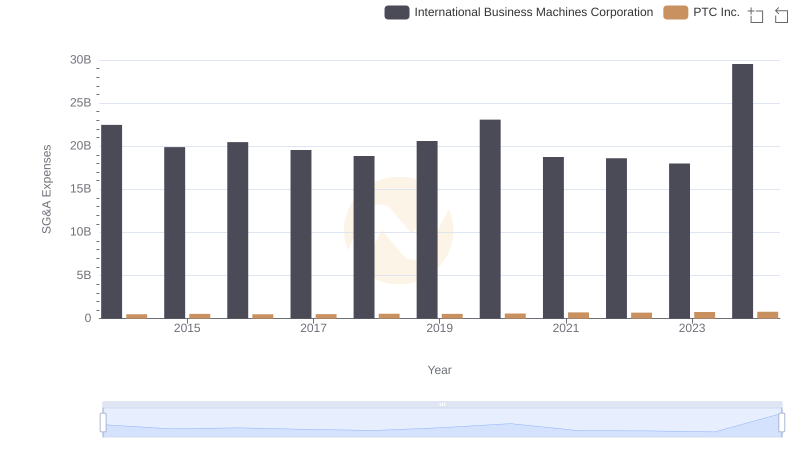

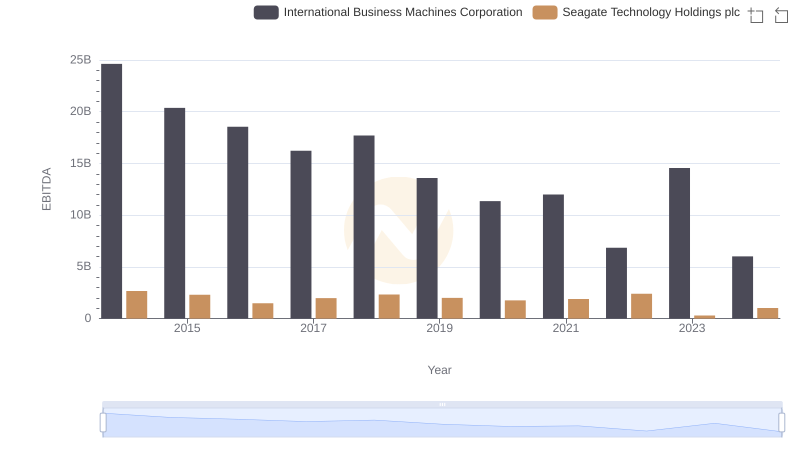

| __timestamp | International Business Machines Corporation | Seagate Technology Holdings plc |

|---|---|---|

| Wednesday, January 1, 2014 | 22472000000 | 722000000 |

| Thursday, January 1, 2015 | 19894000000 | 857000000 |

| Friday, January 1, 2016 | 20279000000 | 635000000 |

| Sunday, January 1, 2017 | 19680000000 | 606000000 |

| Monday, January 1, 2018 | 19366000000 | 562000000 |

| Tuesday, January 1, 2019 | 18724000000 | 453000000 |

| Wednesday, January 1, 2020 | 20561000000 | 473000000 |

| Friday, January 1, 2021 | 18745000000 | 502000000 |

| Saturday, January 1, 2022 | 17483000000 | 559000000 |

| Sunday, January 1, 2023 | 17997000000 | 491000000 |

| Monday, January 1, 2024 | 29536000000 | 460000000 |

Data in motion

In the ever-evolving landscape of technology giants, effective cost management remains a pivotal factor for sustained growth and competitiveness. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of two industry leaders: International Business Machines Corporation (IBM) and Seagate Technology Holdings plc, from 2014 to 2024.

IBM's SG&A expenses have shown a fluctuating trend over the years, peaking in 2024 with a 42% increase compared to 2023. This surge could indicate strategic investments in marketing and administrative capabilities. However, the overall trend from 2014 to 2023 reflects a 20% decrease, highlighting IBM's focus on optimizing operational efficiencies.

In contrast, Seagate's SG&A expenses have remained relatively stable, with a slight decline of 32% from 2014 to 2024. This consistency underscores Seagate's disciplined approach to cost management, ensuring steady financial health amidst market fluctuations.

