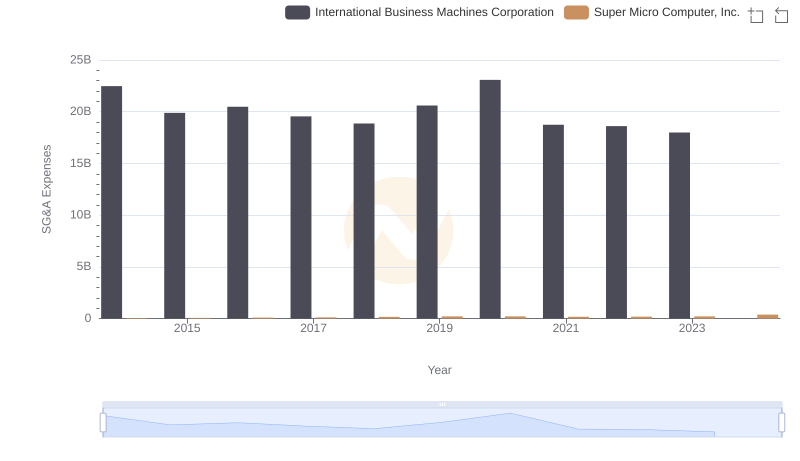

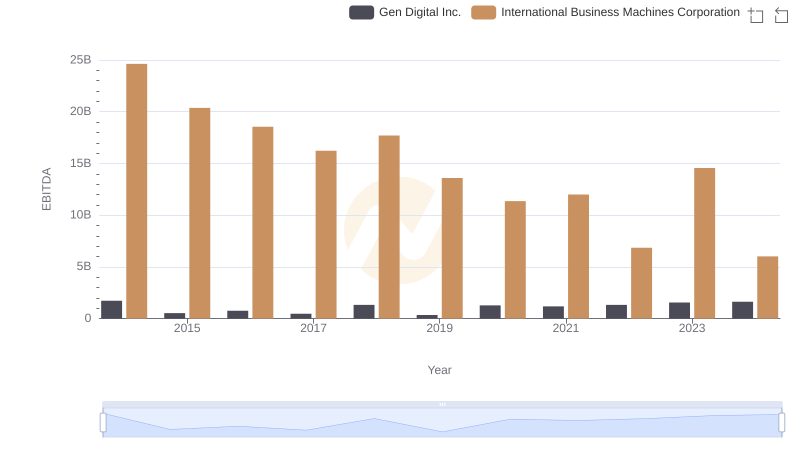

| __timestamp | Gen Digital Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 2880000000 | 22472000000 |

| Thursday, January 1, 2015 | 2702000000 | 19894000000 |

| Friday, January 1, 2016 | 1587000000 | 20279000000 |

| Sunday, January 1, 2017 | 2023000000 | 19680000000 |

| Monday, January 1, 2018 | 2171000000 | 19366000000 |

| Tuesday, January 1, 2019 | 1940000000 | 18724000000 |

| Wednesday, January 1, 2020 | 1069000000 | 20561000000 |

| Friday, January 1, 2021 | 791000000 | 18745000000 |

| Saturday, January 1, 2022 | 1014000000 | 17483000000 |

| Sunday, January 1, 2023 | 968000000 | 17997000000 |

| Monday, January 1, 2024 | 1337000000 | 29536000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding the nuances of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, International Business Machines Corporation (IBM) and Gen Digital Inc. have showcased contrasting trends in their SG&A expenditures. IBM, a stalwart in the tech industry, consistently reported higher SG&A costs, peaking at nearly $30 billion in 2024, reflecting its expansive global operations. In contrast, Gen Digital's expenses have been more volatile, with a notable decline of over 60% from 2014 to 2021, before a slight recovery in 2024. This divergence highlights IBM's strategic investments in innovation and infrastructure, while Gen Digital's leaner approach underscores its agility in adapting to market shifts. As businesses navigate the complexities of the digital age, these insights offer a window into the strategic priorities of two industry giants.

