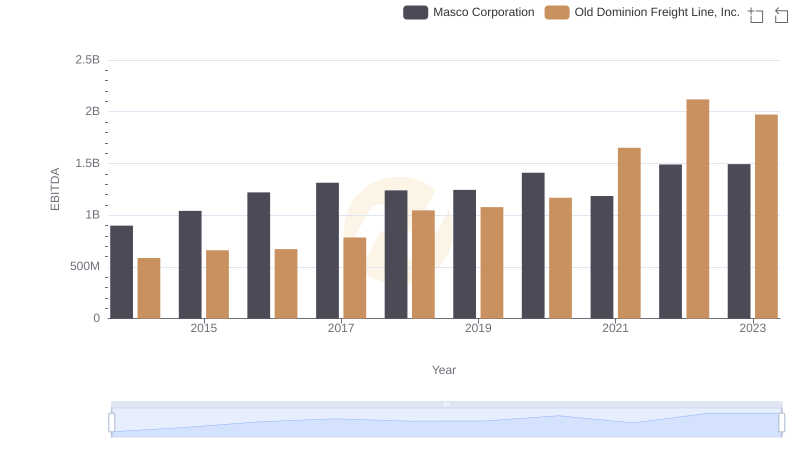

| __timestamp | Masco Corporation | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1607000000 | 144817000 |

| Thursday, January 1, 2015 | 1339000000 | 153589000 |

| Friday, January 1, 2016 | 1403000000 | 152391000 |

| Sunday, January 1, 2017 | 1442000000 | 177205000 |

| Monday, January 1, 2018 | 1478000000 | 194368000 |

| Tuesday, January 1, 2019 | 1274000000 | 206125000 |

| Wednesday, January 1, 2020 | 1292000000 | 184185000 |

| Friday, January 1, 2021 | 1413000000 | 223757000 |

| Saturday, January 1, 2022 | 1390000000 | 258883000 |

| Sunday, January 1, 2023 | 1481000000 | 281053000 |

| Monday, January 1, 2024 | 1468000000 |

Unleashing the power of data

In the world of corporate finance, understanding the trends in Selling, General, and Administrative (SG&A) expenses can offer valuable insights into a company's operational efficiency. Over the past decade, Masco Corporation and Old Dominion Freight Line, Inc. have shown contrasting trajectories in their SG&A expenses.

From 2014 to 2023, Masco Corporation's SG&A expenses have fluctuated, peaking in 2014 and 2023, with a notable dip in 2019. This reflects a strategic shift, possibly towards cost optimization. Meanwhile, Old Dominion Freight Line, Inc. has seen a consistent upward trend, with expenses nearly doubling from 2014 to 2023. This could indicate expansion efforts or increased operational activities.

These trends highlight the different strategic paths taken by these companies. While Masco focuses on stabilizing costs, Old Dominion appears to be investing in growth, each reflecting their unique market positions and future aspirations.

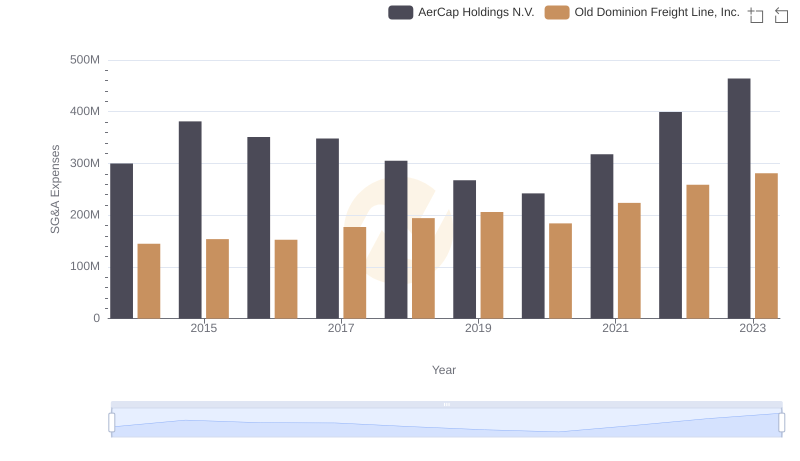

Comparing SG&A Expenses: Old Dominion Freight Line, Inc. vs AerCap Holdings N.V. Trends and Insights

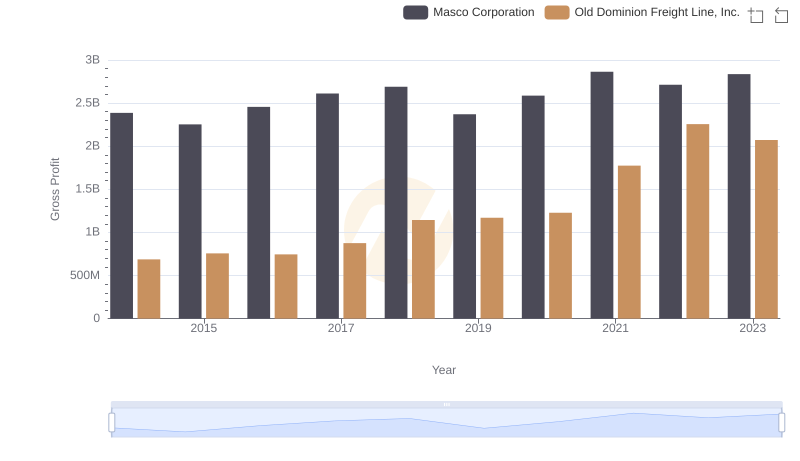

Gross Profit Trends Compared: Old Dominion Freight Line, Inc. vs Masco Corporation

