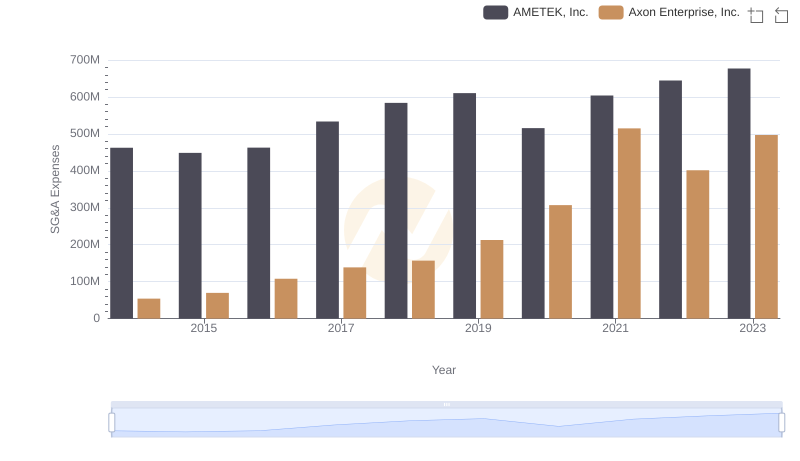

| __timestamp | Axon Enterprise, Inc. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 54158000 | 144817000 |

| Thursday, January 1, 2015 | 69698000 | 153589000 |

| Friday, January 1, 2016 | 108076000 | 152391000 |

| Sunday, January 1, 2017 | 138692000 | 177205000 |

| Monday, January 1, 2018 | 156886000 | 194368000 |

| Tuesday, January 1, 2019 | 212959000 | 206125000 |

| Wednesday, January 1, 2020 | 307286000 | 184185000 |

| Friday, January 1, 2021 | 515007000 | 223757000 |

| Saturday, January 1, 2022 | 401575000 | 258883000 |

| Sunday, January 1, 2023 | 496874000 | 281053000 |

Data in motion

In the world of business, understanding a company's Selling, General, and Administrative (SG&A) expenses is crucial for evaluating its operational efficiency. This analysis compares the SG&A expenses of Axon Enterprise, Inc. and Old Dominion Freight Line, Inc. from 2014 to 2023.

Axon Enterprise, known for its innovative public safety technologies, has seen a dramatic increase in SG&A expenses over the years. From 2014 to 2023, Axon's expenses surged by over 800%, peaking in 2021. This growth reflects the company's aggressive expansion and investment in new technologies.

In contrast, Old Dominion Freight Line, a leader in the freight transportation industry, maintained a more stable SG&A expense trajectory. Over the same period, their expenses grew by approximately 94%, indicating a steady yet controlled growth strategy.

This comparison highlights the differing strategies of two industry leaders, offering insights into their operational priorities and market approaches.

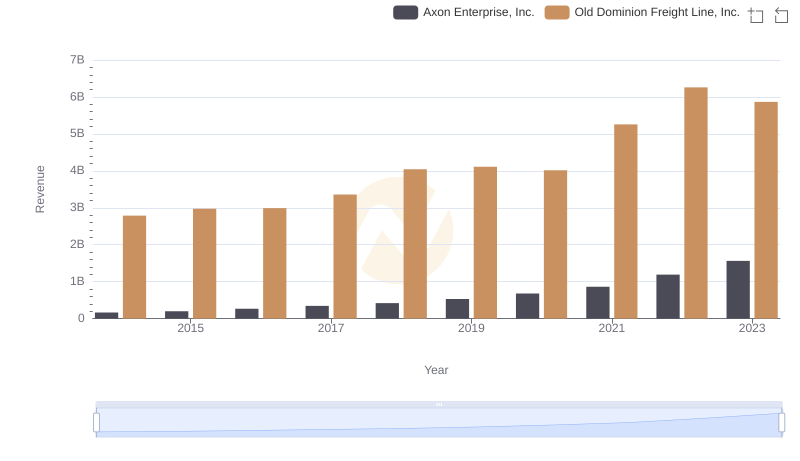

Comparing Revenue Performance: Axon Enterprise, Inc. or Old Dominion Freight Line, Inc.?

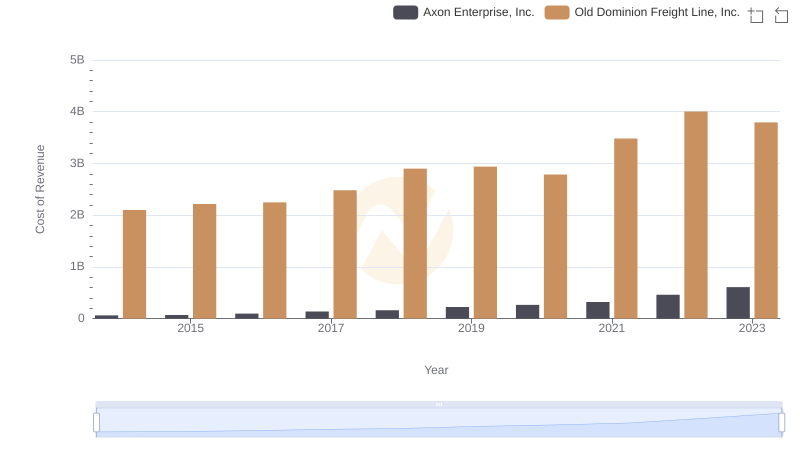

Cost of Revenue Trends: Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.

