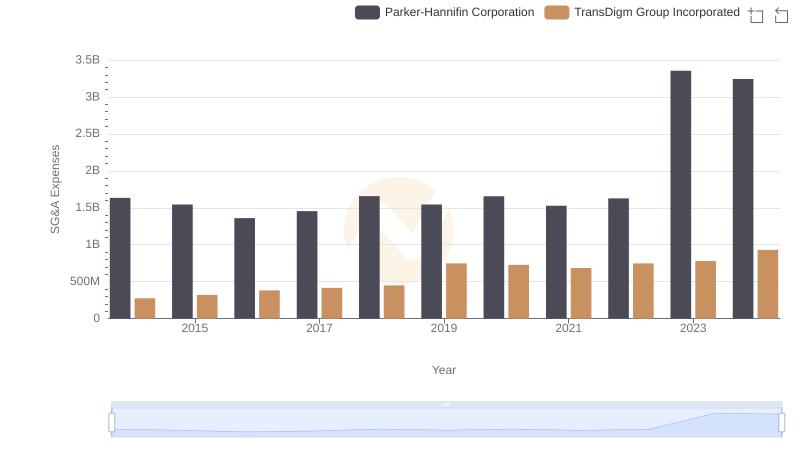

| __timestamp | Cintas Corporation | Parker-Hannifin Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1302752000 | 1633992000 |

| Thursday, January 1, 2015 | 1224930000 | 1544746000 |

| Friday, January 1, 2016 | 1348122000 | 1359360000 |

| Sunday, January 1, 2017 | 1527380000 | 1453935000 |

| Monday, January 1, 2018 | 1916792000 | 1657152000 |

| Tuesday, January 1, 2019 | 1980644000 | 1543939000 |

| Wednesday, January 1, 2020 | 2071052000 | 1656553000 |

| Friday, January 1, 2021 | 1929159000 | 1527302000 |

| Saturday, January 1, 2022 | 2044876000 | 1627116000 |

| Sunday, January 1, 2023 | 2370704000 | 3354103000 |

| Monday, January 1, 2024 | 2617783000 | 3315177000 |

Data in motion

In the ever-evolving landscape of corporate finance, understanding the spending patterns of industry giants can offer valuable insights. Parker-Hannifin Corporation and Cintas Corporation, two stalwarts in their respective fields, have shown intriguing trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2024, Cintas Corporation's SG&A expenses have grown by approximately 100%, reflecting a strategic expansion and investment in operational efficiencies. In contrast, Parker-Hannifin Corporation experienced a significant spike in 2023, with expenses surging by over 100% compared to the previous year, possibly indicating a major acquisition or restructuring.

These patterns not only highlight the dynamic nature of corporate strategies but also underscore the importance of SG&A management in maintaining competitive advantage. As we move forward, monitoring these trends will be crucial for stakeholders and investors alike.

