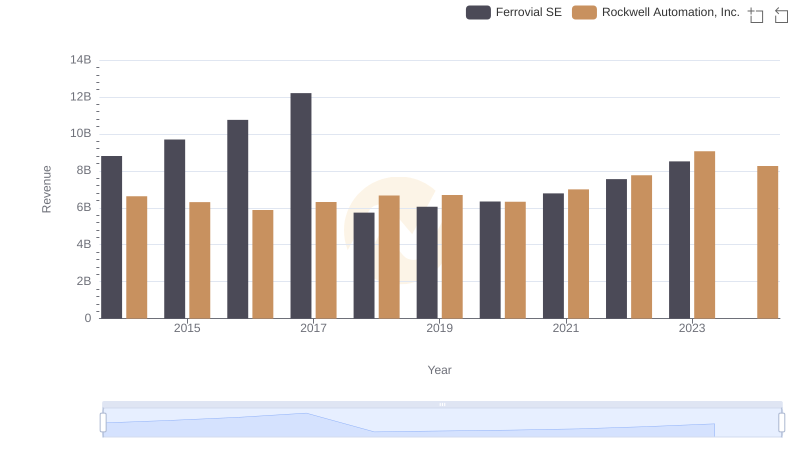

| __timestamp | Ferrovial SE | Rockwell Automation, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 7671000000 | 2753900000 |

| Thursday, January 1, 2015 | 8556000000 | 2703100000 |

| Friday, January 1, 2016 | 9491000000 | 2475500000 |

| Sunday, January 1, 2017 | 10864000000 | 2624200000 |

| Monday, January 1, 2018 | 4752000000 | 2872200000 |

| Tuesday, January 1, 2019 | 5105000000 | 2900100000 |

| Wednesday, January 1, 2020 | 5336000000 | 2595200000 |

| Friday, January 1, 2021 | 5701000000 | 2897700000 |

| Saturday, January 1, 2022 | 6354000000 | 3102000000 |

| Sunday, January 1, 2023 | 7385000000 | 3717000000 |

| Monday, January 1, 2024 | 3193400000 |

Unleashing the power of data

In the ever-evolving landscape of global industry, Rockwell Automation, Inc. and Ferrovial SE stand as titans in their respective fields. Over the past decade, Ferrovial SE has consistently outperformed Rockwell Automation in terms of gross profit, with an average of 7.1 billion compared to Rockwell's 2.9 billion. However, Rockwell Automation has shown a steady growth trajectory, with a notable 30% increase in gross profit from 2014 to 2023. Ferrovial SE, despite a dip in 2018, has maintained a robust growth pattern, peaking in 2017 with a gross profit of over 10 billion. The data for 2024 is incomplete, leaving room for speculation on future trends. This comparison not only highlights the financial prowess of these companies but also underscores the dynamic nature of global markets.

