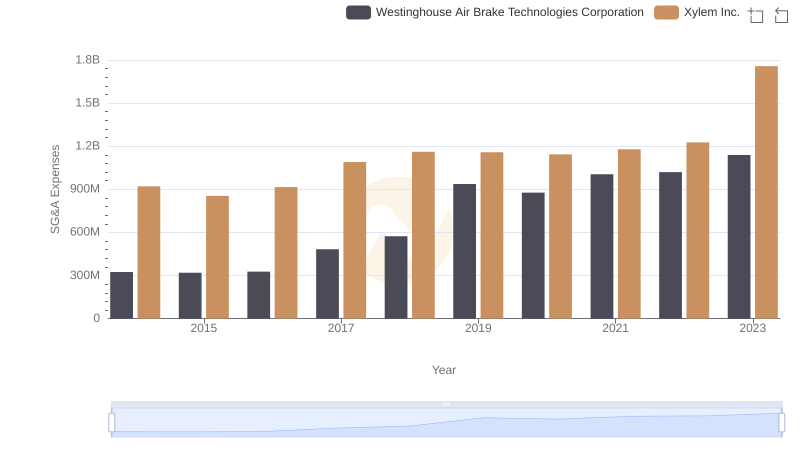

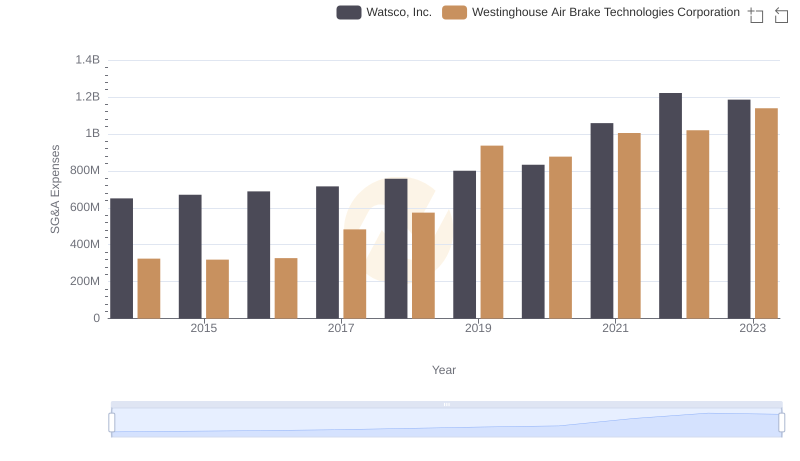

| __timestamp | Hubbell Incorporated | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 591600000 | 324539000 |

| Thursday, January 1, 2015 | 617200000 | 319173000 |

| Friday, January 1, 2016 | 622900000 | 327505000 |

| Sunday, January 1, 2017 | 648200000 | 482852000 |

| Monday, January 1, 2018 | 743500000 | 573644000 |

| Tuesday, January 1, 2019 | 756100000 | 936600000 |

| Wednesday, January 1, 2020 | 676300000 | 877100000 |

| Friday, January 1, 2021 | 619200000 | 1005000000 |

| Saturday, January 1, 2022 | 762500000 | 1020000000 |

| Sunday, January 1, 2023 | 848600000 | 1139000000 |

| Monday, January 1, 2024 | 812500000 | 1248000000 |

Unveiling the hidden dimensions of data

In the competitive landscape of industrial manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Hubbell Incorporated and Westinghouse Air Brake Technologies Corporation have showcased distinct trajectories in their SG&A spending. From 2014 to 2023, Hubbell's SG&A expenses grew by approximately 43%, reflecting a steady increase in operational costs. In contrast, Westinghouse Air Brake Technologies saw a staggering 250% rise, indicating a more aggressive expansion strategy.

These trends underscore the strategic differences between the two companies, offering valuable insights for investors and industry analysts.

