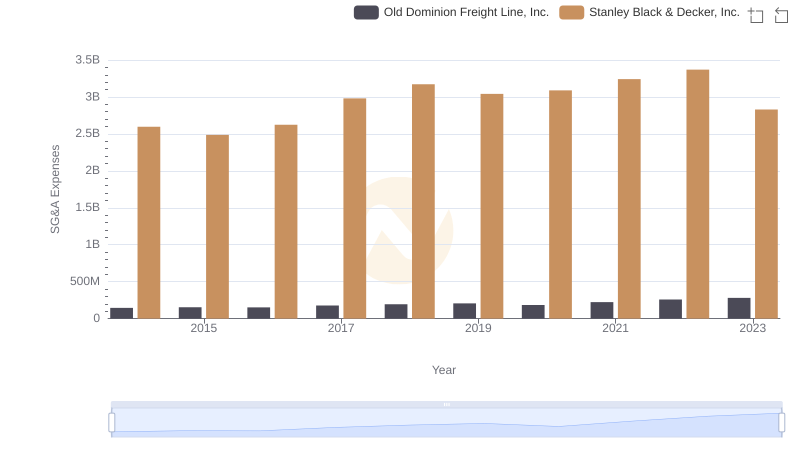

| __timestamp | Old Dominion Freight Line, Inc. | Stanley Black & Decker, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 144817000 | 2595900000 |

| Thursday, January 1, 2015 | 153589000 | 2486400000 |

| Friday, January 1, 2016 | 152391000 | 2623900000 |

| Sunday, January 1, 2017 | 177205000 | 2980100000 |

| Monday, January 1, 2018 | 194368000 | 3171700000 |

| Tuesday, January 1, 2019 | 206125000 | 3041000000 |

| Wednesday, January 1, 2020 | 184185000 | 3089600000 |

| Friday, January 1, 2021 | 223757000 | 3240400000 |

| Saturday, January 1, 2022 | 258883000 | 3370000000 |

| Sunday, January 1, 2023 | 281053000 | 2829300000 |

| Monday, January 1, 2024 | 3310500000 |

Data in motion

In the competitive world of logistics and manufacturing, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Old Dominion Freight Line, Inc. and Stanley Black & Decker, Inc. offer a fascinating comparison in this regard. From 2014 to 2023, Old Dominion Freight Line, Inc. demonstrated a steady increase in SG&A expenses, starting at approximately $145 million and reaching around $281 million by 2023. This represents a growth of about 94% over the decade. In contrast, Stanley Black & Decker, Inc. saw its SG&A expenses fluctuate, peaking at $3.37 billion in 2022 before dropping to $2.83 billion in 2023. Despite the higher absolute numbers, Stanley Black & Decker's expenses grew by only 9% over the same period. This data suggests that while Old Dominion Freight Line, Inc. has been expanding its operations, Stanley Black & Decker, Inc. has been more volatile in its cost management strategy.

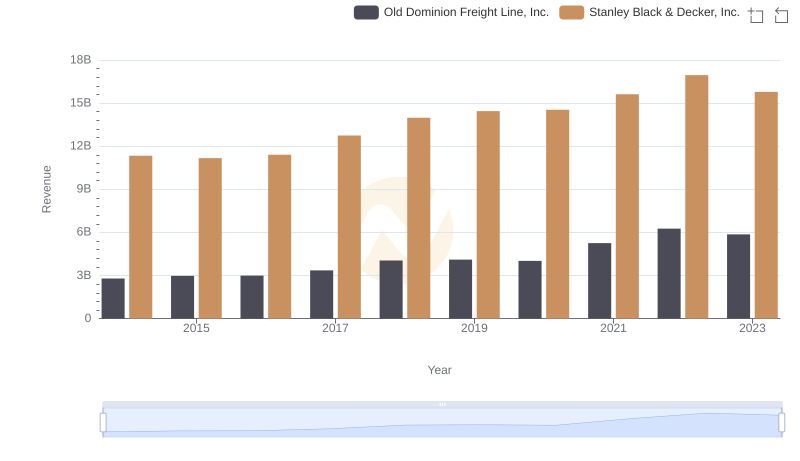

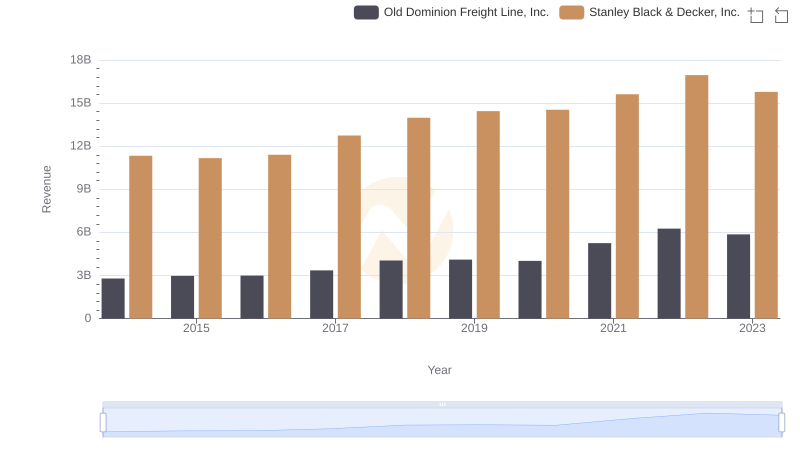

Comparing Revenue Performance: Old Dominion Freight Line, Inc. or Stanley Black & Decker, Inc.?