Breaking Down Revenue Trends: Rockwell Automation, Inc. vs Ferrovial SE

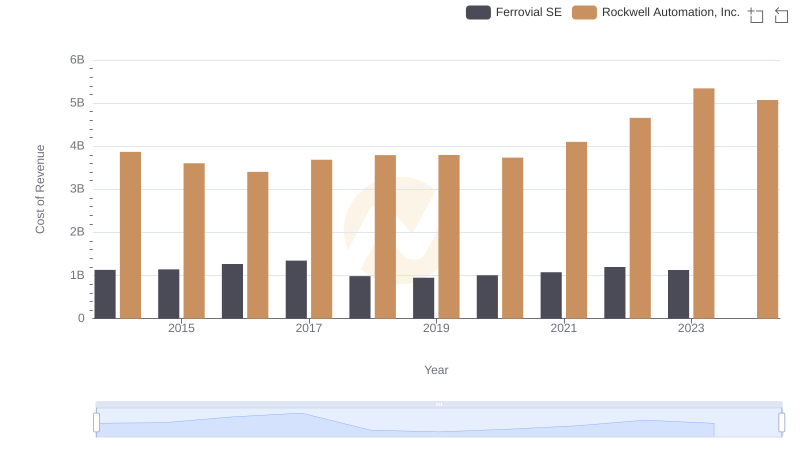

Comparing Cost of Revenue Efficiency: Rockwell Automation, Inc. vs Ferrovial SE

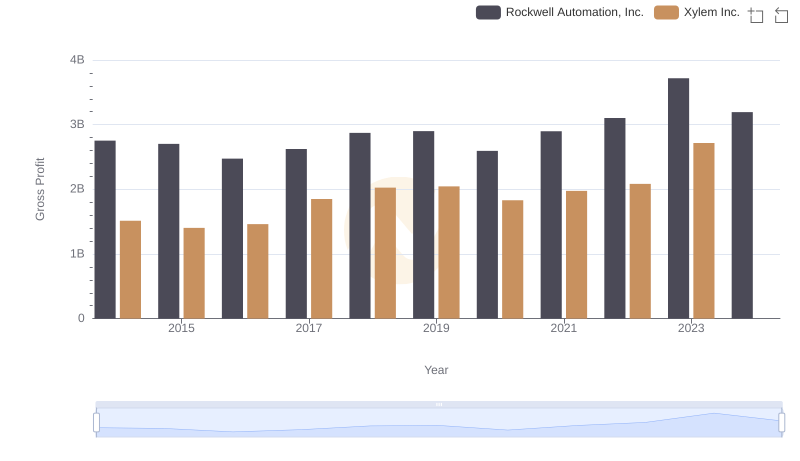

Gross Profit Comparison: Rockwell Automation, Inc. and Xylem Inc. Trends

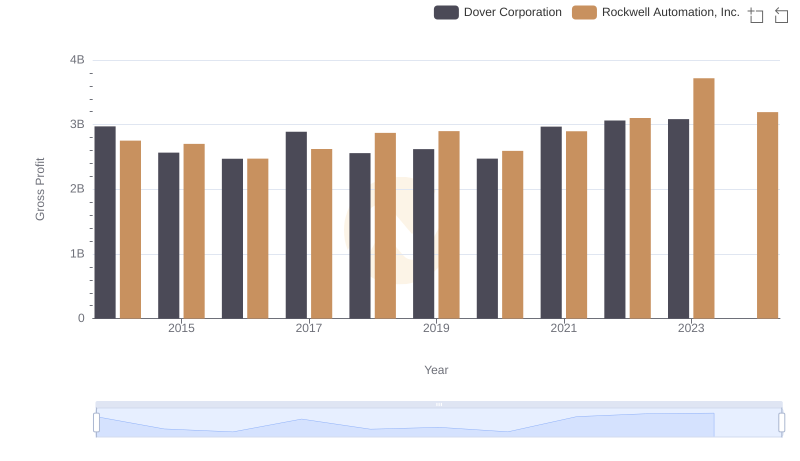

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and Dover Corporation

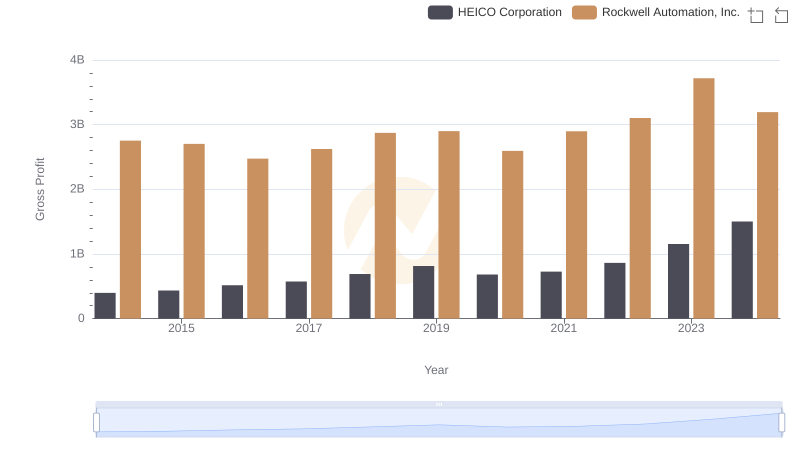

