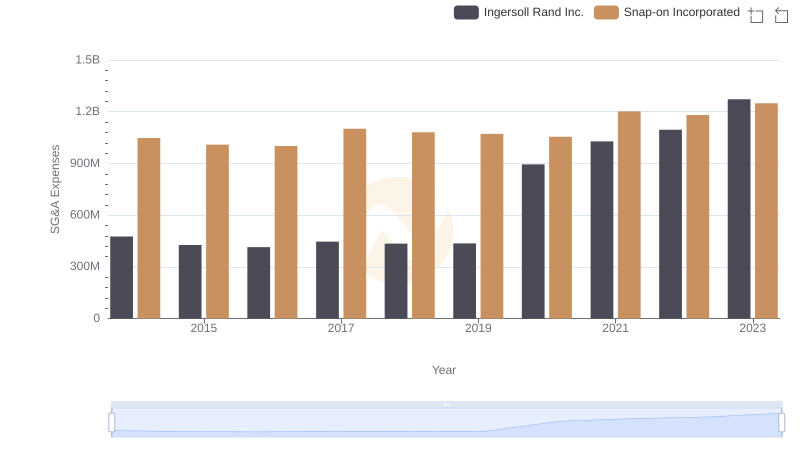

| __timestamp | Ingersoll Rand Inc. | Pentair plc |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 1493800000 |

| Thursday, January 1, 2015 | 427000000 | 1334300000 |

| Friday, January 1, 2016 | 414339000 | 979300000 |

| Sunday, January 1, 2017 | 446600000 | 1032500000 |

| Monday, January 1, 2018 | 434600000 | 534300000 |

| Tuesday, January 1, 2019 | 436400000 | 540100000 |

| Wednesday, January 1, 2020 | 894800000 | 520500000 |

| Friday, January 1, 2021 | 1028000000 | 596400000 |

| Saturday, January 1, 2022 | 1095800000 | 677100000 |

| Sunday, January 1, 2023 | 1272700000 | 680200000 |

| Monday, January 1, 2024 | 0 | 701400000 |

Infusing magic into the data realm

In the ever-evolving landscape of industrial manufacturing, understanding the financial health of companies is crucial. This analysis delves into the Selling, General, and Administrative (SG&A) expenses of Ingersoll Rand Inc. and Pentair plc from 2014 to 2023.

Ingersoll Rand Inc. has shown a remarkable upward trend in SG&A expenses, increasing by approximately 167% over the decade. This growth reflects the company's strategic investments in operational efficiency and market expansion. Notably, the expenses surged from 2019, peaking in 2023, indicating a robust growth phase.

Conversely, Pentair plc's SG&A expenses have decreased by about 54% since 2014. This reduction suggests a focus on cost optimization and streamlined operations. Despite fluctuations, the company maintained a consistent downward trajectory, highlighting its commitment to financial prudence.

This comparative analysis offers valuable insights into the strategic priorities of these industry giants.

