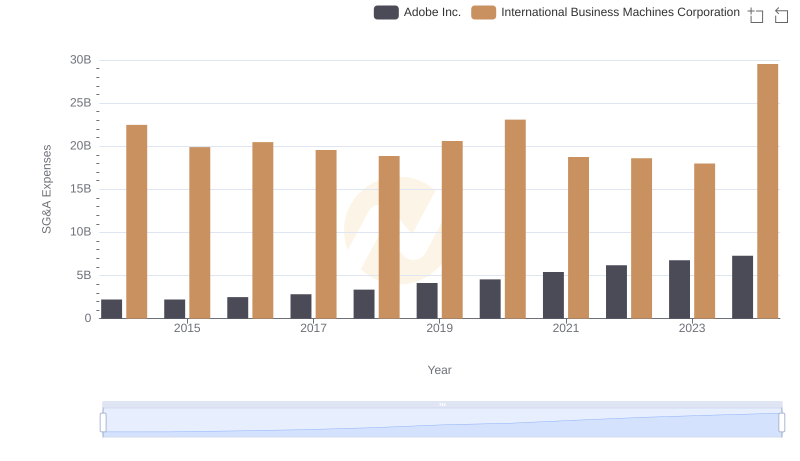

| __timestamp | Adobe Inc. | International Business Machines Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 734698000 | 24962000000 |

| Thursday, January 1, 2015 | 1277438000 | 20268000000 |

| Friday, January 1, 2016 | 1837115000 | 17341000000 |

| Sunday, January 1, 2017 | 2538040000 | 16556000000 |

| Monday, January 1, 2018 | 3229610000 | 16545000000 |

| Tuesday, January 1, 2019 | 4097396000 | 14609000000 |

| Wednesday, January 1, 2020 | 5133000000 | 10555000000 |

| Friday, January 1, 2021 | 6675000000 | 12409000000 |

| Saturday, January 1, 2022 | 7055000000 | 7174000000 |

| Sunday, January 1, 2023 | 6650000000 | 14693000000 |

| Monday, January 1, 2024 | 7957000000 | 6015000000 |

Data in motion

In the ever-evolving landscape of technology, International Business Machines Corporation (IBM) and Adobe Inc. have been pivotal players. From 2014 to 2024, these industry titans have showcased contrasting EBITDA trajectories. Adobe's EBITDA has surged by over 980%, reflecting its strategic pivot towards cloud-based solutions and digital media. In contrast, IBM's EBITDA has seen a decline of approximately 76%, highlighting the challenges faced in its transition from traditional hardware to modern IT services.

This analysis offers a window into the strategic maneuvers and market dynamics shaping these tech behemoths over the past decade.

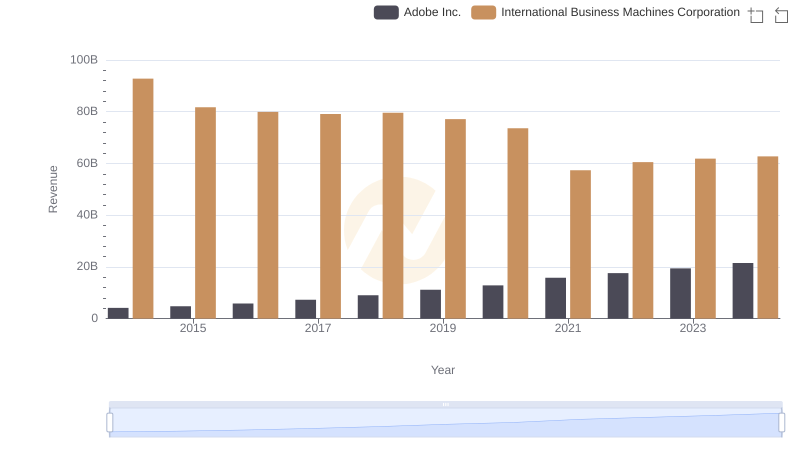

Who Generates More Revenue? International Business Machines Corporation or Adobe Inc.

