| __timestamp | Guidewire Software, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 201299000 | 46407000000 |

| Thursday, January 1, 2015 | 233353000 | 40684000000 |

| Friday, January 1, 2016 | 272612000 | 38516000000 |

| Sunday, January 1, 2017 | 322725000 | 36943000000 |

| Monday, January 1, 2018 | 364360000 | 36936000000 |

| Tuesday, January 1, 2019 | 395164000 | 31533000000 |

| Wednesday, January 1, 2020 | 404292000 | 30865000000 |

| Friday, January 1, 2021 | 368213000 | 31486000000 |

| Saturday, January 1, 2022 | 352220000 | 32687000000 |

| Sunday, January 1, 2023 | 458211000 | 34300000000 |

| Monday, January 1, 2024 | 583361000 | 35551000000 |

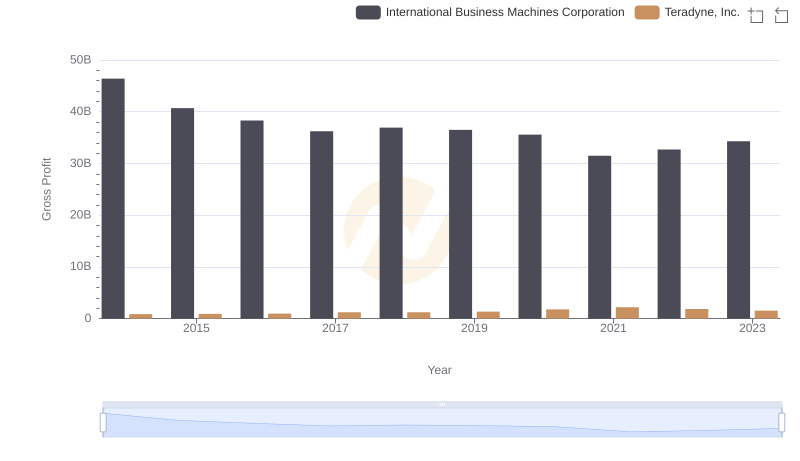

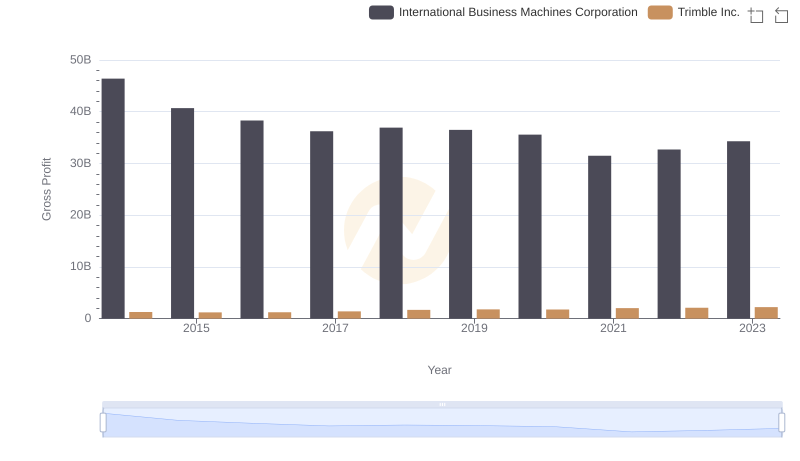

Cracking the code

In the ever-evolving landscape of technology, the financial performance of industry leaders offers a window into their strategic prowess. Over the past decade, International Business Machines Corporation (IBM) and Guidewire Software, Inc. have showcased contrasting trajectories in gross profit. From 2014 to 2024, IBM's gross profit has seen a decline of approximately 24%, reflecting the challenges faced by legacy tech giants in adapting to new market dynamics. In contrast, Guidewire Software has experienced a remarkable growth of nearly 190% in the same period, underscoring its agility and innovation in the software sector.

While IBM's gross profit peaked in 2014, Guidewire's upward trend highlights its successful navigation through the competitive tech landscape. As we look to the future, these insights not only reveal past performance but also hint at the strategic directions these companies might pursue.