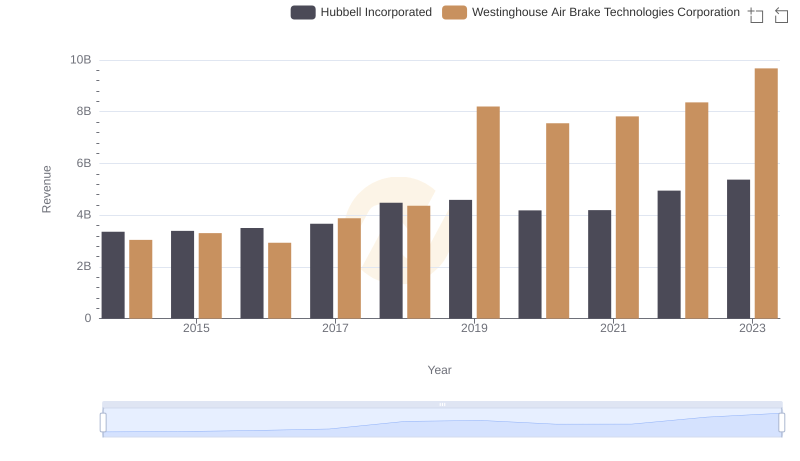

Revenue Showdown: Westinghouse Air Brake Technologies Corporation vs Hubbell Incorporated

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Xylem Inc.

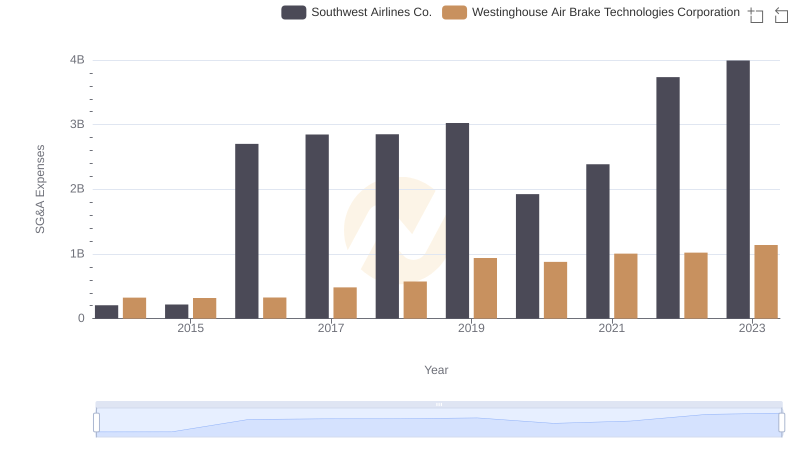

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and Southwest Airlines Co.

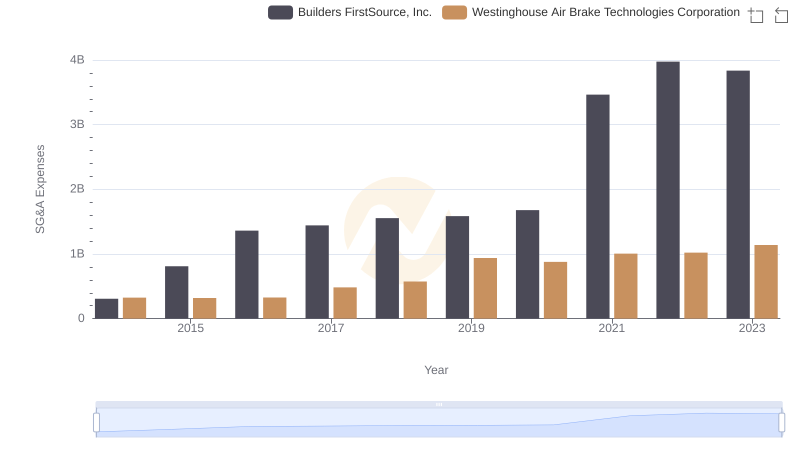

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Builders FirstSource, Inc.

