| __timestamp | Lennox International Inc. | United Airlines Holdings, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 573700000 | 1373000000 |

| Thursday, January 1, 2015 | 580500000 | 1342000000 |

| Friday, January 1, 2016 | 621000000 | 1303000000 |

| Sunday, January 1, 2017 | 637700000 | 1349000000 |

| Monday, January 1, 2018 | 608200000 | 1558000000 |

| Tuesday, January 1, 2019 | 585900000 | 1651000000 |

| Wednesday, January 1, 2020 | 555900000 | 459000000 |

| Friday, January 1, 2021 | 598900000 | 677000000 |

| Saturday, January 1, 2022 | 627200000 | 1535000000 |

| Sunday, January 1, 2023 | 705500000 | 1977000000 |

| Monday, January 1, 2024 | 730600000 | 2231000000 |

Unleashing insights

In the ever-evolving landscape of corporate finance, understanding operational costs is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry titans: United Airlines Holdings, Inc. and Lennox International Inc., from 2014 to 2023.

United Airlines, a leader in the aviation sector, saw its SG&A expenses fluctuate significantly, with a notable dip in 2020, coinciding with the global pandemic, reducing costs by approximately 66%. However, by 2023, expenses rebounded to nearly 1.98 billion, reflecting a robust recovery.

Conversely, Lennox International, a key player in the HVAC industry, demonstrated a steady increase in SG&A expenses, peaking at 730 million in 2023, marking a 27% rise over the decade. This trend underscores the company's consistent growth and strategic investments.

While United Airlines faced data gaps in 2024, Lennox's trajectory remained clear, offering insights into industry-specific financial strategies.

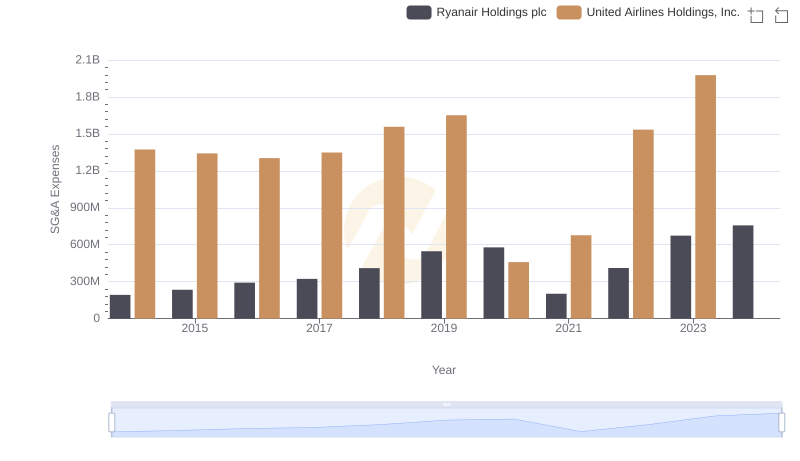

Comparing SG&A Expenses: United Airlines Holdings, Inc. vs Ryanair Holdings plc Trends and Insights

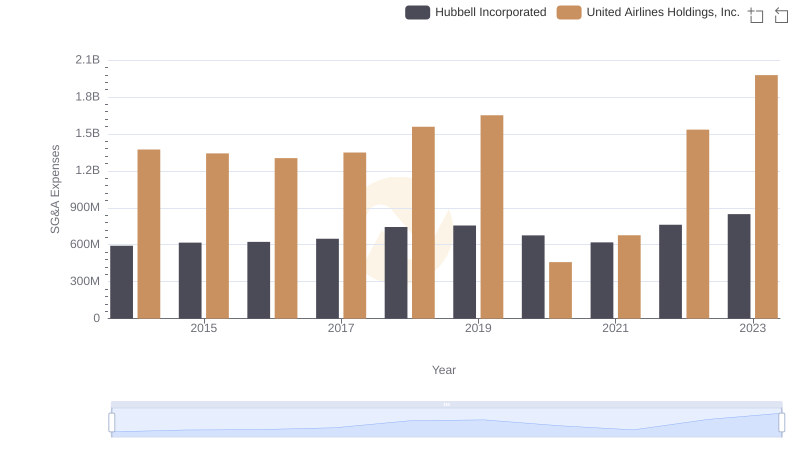

United Airlines Holdings, Inc. and Hubbell Incorporated: SG&A Spending Patterns Compared

