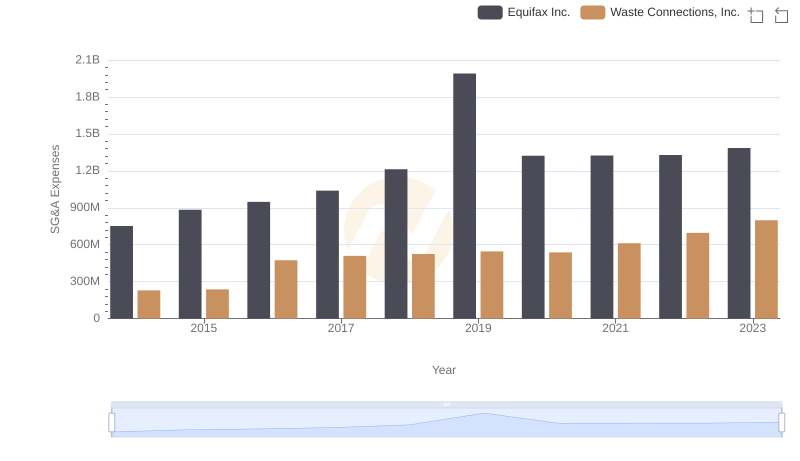

| __timestamp | Equifax Inc. | Waste Connections, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 842400000 | 717805000 |

| Thursday, January 1, 2015 | 914600000 | 191002871 |

| Friday, January 1, 2016 | 1116900000 | 900371894 |

| Sunday, January 1, 2017 | 1013900000 | 1380632000 |

| Monday, January 1, 2018 | 770200000 | 1442229014 |

| Tuesday, January 1, 2019 | 29000000 | 1650754605 |

| Wednesday, January 1, 2020 | 1217800000 | 1597555000 |

| Friday, January 1, 2021 | 1575200000 | 1891001000 |

| Saturday, January 1, 2022 | 1672800000 | 2090554149 |

| Sunday, January 1, 2023 | 1579100000 | 2261354000 |

| Monday, January 1, 2024 | 1251200000 | 2389779000 |

Igniting the spark of knowledge

In the ever-evolving landscape of corporate finance, understanding EBITDA trends is crucial for investors and analysts. Waste Connections, Inc. and Equifax Inc. have shown distinct trajectories over the past decade. From 2014 to 2023, Waste Connections, Inc. has consistently outperformed Equifax Inc. in terms of EBITDA growth. Notably, Waste Connections, Inc. saw a remarkable increase of approximately 215% from 2014 to 2023, reaching a peak EBITDA of over $2.26 billion in 2023. In contrast, Equifax Inc. experienced a more modest growth of around 87% during the same period, with a peak EBITDA of $1.67 billion in 2022. The data highlights Waste Connections, Inc.'s robust financial health and strategic growth, while Equifax Inc. faced challenges, particularly in 2019, with a significant dip in EBITDA. This analysis underscores the importance of strategic management and market positioning in achieving financial success.

EBITDA Metrics Evaluated: Waste Connections, Inc. vs Ferguson plc

EBITDA Metrics Evaluated: Waste Connections, Inc. vs Old Dominion Freight Line, Inc.

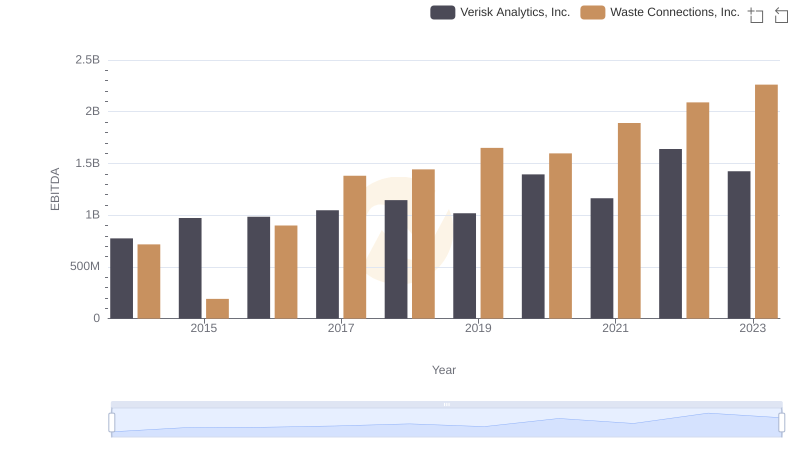

EBITDA Performance Review: Waste Connections, Inc. vs Verisk Analytics, Inc.

