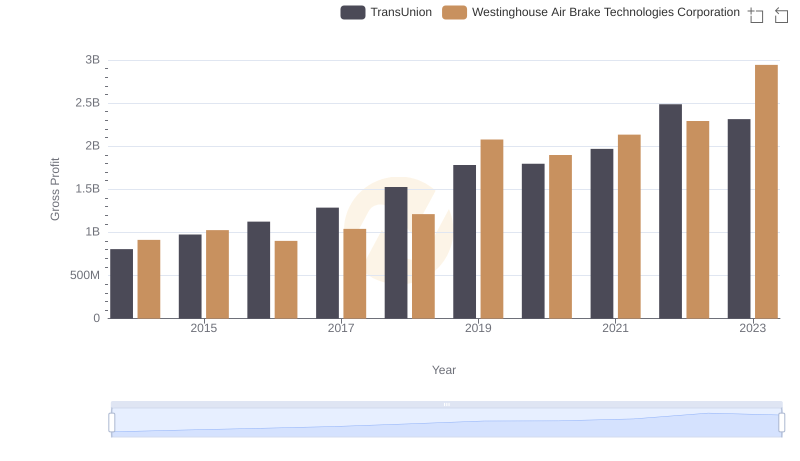

Gross Profit Trends Compared: Westinghouse Air Brake Technologies Corporation vs TransUnion

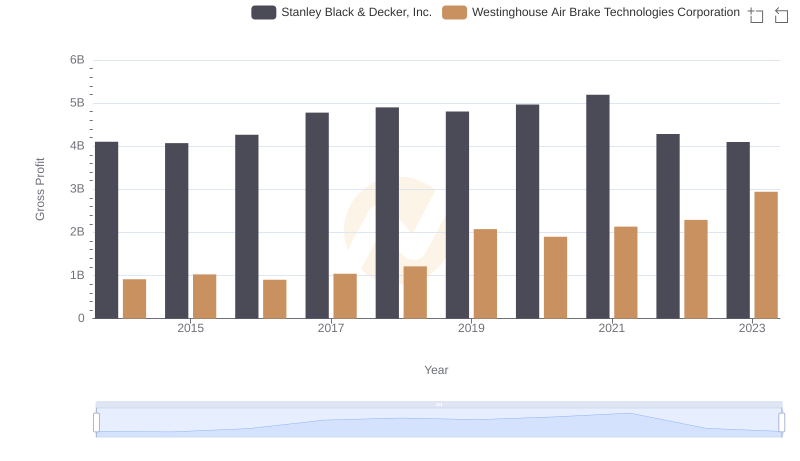

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Stanley Black & Decker, Inc.

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.

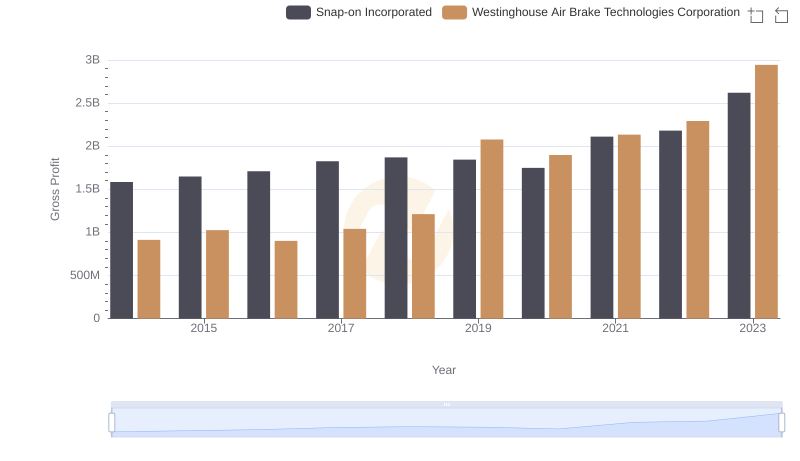

Gross Profit Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Snap-on Incorporated

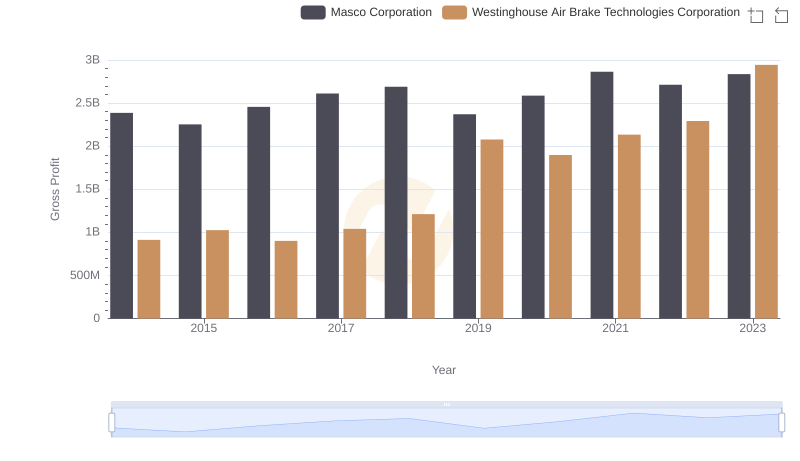

Who Generates Higher Gross Profit? Westinghouse Air Brake Technologies Corporation or Masco Corporation