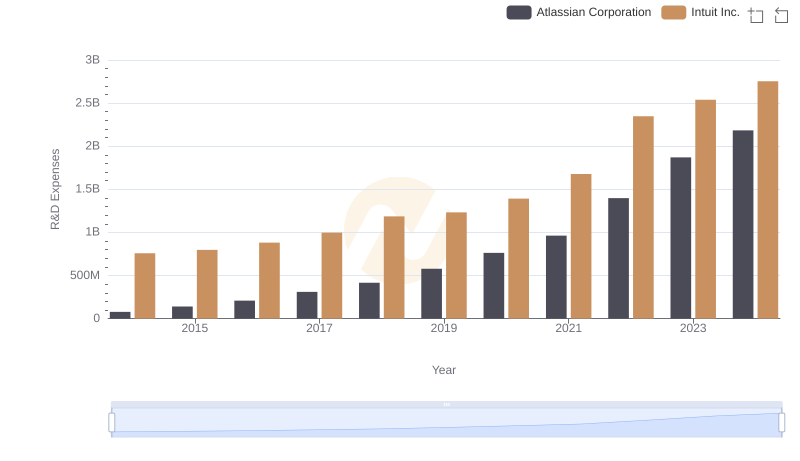

| __timestamp | Intuit Inc. | Workday, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 182116000 |

| Thursday, January 1, 2015 | 798000000 | 316868000 |

| Friday, January 1, 2016 | 881000000 | 469944000 |

| Sunday, January 1, 2017 | 998000000 | 680531000 |

| Monday, January 1, 2018 | 1186000000 | 910584000 |

| Tuesday, January 1, 2019 | 1233000000 | 1211832000 |

| Wednesday, January 1, 2020 | 1392000000 | 1549906000 |

| Friday, January 1, 2021 | 1678000000 | 1721222000 |

| Saturday, January 1, 2022 | 2347000000 | 1879220000 |

| Sunday, January 1, 2023 | 2539000000 | 2270660000 |

| Monday, January 1, 2024 | 2754000000 | 2464000000 |

In pursuit of knowledge

In the ever-evolving tech landscape, research and development (R&D) are the lifeblood of innovation. Over the past decade, Intuit Inc. and Workday, Inc. have demonstrated a steadfast commitment to R&D, with both companies significantly increasing their investments. From 2014 to 2024, Intuit's R&D expenses surged by over 260%, reflecting its dedication to enhancing financial software solutions. Meanwhile, Workday's R&D spending grew by an impressive 1,250%, underscoring its focus on advancing enterprise cloud applications.

By 2023, Intuit's R&D expenses reached approximately 2.5 billion, while Workday's were close behind at 2.3 billion. This trend highlights the competitive nature of the tech industry, where continuous innovation is crucial for maintaining market leadership. As we look to the future, these investments will likely drive groundbreaking advancements, shaping the way businesses and consumers interact with technology.

Stay tuned as we delve deeper into the strategies behind these numbers and what they mean for the future of tech innovation.

