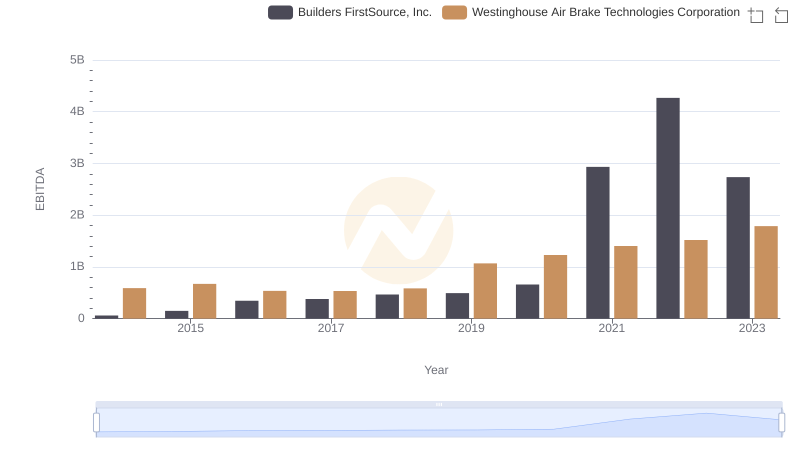

| __timestamp | Builders FirstSource, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 306508000 | 324539000 |

| Thursday, January 1, 2015 | 810841000 | 319173000 |

| Friday, January 1, 2016 | 1360412000 | 327505000 |

| Sunday, January 1, 2017 | 1442288000 | 482852000 |

| Monday, January 1, 2018 | 1553972000 | 573644000 |

| Tuesday, January 1, 2019 | 1584523000 | 936600000 |

| Wednesday, January 1, 2020 | 1678730000 | 877100000 |

| Friday, January 1, 2021 | 3463532000 | 1005000000 |

| Saturday, January 1, 2022 | 3974173000 | 1020000000 |

| Sunday, January 1, 2023 | 3836015000 | 1139000000 |

| Monday, January 1, 2024 | 1248000000 |

Unleashing insights

In the competitive landscape of the U.S. stock market, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Builders FirstSource, Inc. and Westinghouse Air Brake Technologies Corporation have showcased contrasting strategies in optimizing these costs. From 2014 to 2023, Builders FirstSource, Inc. saw a staggering 1,150% increase in SG&A expenses, peaking in 2022. In contrast, Westinghouse Air Brake Technologies Corporation maintained a more stable trajectory, with a modest 250% rise over the same period. This divergence highlights Builders FirstSource's aggressive expansion strategy, while Westinghouse Air Brake Technologies Corporation focuses on steady growth. As investors seek efficiency, understanding these trends offers valuable insights into each company's operational priorities and financial health. The data underscores the importance of strategic cost management in driving long-term success.

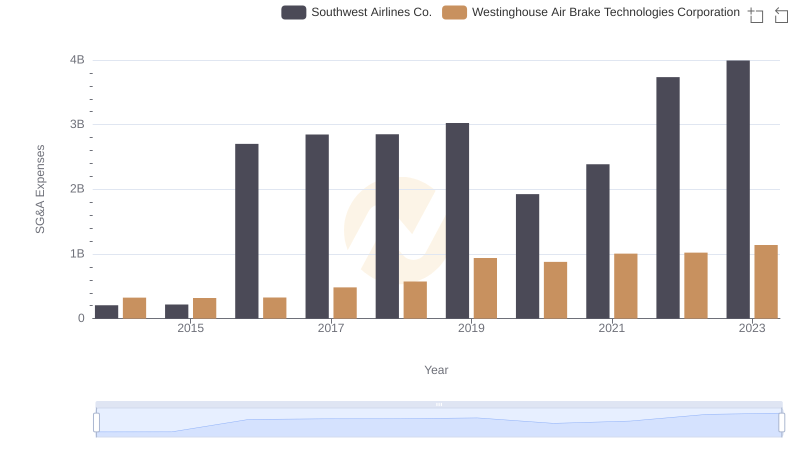

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and Southwest Airlines Co.

