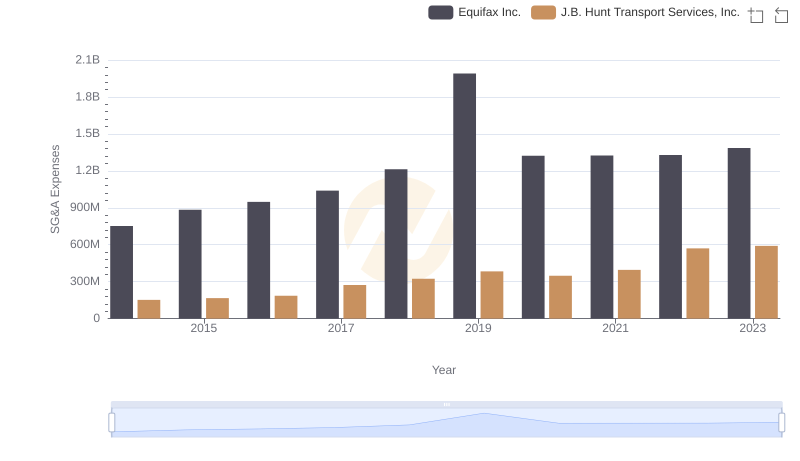

| __timestamp | Equifax Inc. | J.B. Hunt Transport Services, Inc. |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 1041346000 |

| Thursday, January 1, 2015 | 1776200000 | 1146174000 |

| Friday, January 1, 2016 | 2031500000 | 1185633000 |

| Sunday, January 1, 2017 | 2151500000 | 1199293000 |

| Monday, January 1, 2018 | 1971700000 | 1359217000 |

| Tuesday, January 1, 2019 | 1985900000 | 1506255000 |

| Wednesday, January 1, 2020 | 2390100000 | 1449876000 |

| Friday, January 1, 2021 | 2943000000 | 1869819000 |

| Saturday, January 1, 2022 | 2945000000 | 2472527000 |

| Sunday, January 1, 2023 | 2930100000 | 2396388000 |

| Monday, January 1, 2024 | 5681100000 |

Cracking the code

In the ever-evolving landscape of American business, understanding the financial health of companies is crucial. This analysis delves into the gross profit trends of two industry giants: Equifax Inc., a leader in consumer credit reporting, and J.B. Hunt Transport Services, Inc., a major player in the transportation sector. From 2014 to 2023, Equifax's gross profit surged by approximately 84%, peaking in 2022 with a remarkable 2.95 billion. Meanwhile, J.B. Hunt experienced a robust growth of 130% over the same period, reaching its zenith in 2022 with a gross profit of 2.47 billion. Notably, J.B. Hunt's growth trajectory outpaced Equifax, highlighting the dynamic nature of the transportation industry. This comparative analysis offers a window into the strategic maneuvers and market conditions that have shaped these companies' financial journeys over the past decade.

