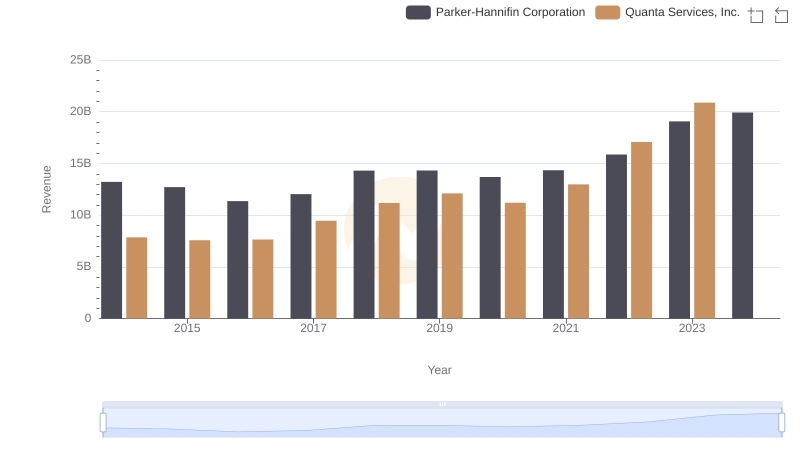

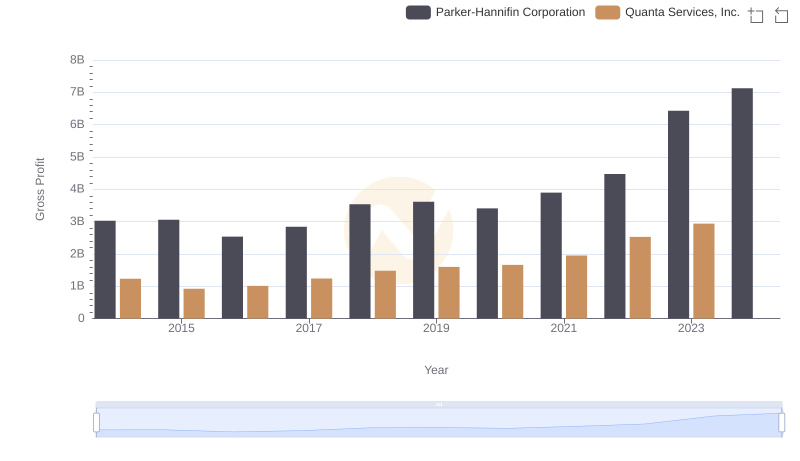

| __timestamp | Parker-Hannifin Corporation | Quanta Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 10188227000 | 6617730000 |

| Thursday, January 1, 2015 | 9655245000 | 6648771000 |

| Friday, January 1, 2016 | 8823384000 | 6637519000 |

| Sunday, January 1, 2017 | 9188962000 | 8224618000 |

| Monday, January 1, 2018 | 10762841000 | 9691459000 |

| Tuesday, January 1, 2019 | 10703484000 | 10511901000 |

| Wednesday, January 1, 2020 | 10286518000 | 9541825000 |

| Friday, January 1, 2021 | 10449680000 | 11026954000 |

| Saturday, January 1, 2022 | 11387267000 | 14544748000 |

| Sunday, January 1, 2023 | 12635892000 | 17945120000 |

| Monday, January 1, 2024 | 12801816000 |

Data in motion

In the competitive landscape of industrial giants, Parker-Hannifin Corporation and Quanta Services, Inc. have showcased intriguing trends in cost efficiency over the past decade. From 2014 to 2023, Parker-Hannifin's cost of revenue has seen a steady increase, peaking at approximately $12.6 billion in 2023, marking a 24% rise from 2014. Meanwhile, Quanta Services has demonstrated a more dramatic growth, with its cost of revenue surging by 171% to nearly $17.9 billion in the same period.

The data for 2024 remains incomplete, hinting at potential shifts in these trends. As these companies evolve, their cost management strategies will be pivotal in shaping their future competitiveness.

