| __timestamp | Axon Enterprise, Inc. | L3Harris Technologies, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 883000000 |

| Thursday, January 1, 2015 | 69698000 | 1105000000 |

| Friday, January 1, 2016 | 108076000 | 1150000000 |

| Sunday, January 1, 2017 | 138692000 | 1182000000 |

| Monday, January 1, 2018 | 156886000 | 1242000000 |

| Tuesday, January 1, 2019 | 212959000 | 2156000000 |

| Wednesday, January 1, 2020 | 307286000 | 3315000000 |

| Friday, January 1, 2021 | 515007000 | 3280000000 |

| Saturday, January 1, 2022 | 401575000 | 2998000000 |

| Sunday, January 1, 2023 | 496874000 | 1921000000 |

| Monday, January 1, 2024 | 3568000000 |

In pursuit of knowledge

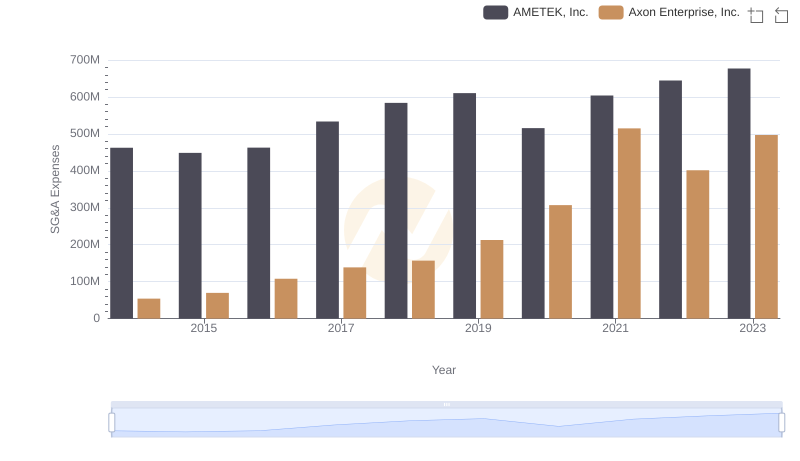

In the competitive landscape of the defense and technology sectors, understanding the financial strategies of leading companies is crucial. Axon Enterprise, Inc. and L3Harris Technologies, Inc. have shown distinct trends in their Selling, General, and Administrative (SG&A) expenses from 2014 to 2023.

Axon has demonstrated a remarkable growth trajectory, with SG&A expenses increasing by over 800% from 2014 to 2021. This surge reflects Axon's aggressive expansion and investment in administrative capabilities. However, a slight dip in 2022 suggests a strategic recalibration.

In contrast, L3Harris's SG&A expenses peaked in 2020, marking a 275% increase from 2014. The subsequent decline by 2023 indicates a shift towards cost optimization, possibly in response to market pressures.

These trends highlight the dynamic nature of financial management in the tech and defense industries, offering valuable insights for investors and analysts alike.

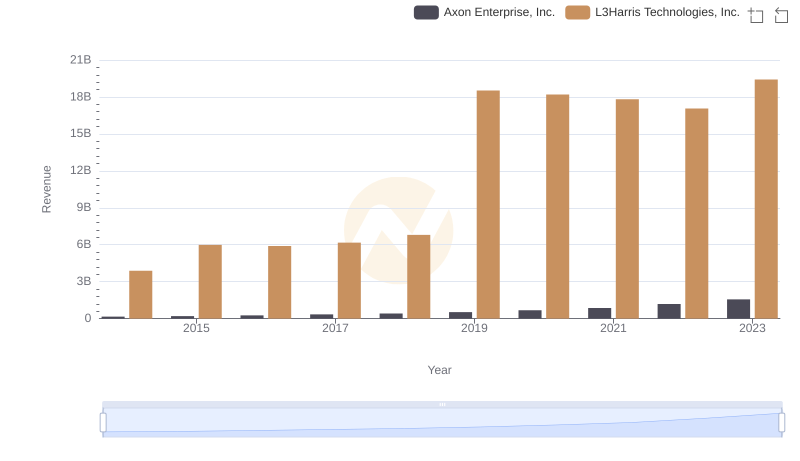

Annual Revenue Comparison: Axon Enterprise, Inc. vs L3Harris Technologies, Inc.

