| __timestamp | AerCap Holdings N.V. | Old Dominion Freight Line, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 299900000 | 144817000 |

| Thursday, January 1, 2015 | 381308000 | 153589000 |

| Friday, January 1, 2016 | 351012000 | 152391000 |

| Sunday, January 1, 2017 | 348291000 | 177205000 |

| Monday, January 1, 2018 | 305226000 | 194368000 |

| Tuesday, January 1, 2019 | 267458000 | 206125000 |

| Wednesday, January 1, 2020 | 242161000 | 184185000 |

| Friday, January 1, 2021 | 317888000 | 223757000 |

| Saturday, January 1, 2022 | 399530000 | 258883000 |

| Sunday, January 1, 2023 | 464128000 | 281053000 |

In pursuit of knowledge

In the world of corporate finance, Selling, General, and Administrative (SG&A) expenses are a critical measure of a company's operational efficiency. This chart provides a fascinating comparison between Old Dominion Freight Line, Inc. and AerCap Holdings N.V. over the past decade.

From 2014 to 2023, AerCap Holdings N.V. consistently reported higher SG&A expenses compared to Old Dominion Freight Line, Inc. In 2023, AerCap's expenses surged to approximately 55% higher than Old Dominion's, highlighting a significant operational cost difference. Notably, AerCap's expenses peaked in 2023, showing a 54% increase from its lowest point in 2020. Meanwhile, Old Dominion's expenses grew steadily, with a 94% increase from 2014 to 2023.

This analysis underscores the importance of managing SG&A expenses to maintain competitive advantage and operational efficiency in the logistics and leasing sectors.

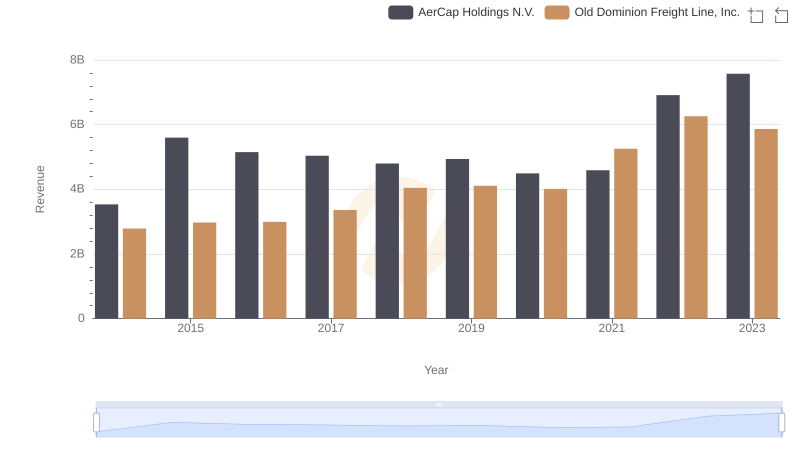

Old Dominion Freight Line, Inc. vs AerCap Holdings N.V.: Examining Key Revenue Metrics

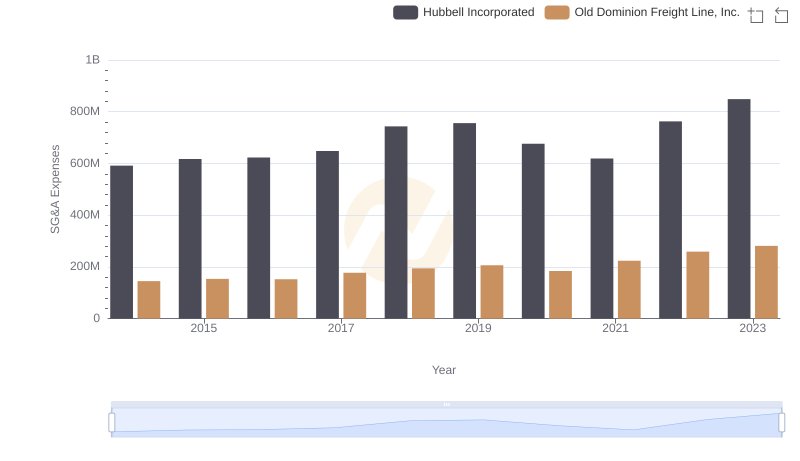

SG&A Efficiency Analysis: Comparing Old Dominion Freight Line, Inc. and Hubbell Incorporated

