| __timestamp | Ingersoll Rand Inc. | Westinghouse Air Brake Technologies Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 476000000 | 324539000 |

| Thursday, January 1, 2015 | 427000000 | 319173000 |

| Friday, January 1, 2016 | 414339000 | 327505000 |

| Sunday, January 1, 2017 | 446600000 | 482852000 |

| Monday, January 1, 2018 | 434600000 | 573644000 |

| Tuesday, January 1, 2019 | 436400000 | 936600000 |

| Wednesday, January 1, 2020 | 894800000 | 877100000 |

| Friday, January 1, 2021 | 1028000000 | 1005000000 |

| Saturday, January 1, 2022 | 1095800000 | 1020000000 |

| Sunday, January 1, 2023 | 1272700000 | 1139000000 |

| Monday, January 1, 2024 | 0 | 1248000000 |

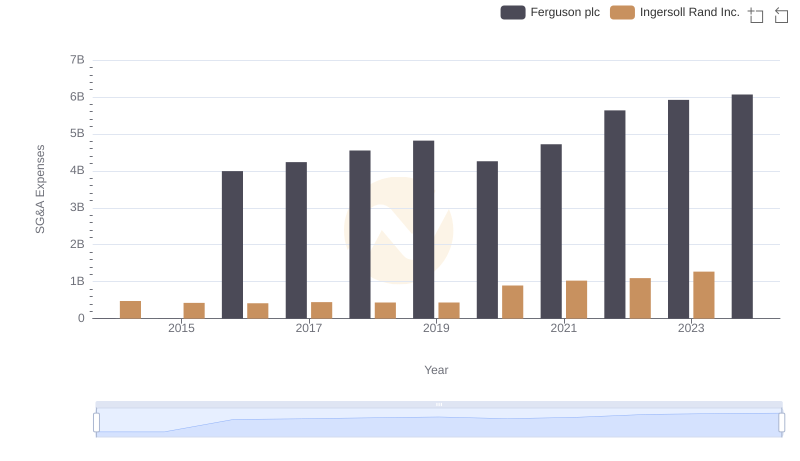

Cracking the code

In the competitive landscape of industrial manufacturing, understanding the financial strategies of key players is crucial. Ingersoll Rand Inc. and Westinghouse Air Brake Technologies Corporation, two titans in the industry, have shown intriguing trends in their Selling, General, and Administrative (SG&A) expenses over the past decade.

From 2014 to 2023, Ingersoll Rand Inc. has seen a remarkable 167% increase in SG&A expenses, peaking in 2023. This growth reflects strategic investments in operations and market expansion. Meanwhile, Westinghouse Air Brake Technologies Corporation experienced a 251% rise, with a significant leap in 2019, indicating a robust push towards innovation and market penetration.

These trends highlight the dynamic nature of financial management in the industrial sector. As both companies continue to evolve, their SG&A strategies will be pivotal in shaping their competitive edge.

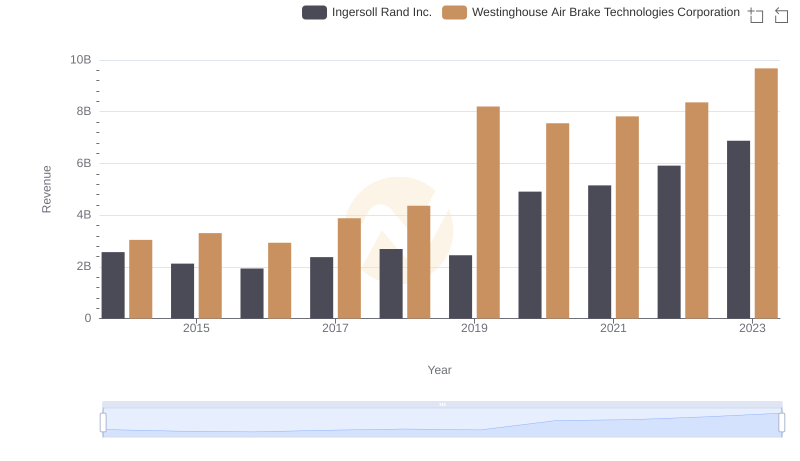

Revenue Insights: Ingersoll Rand Inc. and Westinghouse Air Brake Technologies Corporation Performance Compared