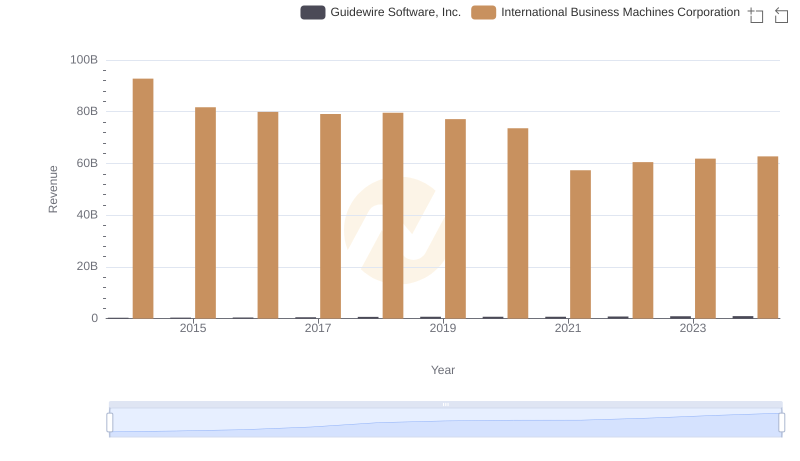

International Business Machines Corporation or Guidewire Software, Inc.: Who Leads in Yearly Revenue?

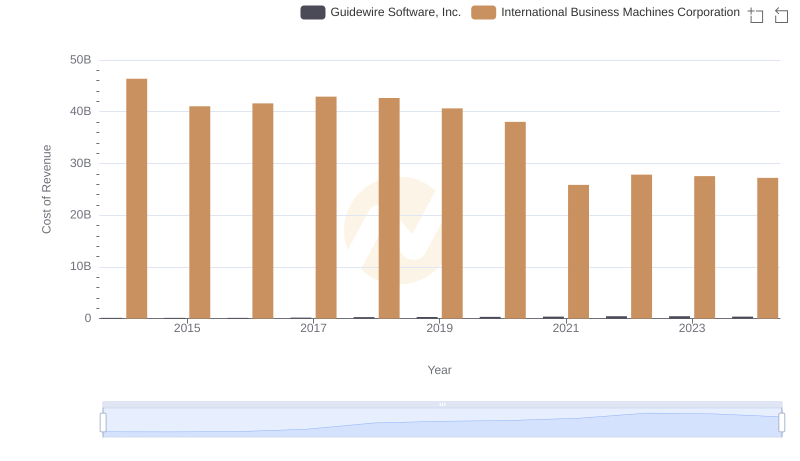

International Business Machines Corporation vs Guidewire Software, Inc.: Efficiency in Cost of Revenue Explored

Key Insights on Gross Profit: International Business Machines Corporation vs Teradyne, Inc.

Gross Profit Trends Compared: International Business Machines Corporation vs Trimble Inc.

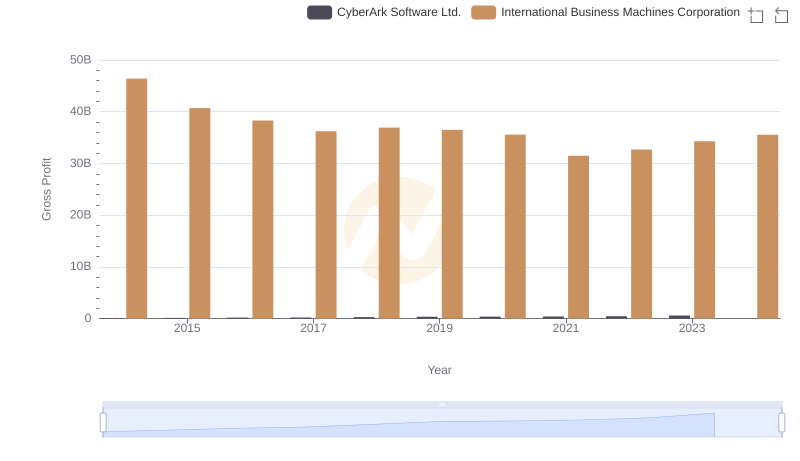

Who Generates Higher Gross Profit? International Business Machines Corporation or CyberArk Software Ltd.

