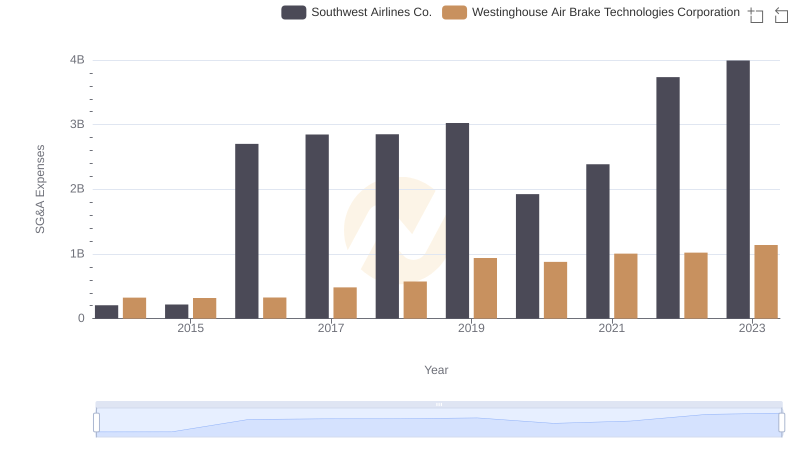

| __timestamp | Watsco, Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 650655000 | 324539000 |

| Thursday, January 1, 2015 | 670609000 | 319173000 |

| Friday, January 1, 2016 | 688952000 | 327505000 |

| Sunday, January 1, 2017 | 715671000 | 482852000 |

| Monday, January 1, 2018 | 757452000 | 573644000 |

| Tuesday, January 1, 2019 | 800328000 | 936600000 |

| Wednesday, January 1, 2020 | 833051000 | 877100000 |

| Friday, January 1, 2021 | 1058316000 | 1005000000 |

| Saturday, January 1, 2022 | 1221382000 | 1020000000 |

| Sunday, January 1, 2023 | 1185626000 | 1139000000 |

| Monday, January 1, 2024 | 1262938000 | 1248000000 |

Infusing magic into the data realm

In the competitive landscape of industrial and consumer goods, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Watsco, Inc. and Westinghouse Air Brake Technologies Corporation have demonstrated distinct trends in managing these costs.

From 2014 to 2023, Watsco, Inc. has seen a steady increase in SG&A expenses, peaking at approximately 1.2 billion in 2022. This represents a growth of about 82% from 2014. Meanwhile, Westinghouse Air Brake Technologies Corporation has also experienced a rise, with expenses reaching around 1.1 billion in 2023, marking a 250% increase since 2014.

These figures highlight the strategic differences in cost management between the two companies. While both have increased their SG&A spending, the rate and scale differ significantly, reflecting their unique operational strategies and market challenges.

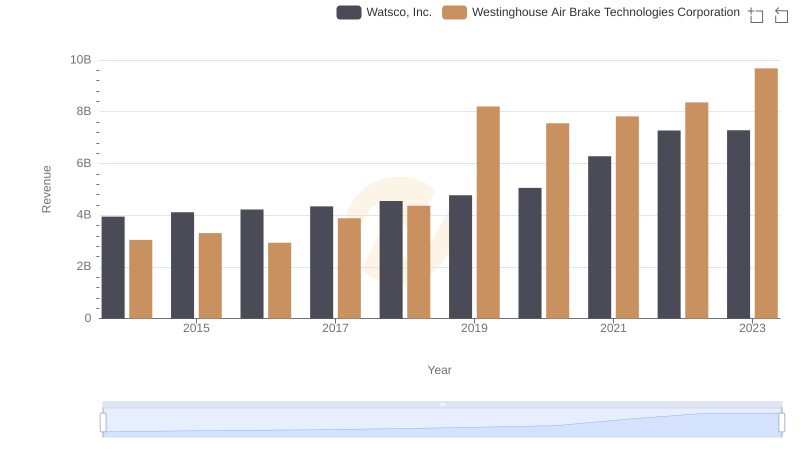

Revenue Insights: Westinghouse Air Brake Technologies Corporation and Watsco, Inc. Performance Compared