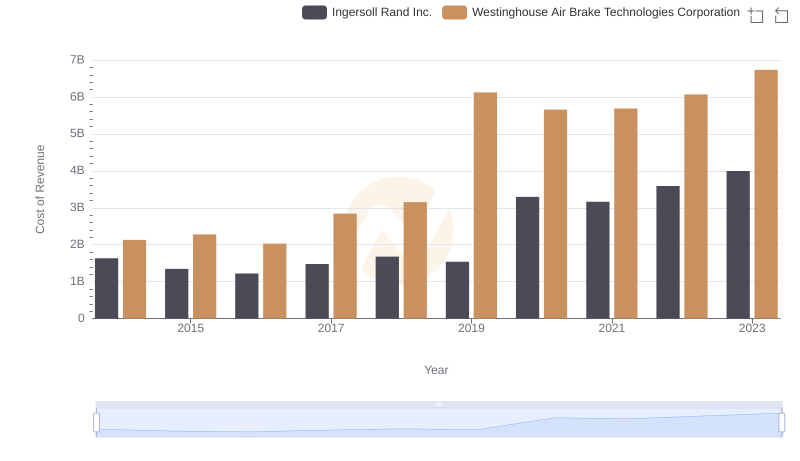

Cost of Revenue Comparison: Ingersoll Rand Inc. vs Westinghouse Air Brake Technologies Corporation

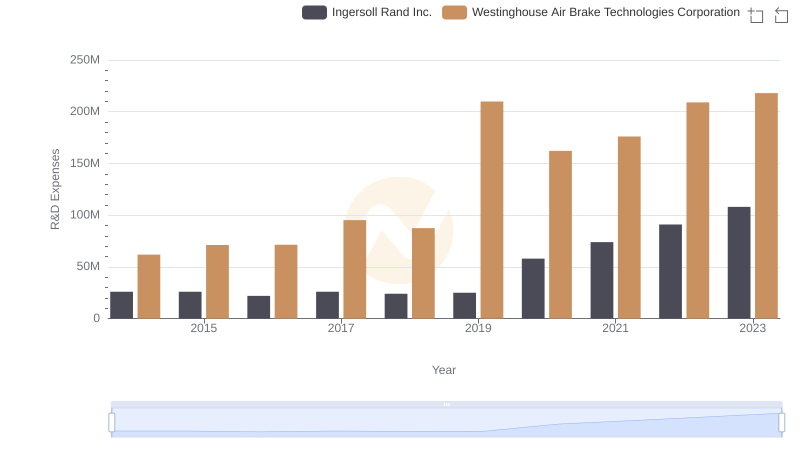

Research and Development Expenses Breakdown: Ingersoll Rand Inc. vs Westinghouse Air Brake Technologies Corporation

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Ferguson plc

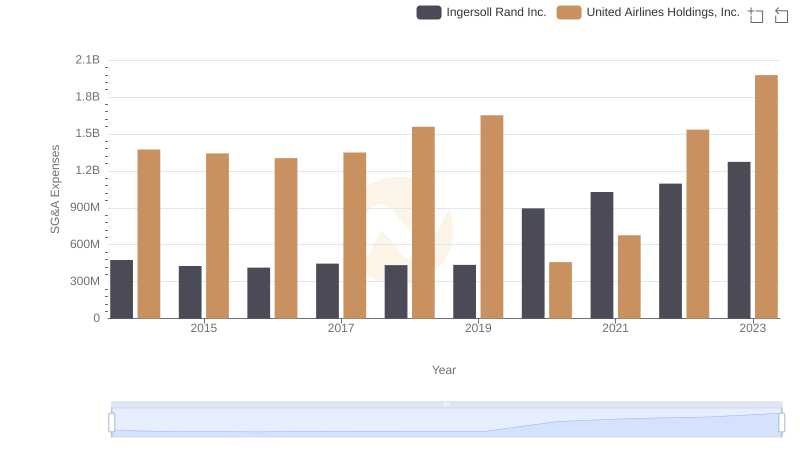

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and United Airlines Holdings, Inc.

