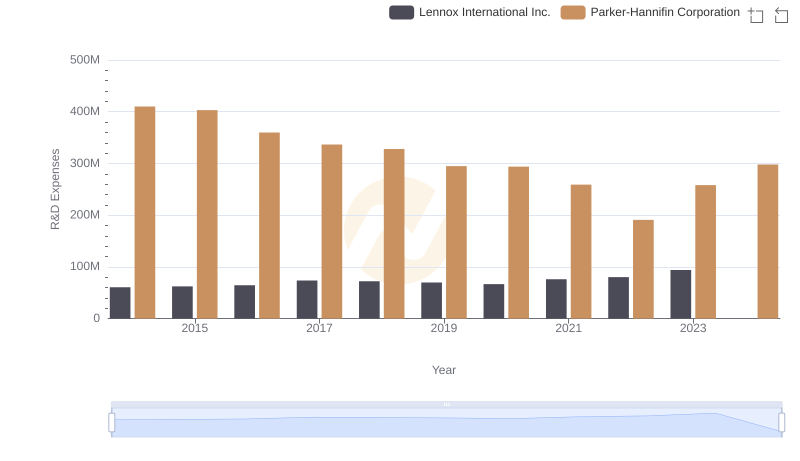

| __timestamp | Lennox International Inc. | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 387700000 | 1832903000 |

| Thursday, January 1, 2015 | 423600000 | 1861551000 |

| Friday, January 1, 2016 | 490800000 | 1558088000 |

| Sunday, January 1, 2017 | 562900000 | 1846306000 |

| Monday, January 1, 2018 | 575200000 | 2382235000 |

| Tuesday, January 1, 2019 | 633300000 | 2513468000 |

| Wednesday, January 1, 2020 | 553900000 | 2431500000 |

| Friday, January 1, 2021 | 652500000 | 3092383000 |

| Saturday, January 1, 2022 | 729000000 | 2441242000 |

| Sunday, January 1, 2023 | 879500000 | 4071687000 |

| Monday, January 1, 2024 | 1034800000 | 5028229000 |

In pursuit of knowledge

In the competitive landscape of industrial manufacturing, Parker-Hannifin Corporation and Lennox International Inc. have emerged as formidable players. Over the past decade, Parker-Hannifin has consistently outperformed Lennox International in terms of EBITDA, showcasing a robust growth trajectory. From 2014 to 2024, Parker-Hannifin's EBITDA surged by approximately 175%, reaching a peak in 2024. In contrast, Lennox International experienced a more modest growth of around 167% during the same period.

This analysis underscores the dynamic nature of the industrial sector and the strategic maneuvers that define corporate success.

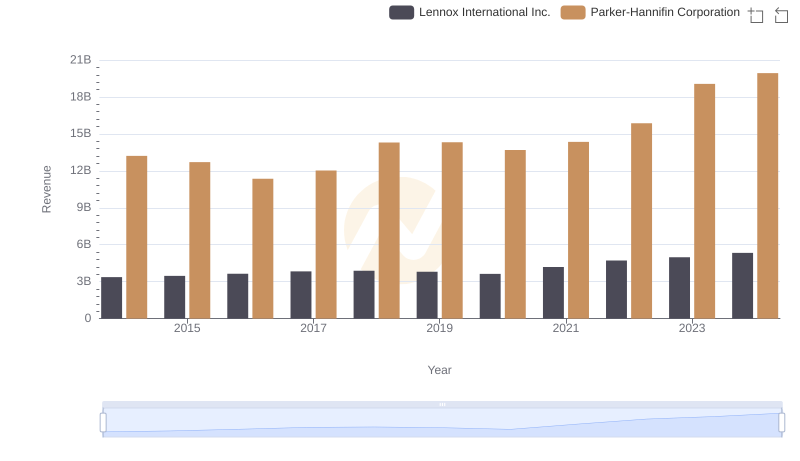

Annual Revenue Comparison: Parker-Hannifin Corporation vs Lennox International Inc.