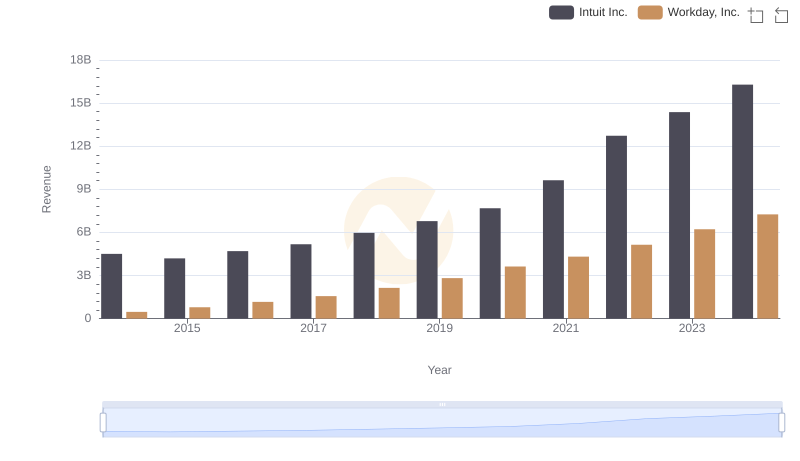

Intuit Inc. vs Workday, Inc.: Annual Revenue Growth Compared

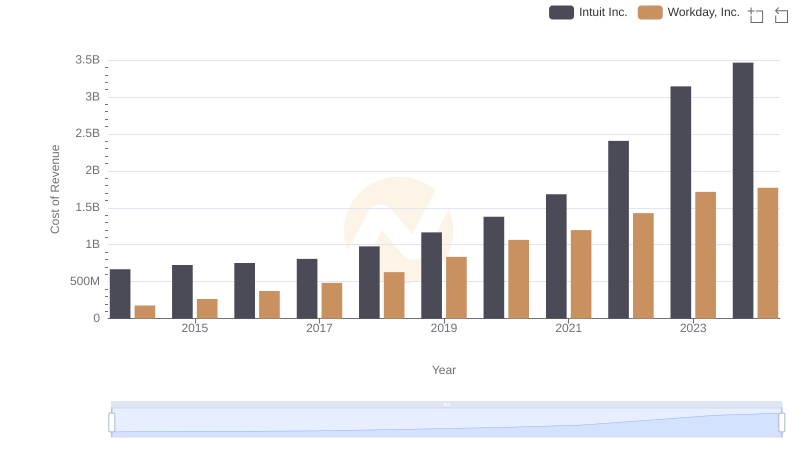

Comparing Cost of Revenue Efficiency: Intuit Inc. vs Workday, Inc.

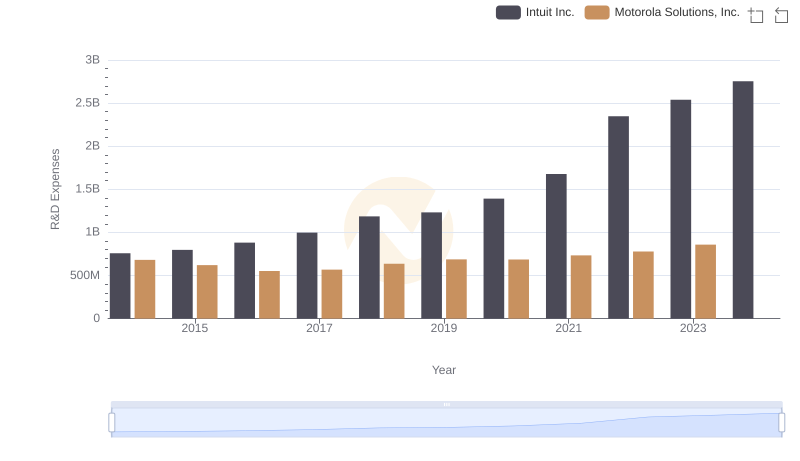

Analyzing R&D Budgets: Intuit Inc. vs Motorola Solutions, Inc.

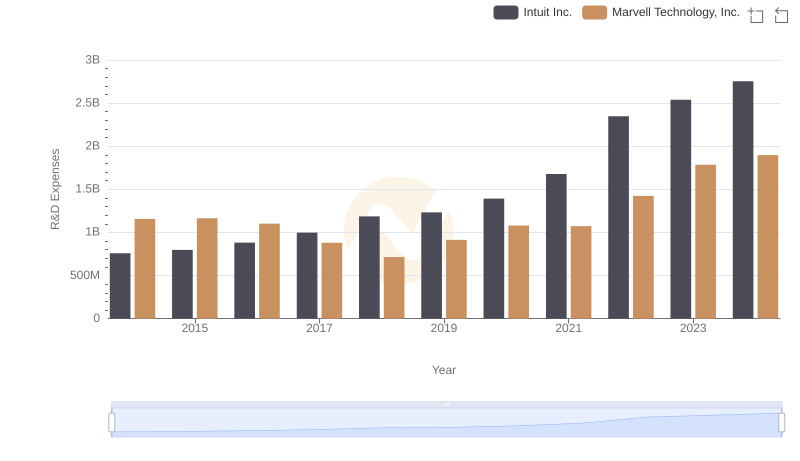

Research and Development Expenses Breakdown: Intuit Inc. vs Marvell Technology, Inc.