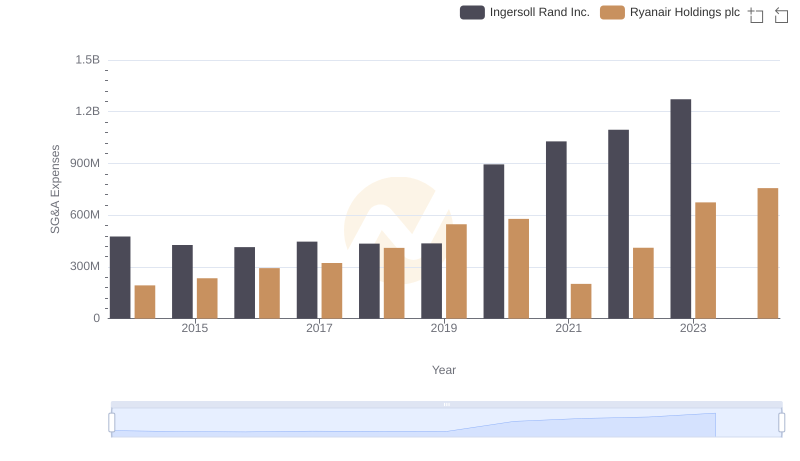

Ingersoll Rand Inc. or Ryanair Holdings plc: Who Manages SG&A Costs Better?

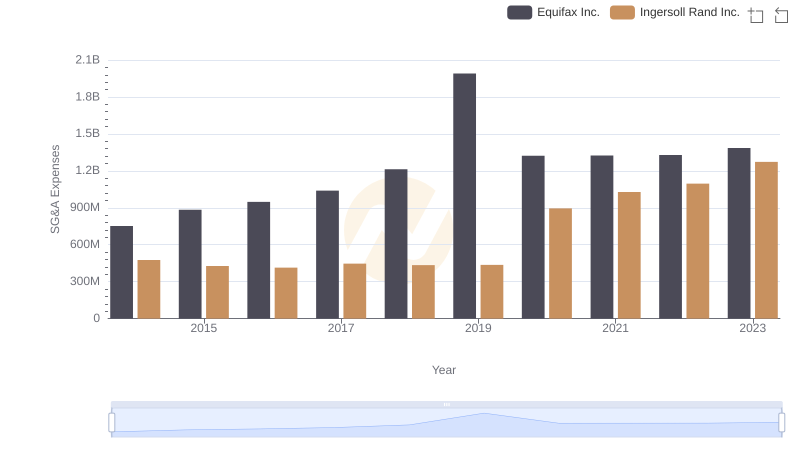

Ingersoll Rand Inc. or Equifax Inc.: Who Manages SG&A Costs Better?

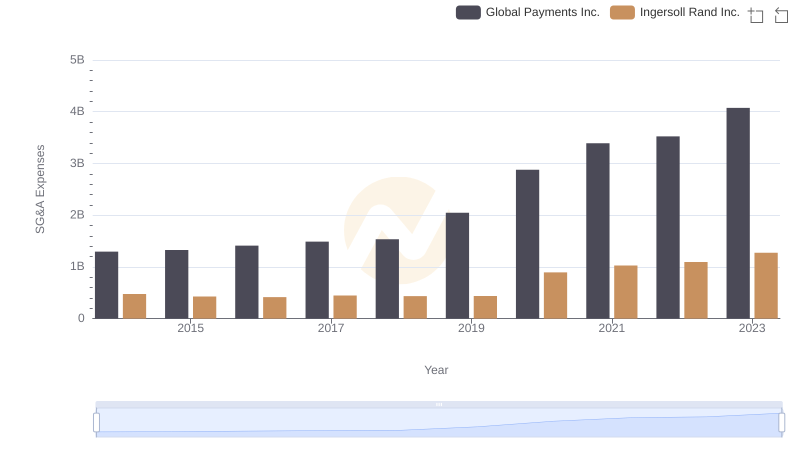

Cost Management Insights: SG&A Expenses for Ingersoll Rand Inc. and Global Payments Inc.