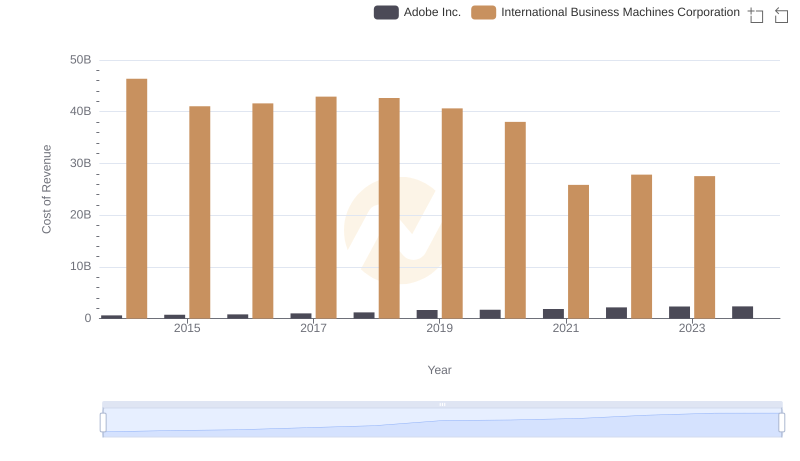

Cost of Revenue Trends: International Business Machines Corporation vs Adobe Inc.

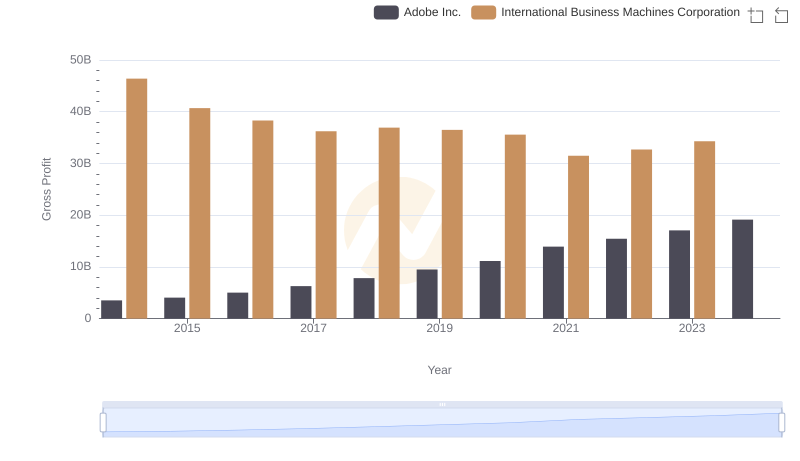

Gross Profit Trends Compared: International Business Machines Corporation vs Adobe Inc.

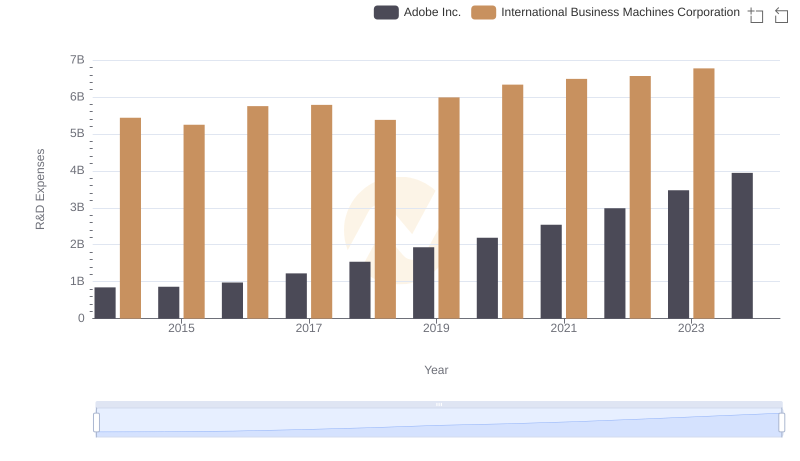

Analyzing R&D Budgets: International Business Machines Corporation vs Adobe Inc.

