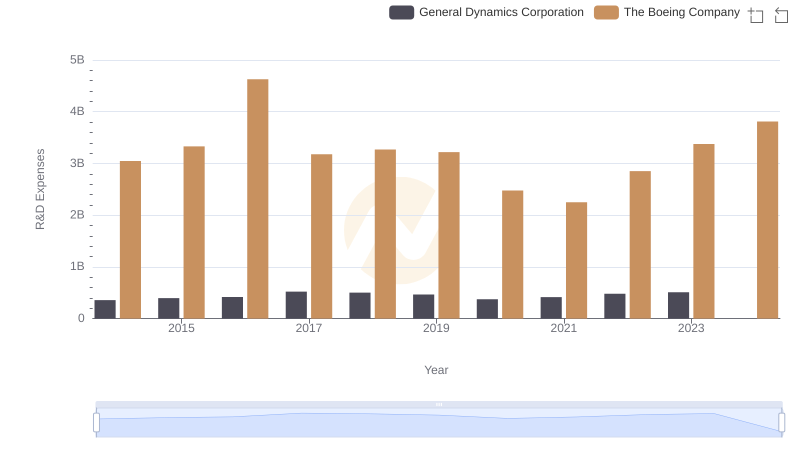

| __timestamp | General Dynamics Corporation | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 1984000000 | 3767000000 |

| Thursday, January 1, 2015 | 1952000000 | 3525000000 |

| Friday, January 1, 2016 | 1940000000 | 3616000000 |

| Sunday, January 1, 2017 | 2010000000 | 4094000000 |

| Monday, January 1, 2018 | 2258000000 | 4567000000 |

| Tuesday, January 1, 2019 | 2411000000 | 3909000000 |

| Wednesday, January 1, 2020 | 2192000000 | 4817000000 |

| Friday, January 1, 2021 | 2245000000 | 4157000000 |

| Saturday, January 1, 2022 | 2411000000 | 4187000000 |

| Sunday, January 1, 2023 | 2427000000 | 5168000000 |

| Monday, January 1, 2024 | 2568000000 | 5021000000 |

Data in motion

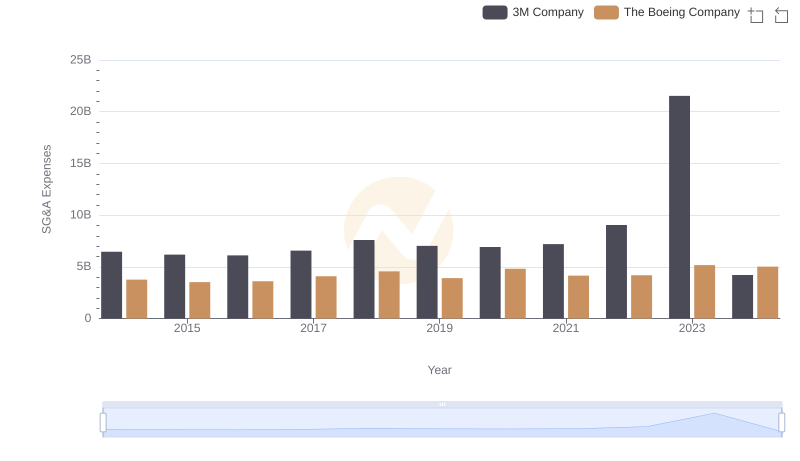

In the ever-evolving aerospace and defense industry, operational efficiency is paramount. Over the past decade, The Boeing Company and General Dynamics Corporation have showcased contrasting strategies in managing their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, Boeing consistently outpaced General Dynamics in SG&A spending, peaking in 2023 with a 38% increase from 2014. Meanwhile, General Dynamics maintained a more conservative approach, with a notable spike in 2024, suggesting a strategic shift or an anomaly. This divergence highlights Boeing's aggressive investment in administrative capabilities, possibly to support its expansive global operations, while General Dynamics' steadier path reflects a focus on streamlined processes. As the industry faces new challenges, understanding these financial strategies offers valuable insights into each company's operational priorities and future trajectories.

