| __timestamp | Equifax Inc. | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 751700000 | 476000000 |

| Thursday, January 1, 2015 | 884300000 | 427000000 |

| Friday, January 1, 2016 | 948200000 | 414339000 |

| Sunday, January 1, 2017 | 1039100000 | 446600000 |

| Monday, January 1, 2018 | 1213300000 | 434600000 |

| Tuesday, January 1, 2019 | 1990200000 | 436400000 |

| Wednesday, January 1, 2020 | 1322500000 | 894800000 |

| Friday, January 1, 2021 | 1324600000 | 1028000000 |

| Saturday, January 1, 2022 | 1328900000 | 1095800000 |

| Sunday, January 1, 2023 | 1385700000 | 1272700000 |

| Monday, January 1, 2024 | 1450500000 | 0 |

Unleashing insights

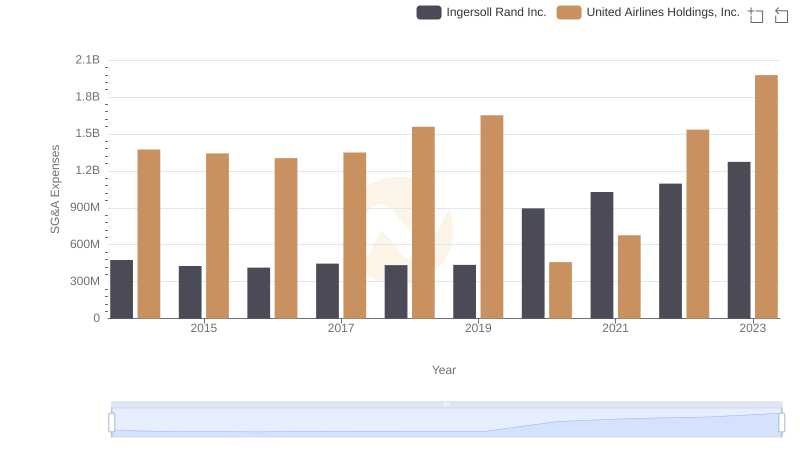

In the competitive landscape of corporate finance, managing Selling, General, and Administrative (SG&A) expenses is crucial for profitability. From 2014 to 2023, Equifax Inc. and Ingersoll Rand Inc. have shown distinct strategies in handling these costs. Equifax's SG&A expenses have surged by approximately 84%, peaking in 2019, while Ingersoll Rand's expenses have increased by about 167%, with a notable rise post-2019. Despite Equifax's higher absolute expenses, Ingersoll Rand's rapid growth in SG&A costs suggests a strategic expansion or increased operational investments. This data highlights the importance of balancing cost management with growth strategies. As businesses navigate economic uncertainties, understanding these trends can offer valuable insights into effective financial management. Whether you're an investor or a financial analyst, these insights into SG&A management can guide strategic decisions in the ever-evolving market landscape.

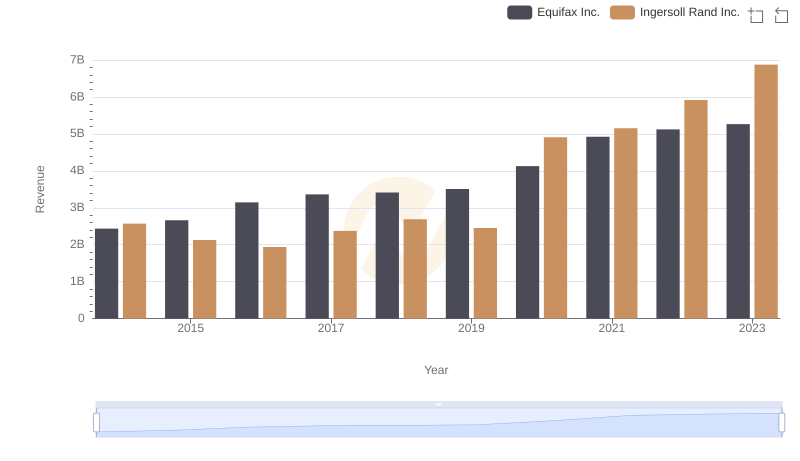

Ingersoll Rand Inc. vs Equifax Inc.: Examining Key Revenue Metrics

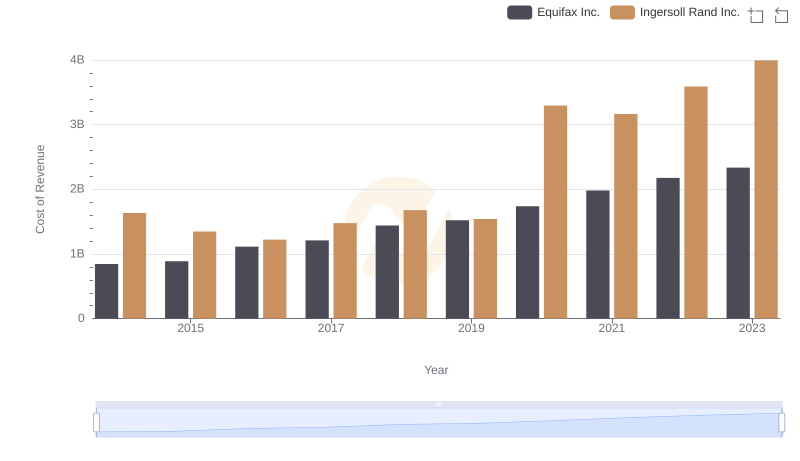

Cost of Revenue: Key Insights for Ingersoll Rand Inc. and Equifax Inc.