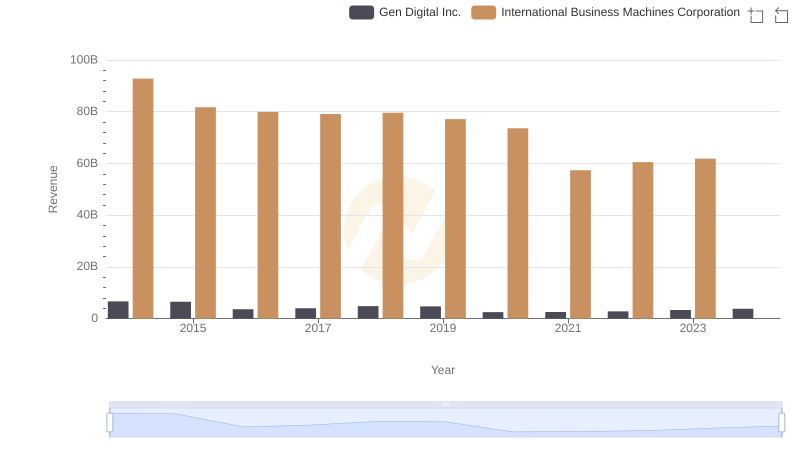

Revenue Insights: International Business Machines Corporation and Gen Digital Inc. Performance Compared

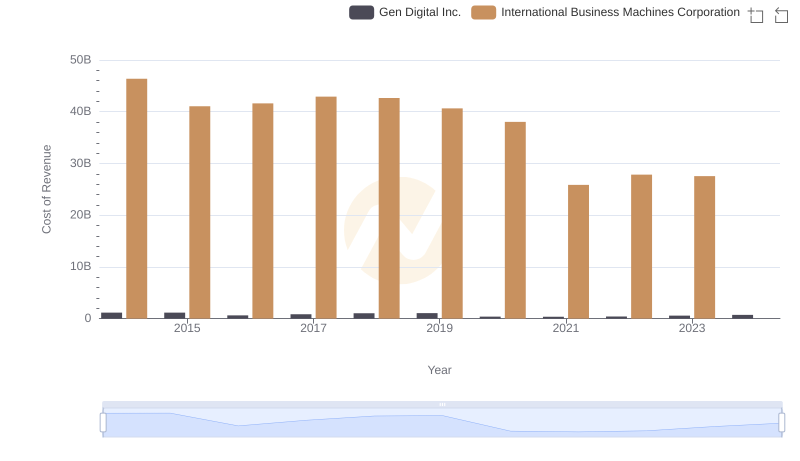

Cost of Revenue Trends: International Business Machines Corporation vs Gen Digital Inc.

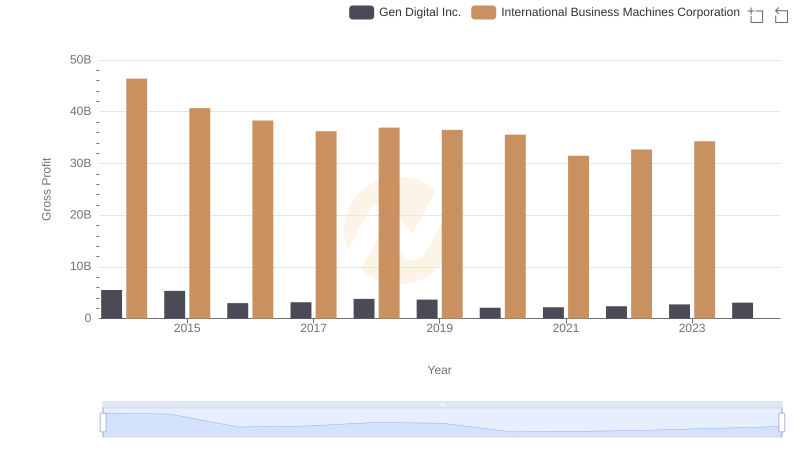

Gross Profit Analysis: Comparing International Business Machines Corporation and Gen Digital Inc.

Selling, General, and Administrative Costs: International Business Machines Corporation vs Super Micro Computer, Inc.