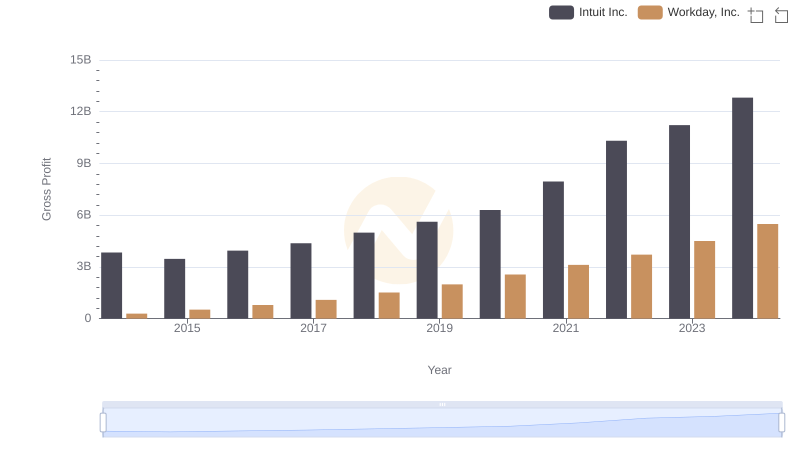

Gross Profit Comparison: Intuit Inc. and Workday, Inc. Trends

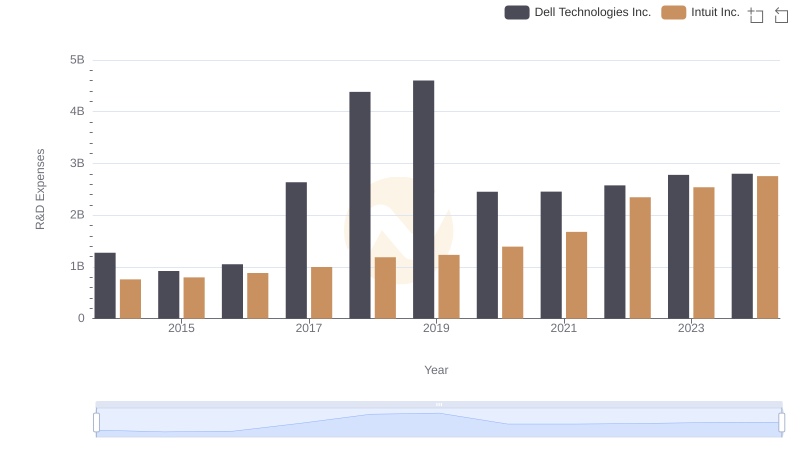

Intuit Inc. vs Dell Technologies Inc.: Strategic Focus on R&D Spending

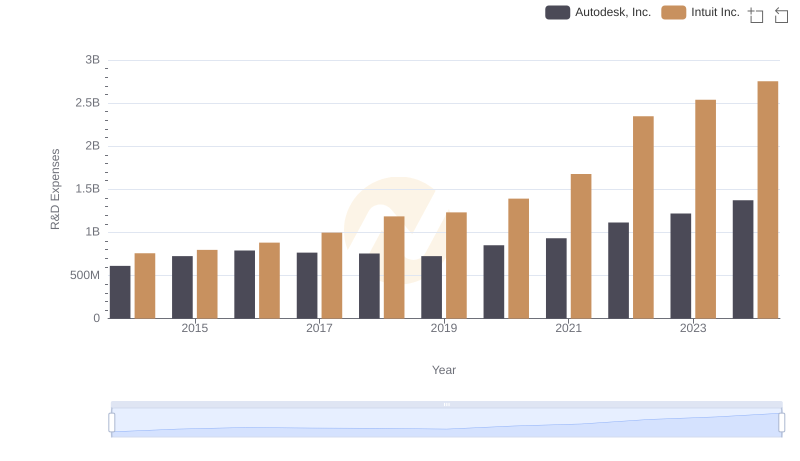

Research and Development Investment: Intuit Inc. vs Autodesk, Inc.

R&D Insights: How Intuit Inc. and Atlassian Corporation Allocate Funds

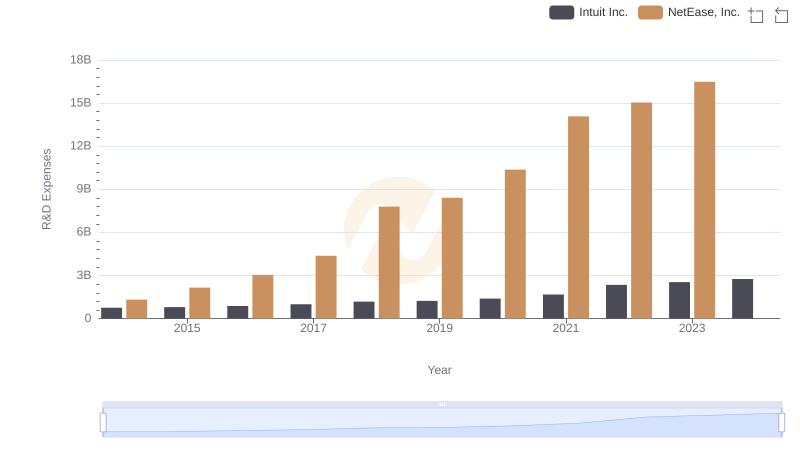

Research and Development Investment: Intuit Inc. vs NetEase, Inc.