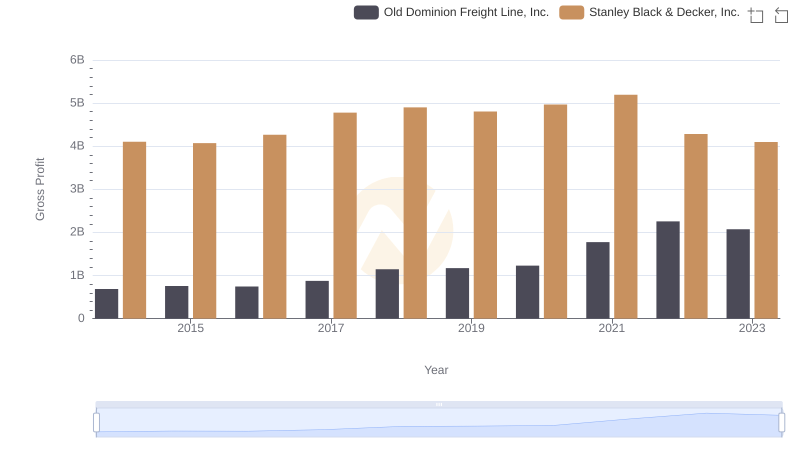

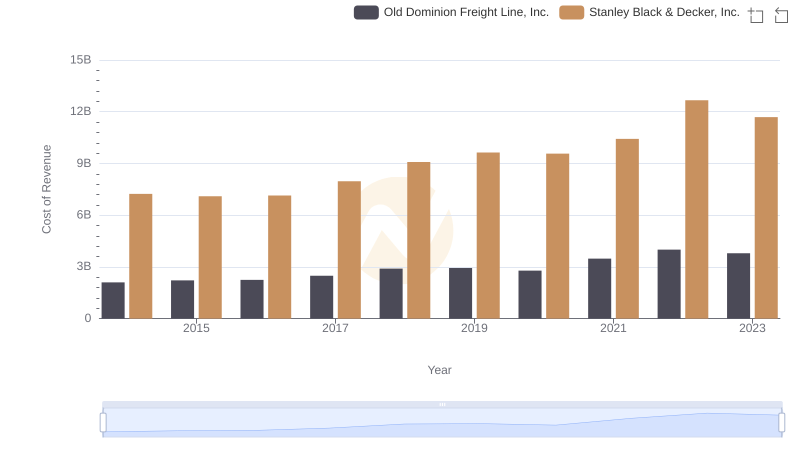

Gross Profit Comparison: Old Dominion Freight Line, Inc. and Stanley Black & Decker, Inc. Trends

