| __timestamp | Ingersoll Rand Inc. | XPO Logistics, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 422500000 |

| Thursday, January 1, 2015 | 427000000 | 1113400000 |

| Friday, January 1, 2016 | 414339000 | 1651200000 |

| Sunday, January 1, 2017 | 446600000 | 1656500000 |

| Monday, January 1, 2018 | 434600000 | 1837000000 |

| Tuesday, January 1, 2019 | 436400000 | 1845000000 |

| Wednesday, January 1, 2020 | 894800000 | 2172000000 |

| Friday, January 1, 2021 | 1028000000 | 1322000000 |

| Saturday, January 1, 2022 | 1095800000 | 678000000 |

| Sunday, January 1, 2023 | 1272700000 | 167000000 |

| Monday, January 1, 2024 | 0 | 134000000 |

Unveiling the hidden dimensions of data

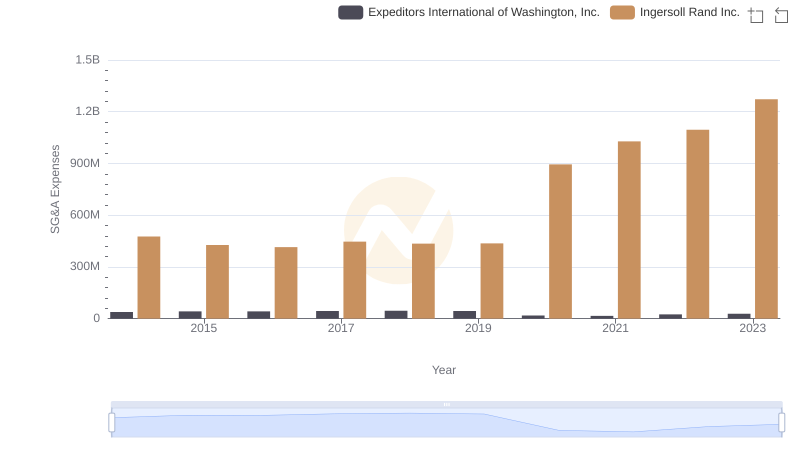

In the competitive landscape of industrial and logistics sectors, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. Over the past decade, Ingersoll Rand Inc. and XPO Logistics, Inc. have showcased contrasting strategies in handling these costs. From 2014 to 2023, Ingersoll Rand's SG&A expenses grew by approximately 167%, peaking in 2023. In contrast, XPO Logistics saw a significant reduction of about 60% in the same period, with a notable drop in 2023. This divergence highlights Ingersoll Rand's investment in growth and expansion, while XPO Logistics appears to have streamlined operations, focusing on efficiency. The data suggests that while Ingersoll Rand is expanding its operational footprint, XPO Logistics is optimizing its existing resources. This strategic difference could influence their competitive positioning in the coming years.

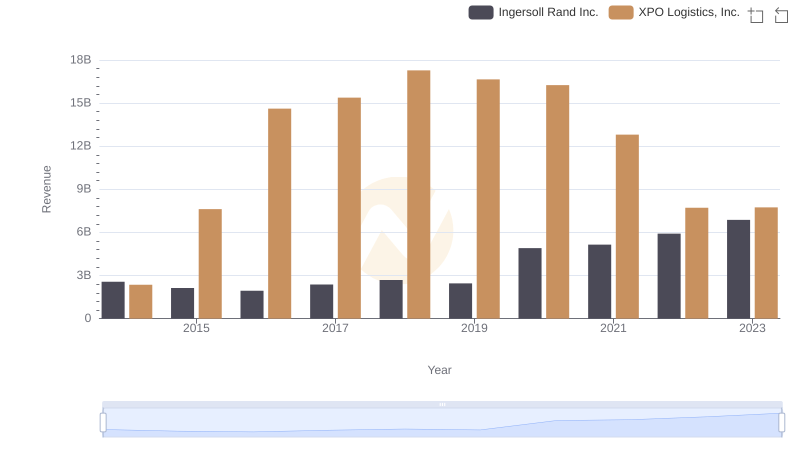

Annual Revenue Comparison: Ingersoll Rand Inc. vs XPO Logistics, Inc.

