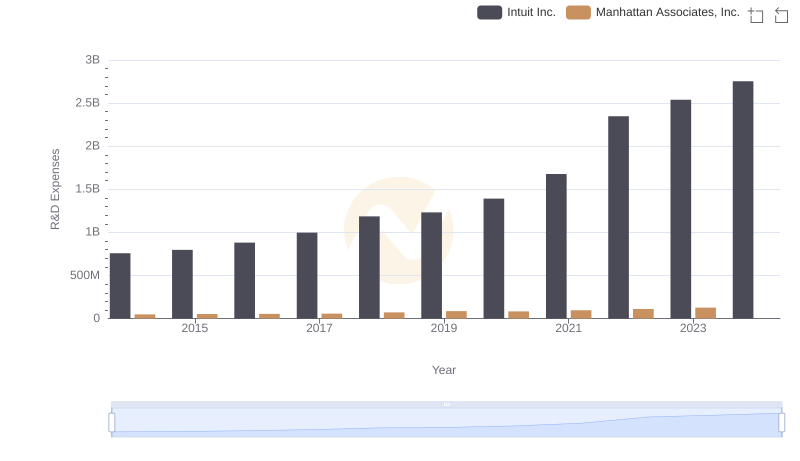

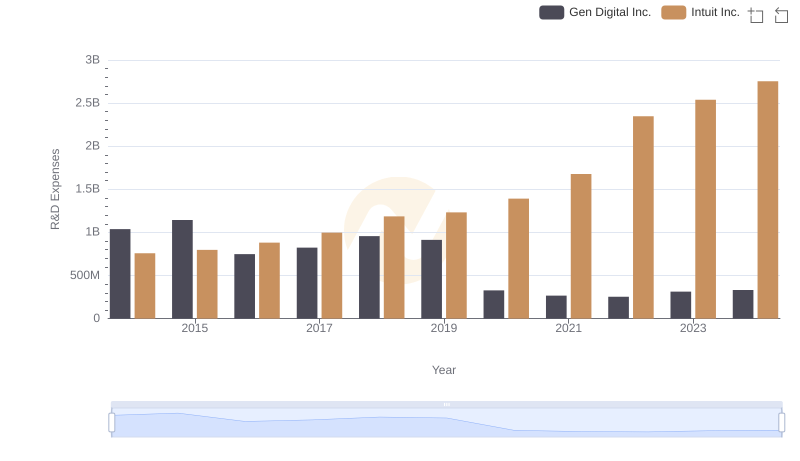

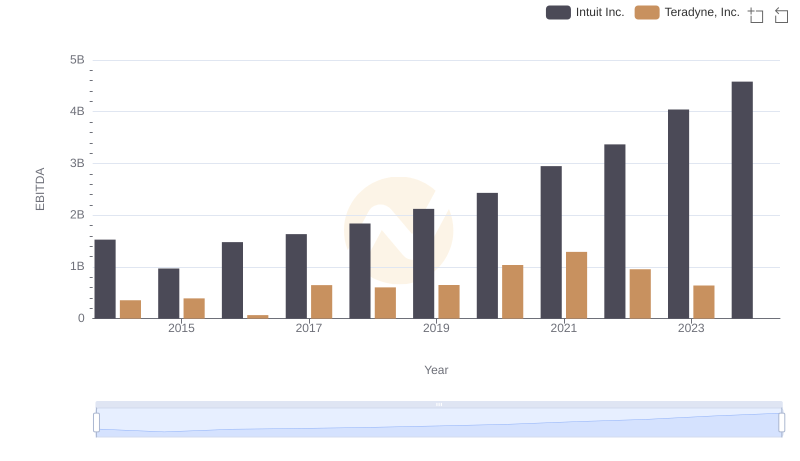

| __timestamp | Intuit Inc. | Teradyne, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 758000000 | 291639000 |

