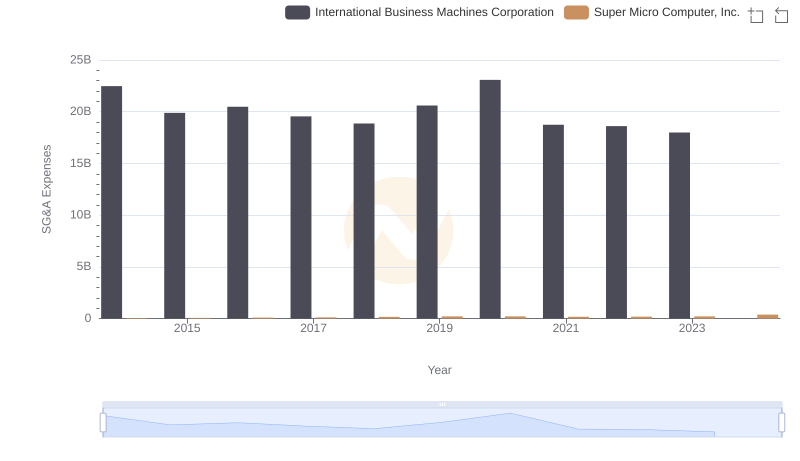

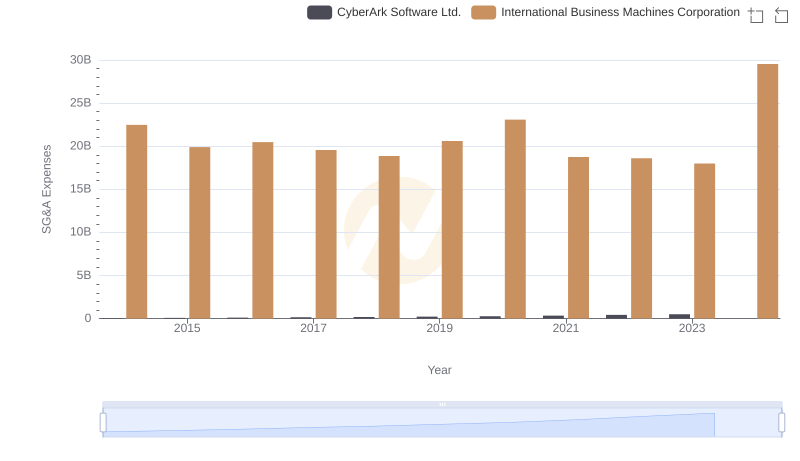

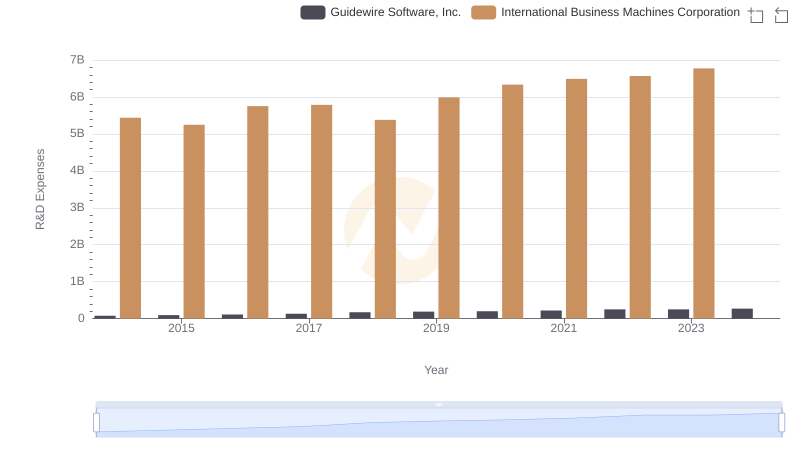

| __timestamp | Guidewire Software, Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 106699000 | 22472000000 |