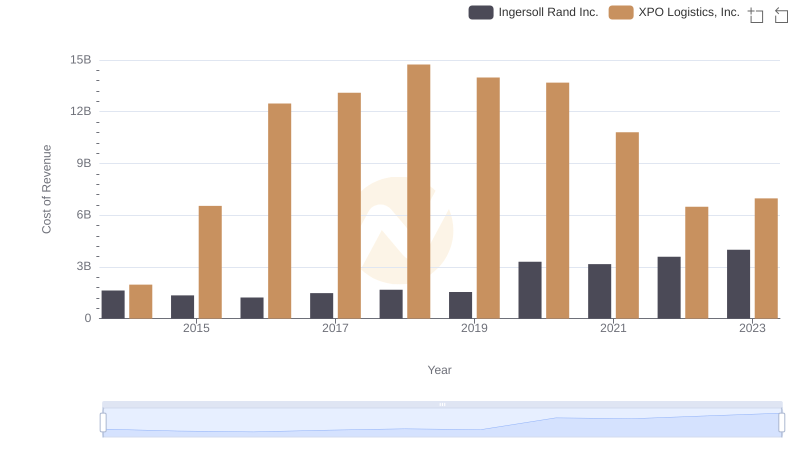

Cost of Revenue Trends: Ingersoll Rand Inc. vs XPO Logistics, Inc.

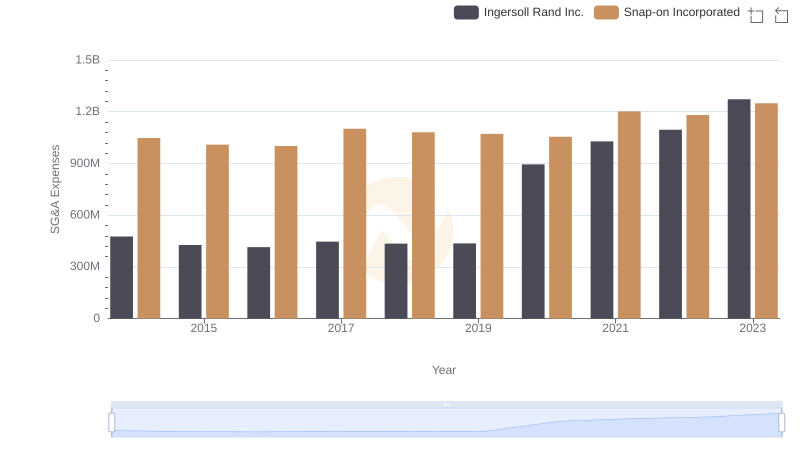

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Snap-on Incorporated

Ingersoll Rand Inc. and Expeditors International of Washington, Inc.: SG&A Spending Patterns Compared