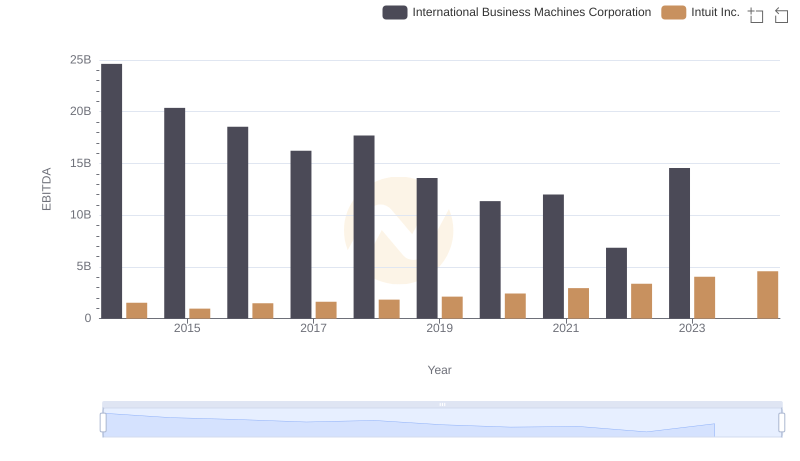

International Business Machines Corporation vs Intuit Inc.: In-Depth EBITDA Performance Comparison

Comparing SG&A Expenses: International Business Machines Corporation vs Adobe Inc. Trends and Insights

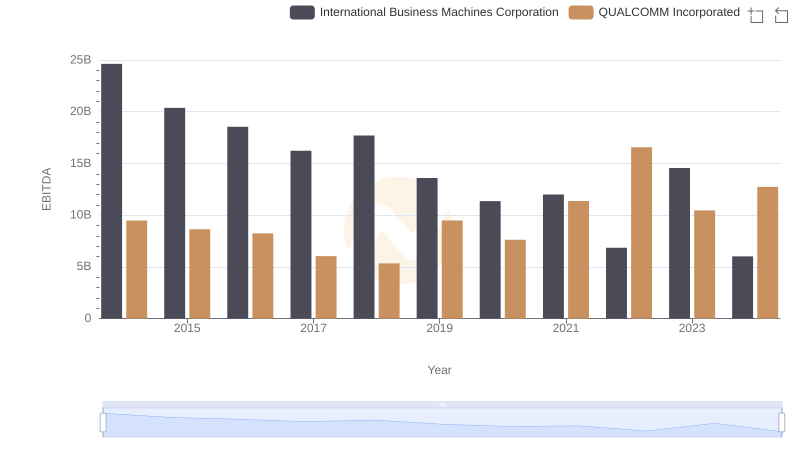

Professional EBITDA Benchmarking: International Business Machines Corporation vs QUALCOMM Incorporated

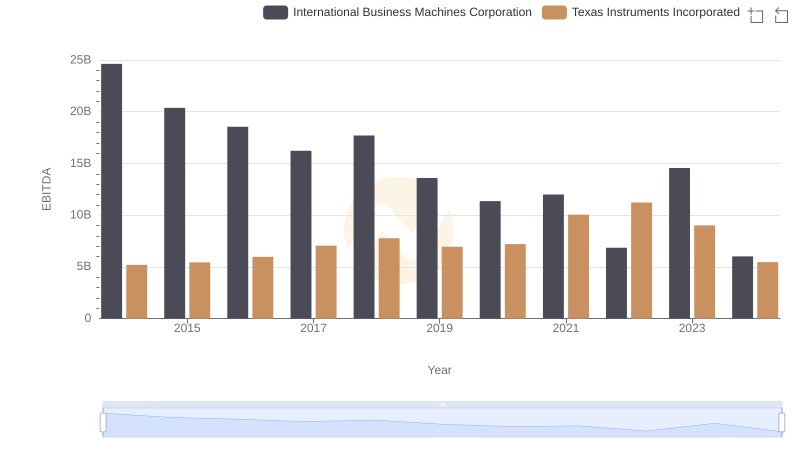

EBITDA Performance Review: International Business Machines Corporation vs Texas Instruments Incorporated