| Thursday, January 1, 2015 | 798000000 | 292250000 |

| Friday, January 1, 2016 | 881000000 | 291025000 |

| Sunday, January 1, 2017 | 998000000 | 305665000 |

| Monday, January 1, 2018 | 1186000000 | 301505000 |

| Tuesday, January 1, 2019 | 1233000000 | 322824000 |

| Wednesday, January 1, 2020 | 1392000000 | 374964000 |

| Friday, January 1, 2021 | 1678000000 | 427609000 |

| Saturday, January 1, 2022 | 2347000000 | 440591000 |

| Sunday, January 1, 2023 | 2539000000 | 418089000 |

| Monday, January 1, 2024 | 2754000000 | 0 |

In pursuit of knowledge

In the ever-evolving landscape of technology, research and development (R&D) expenses serve as a barometer for innovation and future growth. Over the past decade, Intuit Inc. and Teradyne, Inc. have demonstrated contrasting trajectories in their R&D investments. Intuit Inc., a leader in financial software, has seen its R&D expenses soar by over 260% from 2014 to 2023, reflecting its commitment to innovation and market leadership. In contrast, Teradyne, Inc., a key player in the semiconductor industry, has maintained a steady R&D investment, with a modest increase of around 43% over the same period. This divergence highlights Intuit's aggressive push towards technological advancement, while Teradyne focuses on consistent, incremental improvements. As we look to the future, these trends offer a glimpse into the strategic priorities of these industry giants.

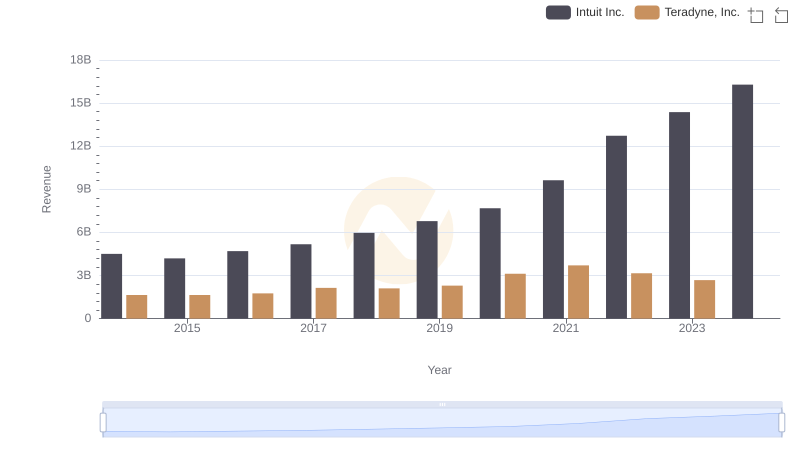

Annual Revenue Comparison: Intuit Inc. vs Teradyne, Inc.

Cost of Revenue Comparison: Intuit Inc. vs Teradyne, Inc.

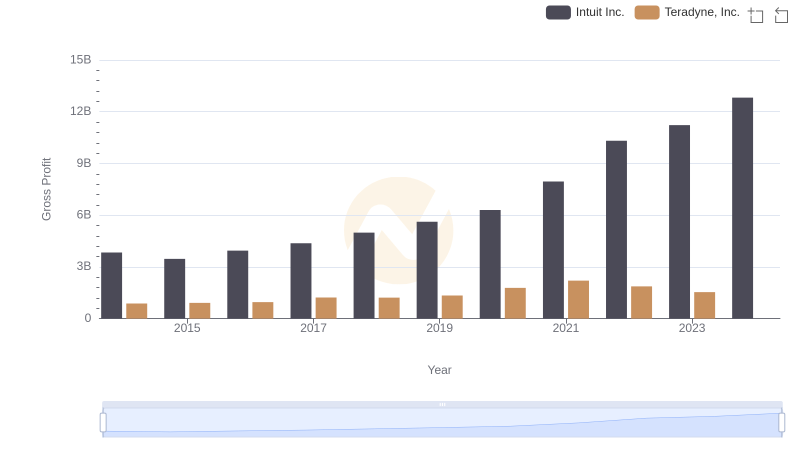

Gross Profit Analysis: Comparing Intuit Inc. and Teradyne, Inc.

R&D Insights: How Intuit Inc. and Trimble Inc. Allocate Funds

R&D Spending Showdown: Intuit Inc. vs Manhattan Associates, Inc.

Intuit Inc. and Teradyne, Inc.: SG&A Spending Patterns Compared

Research and Development Investment: Intuit Inc. vs Gen Digital Inc.