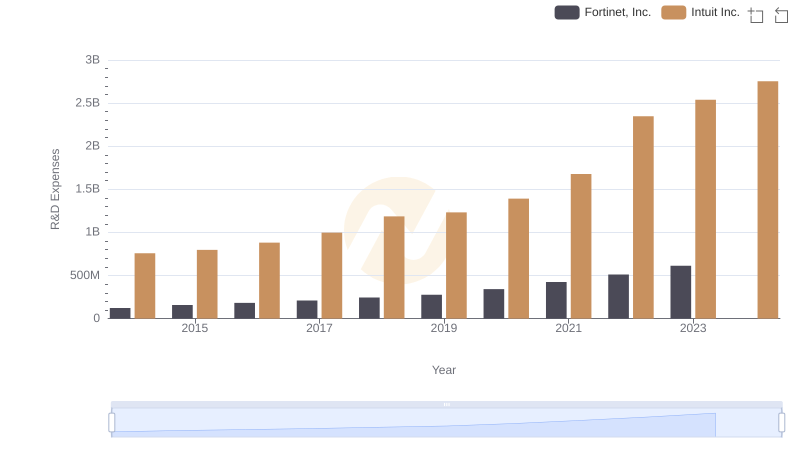

Intuit Inc. vs Fortinet, Inc.: Strategic Focus on R&D Spending

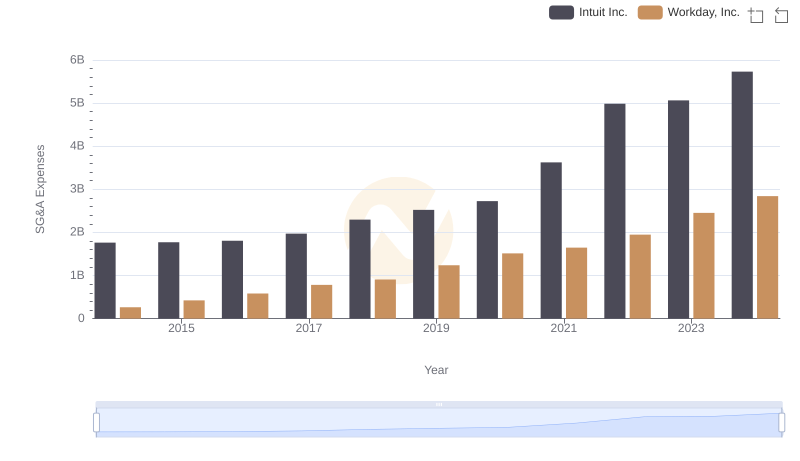

Intuit Inc. and Workday, Inc.: SG&A Spending Patterns Compared

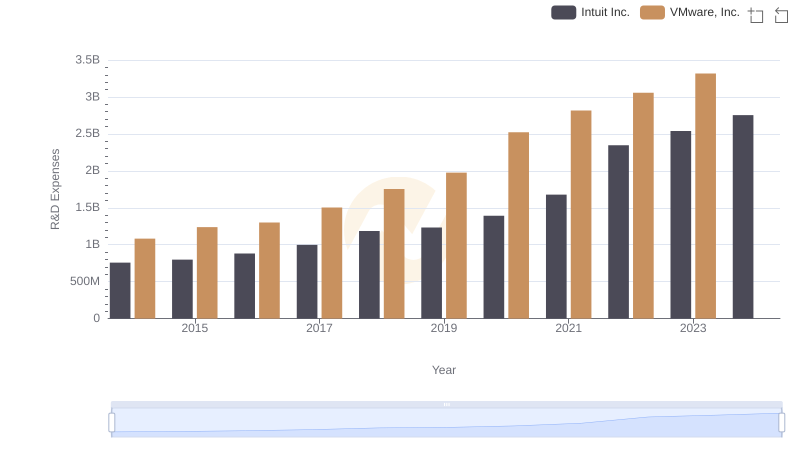

Intuit Inc. or VMware, Inc.: Who Invests More in Innovation?