| __timestamp | 3M Company | The Boeing Company |

|---|---|---|

| Wednesday, January 1, 2014 | 6469000000 | 3767000000 |

| Thursday, January 1, 2015 | 6182000000 | 3525000000 |

| Friday, January 1, 2016 | 6111000000 | 3616000000 |

| Sunday, January 1, 2017 | 6572000000 | 4094000000 |

| Monday, January 1, 2018 | 7602000000 | 4567000000 |

| Tuesday, January 1, 2019 | 7029000000 | 3909000000 |

| Wednesday, January 1, 2020 | 6929000000 | 4817000000 |

| Friday, January 1, 2021 | 7197000000 | 4157000000 |

| Saturday, January 1, 2022 | 9049000000 | 4187000000 |

| Sunday, January 1, 2023 | 21526000000 | 5168000000 |

| Monday, January 1, 2024 | 4221000000 | 5021000000 |

Infusing magic into the data realm

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, 3M and Boeing have showcased contrasting strategies in handling these costs. From 2014 to 2023, 3M's SG&A expenses have fluctuated, peaking in 2023 with a staggering 165% increase from 2014. In contrast, Boeing's expenses have remained relatively stable, with a modest 37% increase over the same period. This stability suggests Boeing's disciplined approach to cost management, despite the challenges faced by the aerospace industry. Meanwhile, 3M's significant rise in 2023 could indicate strategic investments or restructuring efforts. As we look to 2024, with 3M's expenses dropping by 80% from the previous year, the question remains: will 3M's aggressive cost-cutting yield long-term benefits, or will Boeing's steady approach prove more sustainable?

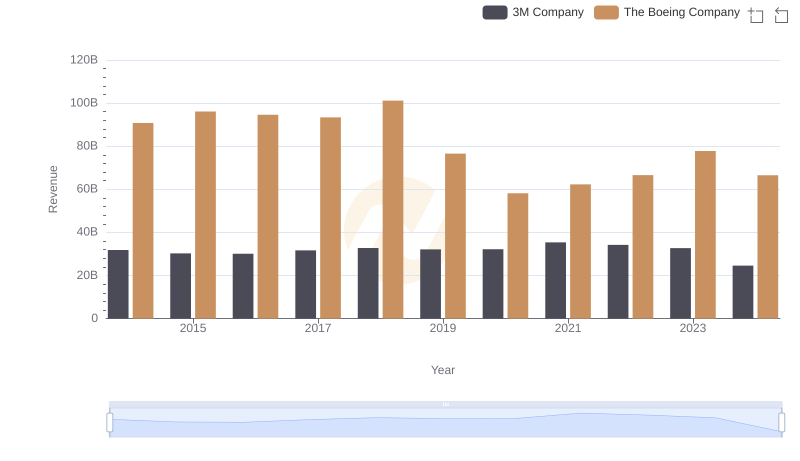

The Boeing Company or 3M Company: Who Leads in Yearly Revenue?

Cost of Revenue Comparison: The Boeing Company vs 3M Company

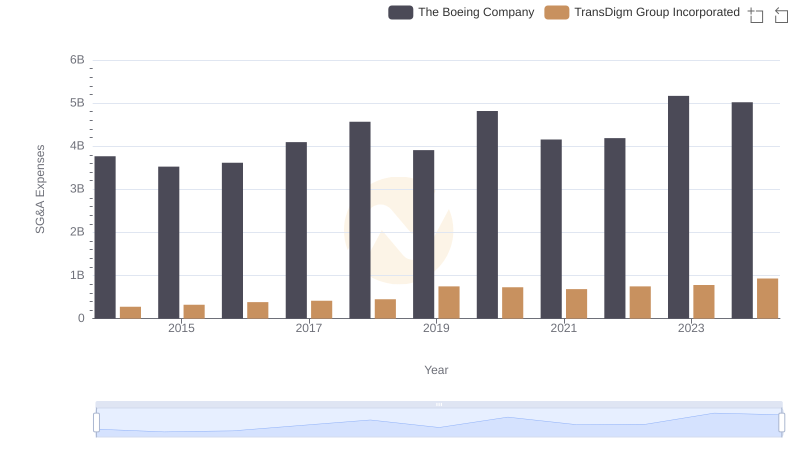

The Boeing Company and TransDigm Group Incorporated: SG&A Spending Patterns Compared

