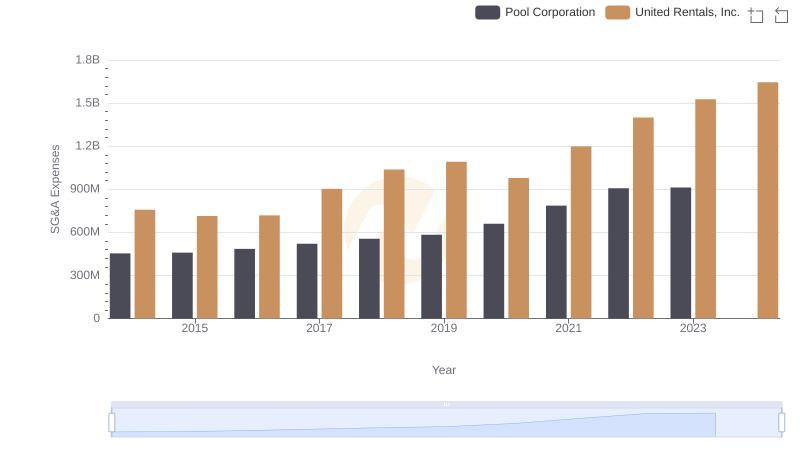

| __timestamp | Clean Harbors, Inc. | United Rentals, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 437921000 | 758000000 |

| Thursday, January 1, 2015 | 414164000 | 714000000 |

| Friday, January 1, 2016 | 422015000 | 719000000 |

| Sunday, January 1, 2017 | 456648000 | 903000000 |

| Monday, January 1, 2018 | 503747000 | 1038000000 |

| Tuesday, January 1, 2019 | 484054000 | 1092000000 |

| Wednesday, January 1, 2020 | 451044000 | 979000000 |

| Friday, January 1, 2021 | 537962000 | 1199000000 |

| Saturday, January 1, 2022 | 627391000 | 1400000000 |

| Sunday, January 1, 2023 | 671161000 | 1527000000 |

| Monday, January 1, 2024 | 739629000 | 1645000000 |

Unleashing the power of data

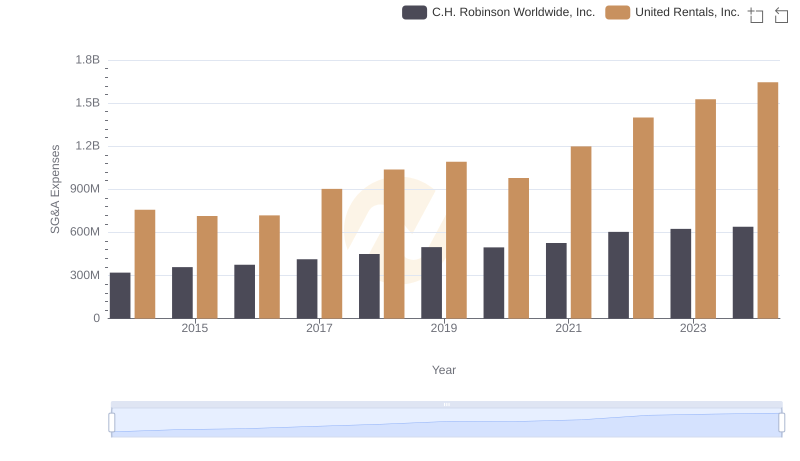

In the ever-evolving landscape of industrial services, understanding operational costs is crucial. Over the past decade, United Rentals, Inc. and Clean Harbors, Inc. have showcased distinct trajectories in their Selling, General, and Administrative (SG&A) expenses. From 2014 to 2023, United Rentals saw a remarkable 101% increase in SG&A expenses, peaking at 1.53 billion in 2023. In contrast, Clean Harbors experienced a 53% rise, reaching 671 million in the same year. This divergence highlights United Rentals' aggressive expansion strategy, while Clean Harbors maintains a more conservative approach. Notably, 2024 data for Clean Harbors is missing, leaving room for speculation on future trends. As these industry giants navigate economic shifts, their SG&A expenses offer a window into their strategic priorities and market positioning.