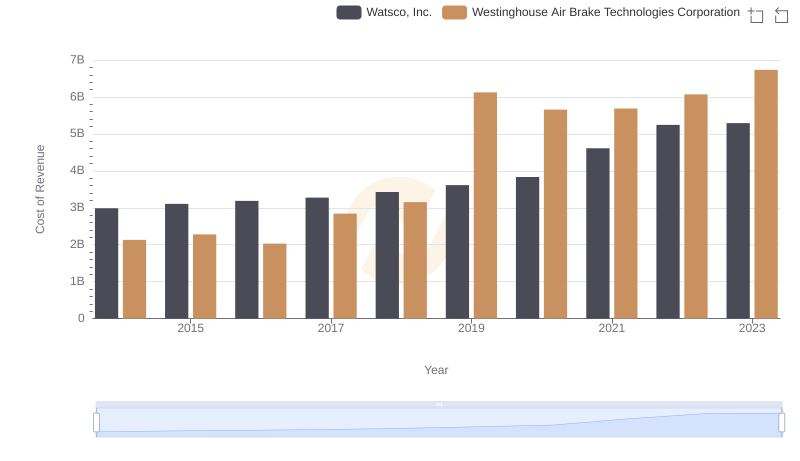

Cost of Revenue: Key Insights for Westinghouse Air Brake Technologies Corporation and Watsco, Inc.

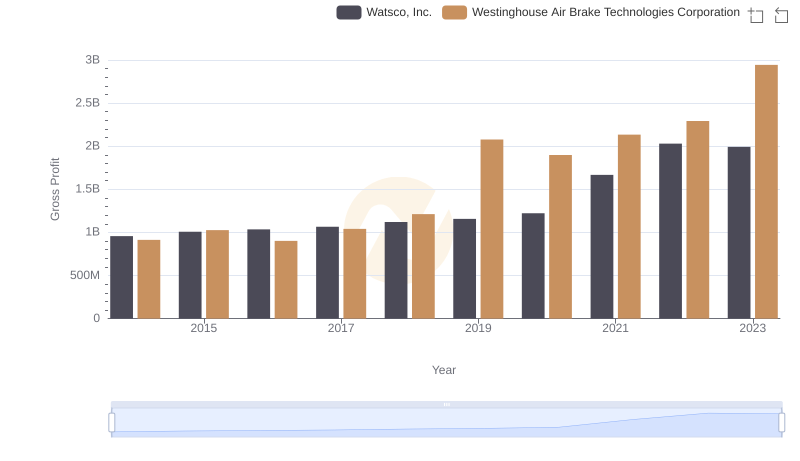

Gross Profit Trends Compared: Westinghouse Air Brake Technologies Corporation vs Watsco, Inc.

Cost Management Insights: SG&A Expenses for Westinghouse Air Brake Technologies Corporation and Southwest Airlines Co.