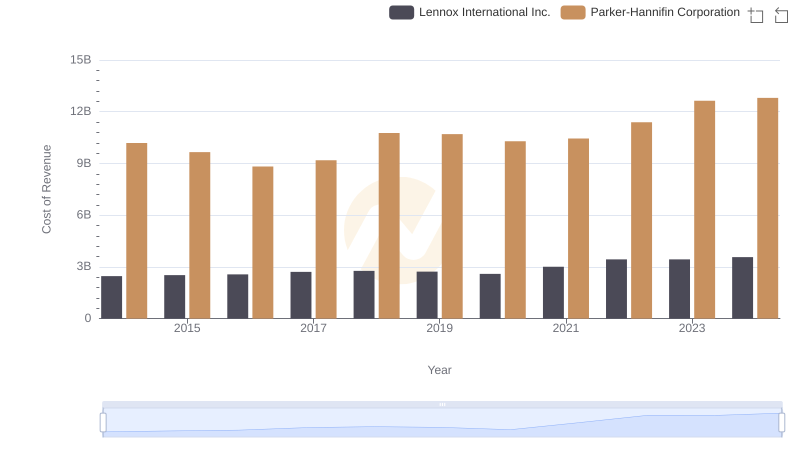

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Lennox International Inc.

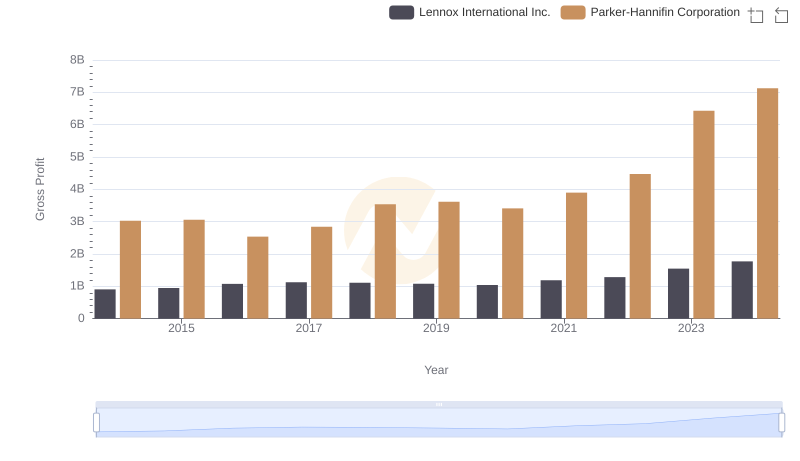

Gross Profit Comparison: Parker-Hannifin Corporation and Lennox International Inc. Trends

Research and Development: Comparing Key Metrics for Parker-Hannifin Corporation and Lennox International Inc.