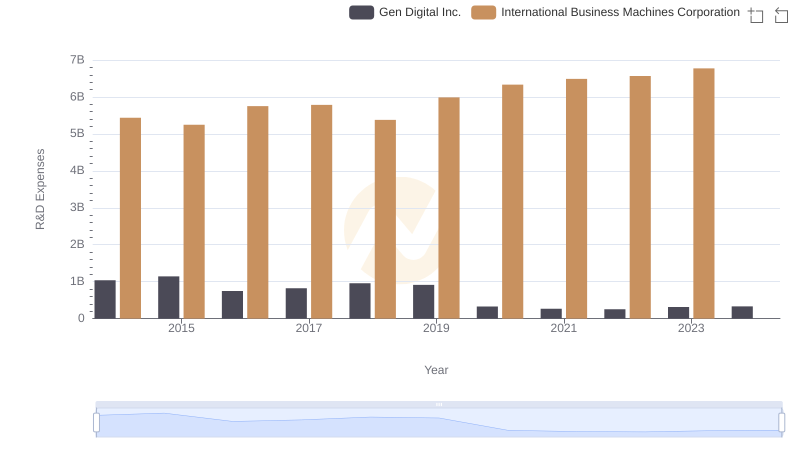

International Business Machines Corporation or Gen Digital Inc.: Who Invests More in Innovation?

Breaking Down SG&A Expenses: International Business Machines Corporation vs Trimble Inc.

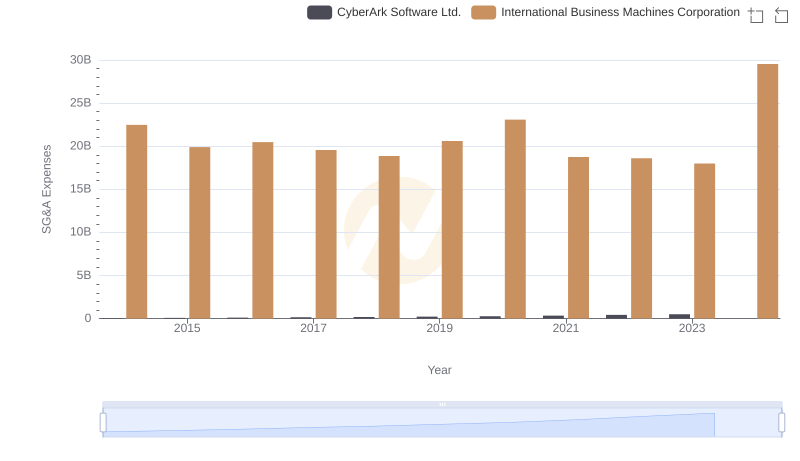

International Business Machines Corporation or CyberArk Software Ltd.: Who Manages SG&A Costs Better?

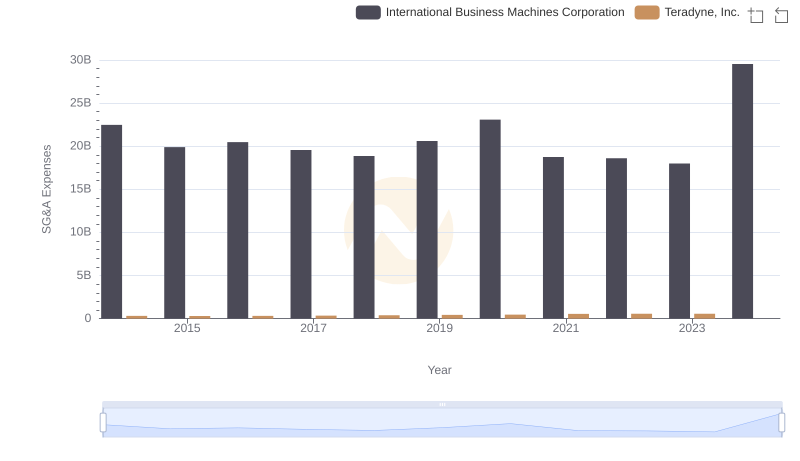

Selling, General, and Administrative Costs: International Business Machines Corporation vs Teradyne, Inc.