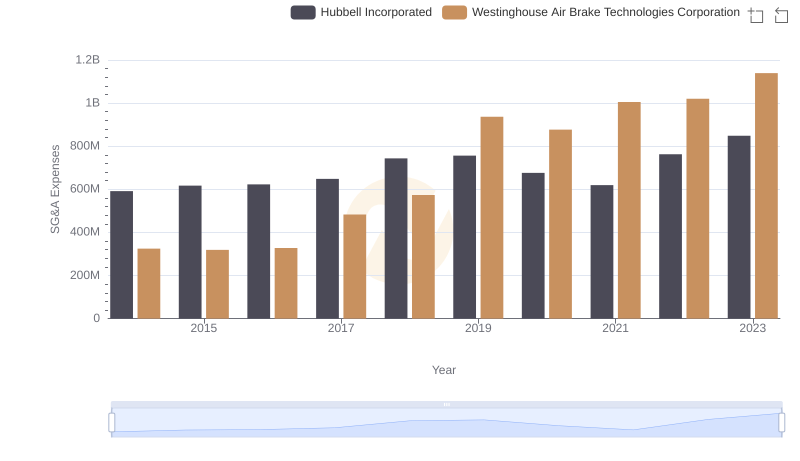

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Hubbell Incorporated

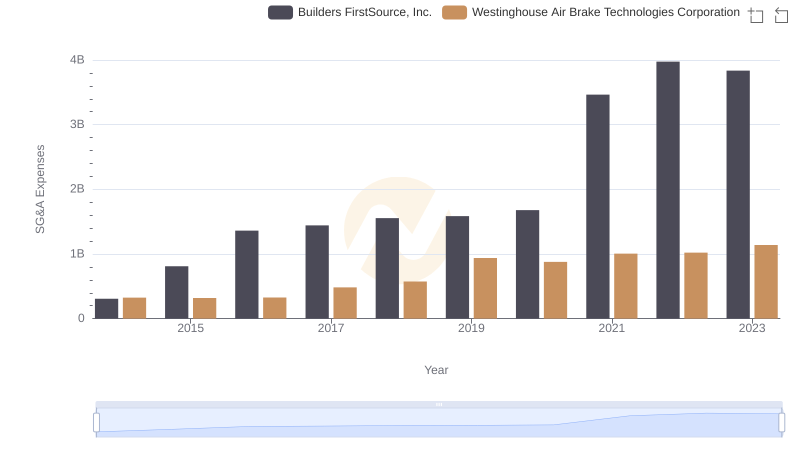

Who Optimizes SG&A Costs Better? Westinghouse Air Brake Technologies Corporation or Builders FirstSource, Inc.

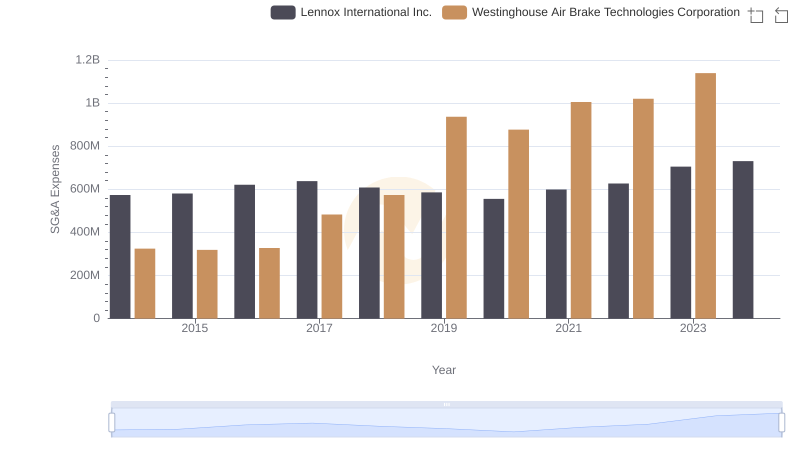

SG&A Efficiency Analysis: Comparing Westinghouse Air Brake Technologies Corporation and Lennox International Inc.

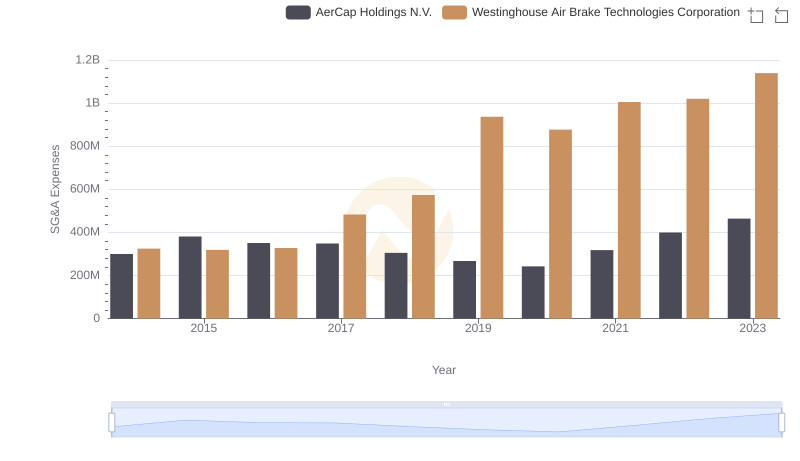

Selling, General, and Administrative Costs: Westinghouse Air Brake Technologies Corporation vs AerCap Holdings N.V.