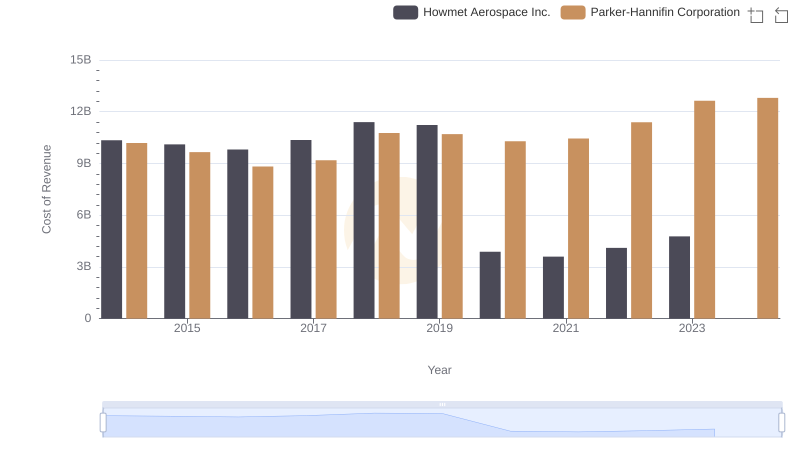

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Howmet Aerospace Inc.

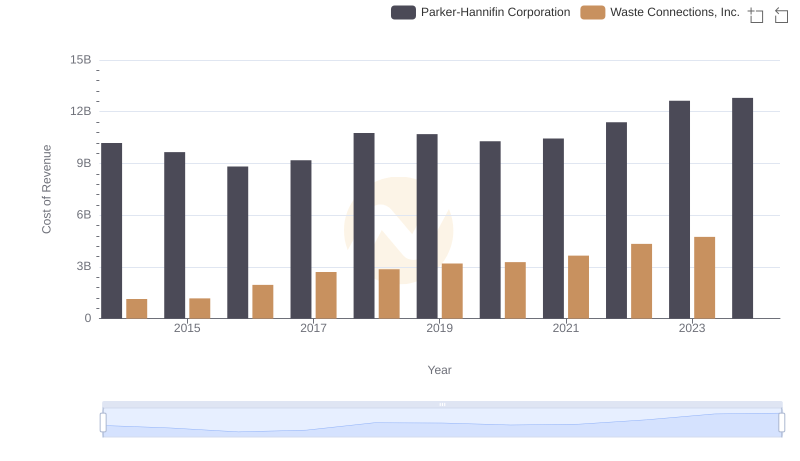

Cost Insights: Breaking Down Parker-Hannifin Corporation and Waste Connections, Inc.'s Expenses

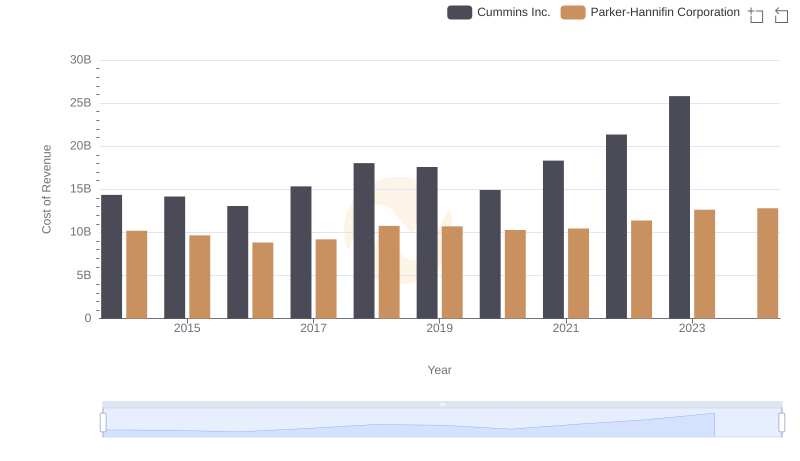

Analyzing Cost of Revenue: Parker-Hannifin Corporation and Cummins Inc.

Comparing Revenue Performance: Parker-Hannifin Corporation or Quanta Services, Inc.?

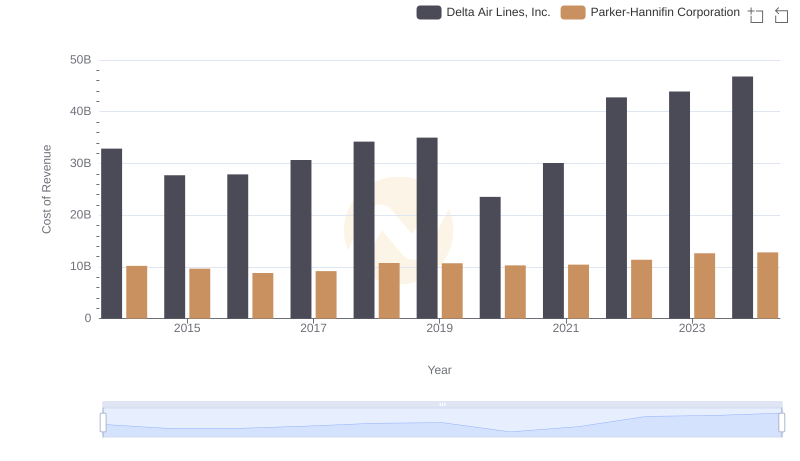

Cost of Revenue Trends: Parker-Hannifin Corporation vs Delta Air Lines, Inc.