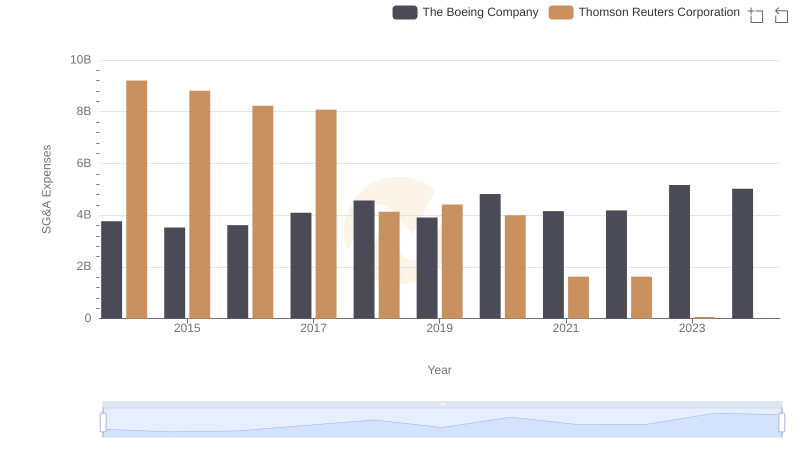

Selling, General, and Administrative Costs: The Boeing Company vs Thomson Reuters Corporation

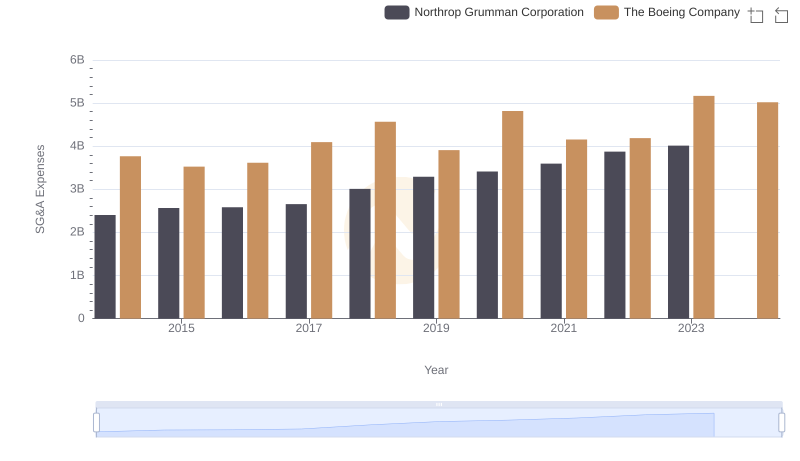

Operational Costs Compared: SG&A Analysis of The Boeing Company and Northrop Grumman Corporation

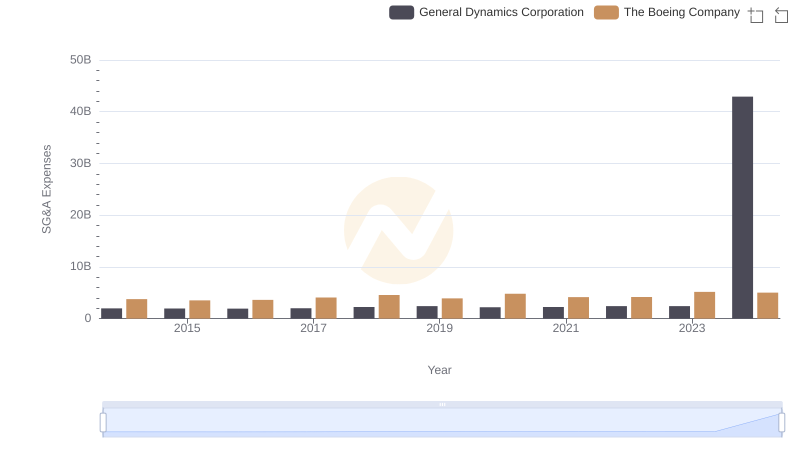

Operational Costs Compared: SG&A Analysis of The Boeing Company and General Dynamics Corporation