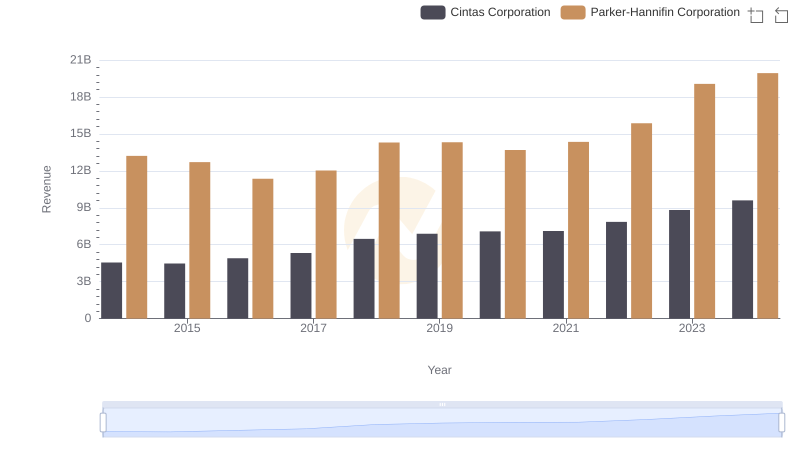

Revenue Showdown: Parker-Hannifin Corporation vs Cintas Corporation

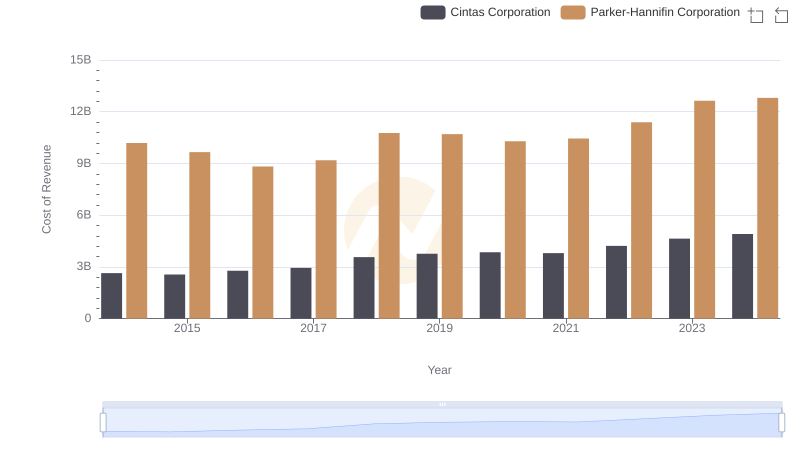

Cost Insights: Breaking Down Parker-Hannifin Corporation and Cintas Corporation's Expenses

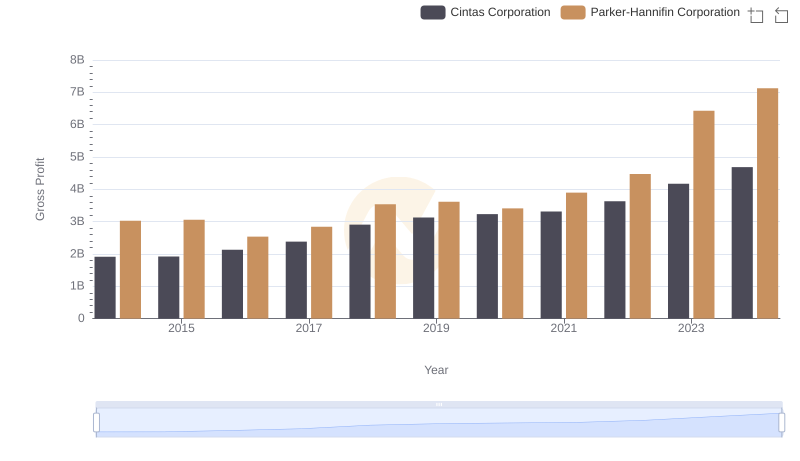

Parker-Hannifin Corporation vs Cintas Corporation: A Gross Profit Performance Breakdown

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and TransDigm Group Incorporated

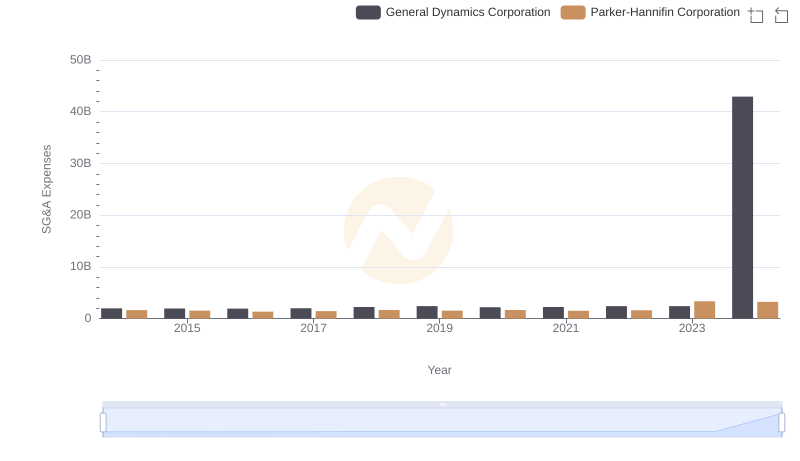

Operational Costs Compared: SG&A Analysis of Parker-Hannifin Corporation and General Dynamics Corporation

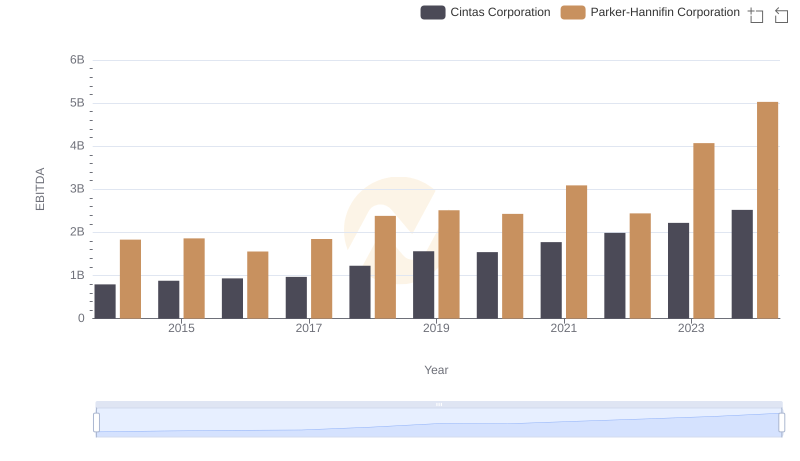

A Side-by-Side Analysis of EBITDA: Parker-Hannifin Corporation and Cintas Corporation