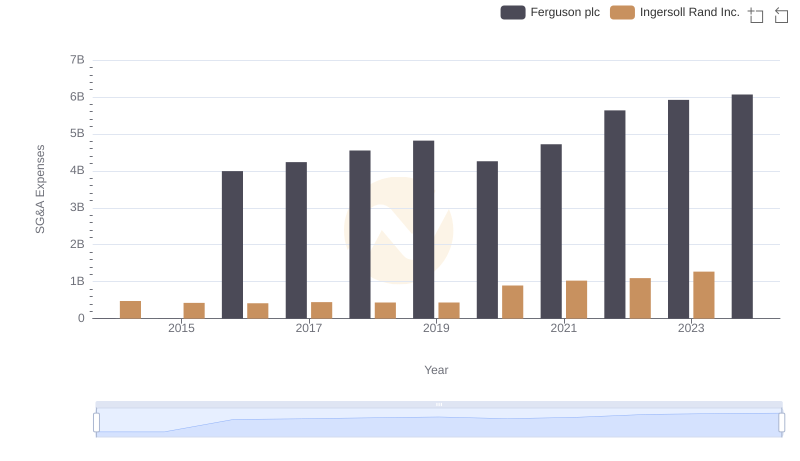

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Ferguson plc

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and United Airlines Holdings, Inc.

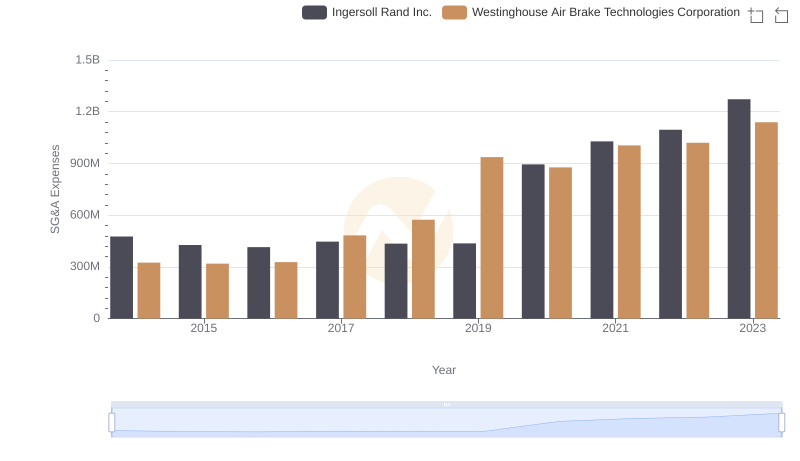

Comparing SG&A Expenses: Ingersoll Rand Inc. vs Westinghouse Air Brake Technologies Corporation Trends and Insights

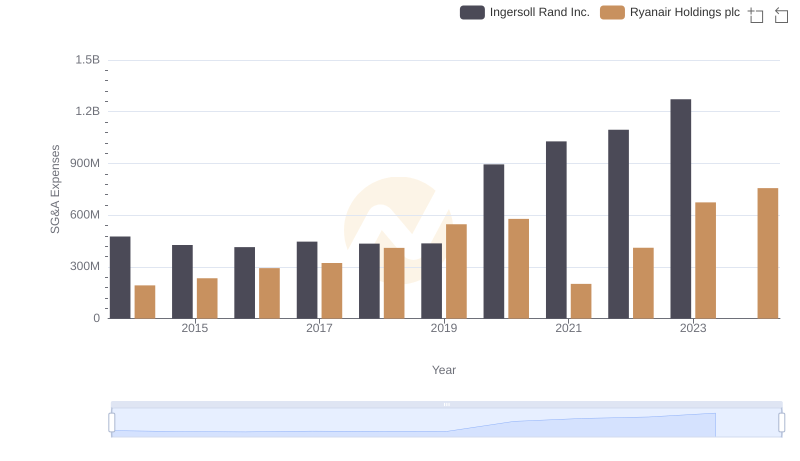

Ingersoll Rand Inc. or Ryanair Holdings plc: Who Manages SG&A Costs Better?