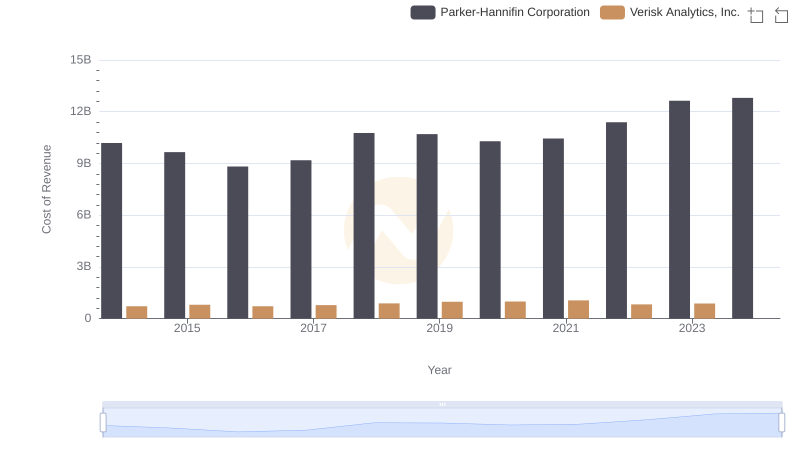

Cost of Revenue Comparison: Parker-Hannifin Corporation vs Verisk Analytics, Inc.

Key Insights on Gross Profit: Parker-Hannifin Corporation vs Quanta Services, Inc.

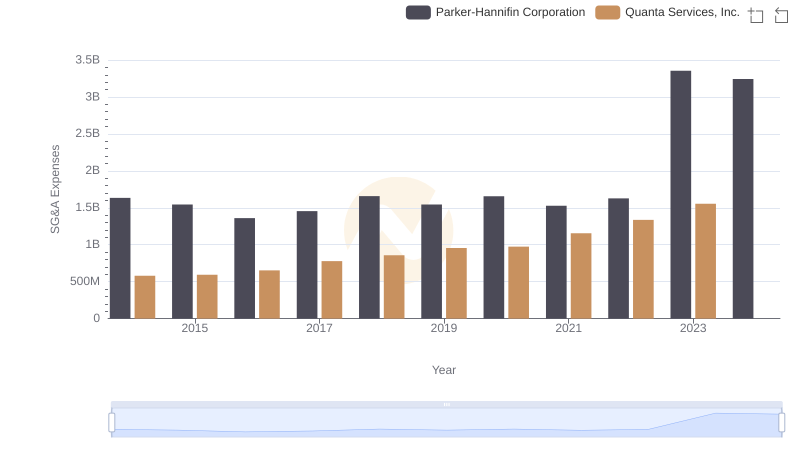

Parker-Hannifin Corporation vs Quanta Services, Inc.: SG&A Expense Trends

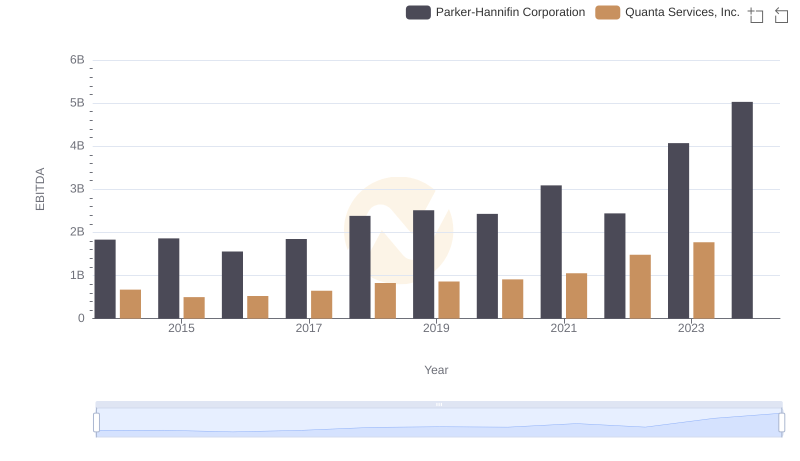

A Professional Review of EBITDA: Parker-Hannifin Corporation Compared to Quanta Services, Inc.