| __timestamp | Dover Corporation | Ingersoll Rand Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1758765000 | 476000000 |

| Thursday, January 1, 2015 | 1647382000 | 427000000 |

| Friday, January 1, 2016 | 1757523000 | 414339000 |

| Sunday, January 1, 2017 | 1975932000 | 446600000 |

| Monday, January 1, 2018 | 1716444000 | 434600000 |

| Tuesday, January 1, 2019 | 1599098000 | 436400000 |

| Wednesday, January 1, 2020 | 1541032000 | 894800000 |

| Friday, January 1, 2021 | 1688278000 | 1028000000 |

| Saturday, January 1, 2022 | 1684226000 | 1095800000 |

| Sunday, January 1, 2023 | 1718290000 | 1272700000 |

| Monday, January 1, 2024 | 1752266000 | 0 |

Igniting the spark of knowledge

In the ever-evolving landscape of industrial manufacturing, understanding the efficiency of Selling, General, and Administrative (SG&A) expenses is crucial. Over the past decade, Dover Corporation and Ingersoll Rand Inc. have showcased distinct trajectories in their SG&A spending. Dover Corporation, with a consistent average SG&A expense of approximately $1.7 billion annually, reflects a stable operational strategy. In contrast, Ingersoll Rand Inc. has demonstrated a dynamic shift, with SG&A expenses growing by over 160% from 2014 to 2023. This increase highlights a strategic pivot, possibly towards expansion or innovation. Notably, 2020 marked a significant rise for Ingersoll Rand, with expenses nearly doubling, suggesting a response to global economic shifts. As we delve into these trends, it becomes evident that SG&A efficiency is not just about cost control but also about strategic alignment with market demands.

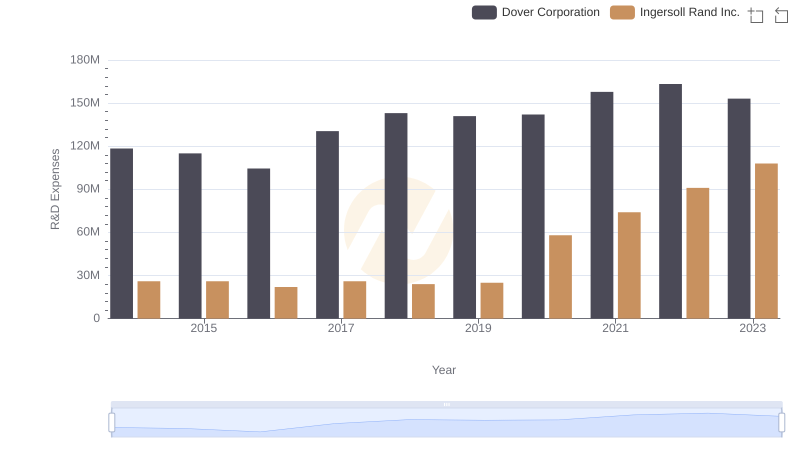

R&D Insights: How Ingersoll Rand Inc. and Dover Corporation Allocate Funds

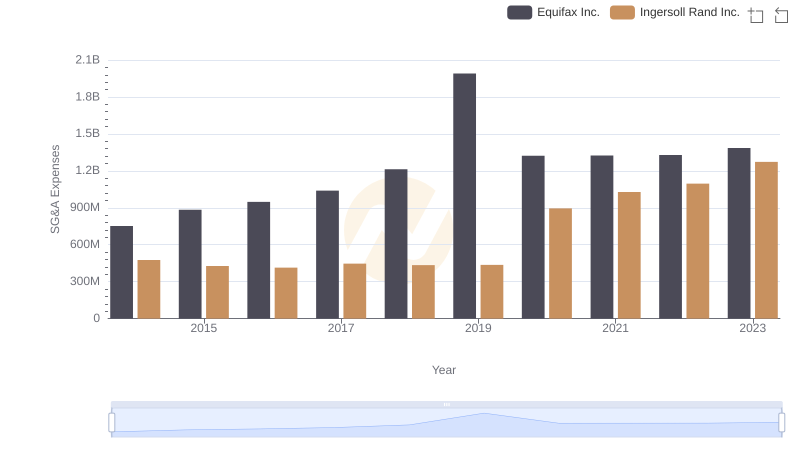

Ingersoll Rand Inc. or Equifax Inc.: Who Manages SG&A Costs Better?