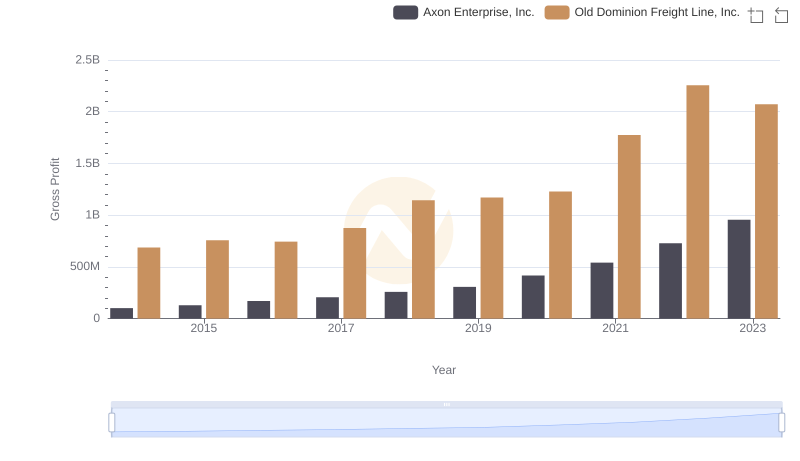

Axon Enterprise, Inc. vs Old Dominion Freight Line, Inc.: A Gross Profit Performance Breakdown

SG&A Efficiency Analysis: Comparing Axon Enterprise, Inc. and AMETEK, Inc.

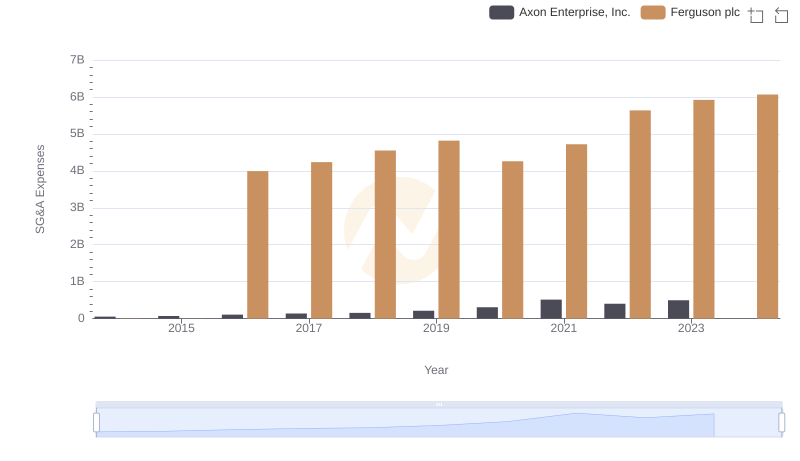

Axon Enterprise, Inc. or Ferguson plc: Who Manages SG&A Costs Better?

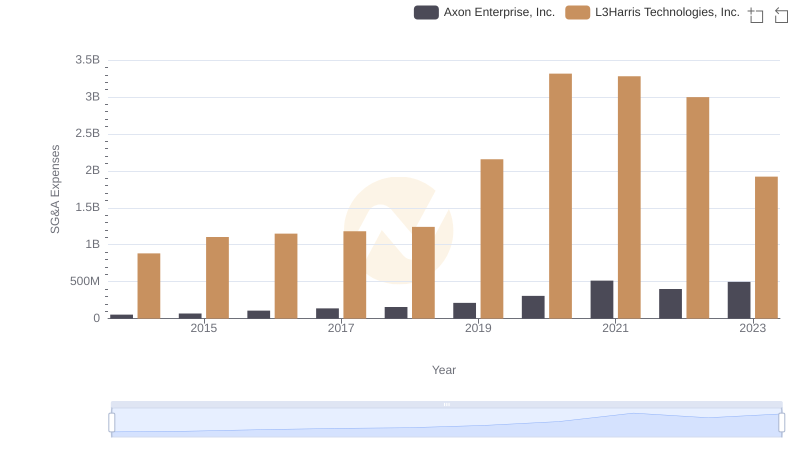

Selling, General, and Administrative Costs: Axon Enterprise, Inc. vs L3Harris Technologies, Inc.

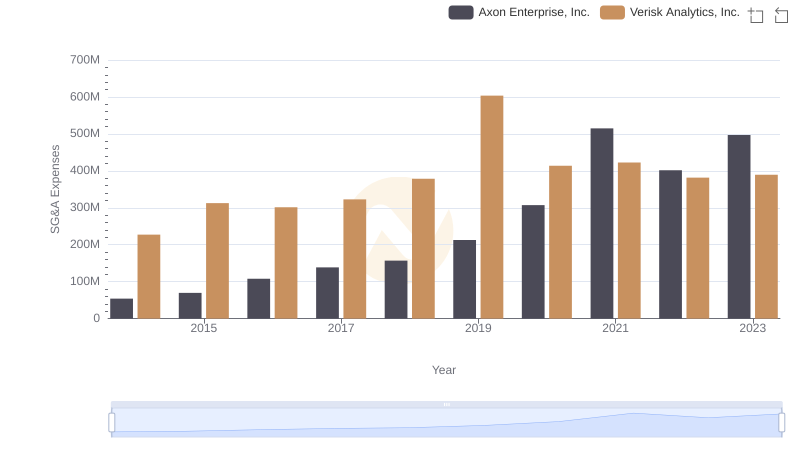

Axon Enterprise, Inc. vs Verisk Analytics, Inc.: SG&A Expense Trends