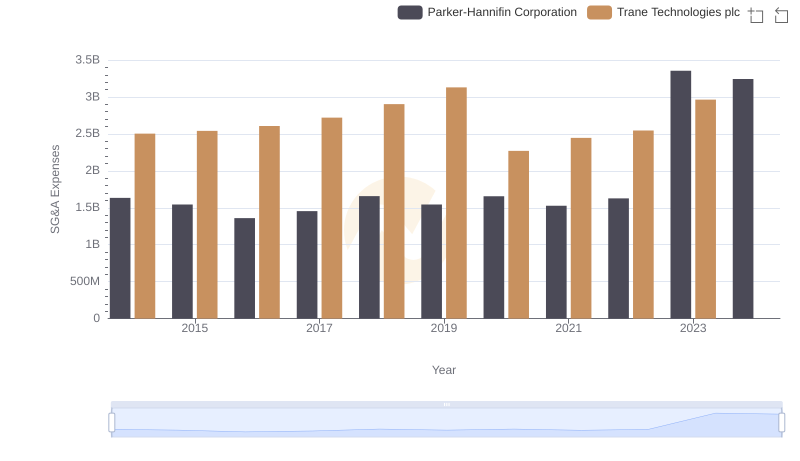

Parker-Hannifin Corporation vs Trane Technologies plc: SG&A Expense Trends

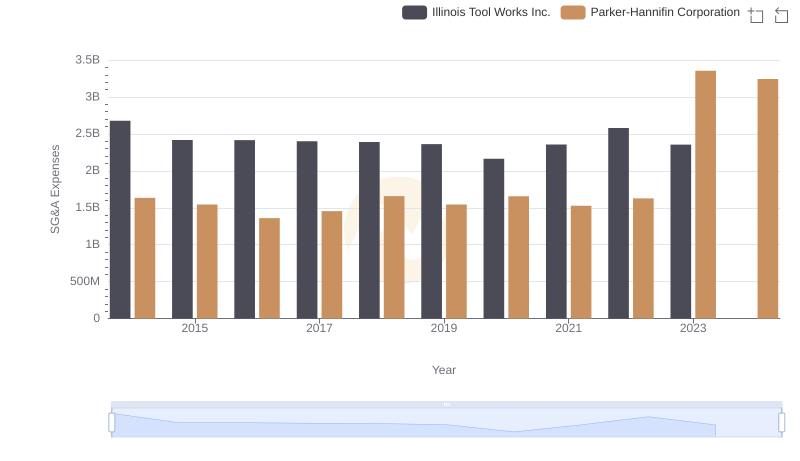

Breaking Down SG&A Expenses: Parker-Hannifin Corporation vs Illinois Tool Works Inc.

Parker-Hannifin Corporation and 3M Company: SG&A Spending Patterns Compared

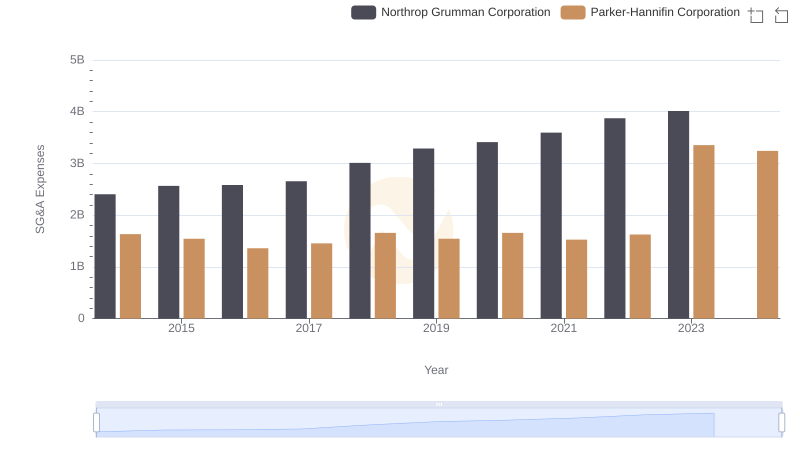

SG&A Efficiency Analysis: Comparing Parker-Hannifin Corporation and Northrop Grumman Corporation