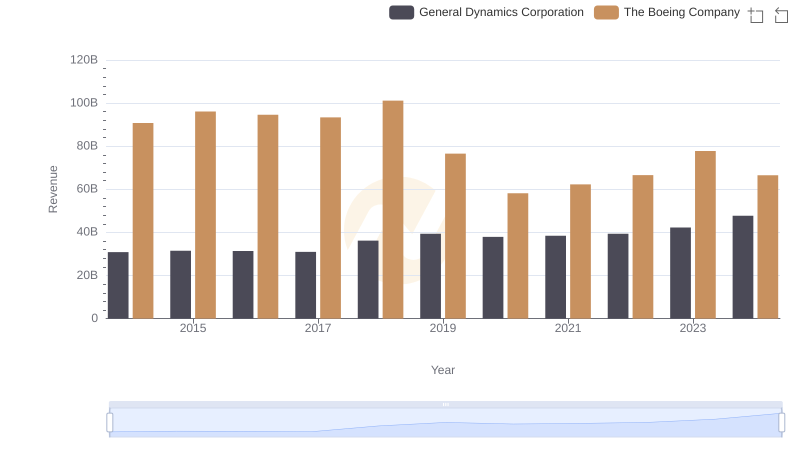

The Boeing Company and General Dynamics Corporation: A Comprehensive Revenue Analysis

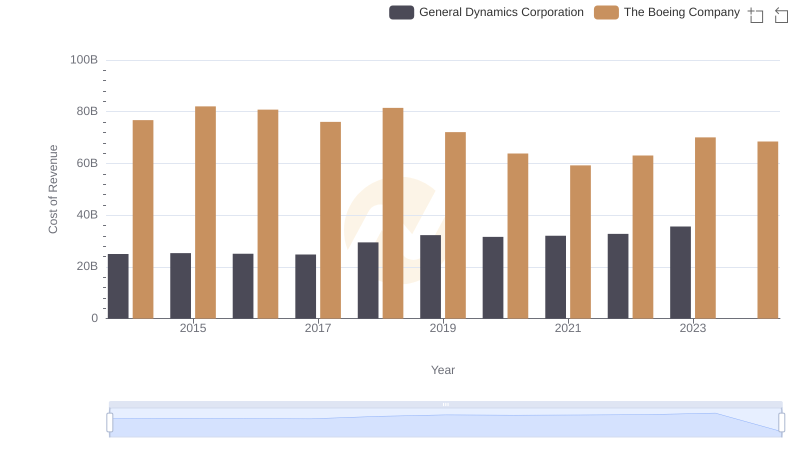

Cost of Revenue: Key Insights for The Boeing Company and General Dynamics Corporation

The Boeing Company or General Dynamics Corporation: Who Invests More in Innovation?

The Boeing Company or 3M Company: Who Manages SG&A Costs Better?

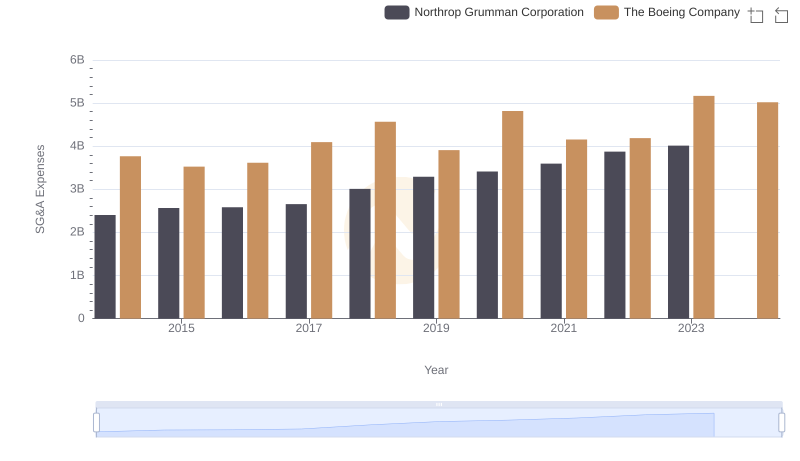

Operational Costs Compared: SG&A Analysis of The Boeing Company and Northrop Grumman Corporation