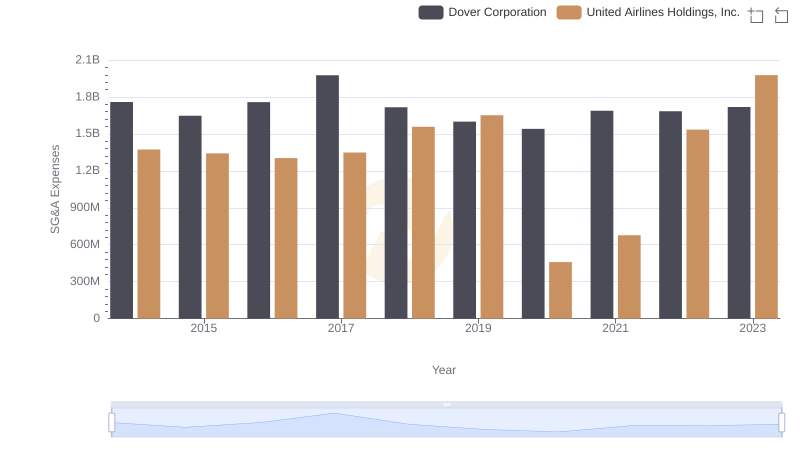

SG&A Efficiency Analysis: Comparing United Airlines Holdings, Inc. and Dover Corporation

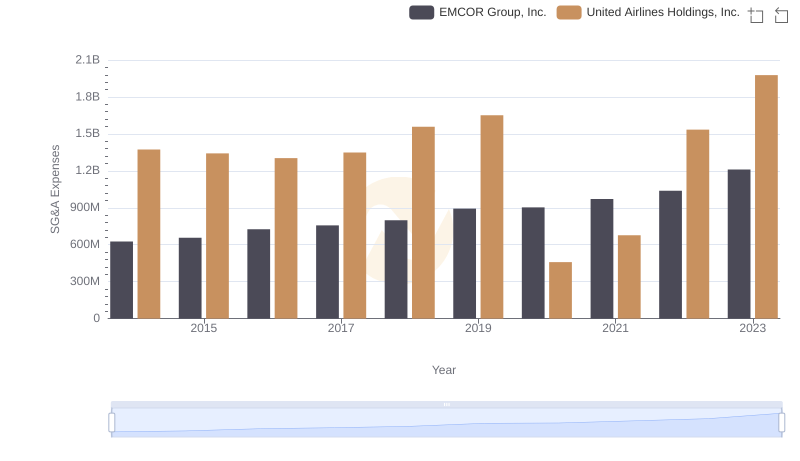

Cost Management Insights: SG&A Expenses for United Airlines Holdings, Inc. and EMCOR Group, Inc.

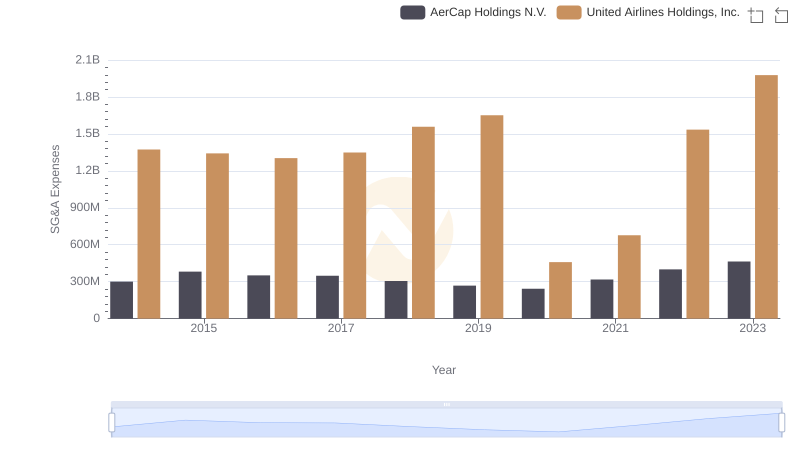

United Airlines Holdings, Inc. or AerCap Holdings N.V.: Who Manages SG&A Costs Better?