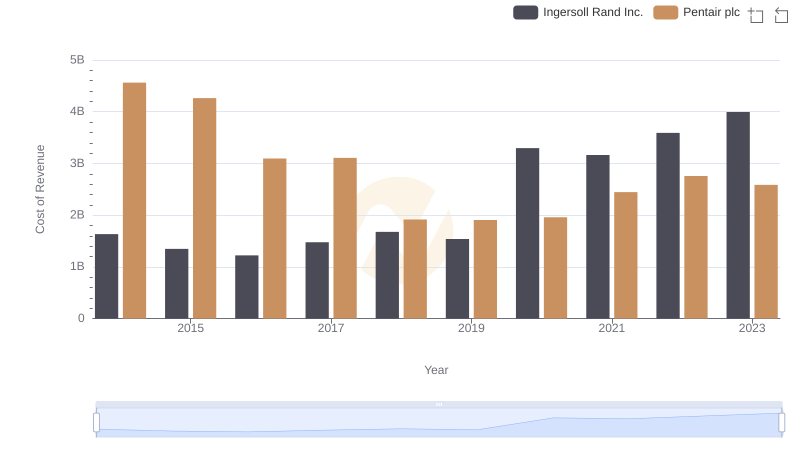

Cost of Revenue: Key Insights for Ingersoll Rand Inc. and Pentair plc

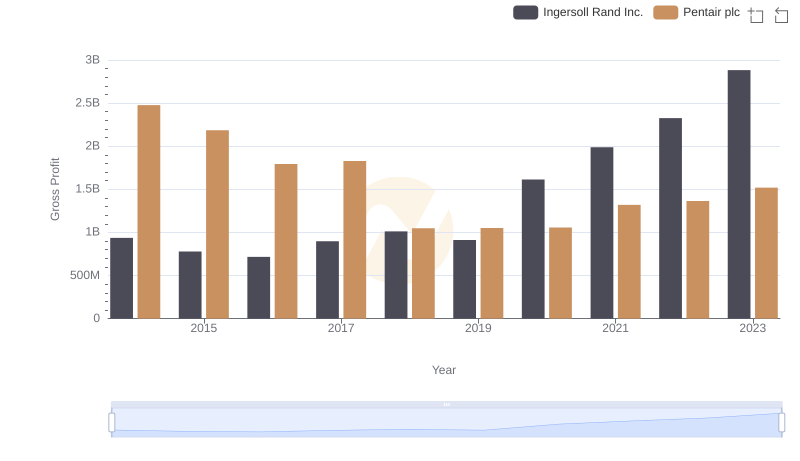

Ingersoll Rand Inc. vs Pentair plc: A Gross Profit Performance Breakdown

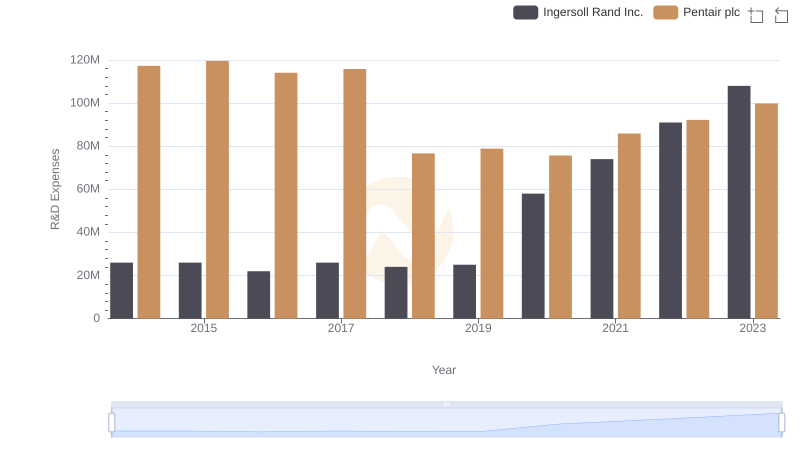

Comparing Innovation Spending: Ingersoll Rand Inc. and Pentair plc

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Snap-on Incorporated

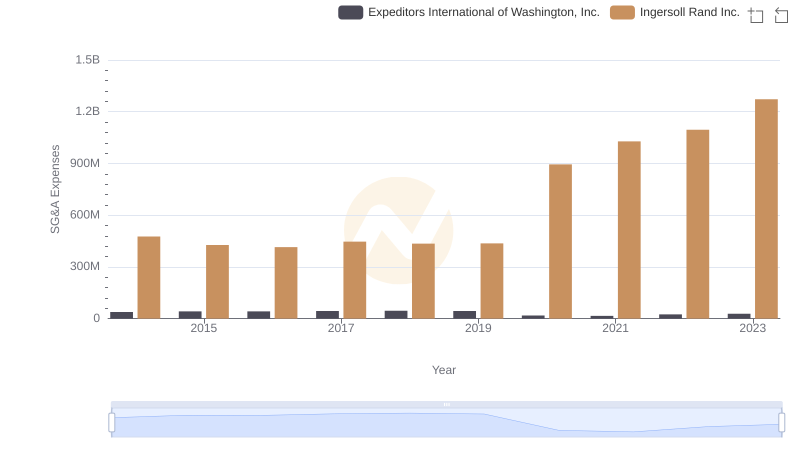

Ingersoll Rand Inc. and Expeditors International of Washington, Inc.: SG&A Spending Patterns Compared

