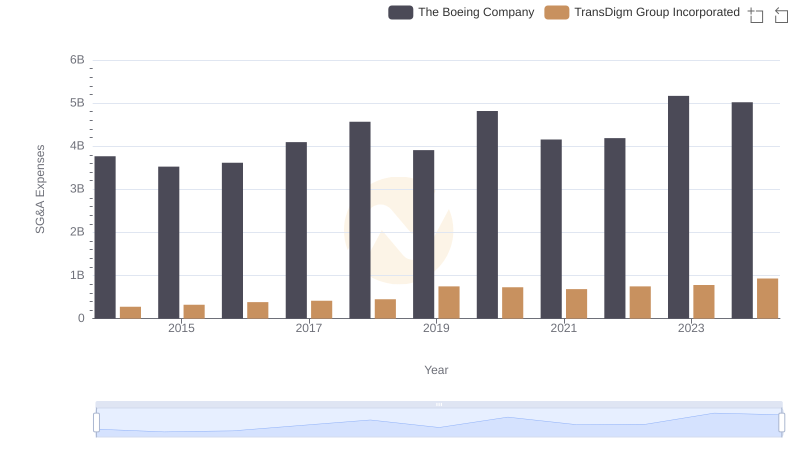

| __timestamp | The Boeing Company | Thomson Reuters Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 3767000000 | 9209000000 |

| Thursday, January 1, 2015 | 3525000000 | 8810000000 |

| Friday, January 1, 2016 | 3616000000 | 8232000000 |

| Sunday, January 1, 2017 | 4094000000 | 8079000000 |

| Monday, January 1, 2018 | 4567000000 | 4131000000 |

| Tuesday, January 1, 2019 | 3909000000 | 4413000000 |

| Wednesday, January 1, 2020 | 4817000000 | 3999000000 |

| Friday, January 1, 2021 | 4157000000 | 1624000000 |

| Saturday, January 1, 2022 | 4187000000 | 1622000000 |

| Sunday, January 1, 2023 | 5168000000 | 64000000 |

| Monday, January 1, 2024 | 5021000000 |

Cracking the code

Over the past decade, the Selling, General, and Administrative (SG&A) expenses of The Boeing Company and Thomson Reuters Corporation have showcased intriguing trends. Boeing's SG&A costs have seen a steady rise, peaking in 2023 with a 37% increase from 2014. In contrast, Thomson Reuters experienced a dramatic decline, with expenses plummeting by over 99% from 2014 to 2023.

Boeing's consistent increase in SG&A expenses reflects its ongoing investments in innovation and market expansion. Meanwhile, Thomson Reuters' sharp decline suggests strategic cost-cutting and restructuring efforts, possibly influenced by the digital transformation of the media industry.

As we move into 2024, Boeing's expenses remain robust, while Thomson Reuters' data is notably absent, hinting at potential shifts in their financial strategies. These trends offer a fascinating glimpse into the evolving landscapes of aerospace and media industries.

