| __timestamp | Old Dominion Freight Line, Inc. | Watsco, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 585590000 | 323674000 |

| Thursday, January 1, 2015 | 660570000 | 355865000 |

| Friday, January 1, 2016 | 671786000 | 365698000 |

| Sunday, January 1, 2017 | 783749000 | 375907000 |

| Monday, January 1, 2018 | 1046059000 | 394177000 |

| Tuesday, January 1, 2019 | 1078007000 | 391396000 |

| Wednesday, January 1, 2020 | 1168149000 | 426942000 |

| Friday, January 1, 2021 | 1651501000 | 656655000 |

| Saturday, January 1, 2022 | 2118962000 | 863261000 |

| Sunday, January 1, 2023 | 1972689000 | 829900000 |

| Monday, January 1, 2024 | 781775000 |

Unleashing the power of data

In the ever-evolving landscape of American industry, two giants stand out for their impressive EBITDA performance over the past decade. Old Dominion Freight Line, Inc., a leader in the freight and logistics sector, has seen its EBITDA grow by an astounding 237% from 2014 to 2023. Meanwhile, Watsco, Inc., a major player in the HVAC distribution market, has achieved a commendable 157% increase in the same period.

Old Dominion's EBITDA surged from approximately $586 million in 2014 to nearly $2.12 billion in 2022, before slightly dipping in 2023. This growth reflects the company's strategic expansion and operational efficiency. On the other hand, Watsco's EBITDA rose from around $324 million to over $863 million, showcasing its resilience and adaptability in a competitive market.

These figures highlight the dynamic nature of these industries and the companies' ability to capitalize on market opportunities.

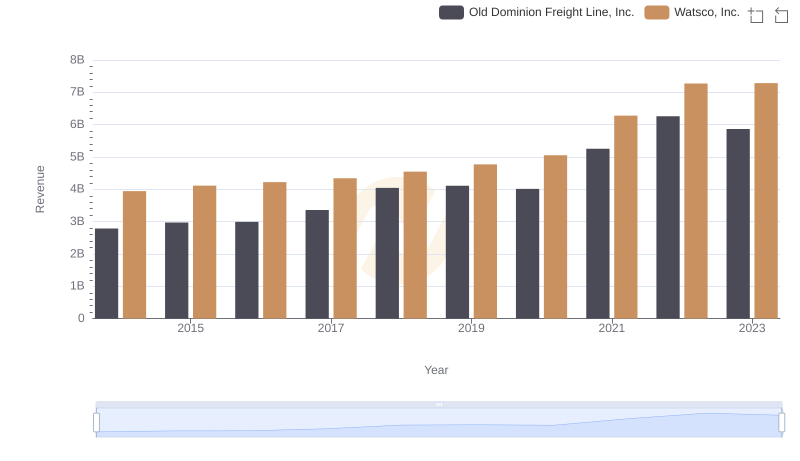

Revenue Showdown: Old Dominion Freight Line, Inc. vs Watsco, Inc.

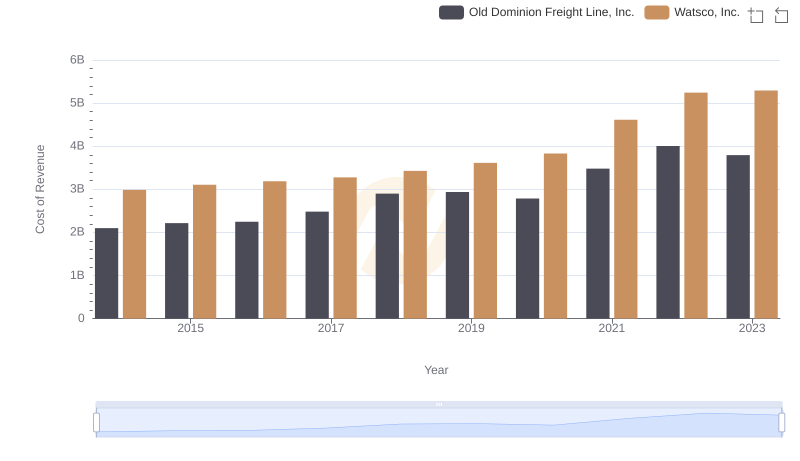

Cost of Revenue Trends: Old Dominion Freight Line, Inc. vs Watsco, Inc.

Selling, General, and Administrative Costs: Old Dominion Freight Line, Inc. vs Watsco, Inc.

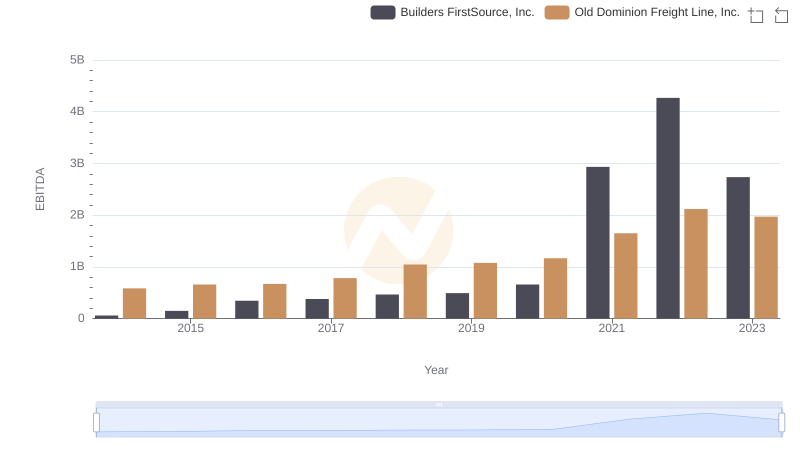

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Builders FirstSource, Inc.