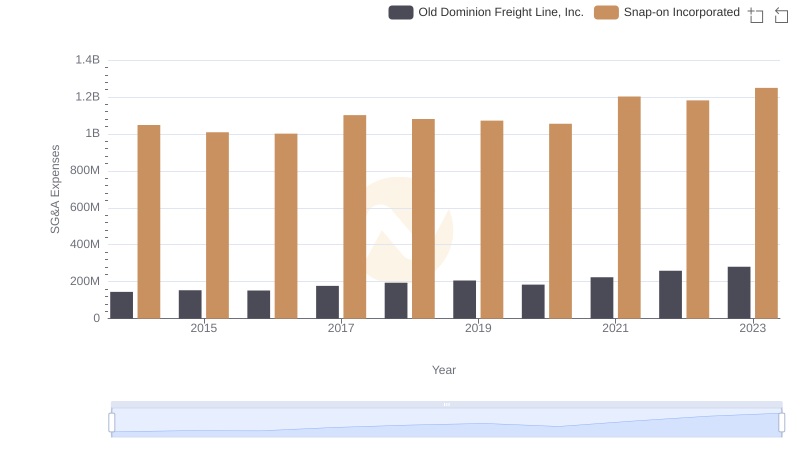

Old Dominion Freight Line, Inc. vs Snap-on Incorporated: SG&A Expense Trends

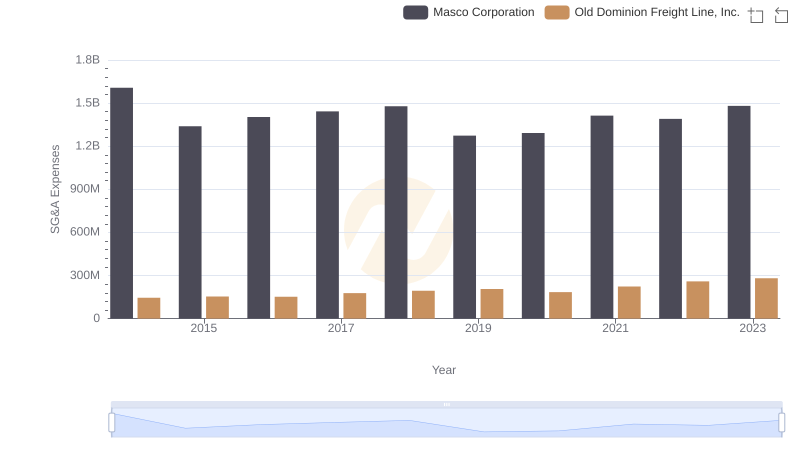

Old Dominion Freight Line, Inc. vs Masco Corporation: SG&A Expense Trends

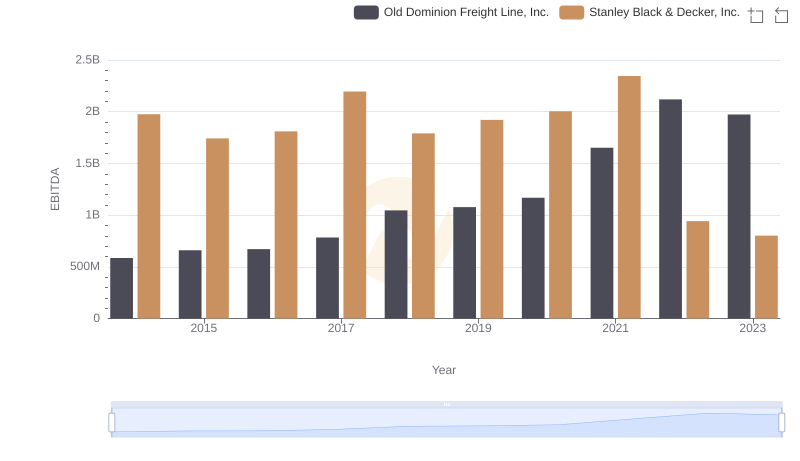

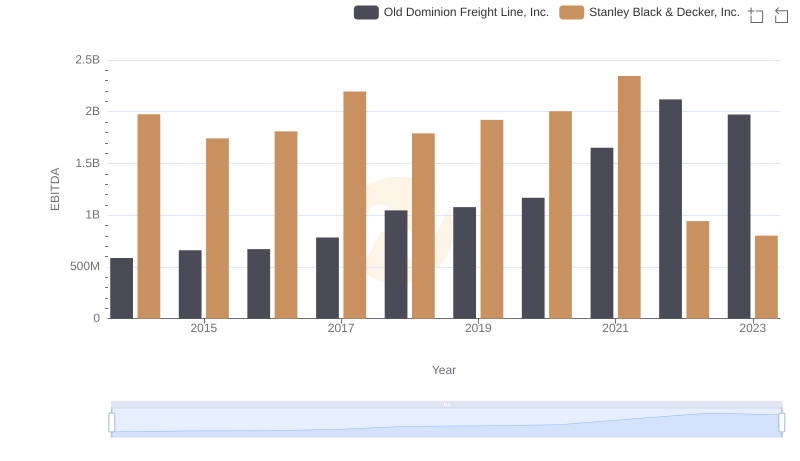

Old Dominion Freight Line, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison

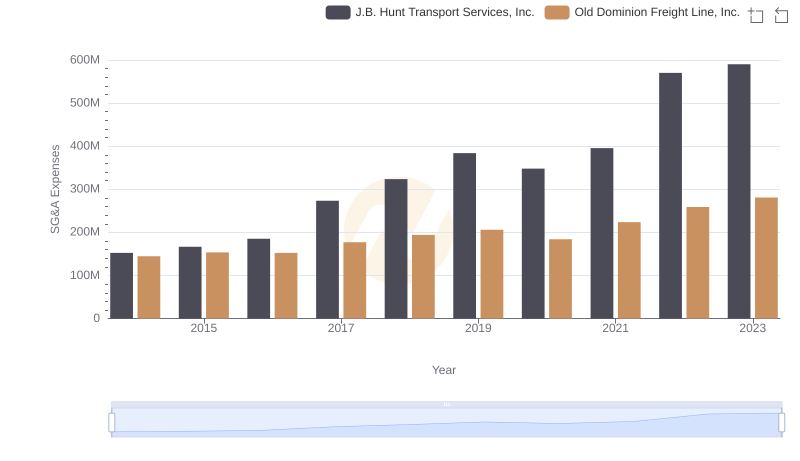

Old Dominion Freight Line, Inc. or J.B. Hunt Transport Services, Inc.: Who Manages SG&A Costs Better?

Old Dominion Freight Line, Inc. vs Stanley Black & Decker, Inc.: Annual Revenue Growth Compared

Cost Insights: Breaking Down Old Dominion Freight Line, Inc. and Stanley Black & Decker, Inc.'s Expenses

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Stanley Black & Decker, Inc.

A Professional Review of EBITDA: Old Dominion Freight Line, Inc. Compared to Stanley Black & Decker, Inc.