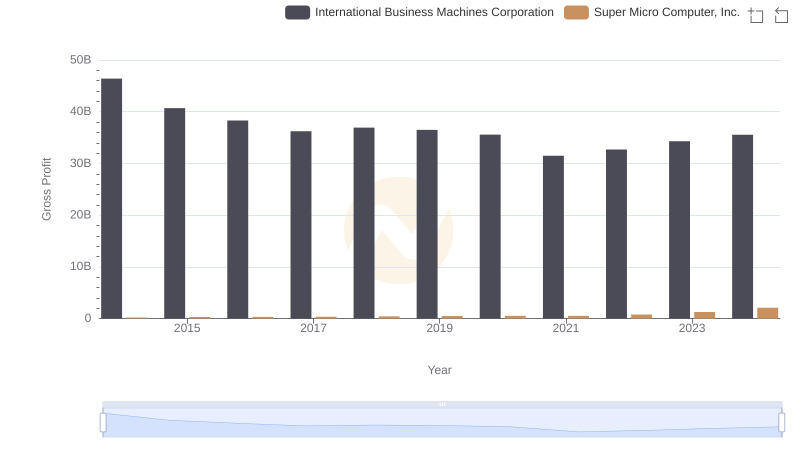

International Business Machines Corporation and Super Micro Computer, Inc.: A Detailed Gross Profit Analysis

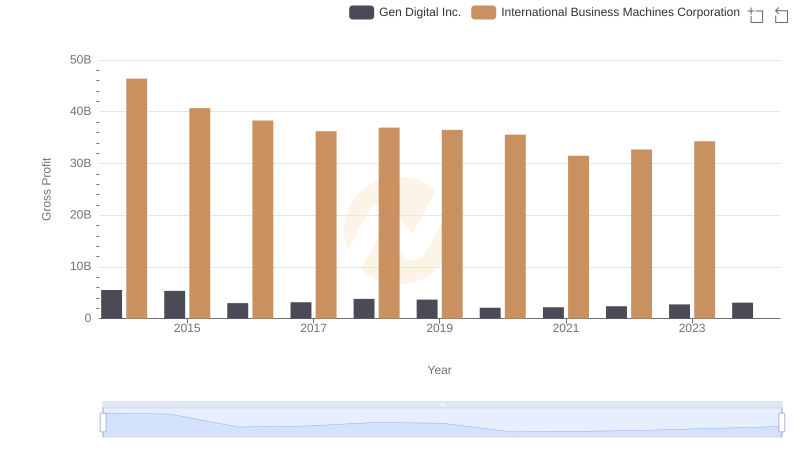

Gross Profit Analysis: Comparing International Business Machines Corporation and Gen Digital Inc.

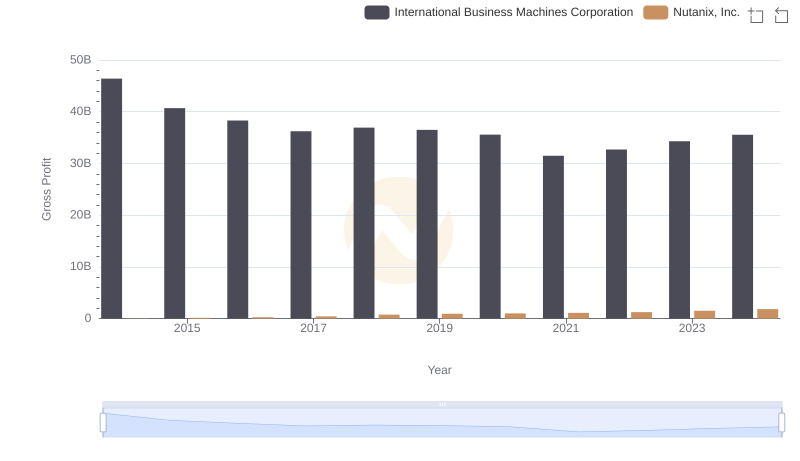

Gross Profit Analysis: Comparing International Business Machines Corporation and Nutanix, Inc.

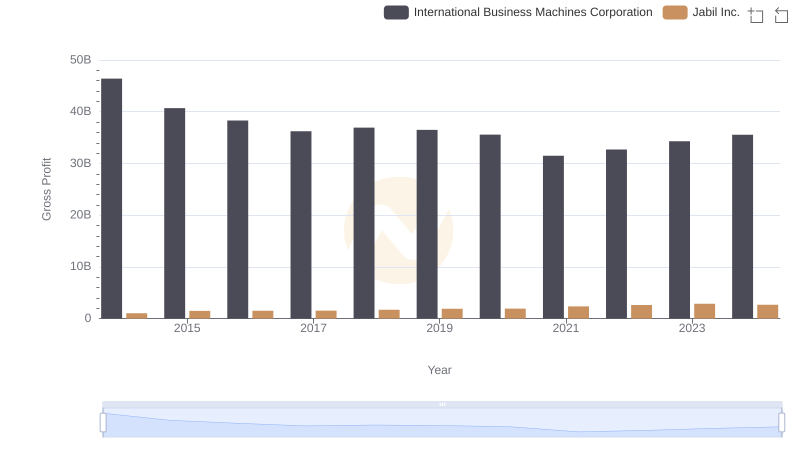

International Business Machines Corporation and Jabil Inc.: A Detailed Gross Profit Analysis