| Thursday, January 1, 2015 | 123420000 | 19894000000 |

| Friday, January 1, 2016 | 143679000 | 20279000000 |

| Sunday, January 1, 2017 | 165790000 | 19680000000 |

| Monday, January 1, 2018 | 200033000 | 19366000000 |

| Tuesday, January 1, 2019 | 205152000 | 18724000000 |

| Wednesday, January 1, 2020 | 227603000 | 20561000000 |

| Friday, January 1, 2021 | 254303000 | 18745000000 |

| Saturday, January 1, 2022 | 302002000 | 17483000000 |

| Sunday, January 1, 2023 | 357955000 | 17997000000 |

| Monday, January 1, 2024 | 366553000 | 29536000000 |

Cracking the code

In the ever-evolving landscape of technology, understanding the financial strategies of industry giants like International Business Machines Corporation (IBM) and emerging players such as Guidewire Software, Inc. is crucial. Over the past decade, IBM's Selling, General, and Administrative (SG&A) expenses have shown a fluctuating trend, peaking in 2024 with a 48% increase from 2023. This reflects IBM's strategic investments in innovation and market expansion. In contrast, Guidewire's SG&A expenses have steadily risen, marking a 243% increase from 2014 to 2024, indicating its aggressive growth strategy in the software industry. This comparison highlights the distinct financial approaches of a legacy corporation versus a modern software company, offering valuable insights into their operational priorities and market positioning. As the tech industry continues to evolve, these financial trends provide a window into the strategic decisions shaping the future of these companies.

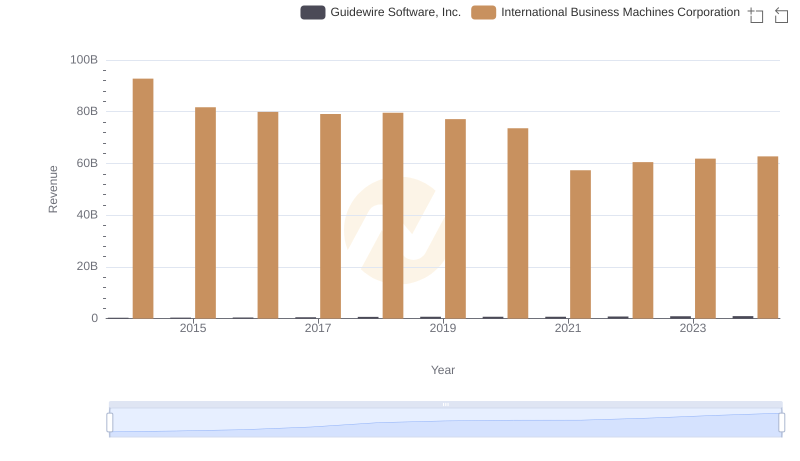

International Business Machines Corporation or Guidewire Software, Inc.: Who Leads in Yearly Revenue?

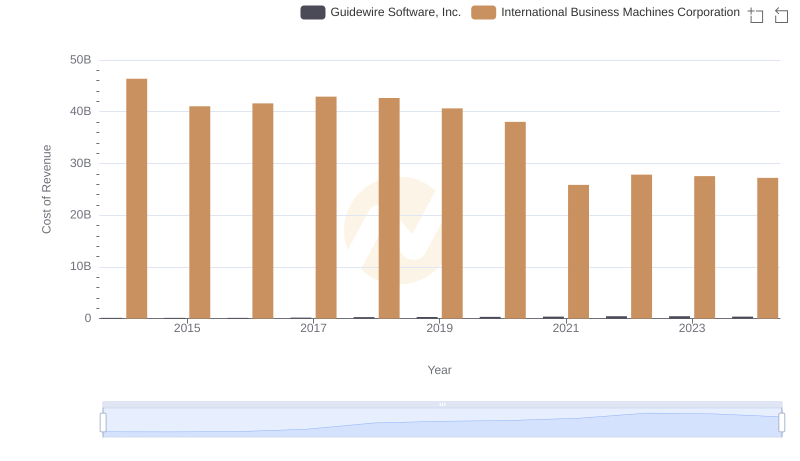

International Business Machines Corporation vs Guidewire Software, Inc.: Efficiency in Cost of Revenue Explored

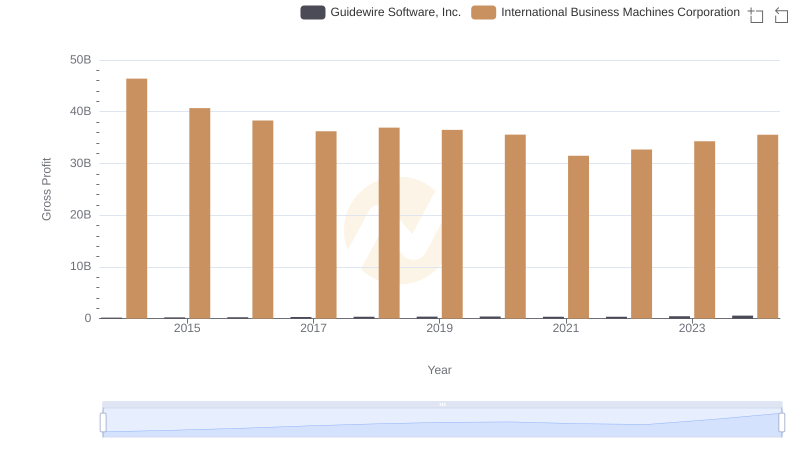

Key Insights on Gross Profit: International Business Machines Corporation vs Guidewire Software, Inc.