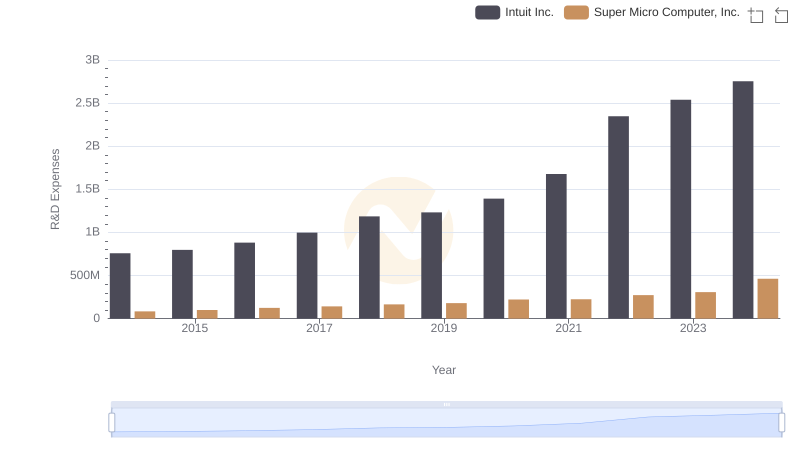

Intuit Inc. or Super Micro Computer, Inc.: Who Invests More in Innovation?

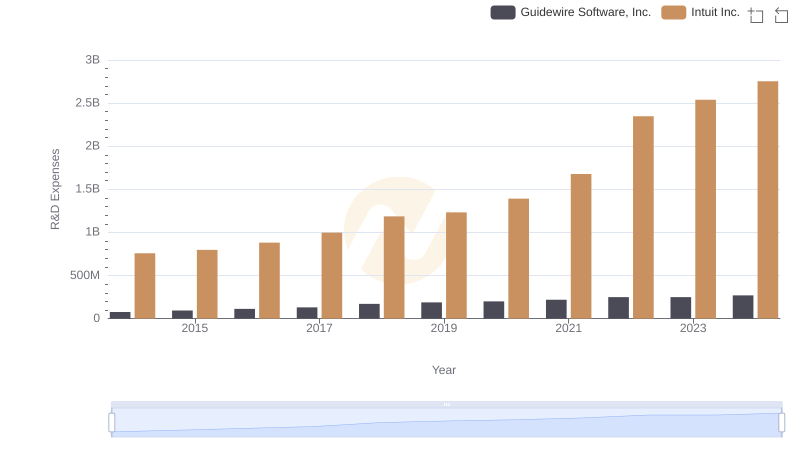

Research and Development Expenses Breakdown: Intuit Inc. vs Guidewire Software, Inc.

A Side-by-Side Analysis of EBITDA: Intuit Inc. and Teradyne, Inc.

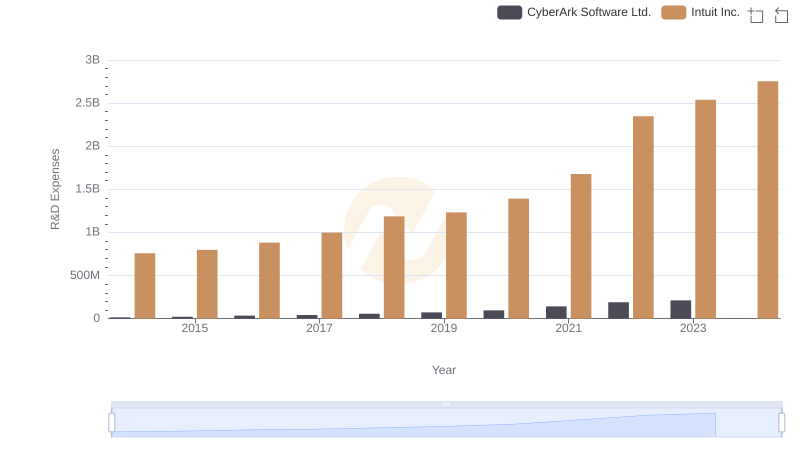

Research and Development Expenses Breakdown: Intuit Inc. vs CyberArk Software Ltd.