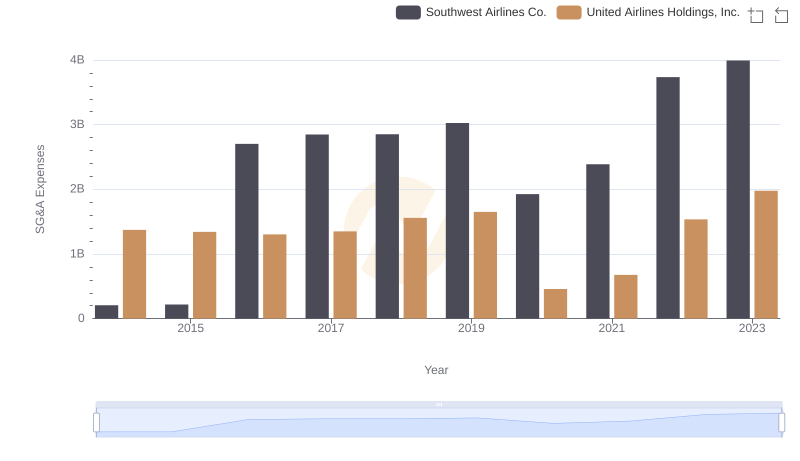

SG&A Efficiency Analysis: Comparing United Airlines Holdings, Inc. and Southwest Airlines Co.

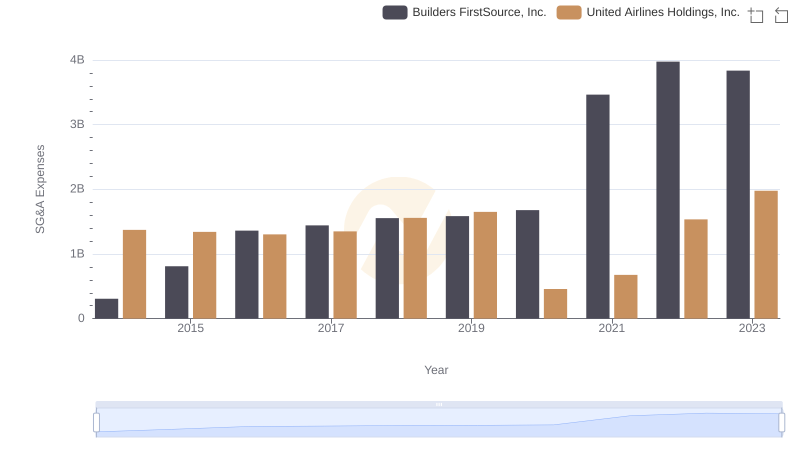

United Airlines Holdings, Inc. and Builders FirstSource, Inc.: SG&A Spending Patterns Compared

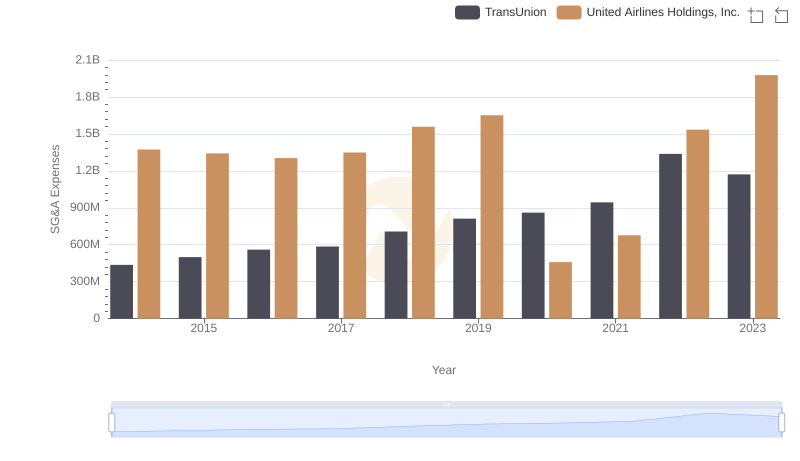

United Airlines Holdings, Inc. vs TransUnion: SG&A Expense Trends