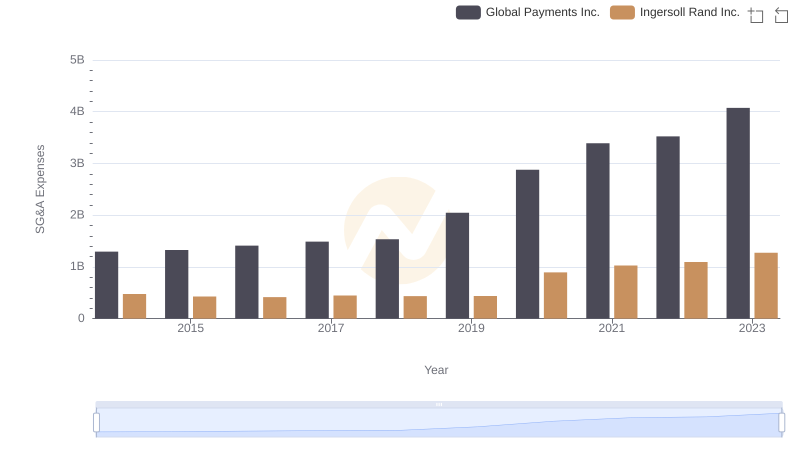

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Global Payments Inc.

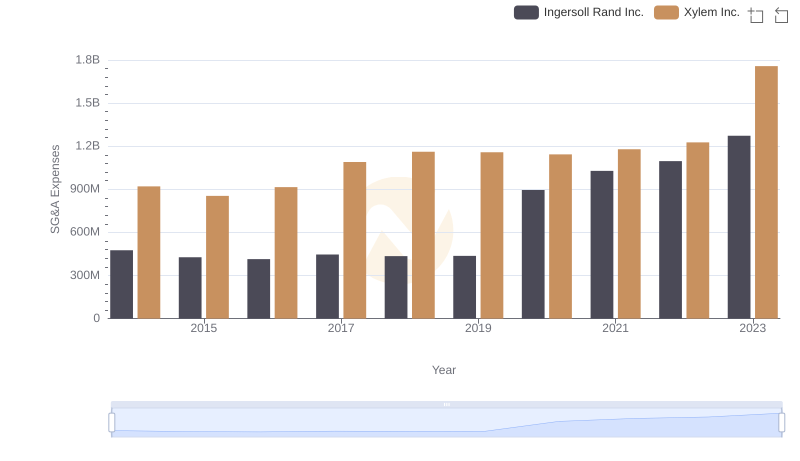

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Xylem Inc.

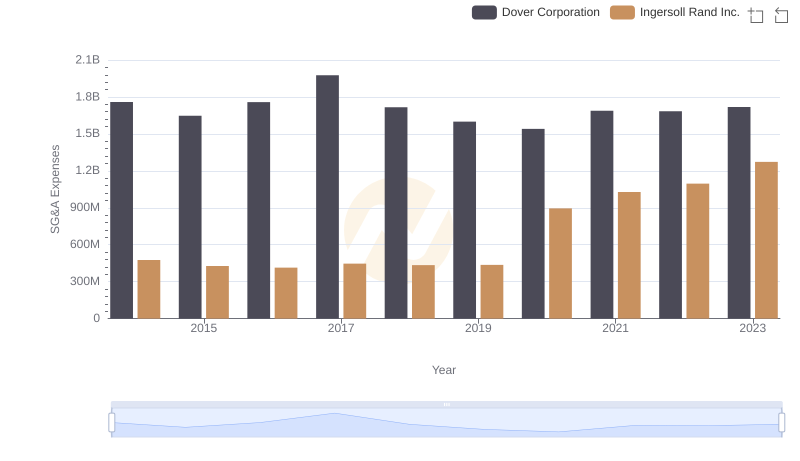

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and Dover Corporation

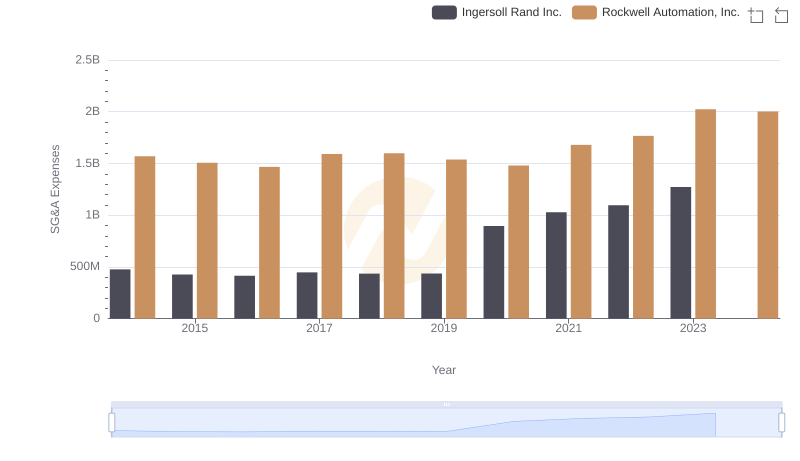

Comparing SG&A Expenses: Ingersoll Rand Inc. vs Rockwell Automation, Inc. Trends and Insights