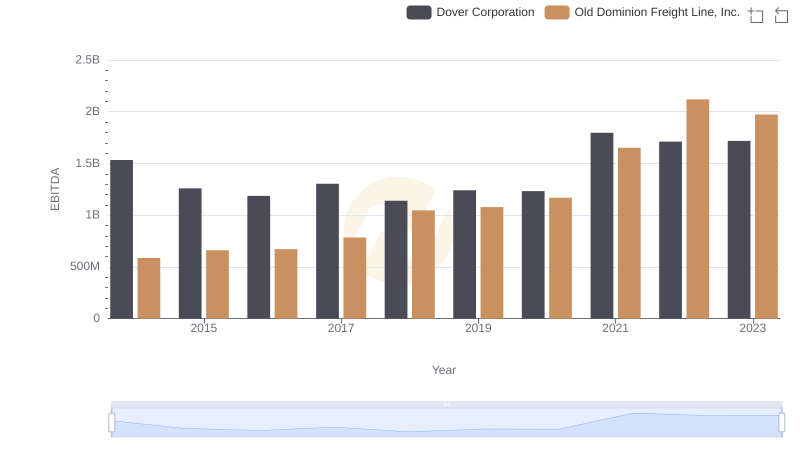

EBITDA Performance Review: Old Dominion Freight Line, Inc. vs Dover Corporation

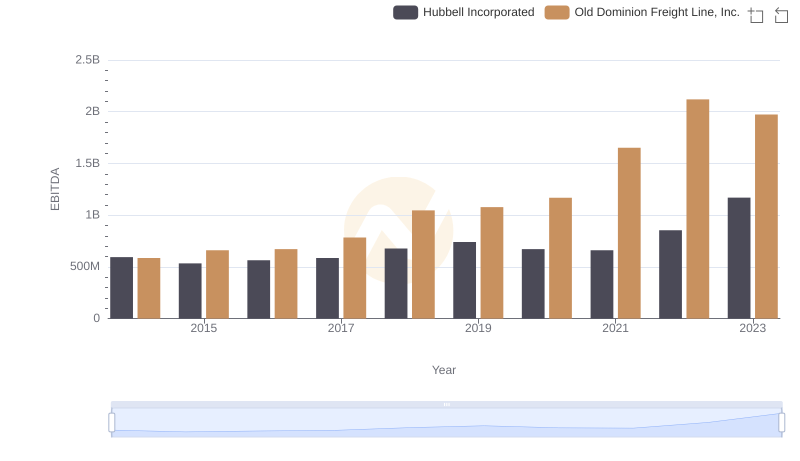

Comprehensive EBITDA Comparison: Old Dominion Freight Line, Inc. vs Hubbell Incorporated

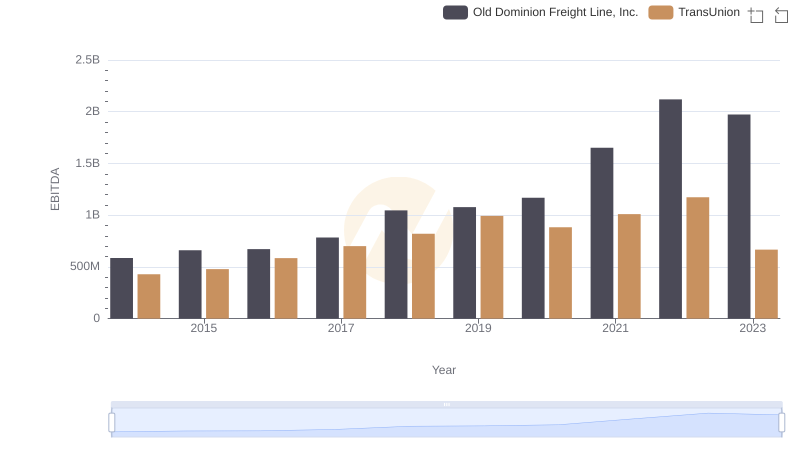

A Side-by-Side Analysis of EBITDA: Old Dominion Freight Line, Inc. and TransUnion

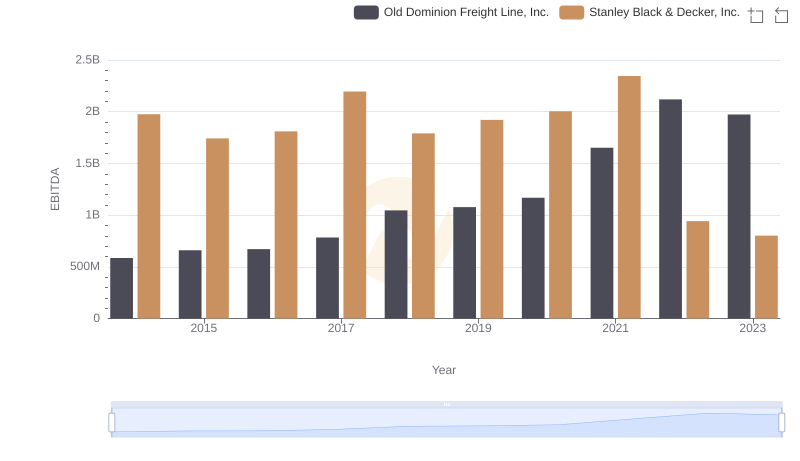

Old Dominion Freight Line, Inc. vs Stanley Black & Decker, Inc.: In-Depth EBITDA Performance Comparison