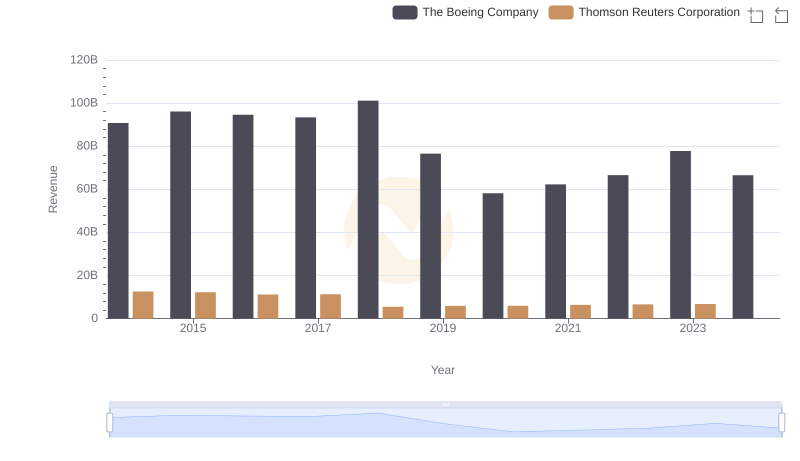

Annual Revenue Comparison: The Boeing Company vs Thomson Reuters Corporation

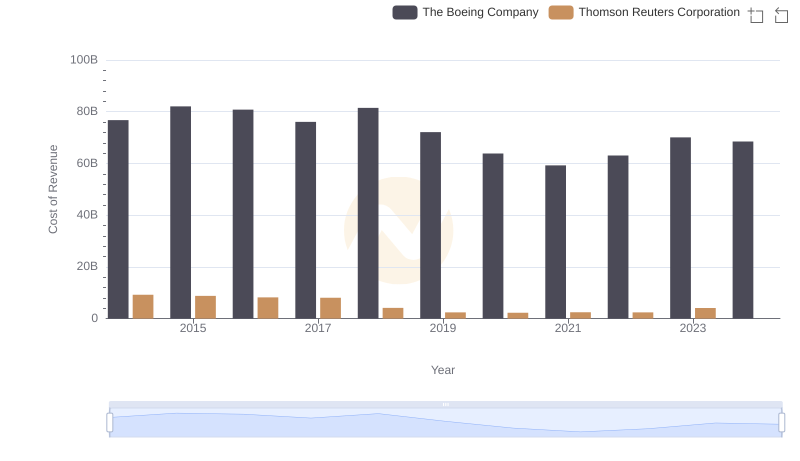

Analyzing Cost of Revenue: The Boeing Company and Thomson Reuters Corporation

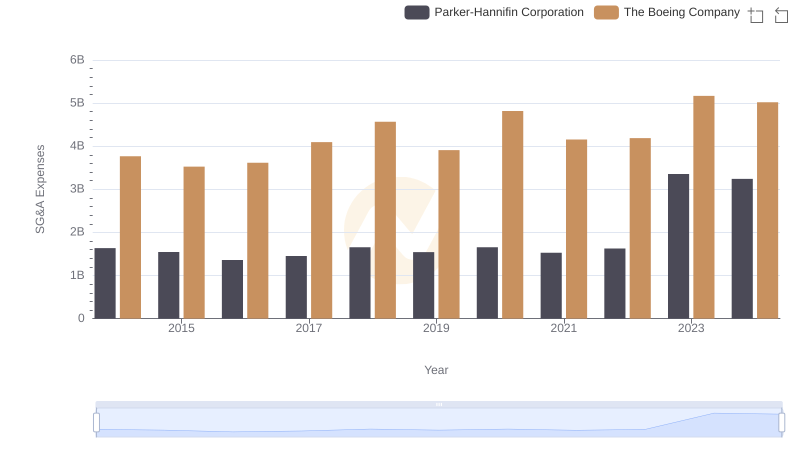

The Boeing Company and Parker-Hannifin Corporation: SG&A Spending Patterns Compared

The Boeing Company and TransDigm Group Incorporated: SG&A Spending Patterns Compared

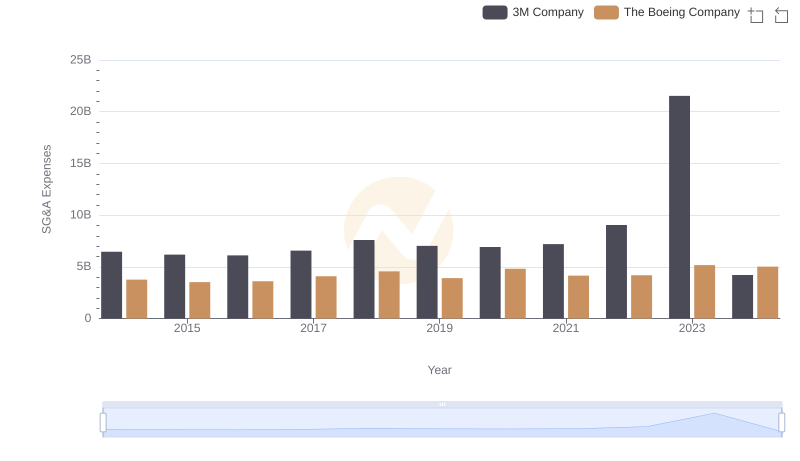

The Boeing Company or 3M Company: Who Manages SG&A Costs Better?

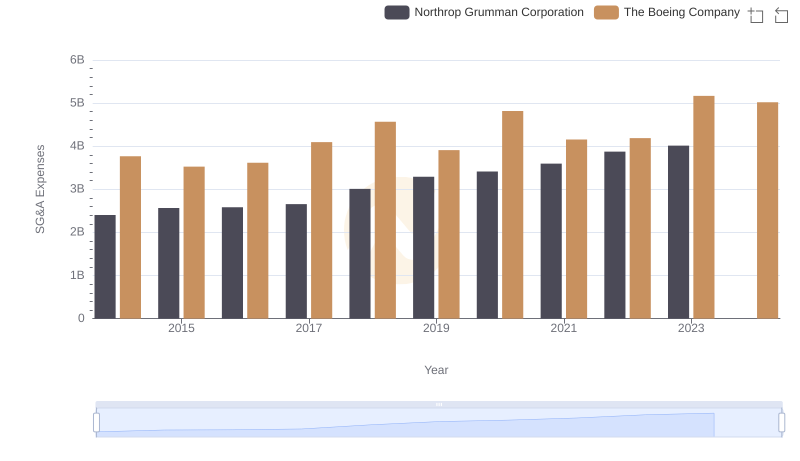

Operational Costs Compared: SG&A Analysis of The Boeing Company and Northrop Grumman Corporation

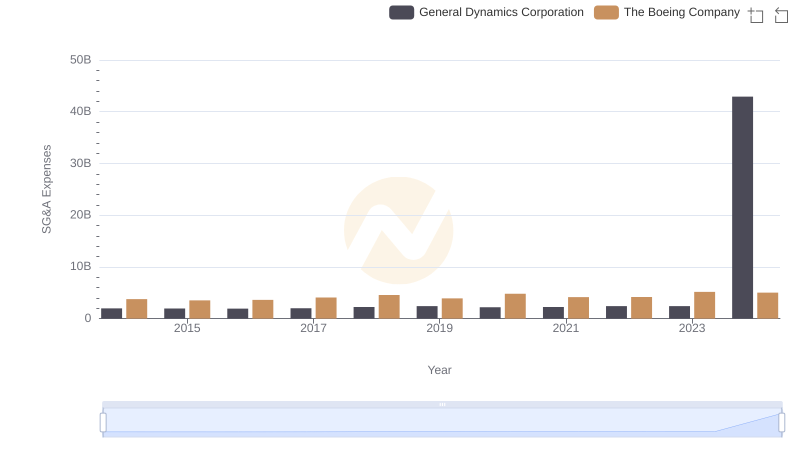

Operational Costs Compared: SG&A Analysis of The Boeing Company and General Dynamics Corporation