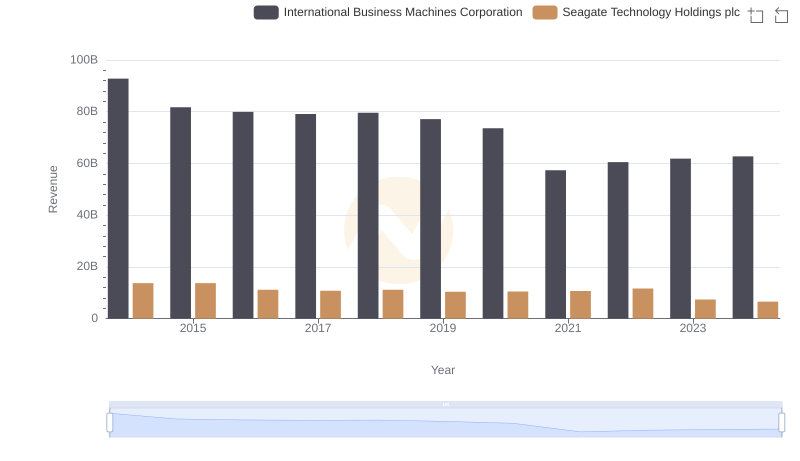

International Business Machines Corporation and Seagate Technology Holdings plc: A Comprehensive Revenue Analysis

International Business Machines Corporation vs Seagate Technology Holdings plc: Efficiency in Cost of Revenue Explored

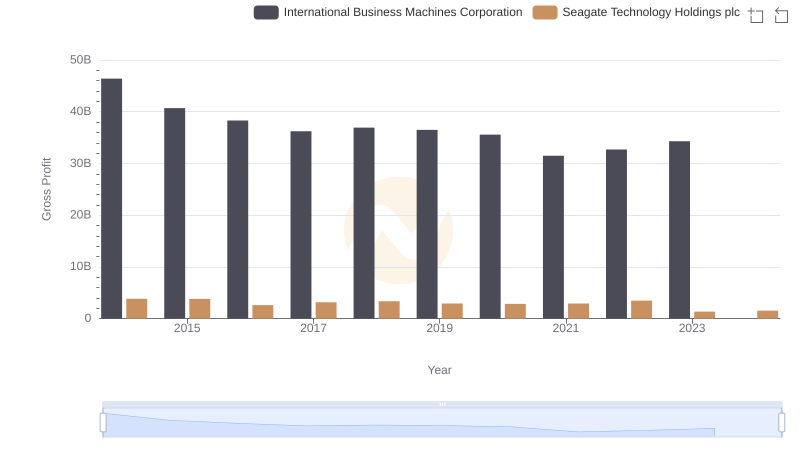

International Business Machines Corporation vs Seagate Technology Holdings plc: A Gross Profit Performance Breakdown

Research and Development Expenses Breakdown: International Business Machines Corporation vs Seagate Technology Holdings plc

International Business Machines Corporation vs PTC Inc.: SG&A Expense Trends

Breaking Down SG&A Expenses: International Business Machines Corporation vs ON Semiconductor Corporation

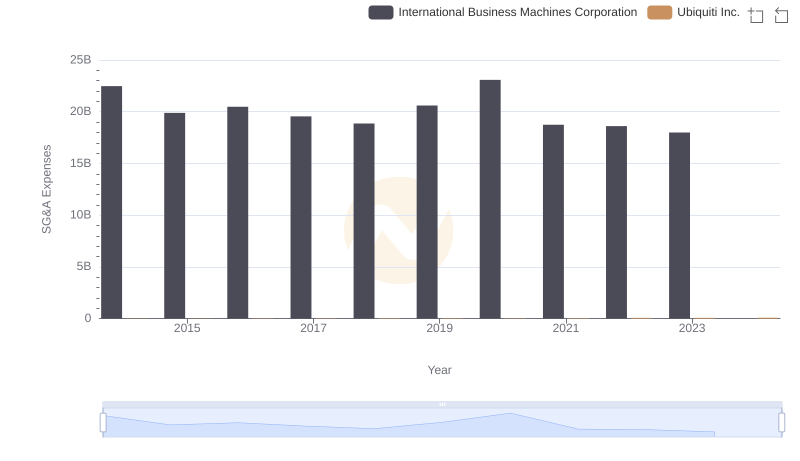

Breaking Down SG&A Expenses: International Business Machines Corporation vs Ubiquiti Inc.

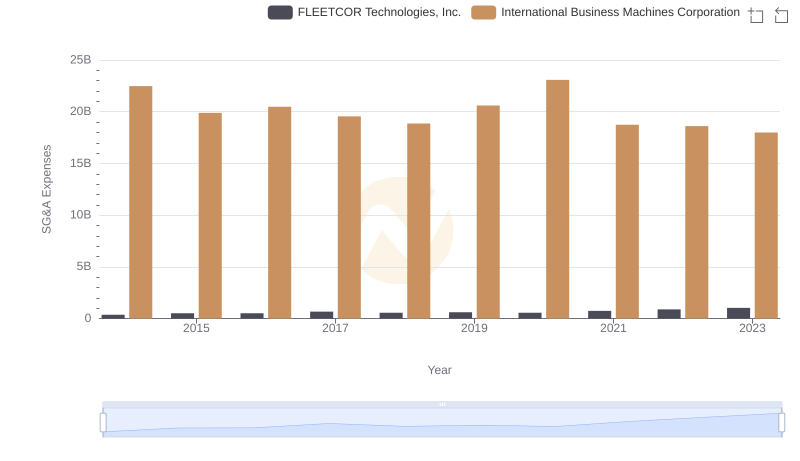

International Business Machines Corporation vs FLEETCOR Technologies, Inc.: SG&A Expense Trends