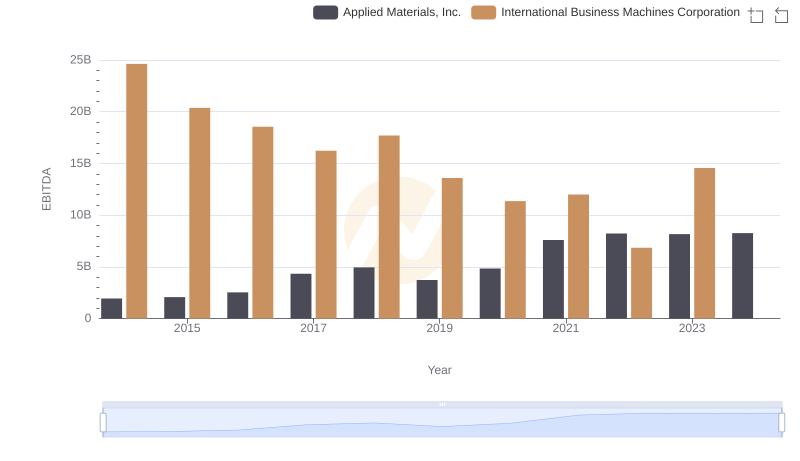

EBITDA Performance Review: International Business Machines Corporation vs Applied Materials, Inc.

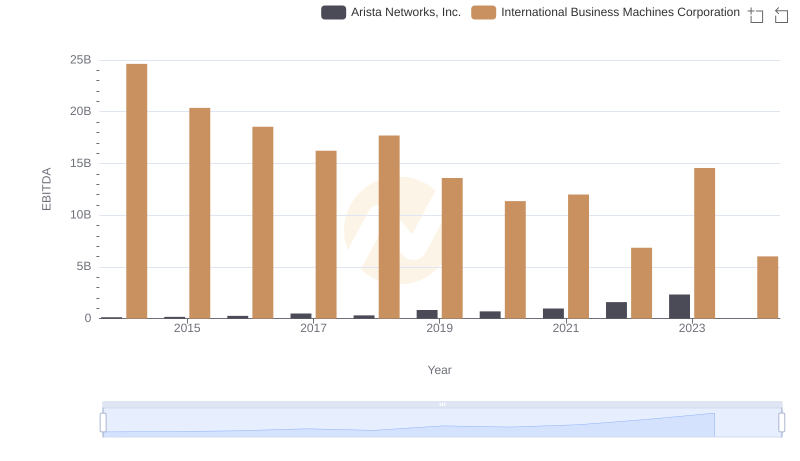

EBITDA Analysis: Evaluating International Business Machines Corporation Against Arista Networks, Inc.

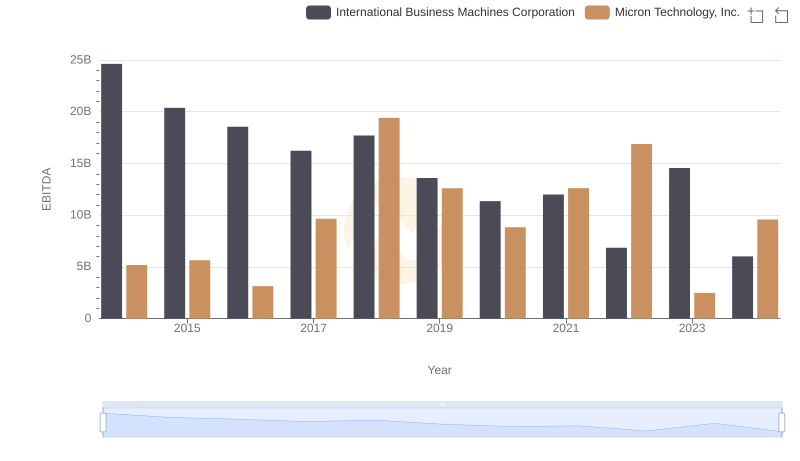

International Business Machines Corporation and Micron Technology, Inc.: A Detailed Examination of EBITDA Performance