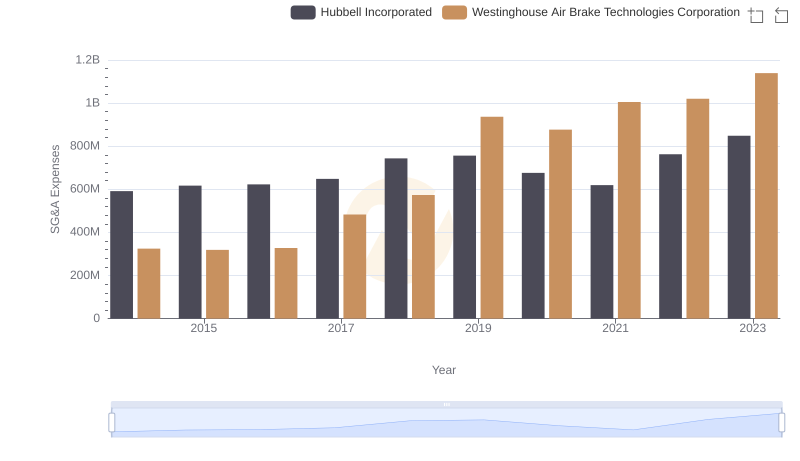

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Hubbell Incorporated

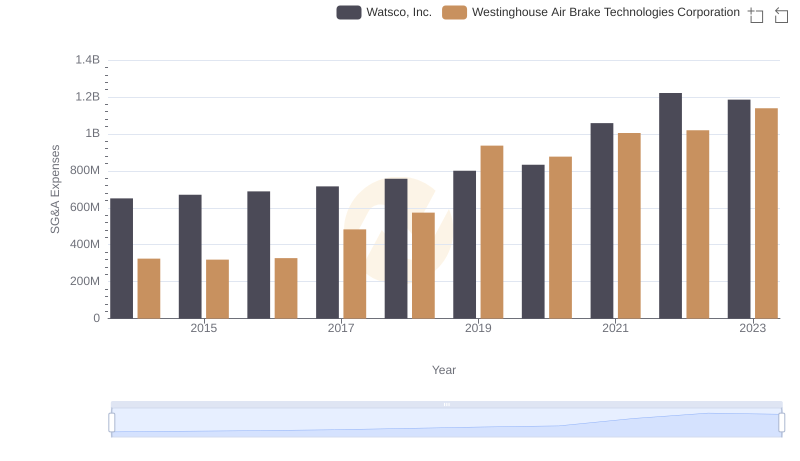

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Watsco, Inc.

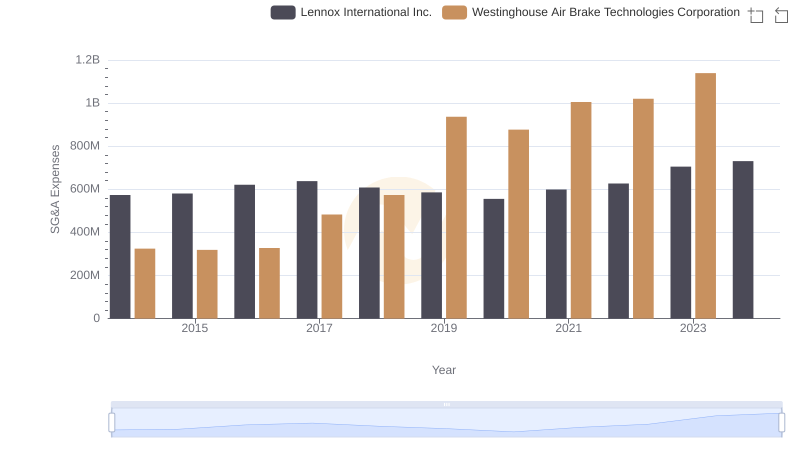

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Lennox International Inc.

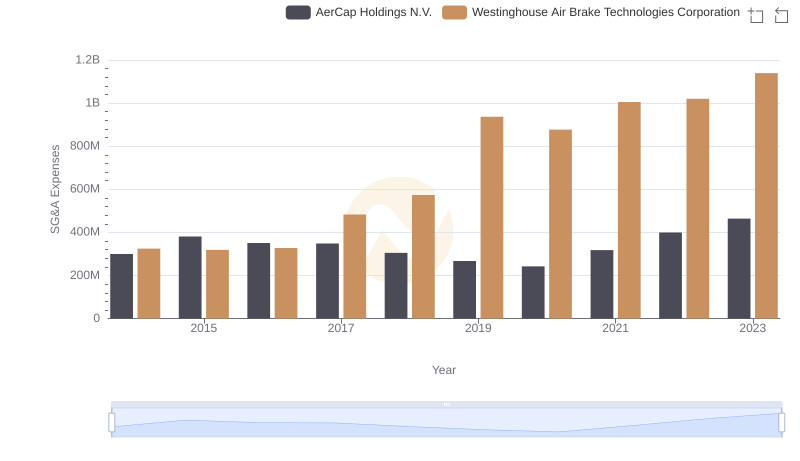

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.

A Side-by-Side Analysis of EBITDA: Westinghouse Air Brake Technologies Corporation and Builders FirstSource, Inc.