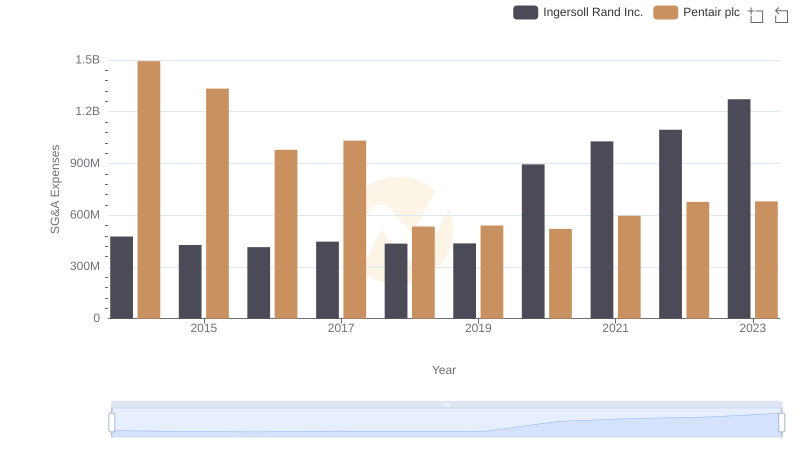

Comparing SG&A Expenses: Ingersoll Rand Inc. vs Pentair plc Trends and Insights

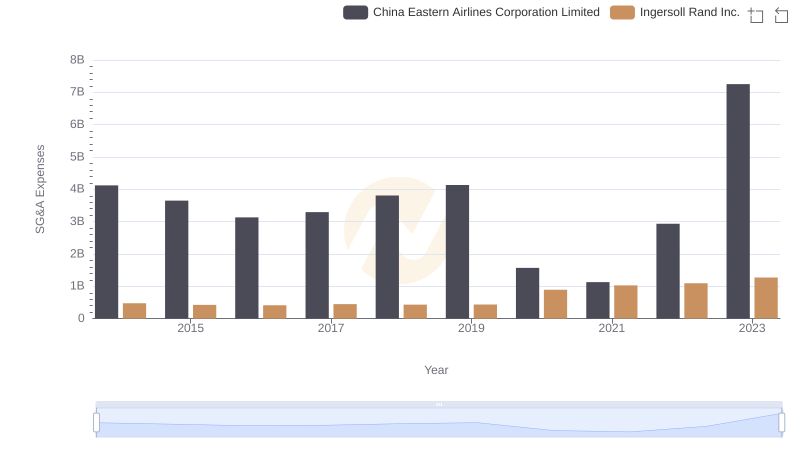

Selling, General, and Administrative Costs: Ingersoll Rand Inc. vs China Eastern Airlines Corporation Limited

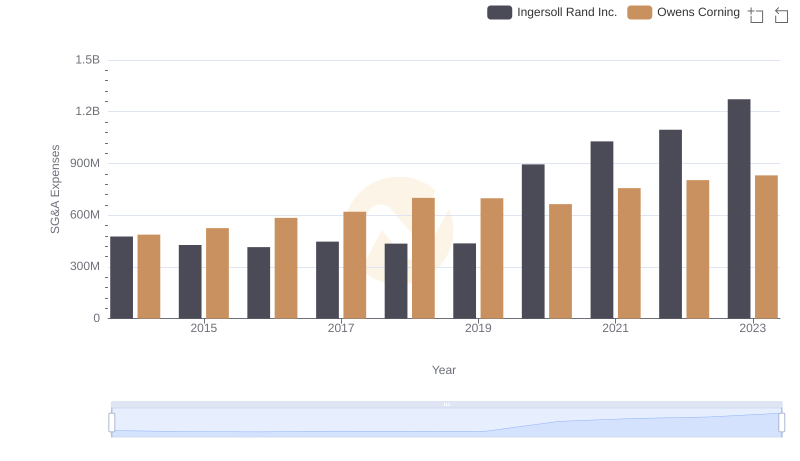

Ingersoll Rand Inc. and Owens Corning: SG&A Spending Patterns Compared

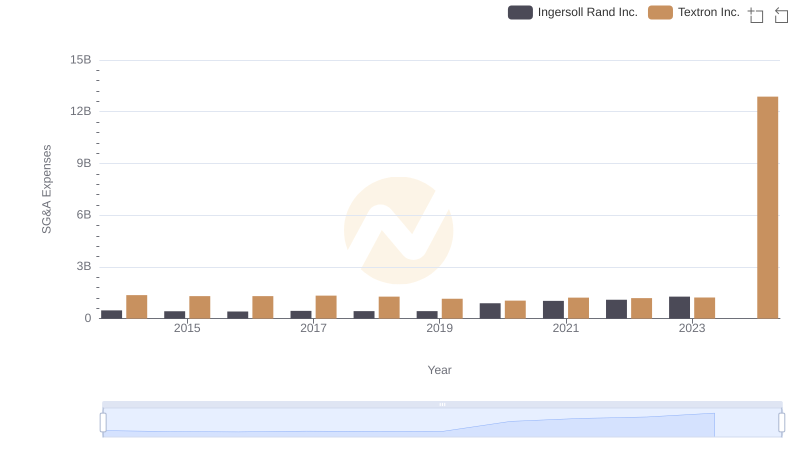

Ingersoll Rand Inc. or Textron Inc.: Who Manages SG&A Costs Better?