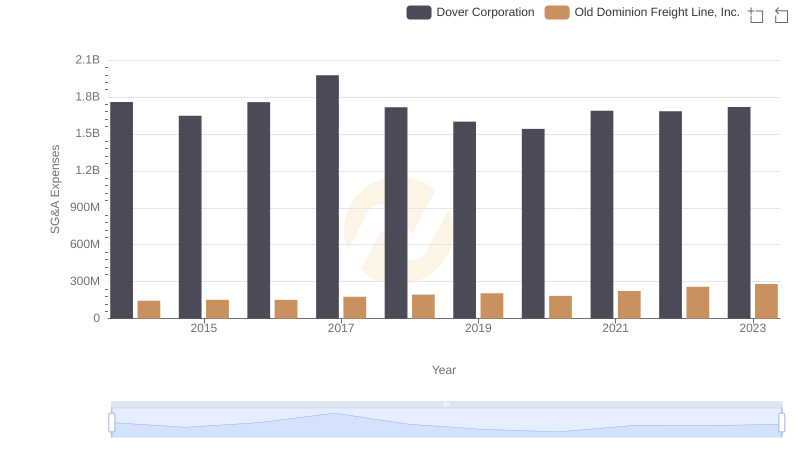

Old Dominion Freight Line, Inc. vs Dover Corporation: SG&A Expense Trends

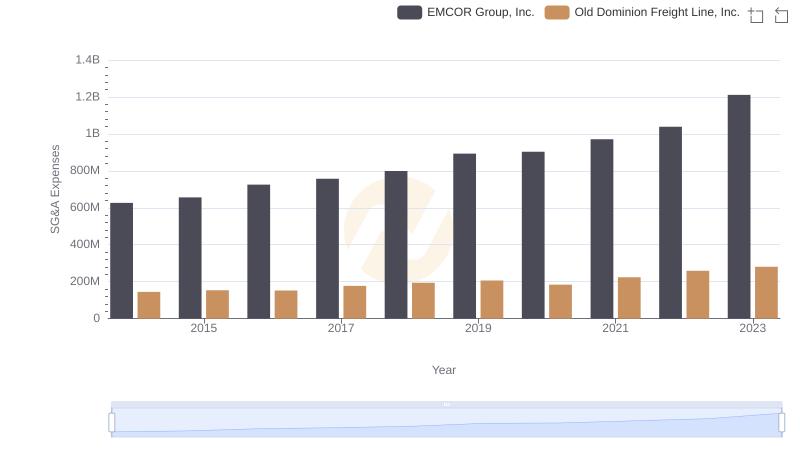

Old Dominion Freight Line, Inc. vs EMCOR Group, Inc.: SG&A Expense Trends

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Watsco, Inc.

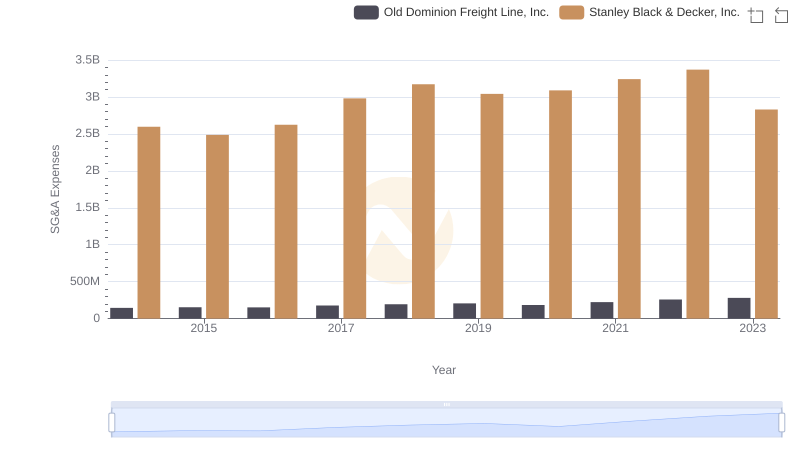

Old Dominion Freight Line, Inc. or Stanley Black & Decker, Inc.: Who Manages SG&A Costs Better?

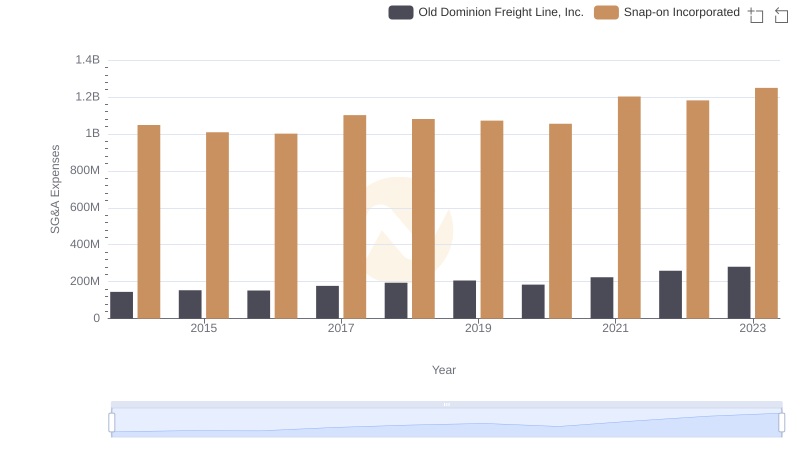

Old Dominion Freight Line, Inc. vs Snap-on Incorporated: SG&A Expense Trends