Gross Profit Analysis: Comparing Rockwell Automation, Inc. and HEICO Corporation

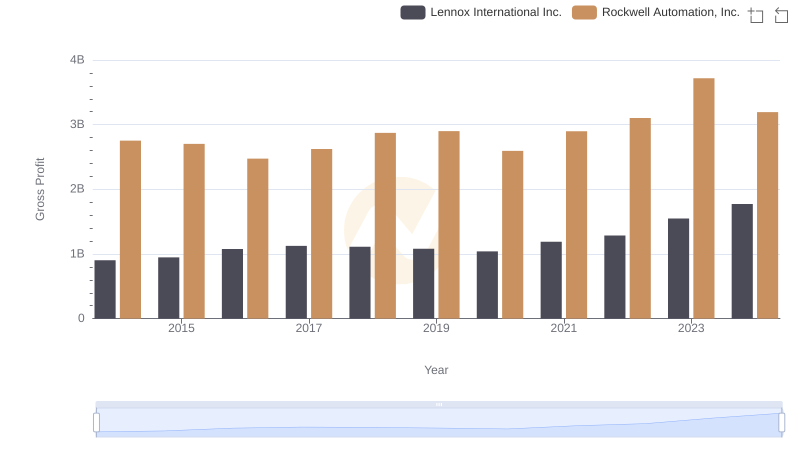

Rockwell Automation, Inc. vs Lennox International Inc.: A Gross Profit Performance Breakdown

Key Insights on Gross Profit: Rockwell Automation, Inc. vs Hubbell Incorporated

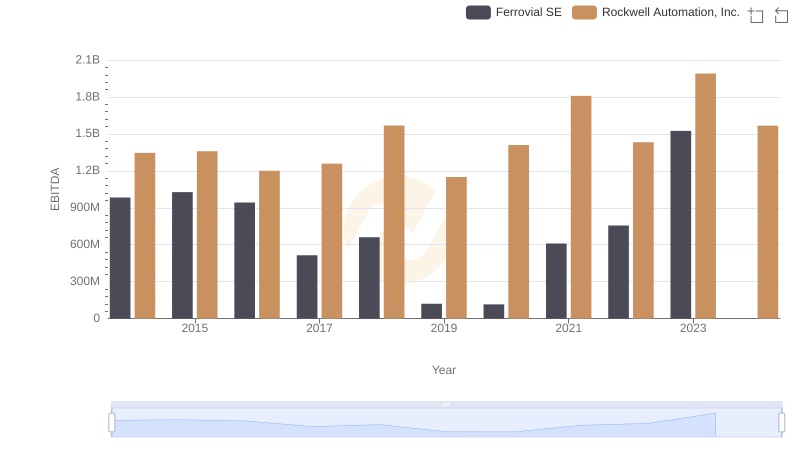

Rockwell Automation, Inc. vs Ferrovial SE: In-Depth EBITDA Performance Comparison

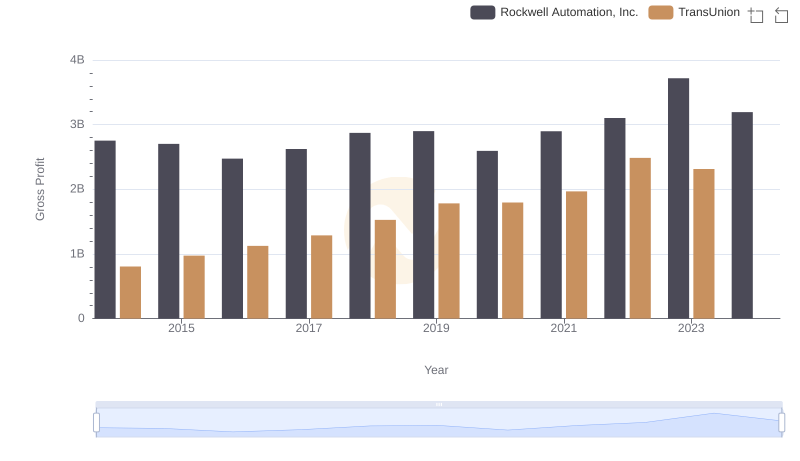

Rockwell Automation, Inc. and TransUnion: A Detailed Gross Profit Analysis