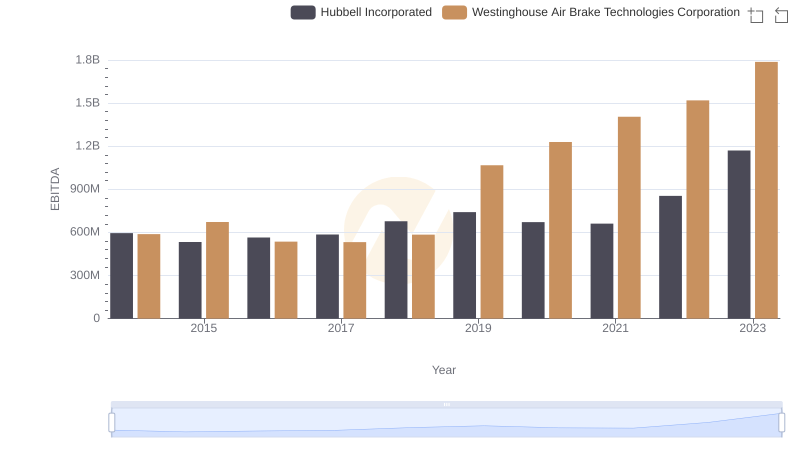

EBITDA Analysis: Evaluating Westinghouse Air Brake Technologies Corporation Against Hubbell Incorporated

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Watsco, Inc.

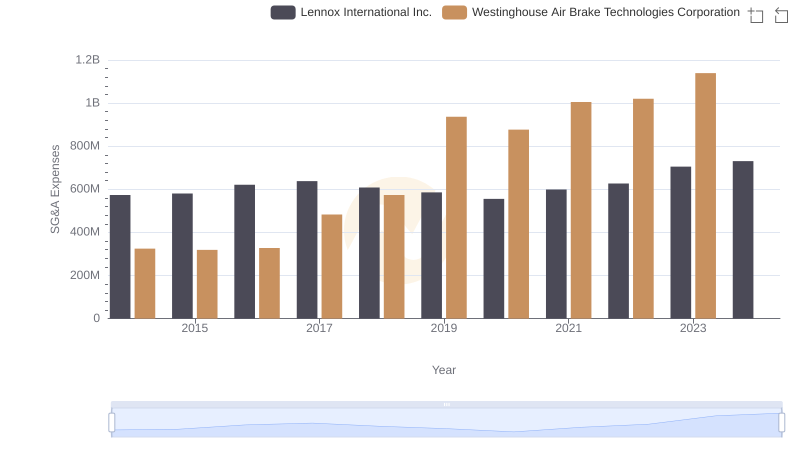

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Lennox International Inc.

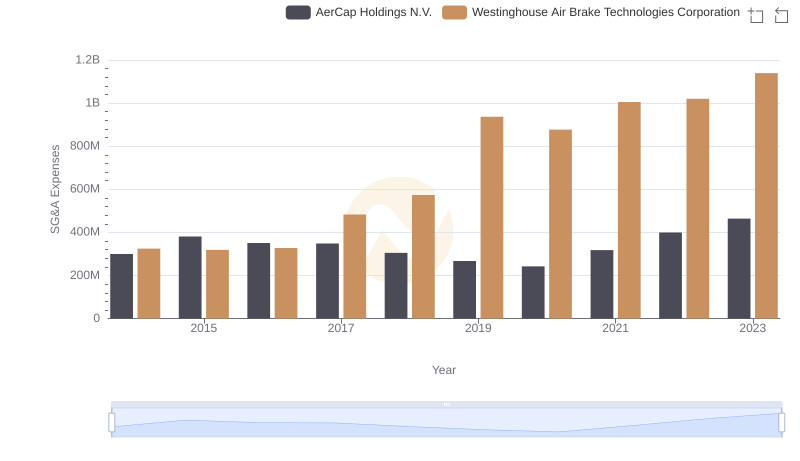

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.