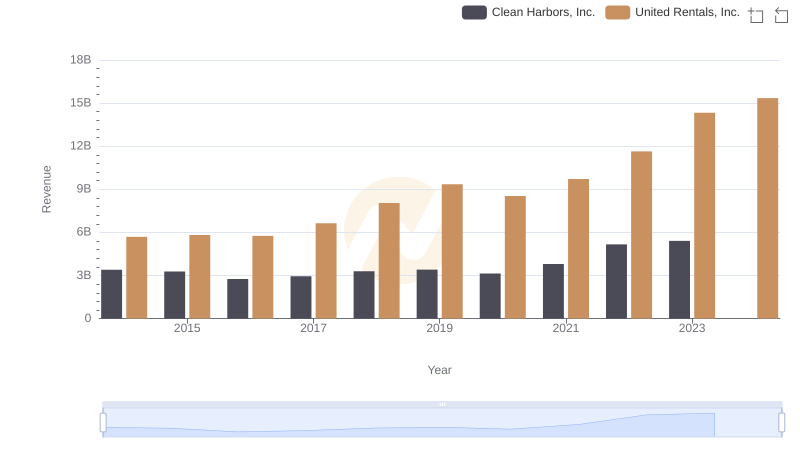

Breaking Down Revenue Trends: United Rentals, Inc. vs Clean Harbors, Inc.

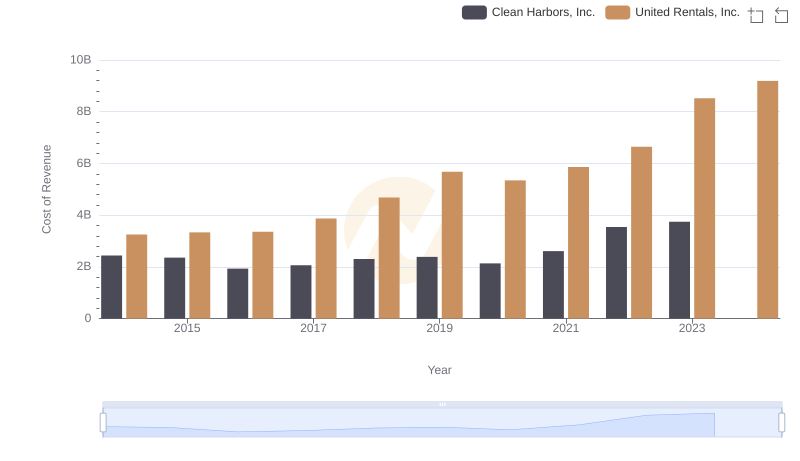

Cost of Revenue: Key Insights for United Rentals, Inc. and Clean Harbors, Inc.

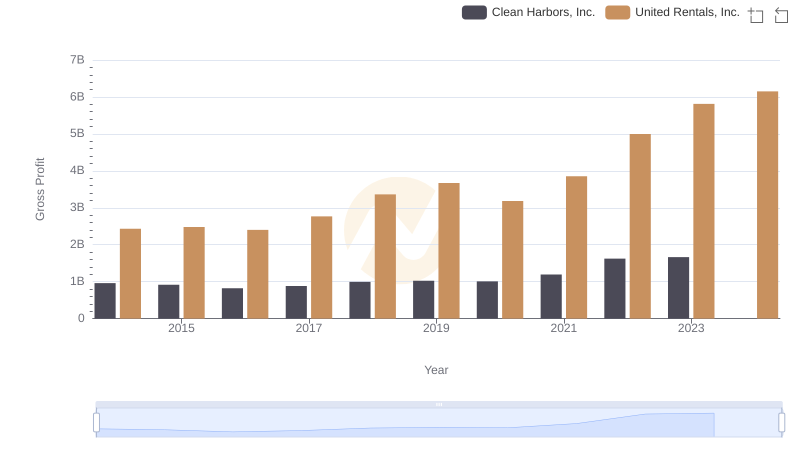

United Rentals, Inc. and Clean Harbors, Inc.: A Detailed Gross Profit Analysis

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Pool Corporation

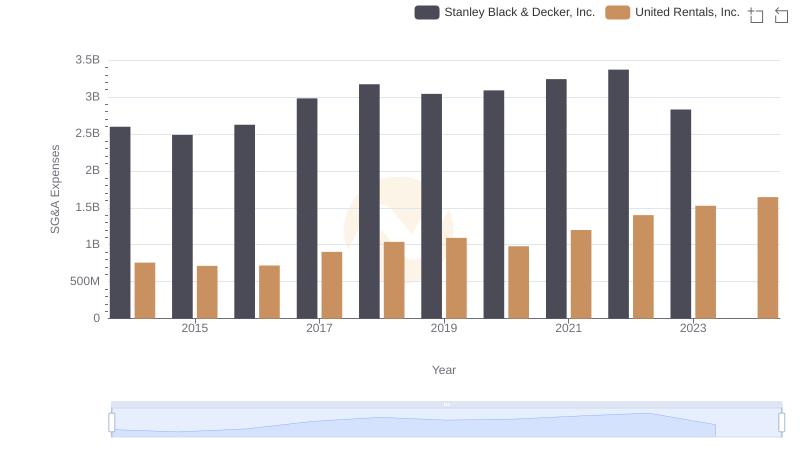

Cost Management Insights: SG&A Expenses for United Rentals, Inc. and Stanley Black & Decker, Inc.

