| __timestamp | Equifax Inc. | Masco Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 1591700000 | 2387000000 |

| Thursday, January 1, 2015 | 1776200000 | 2253000000 |

| Friday, January 1, 2016 | 2031500000 | 2456000000 |

| Sunday, January 1, 2017 | 2151500000 | 2611000000 |

| Monday, January 1, 2018 | 1971700000 | 2689000000 |

| Tuesday, January 1, 2019 | 1985900000 | 2371000000 |

| Wednesday, January 1, 2020 | 2390100000 | 2587000000 |

| Friday, January 1, 2021 | 2943000000 | 2863000000 |

| Saturday, January 1, 2022 | 2945000000 | 2713000000 |

| Sunday, January 1, 2023 | 2930100000 | 2836000000 |

| Monday, January 1, 2024 | 5681100000 | 2831000000 |

Unleashing the power of data

In the competitive landscape of American business, understanding the financial health of companies is crucial. This analysis focuses on the gross profit trends of Equifax Inc. and Masco Corporation from 2014 to 2023. Over this period, Equifax Inc. saw a remarkable 84% increase in gross profit, peaking in 2022 with a 2.95 billion USD mark. Meanwhile, Masco Corporation maintained a steady growth trajectory, with a 19% rise, reaching its highest gross profit in 2021 at 2.86 billion USD. Notably, Equifax's gross profit surpassed Masco's in 2021, highlighting its robust financial performance. These insights provide a window into the strategic maneuvers and market conditions that have shaped these companies' financial journeys over the past decade.

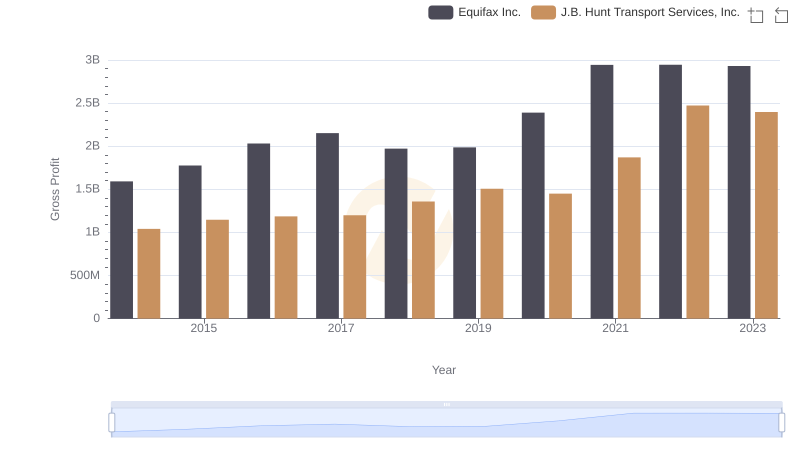

Gross Profit Analysis: Comparing Equifax Inc. and J.B. Hunt Transport Services, Inc.