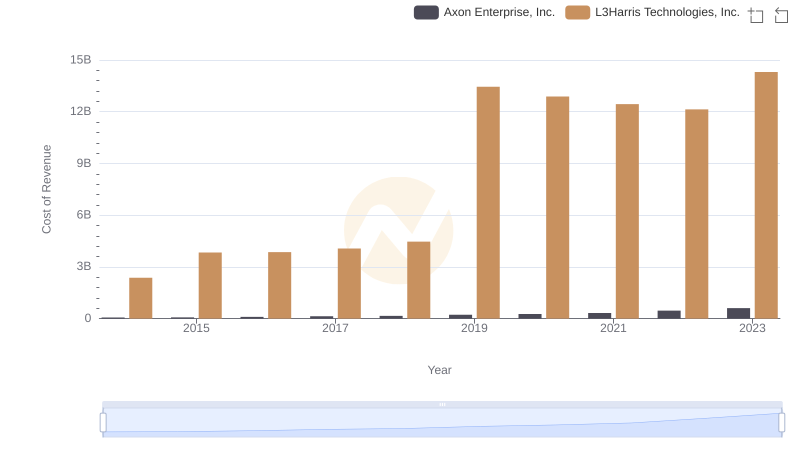

Axon Enterprise, Inc. vs L3Harris Technologies, Inc.: Efficiency in Cost of Revenue Explored

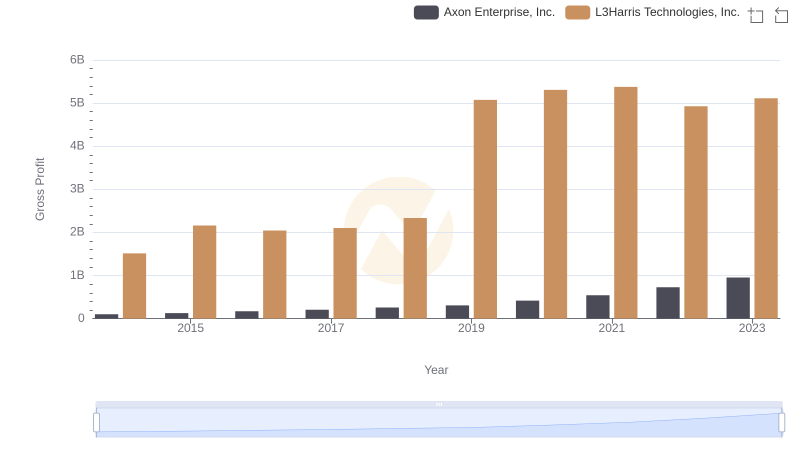

Axon Enterprise, Inc. vs L3Harris Technologies, Inc.: A Gross Profit Performance Breakdown

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and AMETEK, Inc.

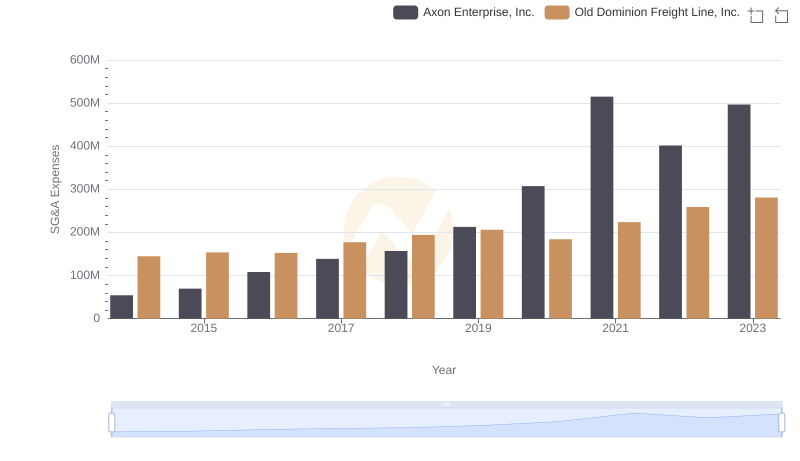

Breaking Down SG&A Expenses: Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.