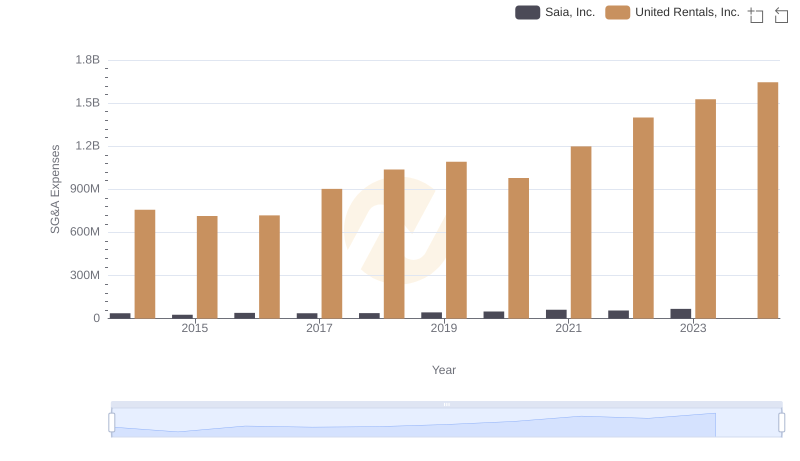

Breaking Down SG&A Expenses: United Rentals, Inc. vs Saia, Inc.

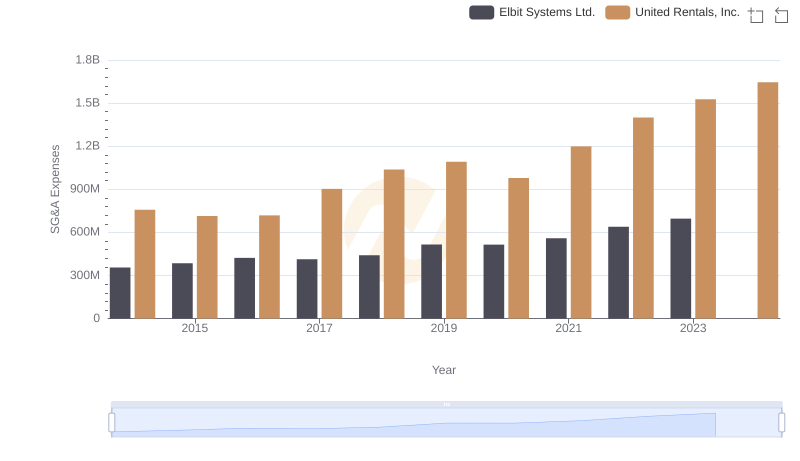

Operational Costs Compared: SG&A Analysis of United Rentals, Inc. and Elbit Systems Ltd.

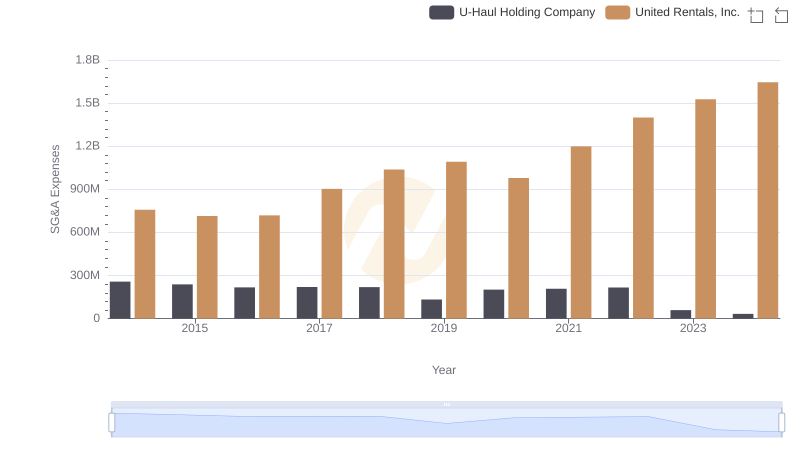

Comparing SG&A Expenses: United Rentals, Inc. vs U-Haul Holding Company Trends and Insights

United Rentals, Inc. and C.H. Robinson Worldwide, Inc.: SG&A Spending Patterns Compared

Comparing SG&A Expenses: United Rentals, Inc. vs Curtiss-Wright Corporation Trends and Insights