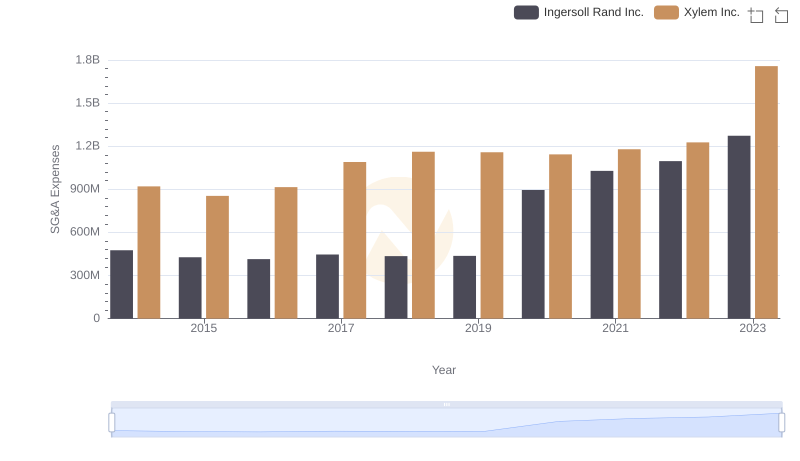

Operational Costs Compared: SG&A Analysis of Ingersoll Rand Inc. and Xylem Inc.

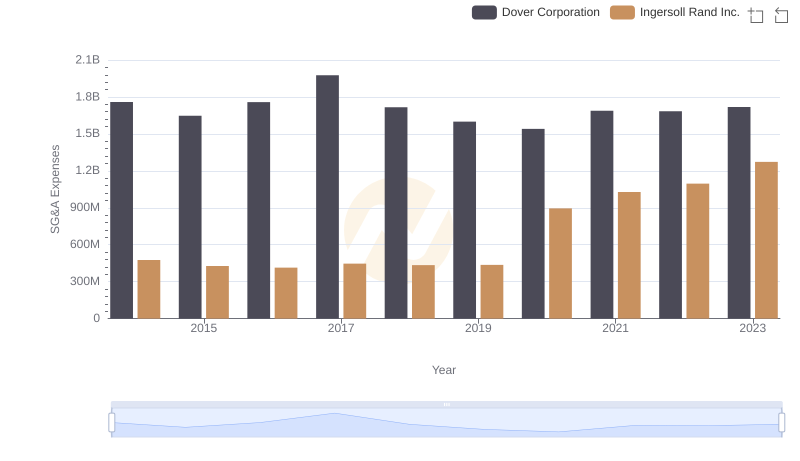

SG&A Efficiency Analysis: Comparing Ingersoll Rand Inc. and Dover Corporation

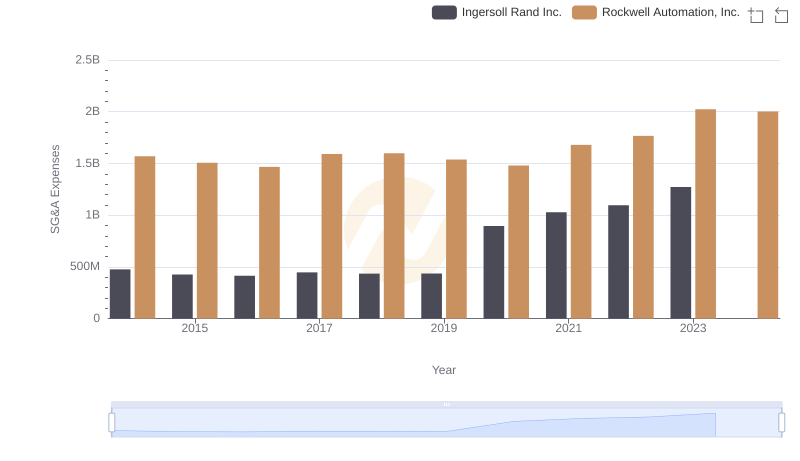

Comparing SG&A Expenses: Ingersoll Rand Inc. vs Rockwell Automation, Inc. Trends and Insights