Waste Connections, Inc. and Equifax Inc.: SG&A Spending Patterns Compared

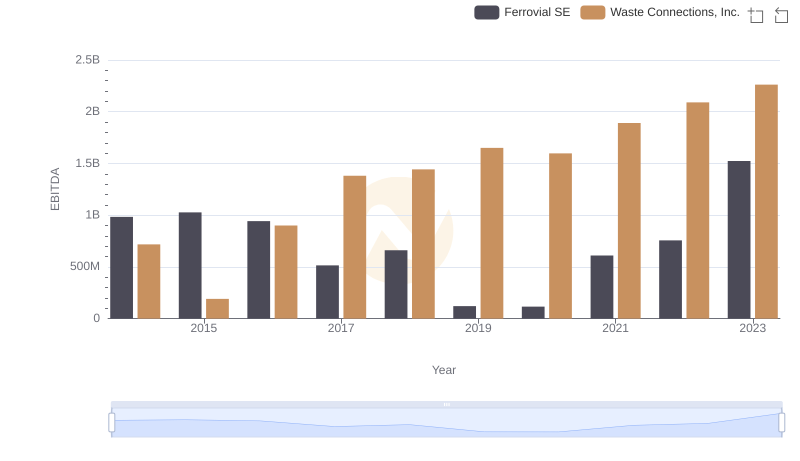

EBITDA Performance Review: Waste Connections, Inc. vs Ferrovial SE

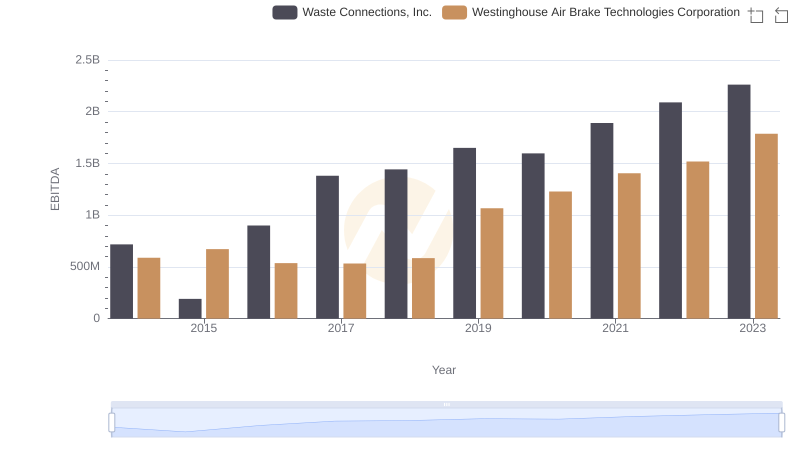

EBITDA Performance Review: Waste Connections, Inc. vs Westinghouse Air Brake Technologies Corporation

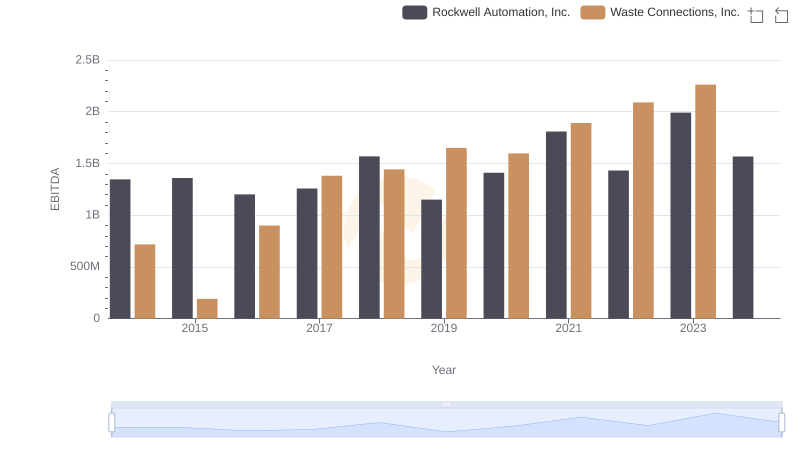

EBITDA Performance Review: Waste Connections, Inc. vs Rockwell Automation, Inc.

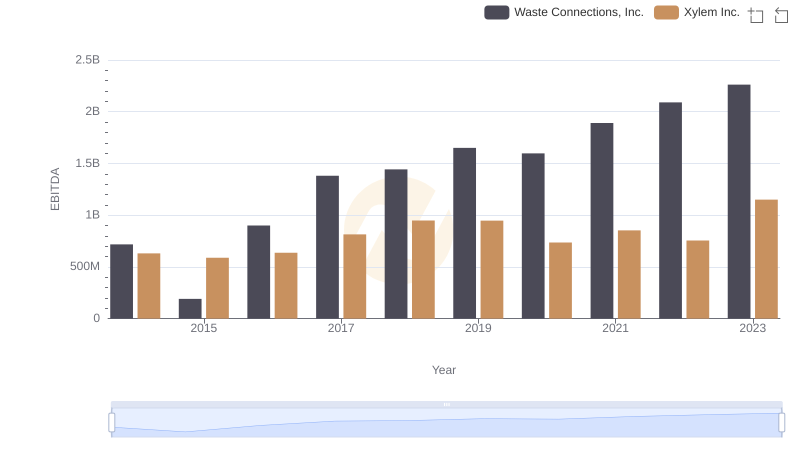

Comprehensive EBITDA Comparison: Waste Connections, Inc. vs Xylem Inc.