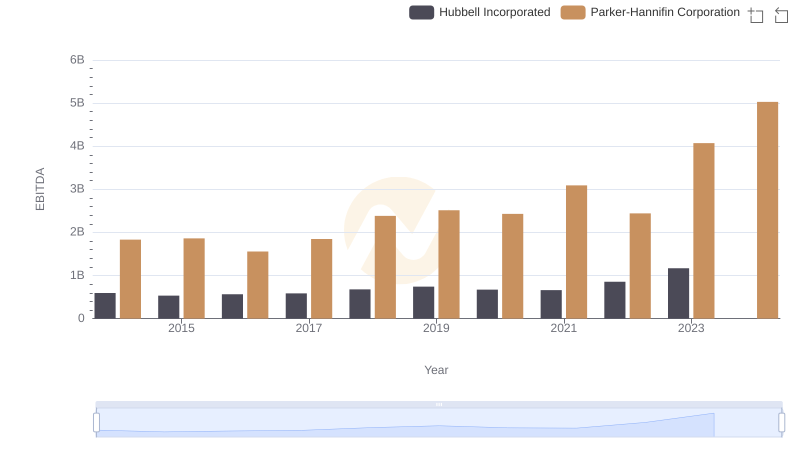

EBITDA Performance Review: Parker-Hannifin Corporation vs Hubbell Incorporated

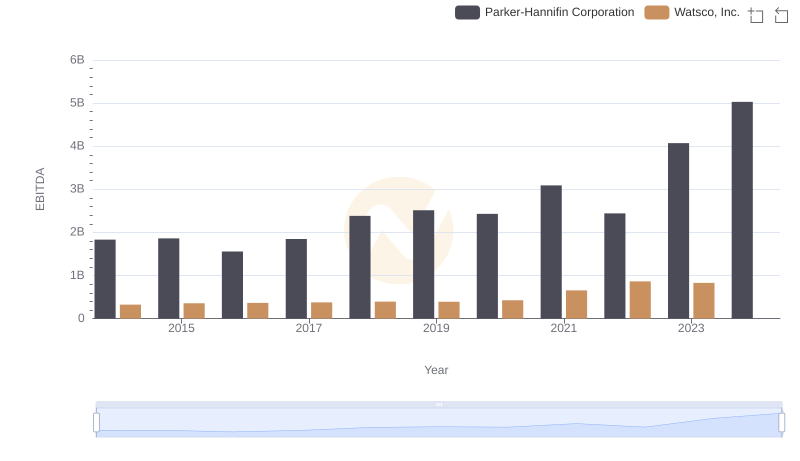

EBITDA Analysis: Evaluating Parker-Hannifin Corporation Against Watsco, Inc.

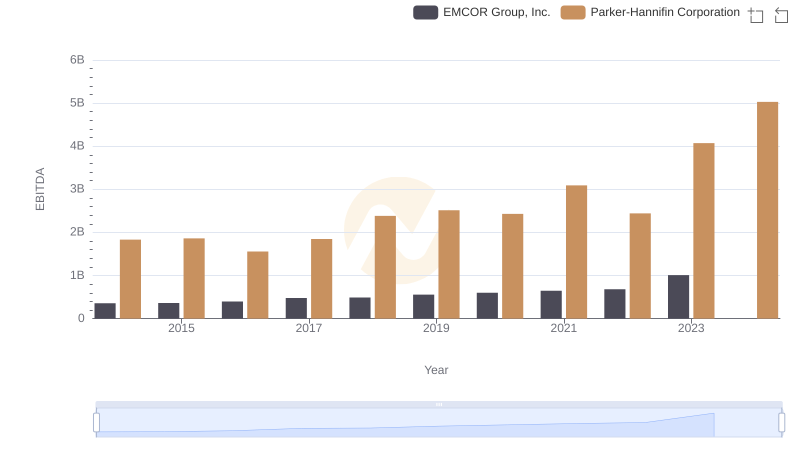

Comprehensive EBITDA Comparison: Parker-Hannifin Corporation vs EMCOR Group, Inc.

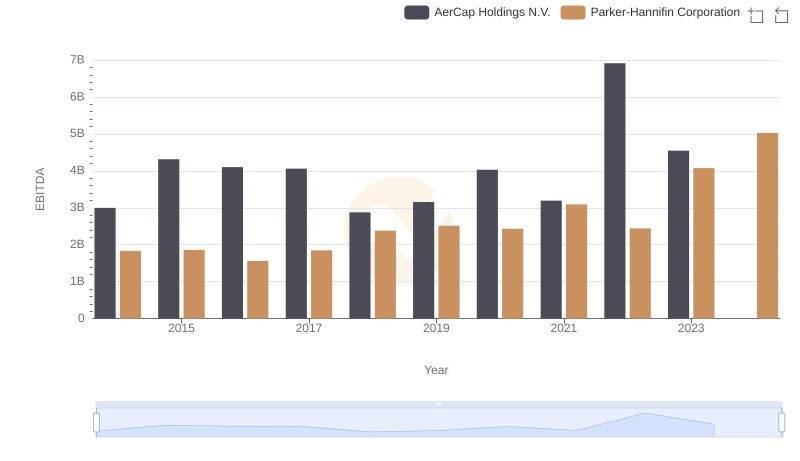

Parker-Hannifin Corporation and AerCap Holdings N.V.: A Detailed Examination of EBITDA Performance