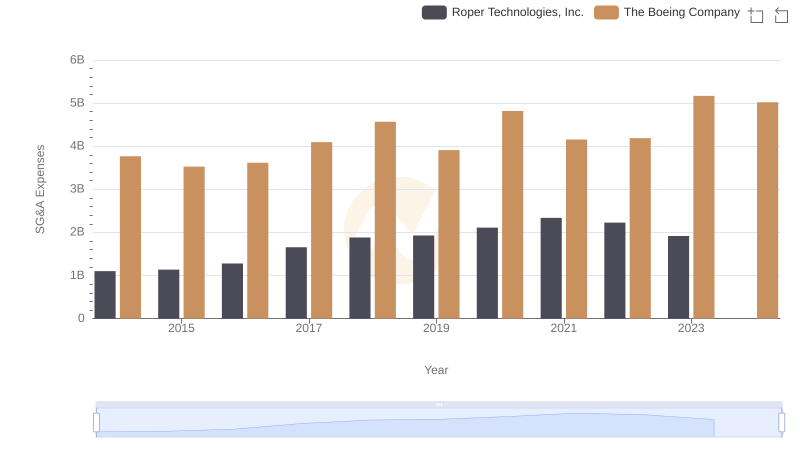

Cost Management Insights: SG&A Expenses for The Boeing Company and Roper Technologies, Inc.

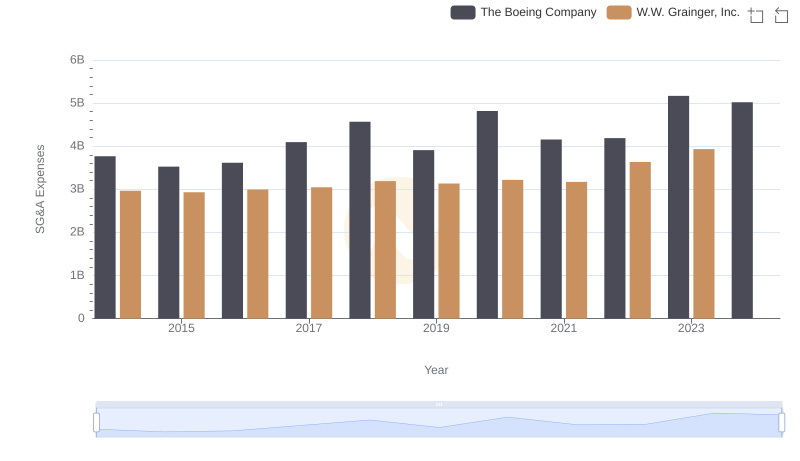

Selling, General, and Administrative Costs: The Boeing Company vs W.W. Grainger, Inc.

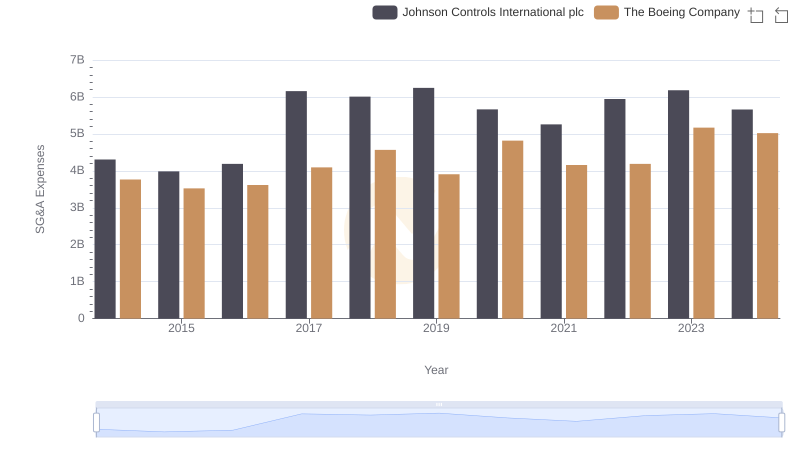

Operational Costs Compared: SG&A Analysis of The Boeing Company and Johnson Controls International plc