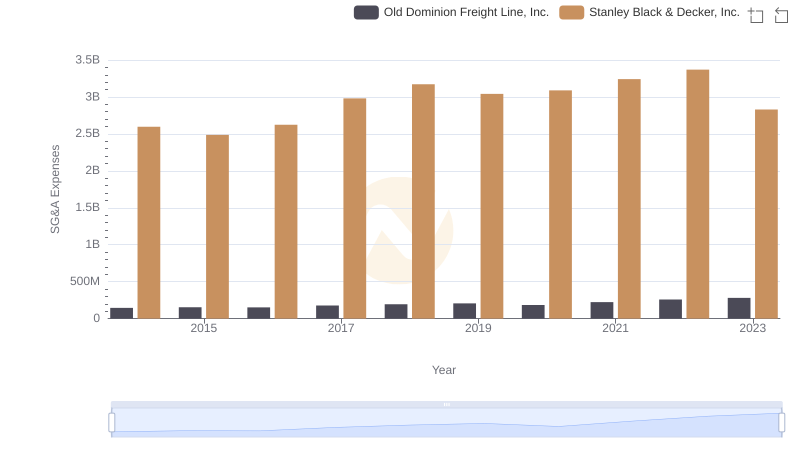

Old Dominion Freight Line, Inc. or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

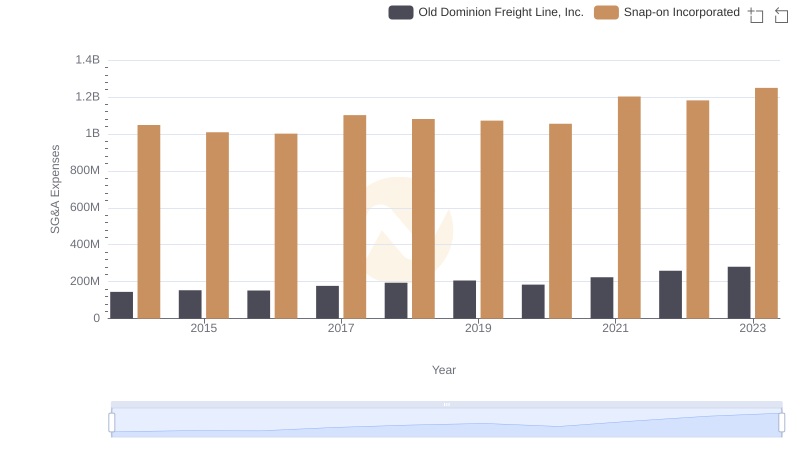

Old Dominion Freight Line, Inc. vs Snap-on Incorporated: SG&A Expense Trends

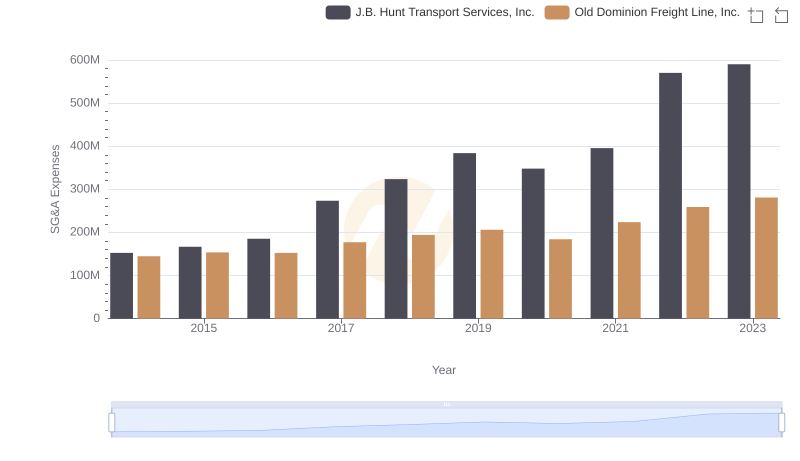

Old Dominion Freight Line, Inc. or J.B. Hunt Transport Services, Inc.: Who Manages SG&A Costs Better?

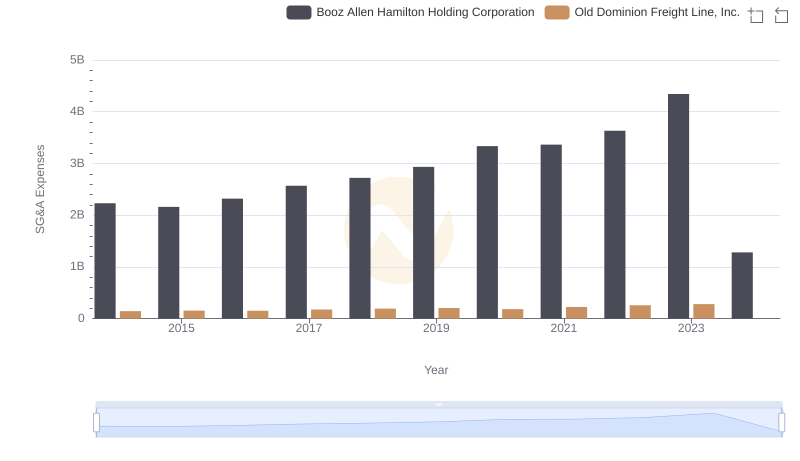

Who Optimizes SG&A Costs Better? Old Dominion Freight Line, Inc. or Booz Allen Hamilton Holding Corporation

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Masco Corporation