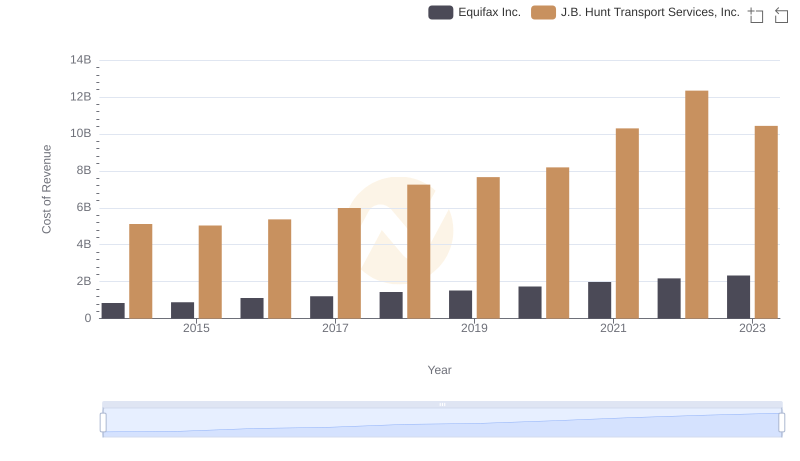

Cost of Revenue Trends: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

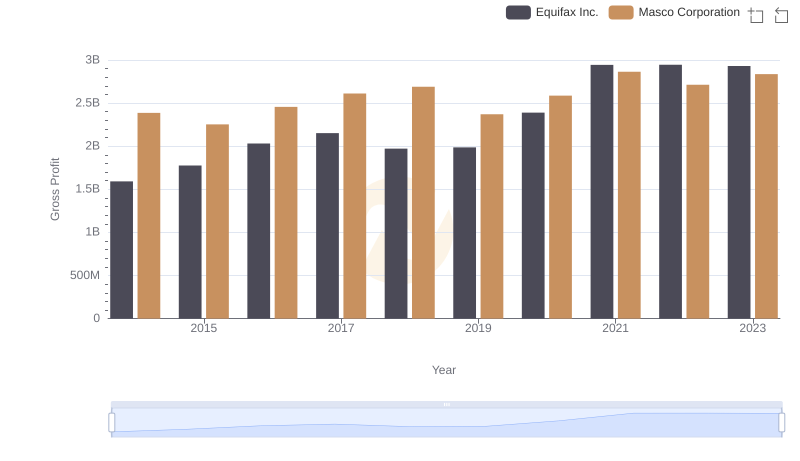

Key Insights on Gross Profit: Equifax Inc. vs Masco Corporation

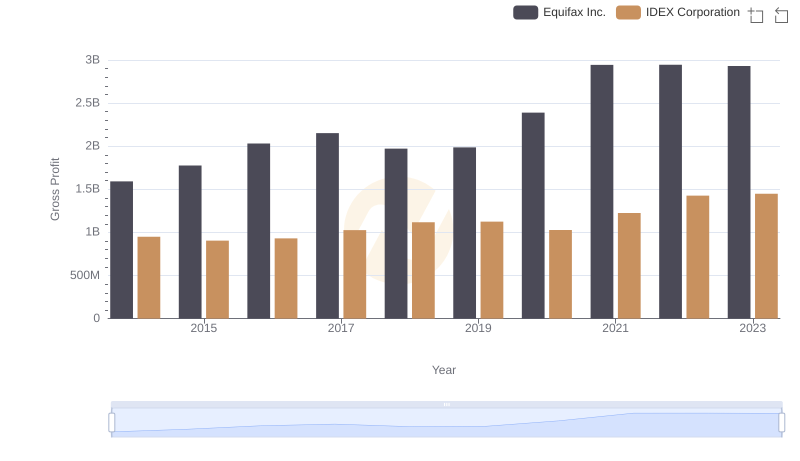

Gross Profit Trends Compared: Equifax Inc. vs IDEX Corporation

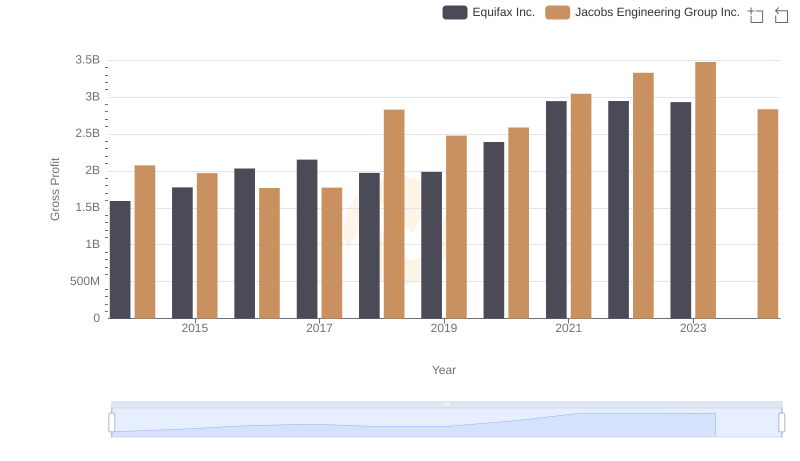

Key Insights on Gross Profit: Equifax Inc. vs Jacobs Engineering Group Inc.

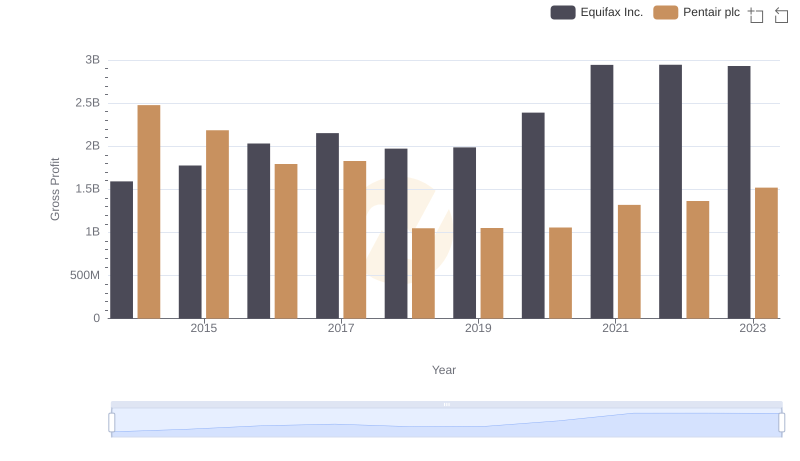

Key Insights on Gross Profit: Equifax Inc. vs Pentair plc

Breaking Down SG&A Expenses: Equifax Inc. vs J.B. Hunt Transport Services, Inc.

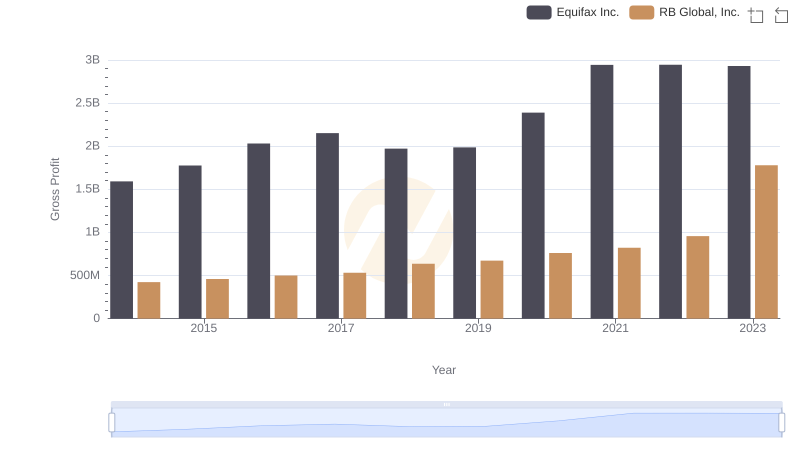

Gross Profit Comparison: Equifax Inc. and RB Global, Inc. Trends