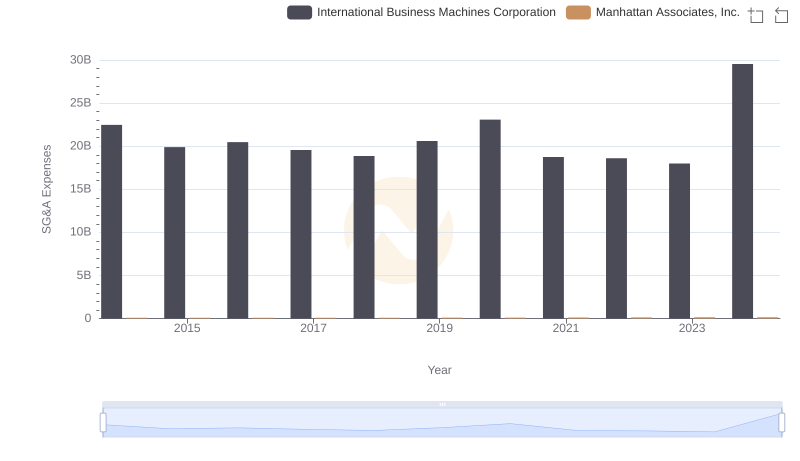

Selling, General, and Administrative Costs: International Business Machines Corporation vs Manhattan Associates, Inc.

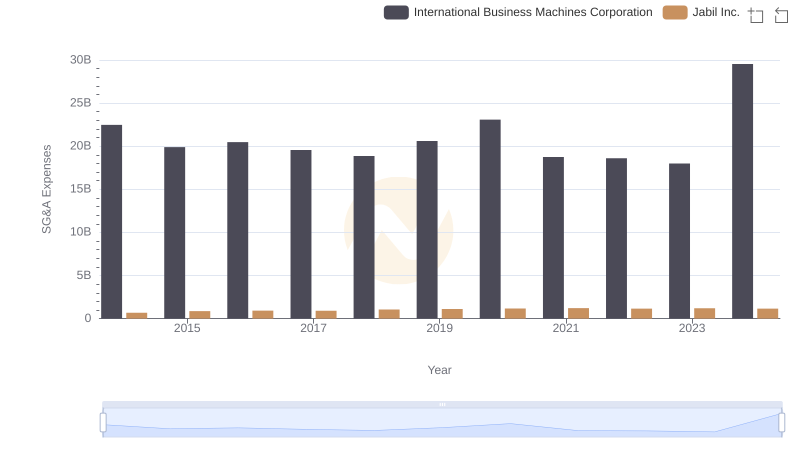

Selling, General, and Administrative Costs: International Business Machines Corporation vs Jabil Inc.

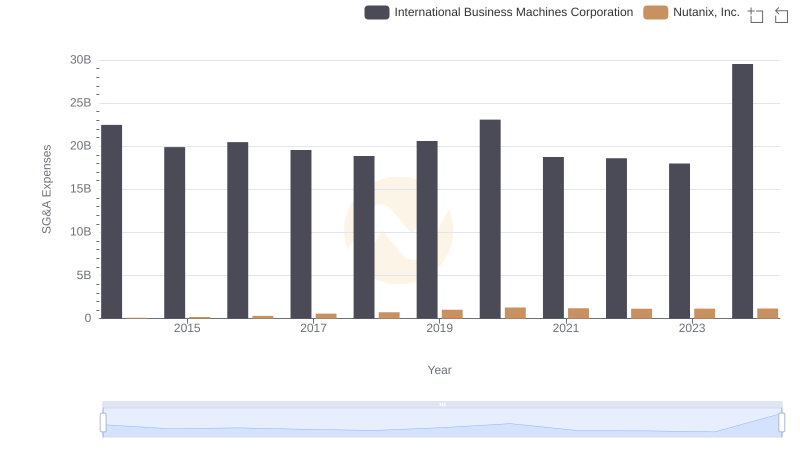

International Business Machines Corporation and Nutanix, Inc.: SG&A Spending Patterns Compared

Comprehensive EBITDA Comparison: International Business Machines Corporation vs Gen Digital Inc.