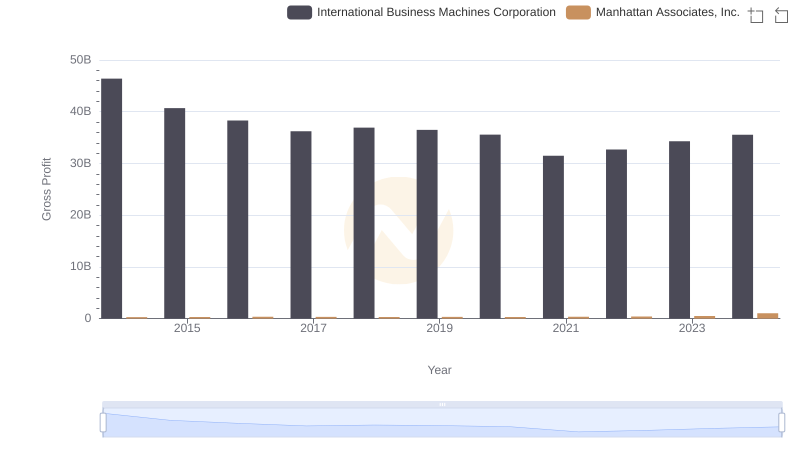

International Business Machines Corporation and Manhattan Associates, Inc.: A Detailed Gross Profit Analysis

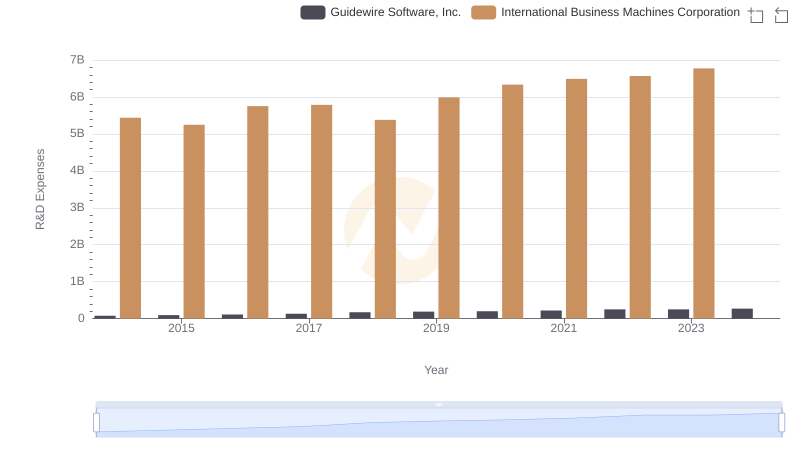

Comparing Innovation Spending: International Business Machines Corporation and Guidewire Software, Inc.

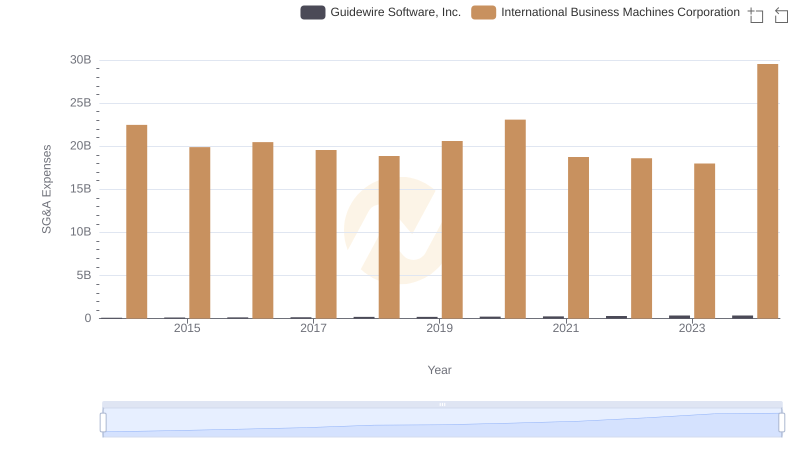

Breaking Down SG&A Expenses: International Business Machines Corporation vs Guidewire Software, Inc.