Selling, General, and Administrative Costs: International Business Machines Corporation vs Super Micro Computer, Inc.

Breaking Down SG&A Expenses: International Business Machines Corporation vs Trimble Inc.

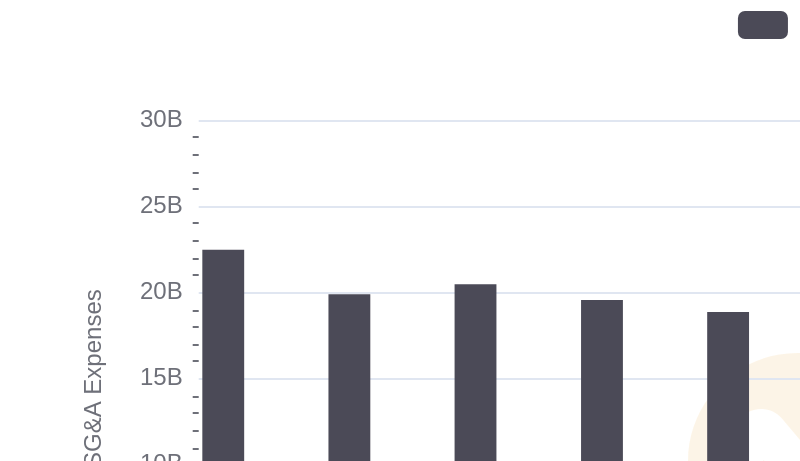

International Business Machines Corporation or CyberArk Software Ltd.: Who Manages SG&A Costs Better?

Comparing Innovation Spending: International Business Machines Corporation and Guidewire Software, Inc.

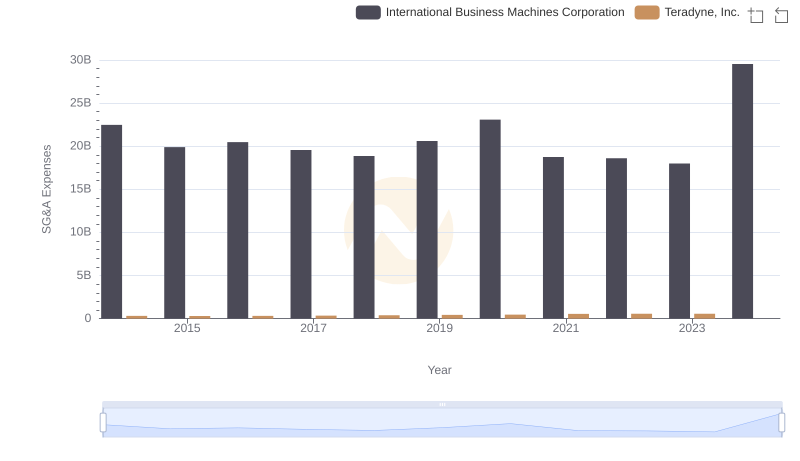

Selling, General, and Administrative Costs: International Business Machines Corporation vs Teradyne, Inc.

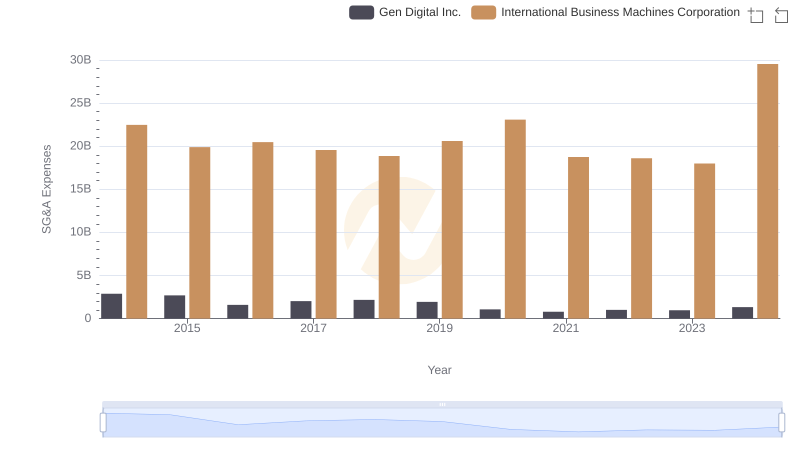

Selling, General, and Administrative Costs: International Business Machines Corporation vs Gen Digital Inc.