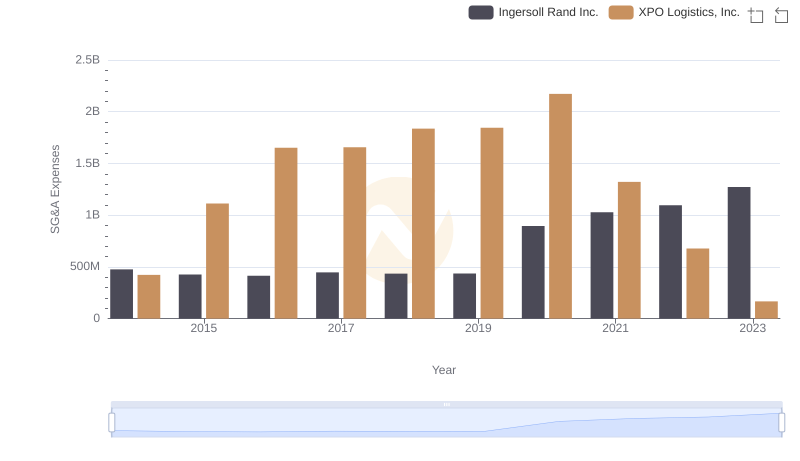

Ingersoll Rand Inc. or XPO Logistics, Inc.: Who Manages SG&A Costs Better?

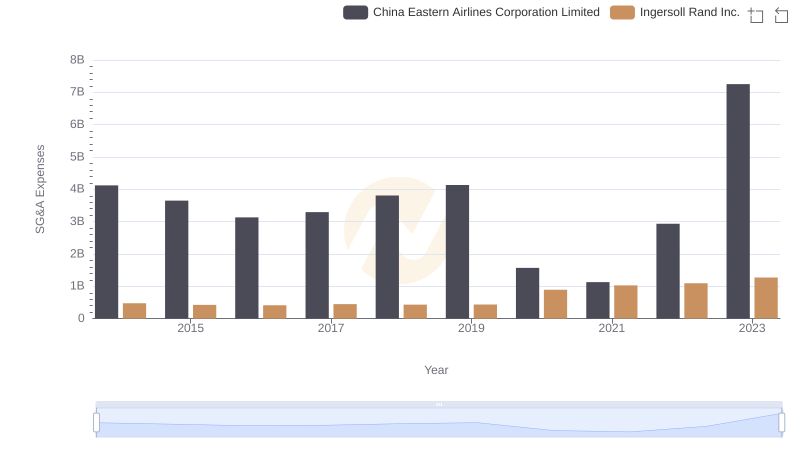

Selling, General, and Administrative Costs: Ingersoll Rand Inc. vs China Eastern Airlines Corporation Limited

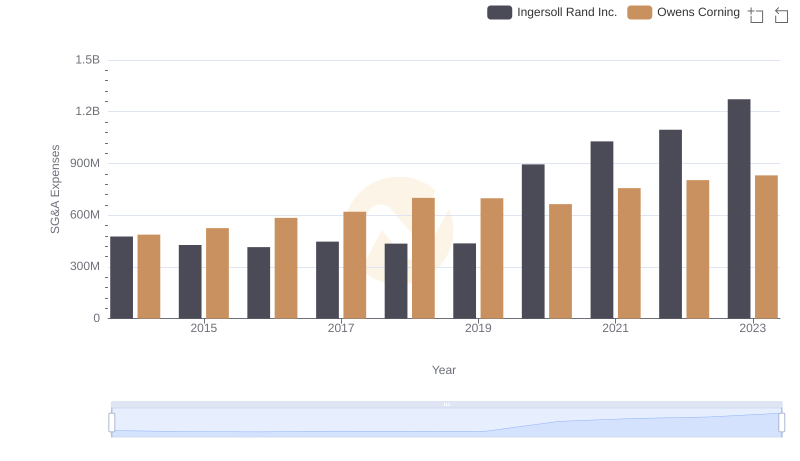

Ingersoll Rand Inc. and Owens Corning: SG&A Spending Patterns Compared