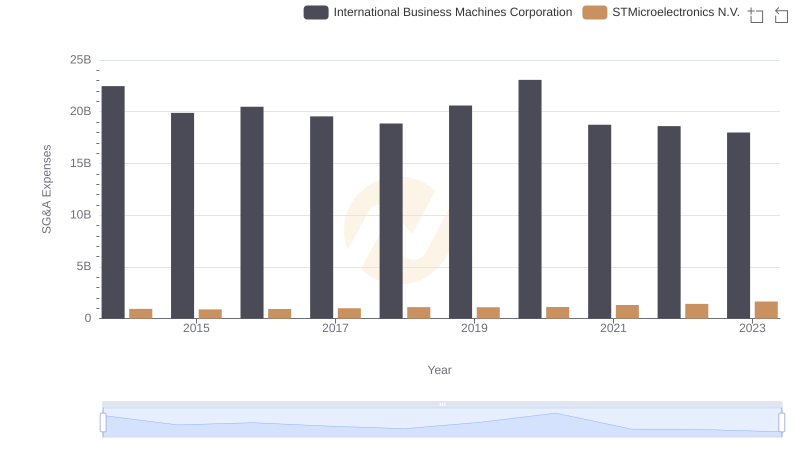

International Business Machines Corporation or STMicroelectronics N.V.: Who Manages SG&A Costs Better?

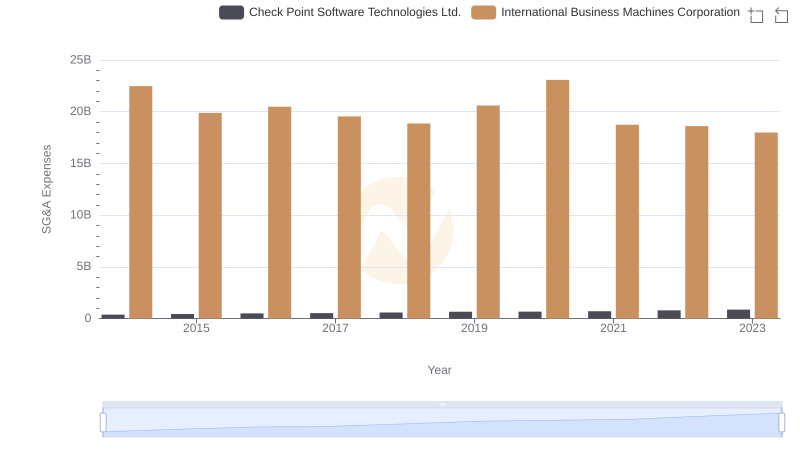

Operational Costs Compared: SG&A Analysis of International Business Machines Corporation and Check Point Software Technologies Ltd.

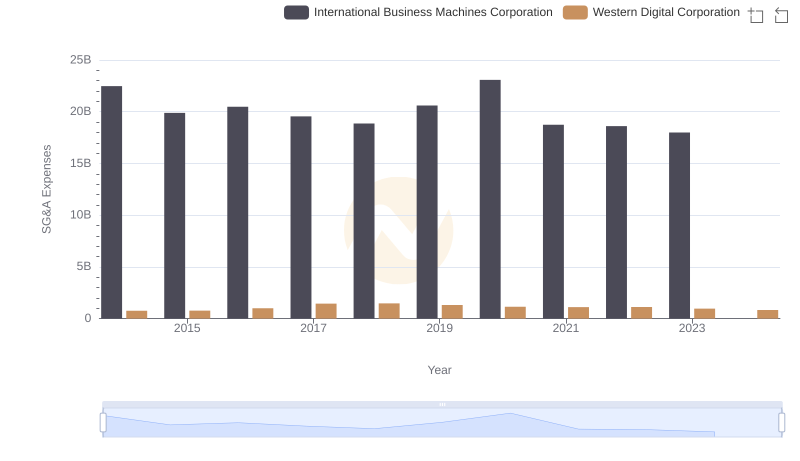

Selling, General, and Administrative Costs: International Business Machines Corporation vs Western Digital Corporation

International Business Machines Corporation vs Seagate Technology Holdings plc: In-Depth EBITDA Performance Comparison