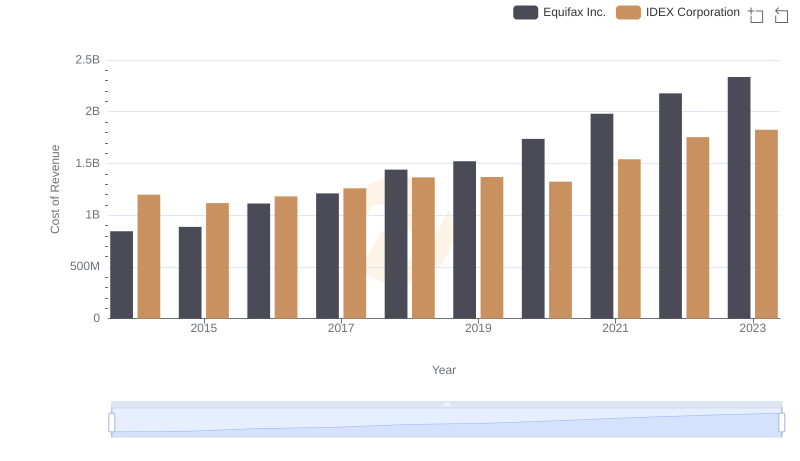

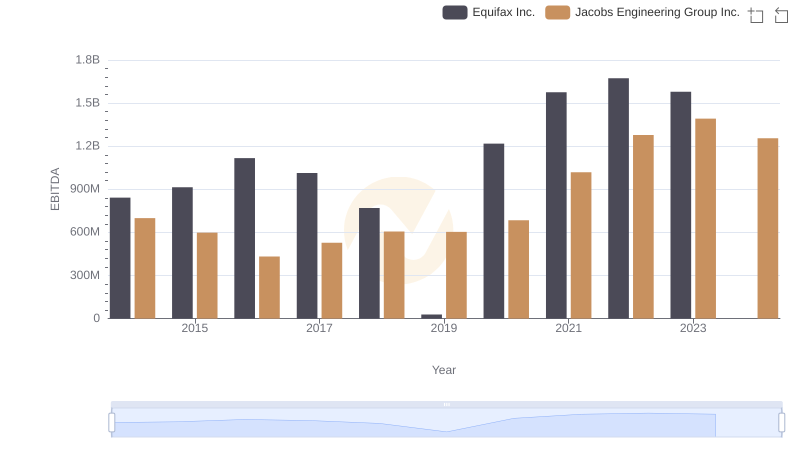

| __timestamp | Equifax Inc. | IDEX Corporation |

|---|---|---|

| Wednesday, January 1, 2014 | 842400000 | 504019000 |

| Thursday, January 1, 2015 | 914600000 | 505071000 |

| Friday, January 1, 2016 | 1116900000 | 507871000 |

| Sunday, January 1, 2017 | 1013900000 | 591033000 |

| Monday, January 1, 2018 | 770200000 | 657092000 |

| Tuesday, January 1, 2019 | 29000000 | 647793000 |

| Wednesday, January 1, 2020 | 1217800000 | 604602000 |

| Friday, January 1, 2021 | 1575200000 | 720500000 |

| Saturday, January 1, 2022 | 1672800000 | 909800000 |

| Sunday, January 1, 2023 | 1579100000 | 964100000 |

| Monday, January 1, 2024 | 1251200000 | 677200000 |

In pursuit of knowledge

In the ever-evolving landscape of financial performance, Equifax Inc. and IDEX Corporation have demonstrated intriguing trends in their EBITDA over the past decade. From 2014 to 2023, Equifax Inc. experienced a remarkable 87% increase in EBITDA, peaking in 2022. This growth trajectory highlights the company's resilience and strategic prowess, despite a notable dip in 2019. In contrast, IDEX Corporation showcased a steady upward trend, with a 91% rise in EBITDA, culminating in 2023. This consistent growth underscores IDEX's robust operational efficiency and market adaptability. The data reveals a fascinating narrative of two industry giants navigating economic challenges and opportunities, offering valuable insights for investors and analysts alike. As we delve deeper into these financial chronicles, the contrasting paths of Equifax and IDEX provide a compelling study of corporate strategy and financial acumen.

Cost Insights: Breaking Down Equifax Inc. and IDEX Corporation's Expenses

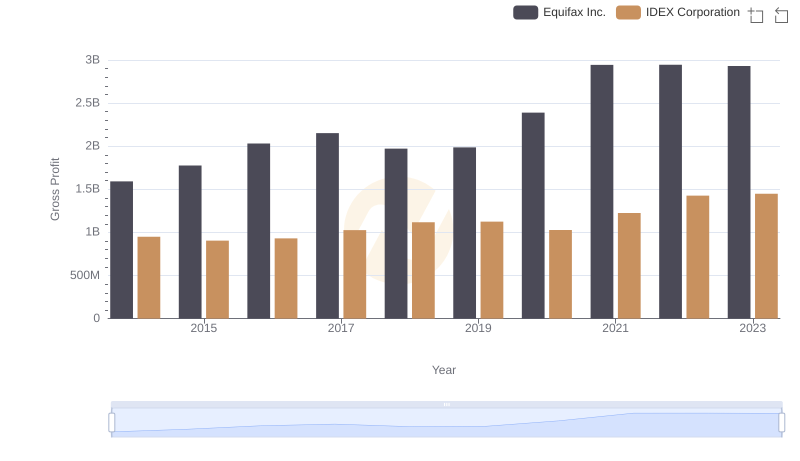

Gross Profit Trends Compared: Equifax Inc. vs IDEX Corporation

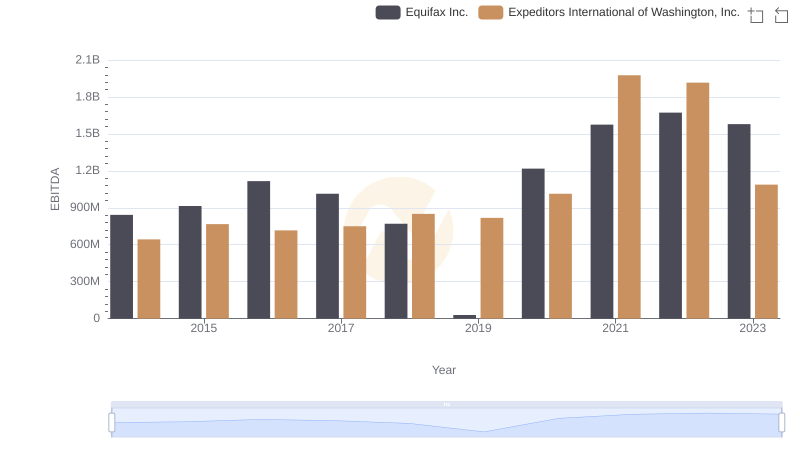

EBITDA Analysis: Evaluating Equifax Inc. Against Expeditors International of Washington, Inc.

Equifax Inc. vs Jacobs Engineering Group Inc.: In-Depth EBITDA Performance Comparison