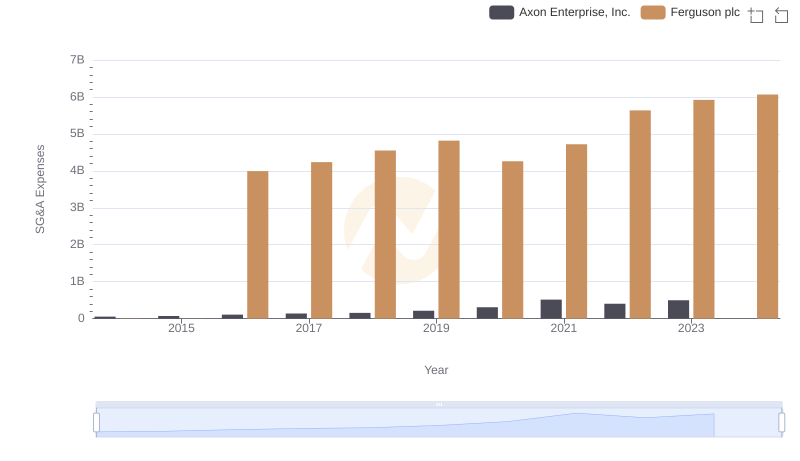

Axon Enterprise, Inc. or Ferguson plc: Who Manages SG&A Costs Better?

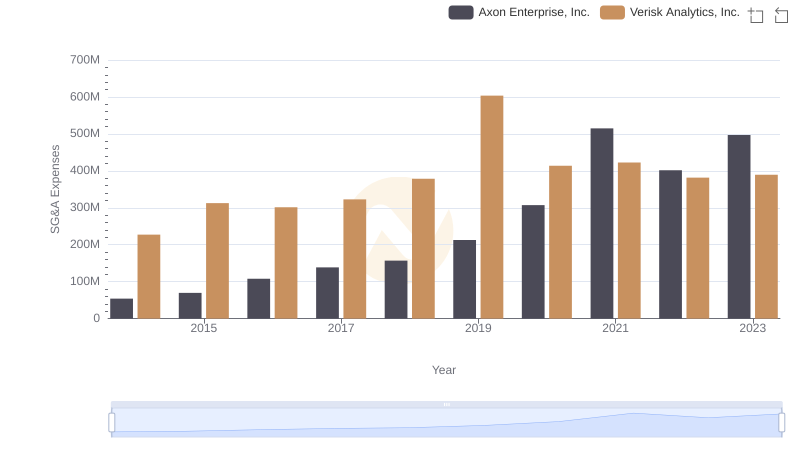

Axon Enterprise, Inc. vs Verisk Analytics, Inc.: SG&A Expense Trends

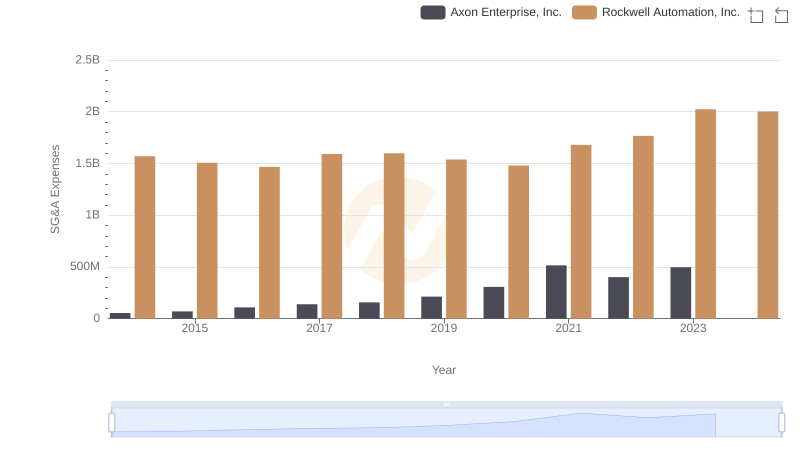

Operational Costs Compared: SG&A Analysis of Axon Enterprise, Inc. and Rockwell Automation, Inc.