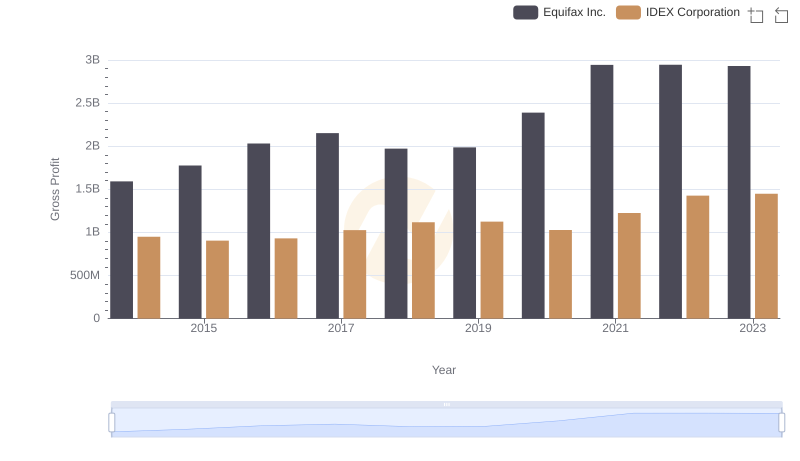

Gross Profit Trends Compared: Equifax Inc. vs IDEX Corporation

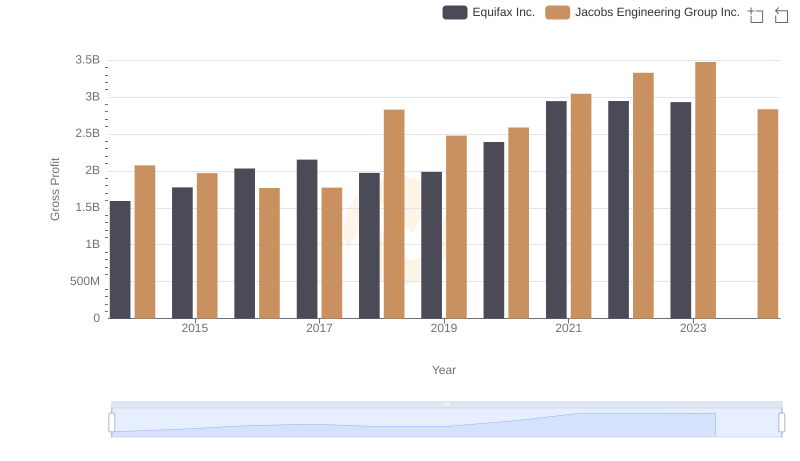

Key Insights on Gross Profit: Equifax Inc. vs Jacobs Engineering Group Inc.

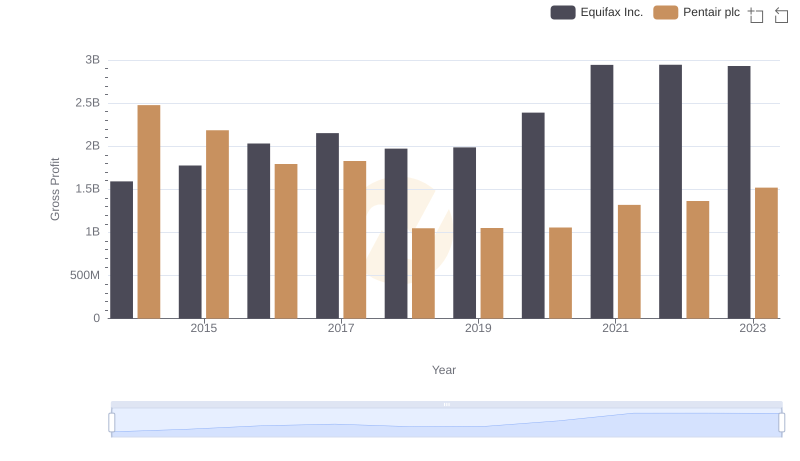

Key Insights on Gross Profit: Equifax Inc. vs Pentair plc

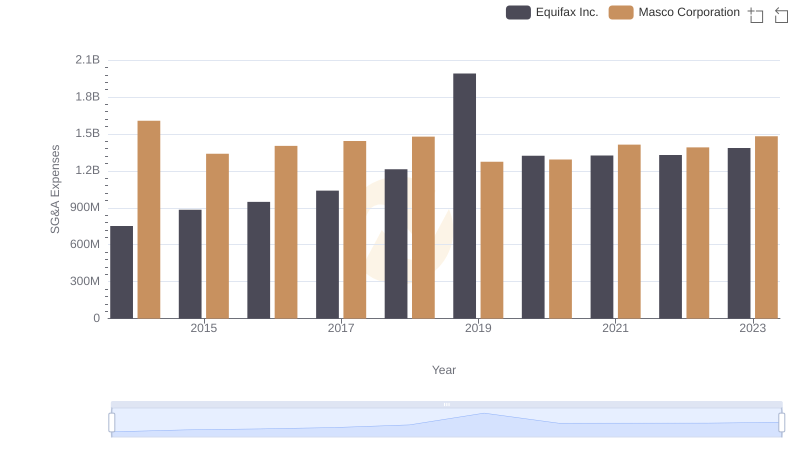

Who Optimizes SG&A Costs Better? Equifax Inc. or Masco Corporation