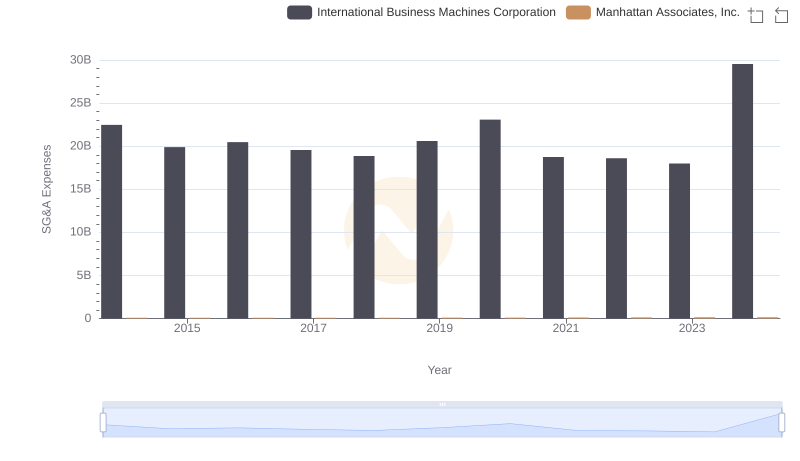

Selling, General, and Administrative Costs: International Business Machines Corporation vs Manhattan Associates, Inc.

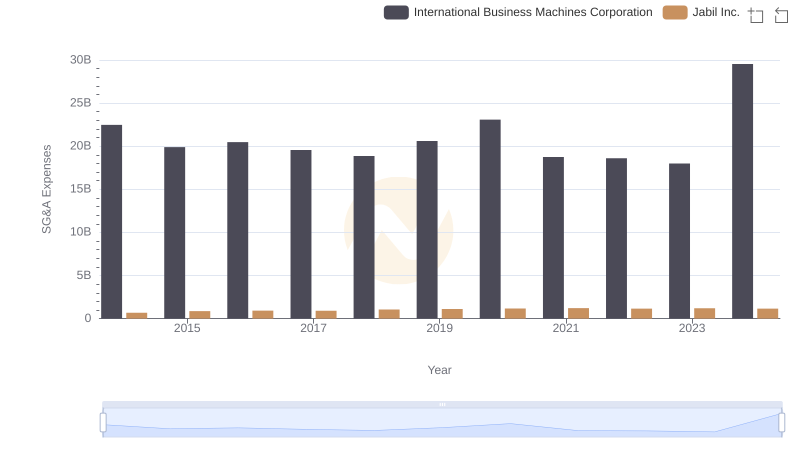

Selling, General, and Administrative Costs: International Business Machines Corporation vs Jabil Inc.

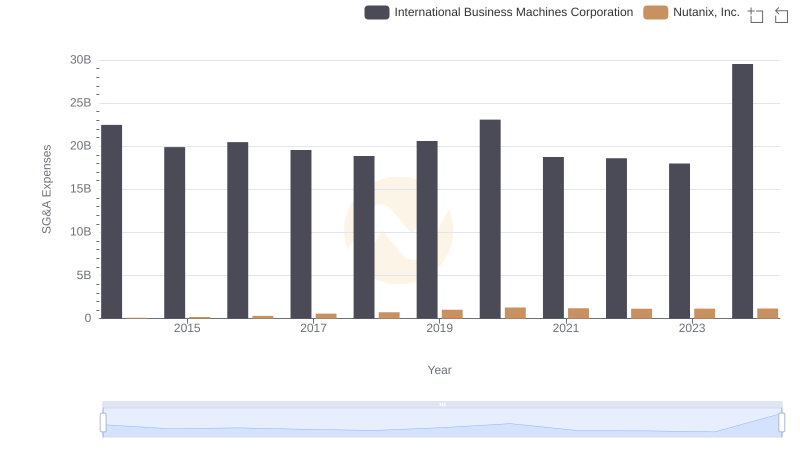

International Business Machines Corporation and Nutanix, Inc.: SG&A Spending Patterns Compared