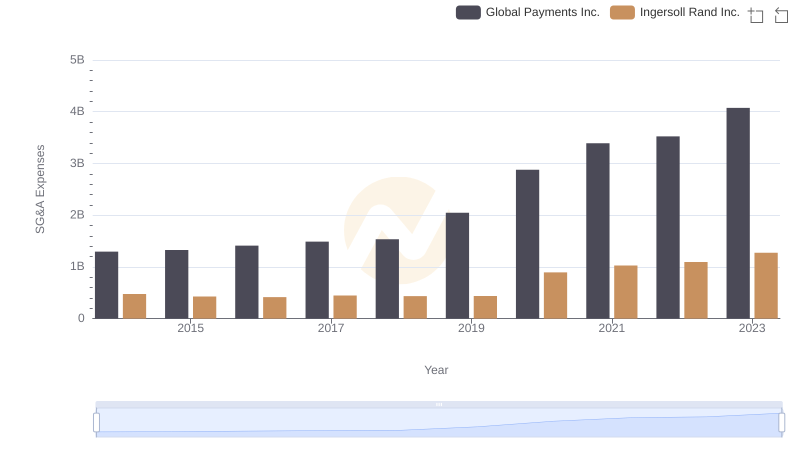

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Global Payments Inc.

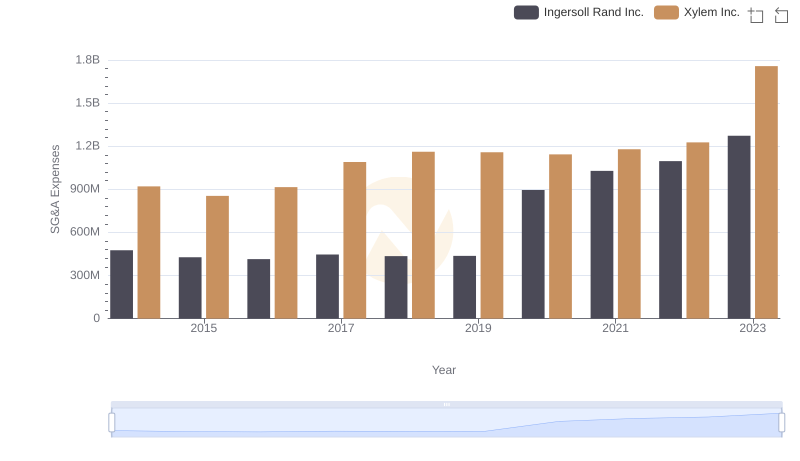

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Xylem Inc.

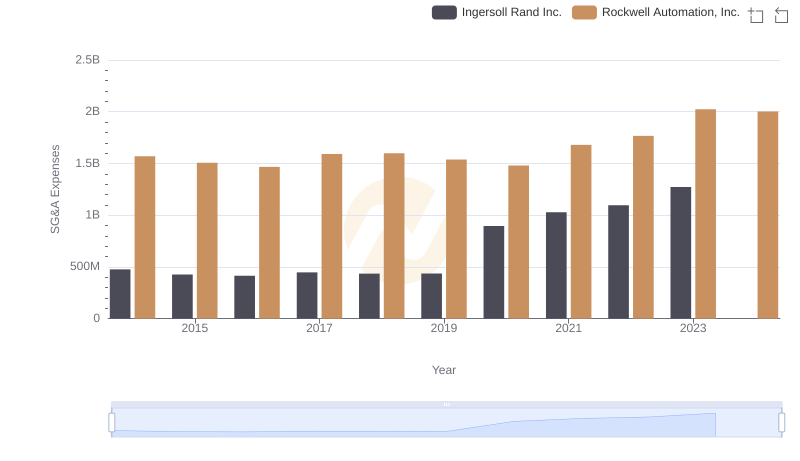

Comparing SG&A Expenses: Ingersoll Rand Inc. vs Rockwell Automation, Inc. Trends and Insights

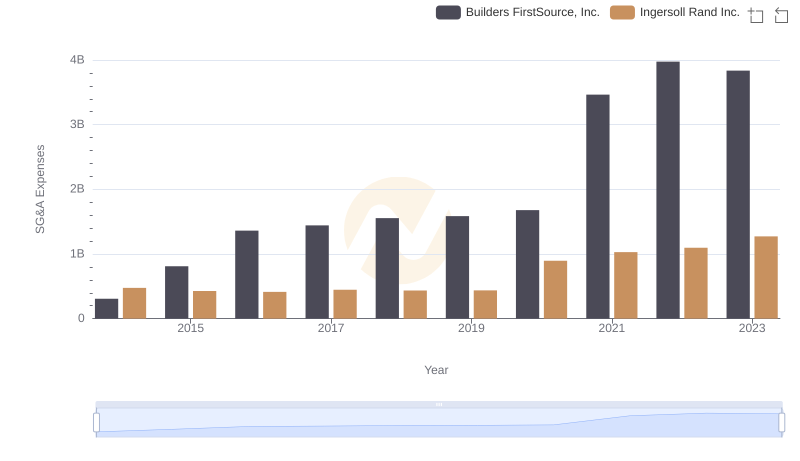

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Builders FirstSource, Inc.